Adjusting Entries Are Primarily Needed For

Imagine a small bakery, "Sweet Surrender," bustling with activity. The aroma of freshly baked bread fills the air, customers line up for their daily dose of happiness, and the owner, Sarah, smiles, knowing she's providing a little joy. But behind the scenes, amidst the flour and sugar, lies a silent partner ensuring the bakery's true financial picture is accurately revealed: adjusting entries.

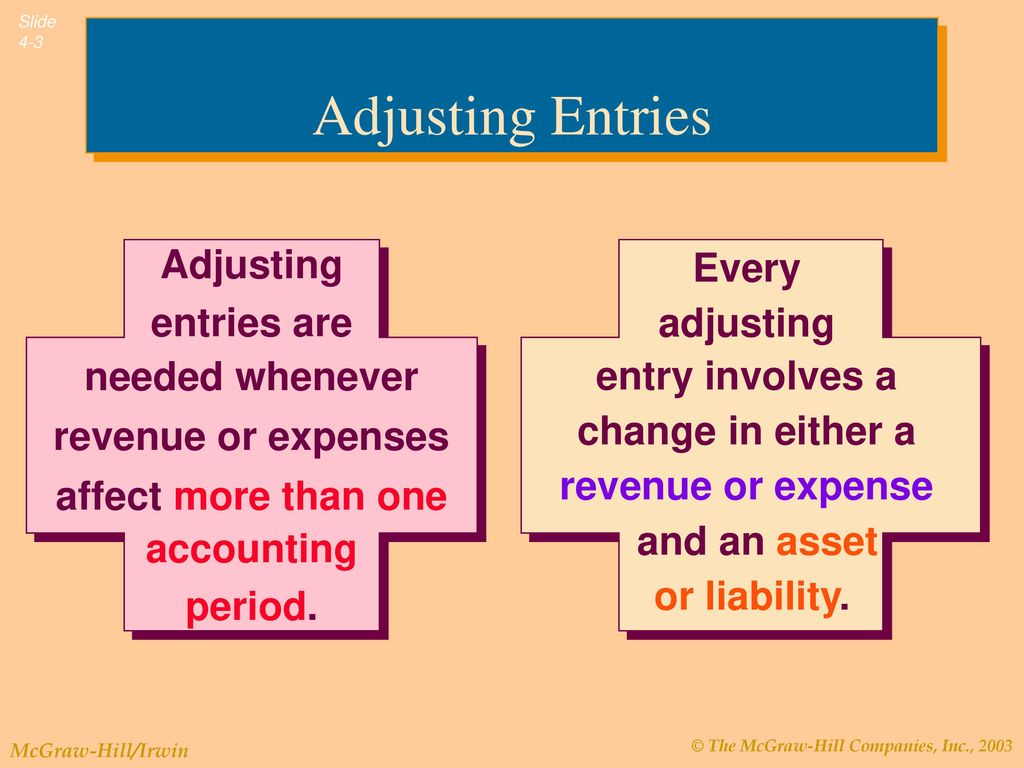

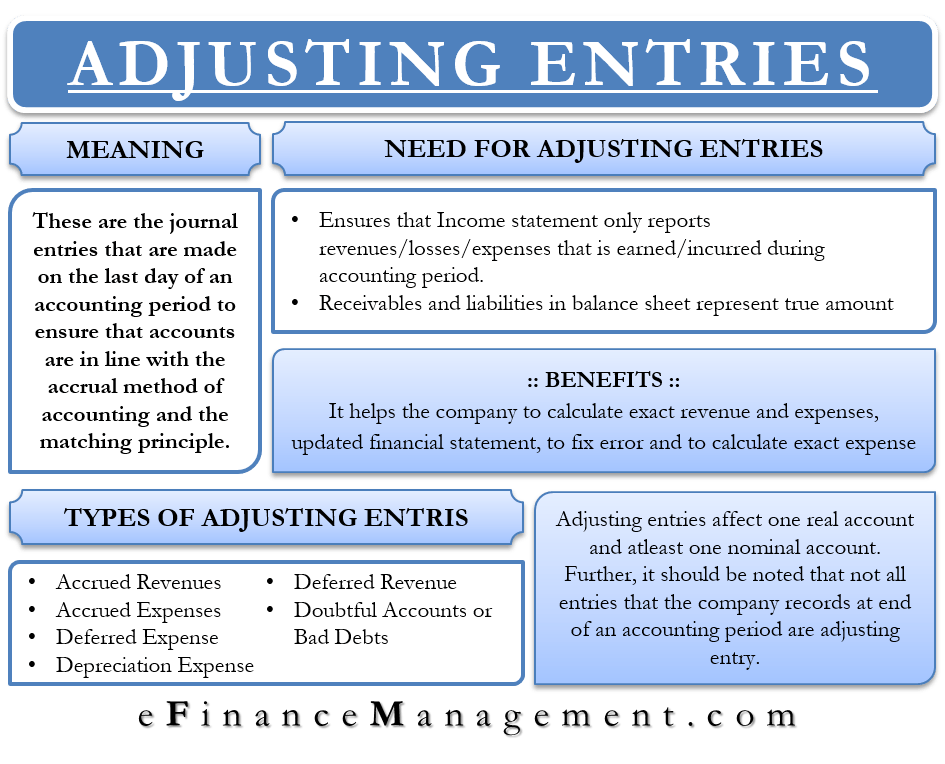

At their core, adjusting entries are primarily needed to ensure that a company's financial statements accurately reflect its financial performance and position in accordance with the accrual basis of accounting. These entries correct discrepancies arising from timing differences between when cash changes hands and when revenues are earned or expenses are incurred, providing a more realistic and comprehensive view of a business's financial health.

The Foundation: Accrual Accounting

To truly grasp the significance of adjusting entries, one must understand the concept of accrual accounting.

Unlike cash-basis accounting, which recognizes revenue when cash is received and expenses when cash is paid, accrual accounting recognizes revenue when it is earned and expenses when they are incurred, regardless of when the cash flow occurs.

This provides a more accurate representation of a company's economic activity over a period. Accrual accounting is generally accepted accounting principles (GAAP) required for most publicly traded companies and many large private businesses because it provides a more complete picture of the company's financial performance.

Why Adjusting Entries Matter

Without adjusting entries, financial statements can be misleading.

Imagine Sweet Surrender purchases a large supply of flour in December but doesn't use it all until January. If they only recorded the expense when they paid for the flour in December, their December financial statements would overstate expenses and understate profits.

Adjusting entries help allocate that expense to the period in which the flour was actually used, providing a more accurate picture of December's and January's profitability.

