Accounting Software For Small Businesses

Imagine Sarah, owner of a blossoming artisanal bakery, once buried under a mountain of invoices and spreadsheets. Her days were a whirlwind of flour dust and frosting, but too often, she found herself awake at night, wrestling with her books. The delicious aroma of freshly baked bread couldn't quite mask the lingering stress of financial uncertainty.

Thankfully, Sarah's story is not unique. And like many small business owners, she found a lifeline in accounting software, transforming her financial management from a daunting chore into a streamlined process. This article explores how accounting software has become an indispensable tool for small businesses, leveling the playing field and empowering entrepreneurs to focus on what they do best: growing their businesses.

The Rise of Accounting Software

For years, accounting was synonymous with hefty ledgers, complex formulas, and specialized professionals. Small business owners often relied on manual methods, making it a time-consuming and error-prone endeavor.

The advent of computers and the internet changed everything. Early accounting software was clunky and expensive, but as technology advanced, so did the accessibility and affordability of these tools.

Today, a plethora of user-friendly accounting software options cater specifically to the needs of small businesses.

What is Accounting Software?

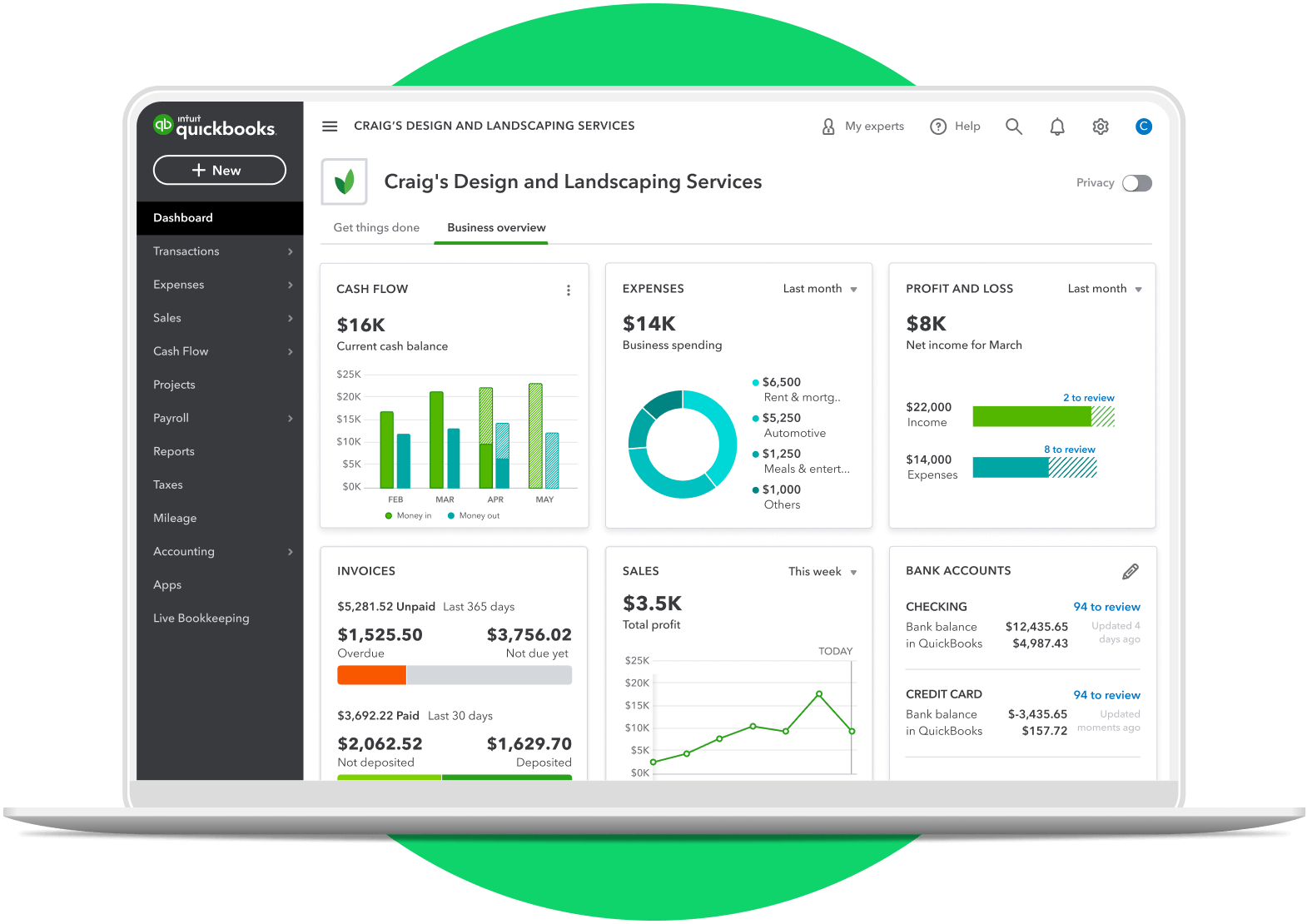

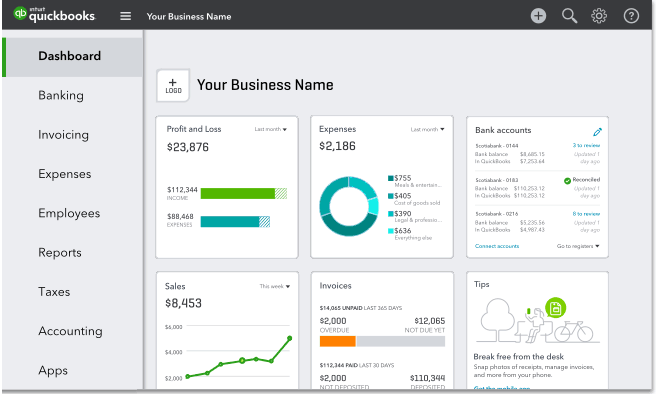

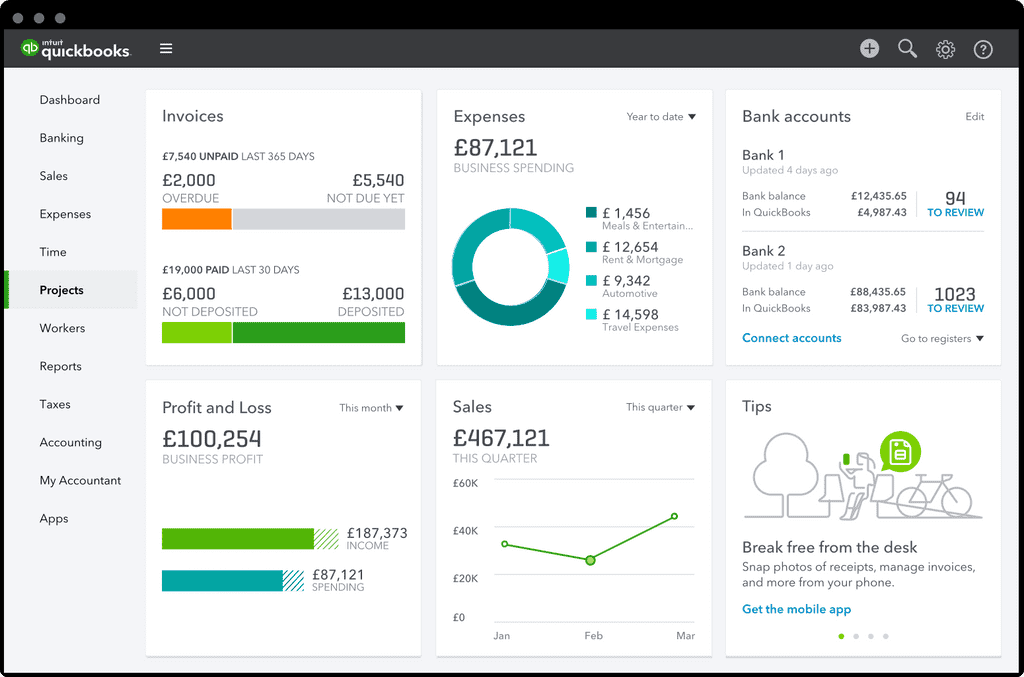

At its core, accounting software automates and streamlines the process of tracking financial transactions. It handles tasks like invoicing, expense tracking, bank reconciliation, and generating financial reports.

Many platforms also offer features such as payroll management, inventory tracking, and customer relationship management (CRM) integration. These integrated solutions offer a central platform for managing many business operations.

Accounting software can be cloud-based or desktop-based. Cloud-based solutions offer flexibility and accessibility, allowing users to access their data from anywhere with an internet connection. Desktop solutions, on the other hand, provide greater control over data security and may be preferred by businesses with specific regulatory requirements.

Benefits for Small Businesses

The benefits of accounting software extend far beyond simply automating manual tasks. Let's examine the reasons why they're becoming a necessity for small business owners.

Improved Accuracy: Human error is a significant risk with manual accounting. Accounting software significantly reduces errors by automating calculations and data entry, leading to more accurate financial records.

Time Savings: Automation frees up valuable time for business owners, allowing them to focus on strategic initiatives like product development, marketing, and customer service. According to a study by Intuit QuickBooks, small businesses using accounting software can save up to 50 hours per month.

