A Security That Represents Part Ownership Of A Company

The modern financial landscape is built on intricate instruments, yet one security remains foundational: the company share. More than just a piece of paper, it represents a fractional ownership stake, binding investors to the fortunes – and misfortunes – of the underlying business. The implications of owning a share are far-reaching, shaping investment strategies, corporate governance, and the overall health of global economies.

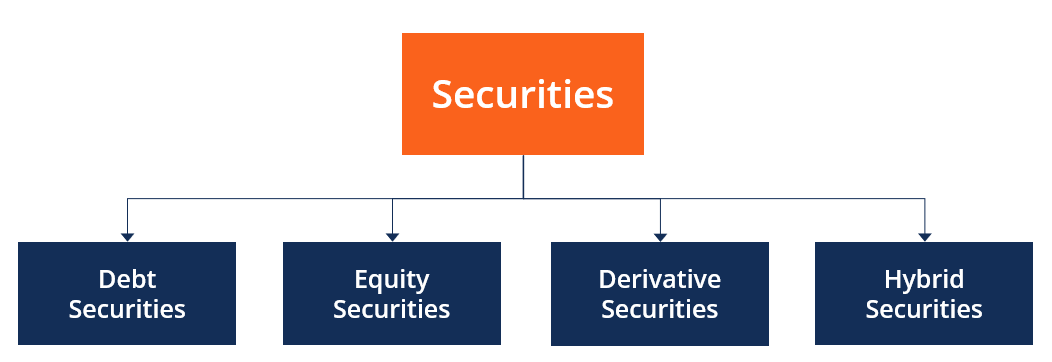

At its core, a share, also known as stock, embodies equity, signifying proportional ownership in a corporation. This article delves into the anatomy of this fundamental security, exploring its mechanics, the rights it confers, the risks it entails, and its crucial role in the broader economic ecosystem. We will examine how shares are issued, traded, and valued, considering perspectives from investors, corporations, and regulatory bodies. Understanding the nuances of share ownership is paramount for anyone navigating the complexities of financial markets.

The Genesis of Share Ownership

The concept of shares dates back centuries, evolving alongside the growth of capitalism. Early examples can be traced to the Dutch East India Company in the 17th century, where shares were issued to finance voyages and distribute profits.

This innovation allowed for risk to be diversified and capital to be accumulated on a scale previously unimaginable. As economies matured, stock exchanges emerged as organized marketplaces for the buying and selling of shares, further facilitating their circulation and democratizing investment opportunities.

Rights and Responsibilities of Shareholders

Owning shares grants specific rights to the holder, proportional to the percentage of the company owned. A primary right is the entitlement to a share of the company's profits, typically distributed as dividends.

Shareholders also have the right to vote on key corporate decisions, such as electing board members and approving mergers and acquisitions. These voting rights are usually tied to the class of shares held, with common stock typically carrying one vote per share.

Beyond rights, shareholders also bear certain responsibilities. They are subject to the risks associated with the company's performance, including potential losses in the value of their investment. Moreover, they have a duty to exercise their voting rights responsibly and to hold management accountable for their actions, promoting good corporate governance.

Issuance and Trading of Shares

Companies issue shares primarily through two mechanisms: Initial Public Offerings (IPOs) and secondary offerings. An IPO marks a company's debut on the public market, allowing it to raise capital from a wide range of investors.

Secondary offerings, on the other hand, involve the issuance of additional shares by an already publicly traded company. These offerings can be used to raise capital for various purposes, such as funding expansion or paying down debt.

Once issued, shares are traded on stock exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq. These exchanges provide a platform for buyers and sellers to connect and execute trades, with prices determined by supply and demand.

Valuation and Performance Metrics

Determining the intrinsic value of a share is a complex process, involving a combination of financial analysis, economic forecasting, and market sentiment. Several metrics are commonly used to assess a company's value, including earnings per share (EPS), price-to-earnings (P/E) ratio, and return on equity (ROE).

Analysts also consider macroeconomic factors, such as interest rates and inflation, which can influence investor sentiment and market valuations. Technical analysis, which focuses on historical price patterns and trading volumes, is another approach used by some investors to predict future share price movements.

However, it's crucial to acknowledge that valuation is not an exact science, and different analysts may arrive at different conclusions. Market sentiment, often driven by emotions and psychological biases, can also play a significant role in share price fluctuations.

Risks and Challenges Associated with Share Ownership

Investing in shares inherently involves risk. Market volatility, economic downturns, and company-specific challenges can all lead to significant losses. Diversification, spreading investments across different companies and sectors, is a common strategy for mitigating risk.

Another challenge is the potential for corporate mismanagement or fraud. Although regulations are in place to protect investors, instances of unethical behavior can still occur, leading to severe consequences for shareholders. Proper due diligence and a critical assessment of management quality are essential safeguards.

Furthermore, information asymmetry can create an uneven playing field. Insiders, such as company executives, may possess information not available to the public, giving them an unfair advantage in trading shares. Regulations such as those enforced by the SEC aim to prevent insider trading and promote fair market practices.

The Evolving Landscape of Share Ownership

The landscape of share ownership is constantly evolving, influenced by technological advancements, regulatory changes, and shifts in investor behavior. The rise of online trading platforms has made it easier and more affordable for individuals to invest in shares.

At the same time, algorithmic trading and high-frequency trading have increased market volatility and complexity. The growing importance of environmental, social, and governance (ESG) factors is also reshaping investment decisions, with investors increasingly prioritizing companies that demonstrate responsible business practices.

Moreover, the emergence of new types of shares, such as those representing ownership in private companies through crowdfunding platforms, is further diversifying the investment landscape. These innovations offer new opportunities but also come with their own set of risks and challenges.

The Future of Equity: A Look Ahead

Shares will likely remain a cornerstone of the global financial system. However, expect continued innovation in how shares are issued, traded, and valued, driven by technology and changing investor preferences.

Increased regulatory scrutiny and a greater emphasis on transparency and corporate governance are also expected to shape the future of share ownership. As technology continues to transform financial markets, investors must remain vigilant, informed, and adaptable to navigate the evolving landscape of equity investing successfully. Responsible share ownership, combined with sound financial planning, will remain crucial for building long-term wealth and contributing to a thriving global economy.