Common Types of Adjusting Entries

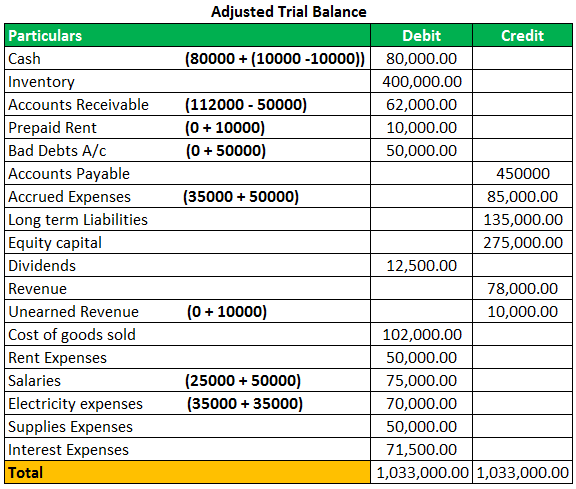

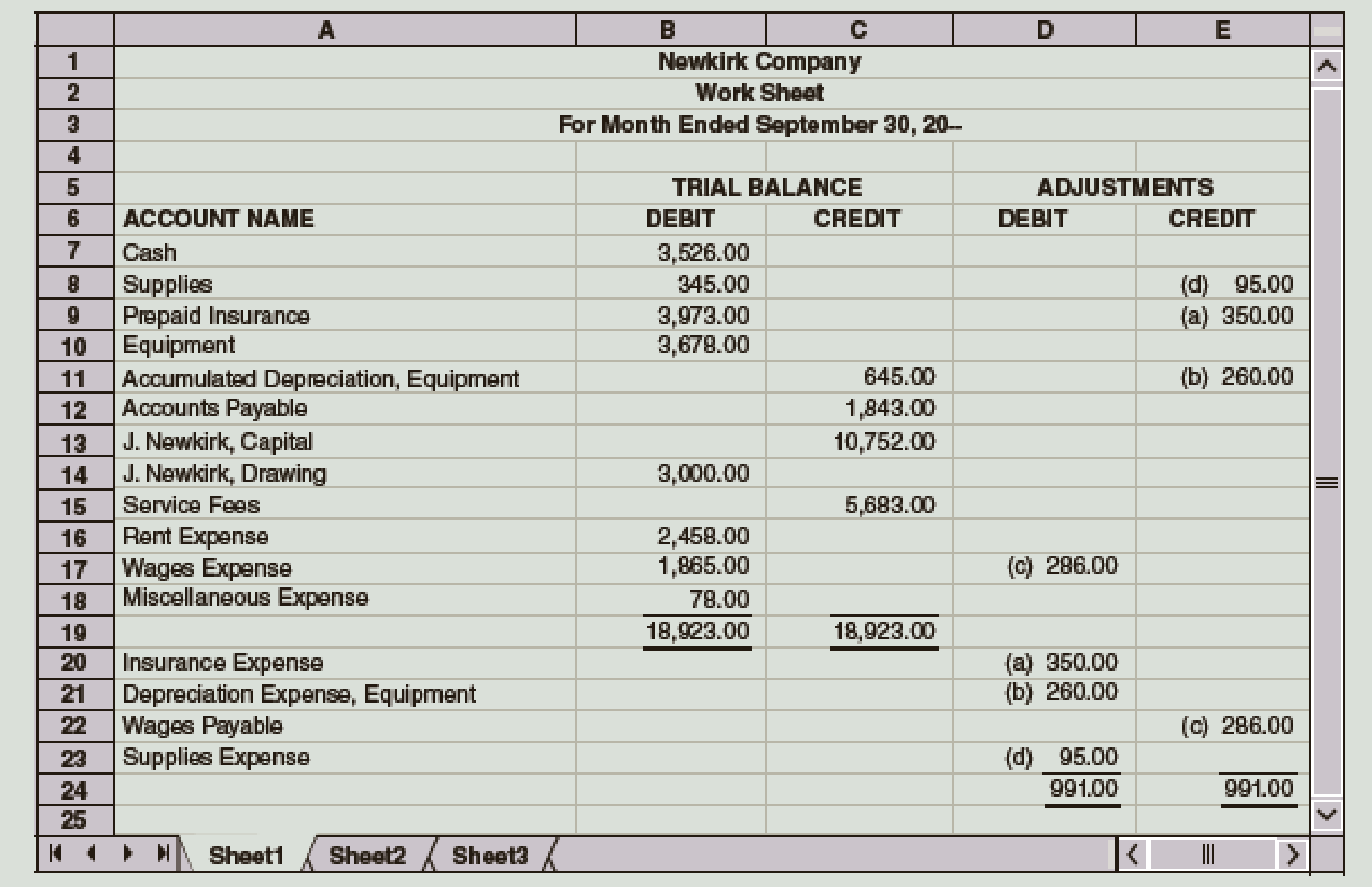