Better Financial Visibility: Accounting software provides real-time insights into a company's financial performance. With the ability to generate detailed reports and dashboards, business owners can easily track key metrics, identify trends, and make informed decisions.

Simplified Tax Preparation: Tax season can be a stressful time for small businesses. Accounting software simplifies the process by organizing financial data and generating reports that can be easily used to prepare tax returns. Many platforms also integrate directly with tax software, further streamlining the process.

Cost-Effectiveness: While there is an initial investment in accounting software, the long-term cost savings can be significant. By automating tasks, reducing errors, and improving financial visibility, accounting software can help businesses operate more efficiently and avoid costly mistakes.

Choosing the Right Software

With so many accounting software options available, selecting the right one can feel overwhelming. Consider the following factors when making your decision:

Business Needs: Assess your specific accounting needs and choose software that offers the features and functionality you require. Consider the size of your business, the industry you operate in, and any specific regulatory requirements you must comply with.

Ease of Use: Opt for software that is user-friendly and intuitive. A steep learning curve can negate the time-saving benefits of automation.

Look for free trials or demos to test the software before committing to a purchase.

Integration Capabilities: Ensure that the software integrates seamlessly with your existing business tools, such as CRM, e-commerce platforms, and payment processors. Integration streamlines workflows and eliminates the need for manual data entry across multiple systems.

Scalability: Choose software that can scale with your business as it grows. Consider whether the software can accommodate increased transaction volumes, additional users, and new features as your business expands.

Support and Training: Look for software providers that offer comprehensive support and training resources. Access to reliable support can be invaluable when troubleshooting issues or learning new features.

The Future of Accounting Software

The evolution of accounting software is far from over. Emerging technologies like artificial intelligence (AI) and machine learning (ML) are poised to further transform the industry.

AI-powered features can automate tasks such as invoice processing, fraud detection, and financial forecasting. ML algorithms can analyze financial data to identify patterns and provide insights that can help businesses make better decisions.

As accounting software continues to evolve, it will become even more essential for small businesses looking to thrive in today's competitive landscape.

Sarah, now armed with her accounting software, spends her evenings perfecting her recipes and dreaming up new creations. The scent of success, both in the oven and on her balance sheet, fills the air.