Several common types of adjusting entries ensure accuracy and compliance.

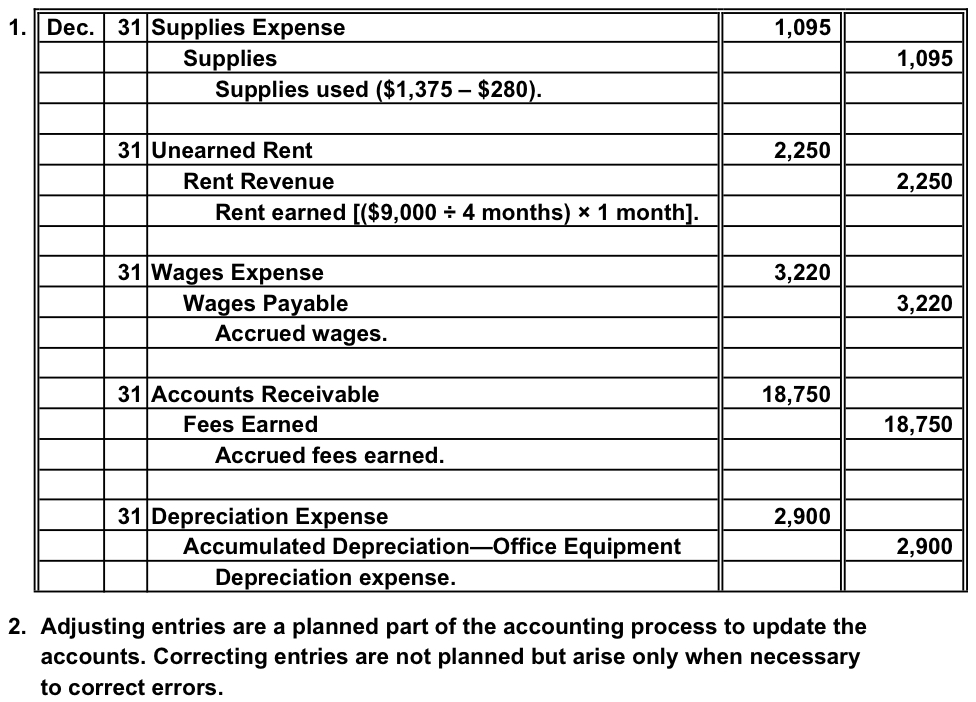

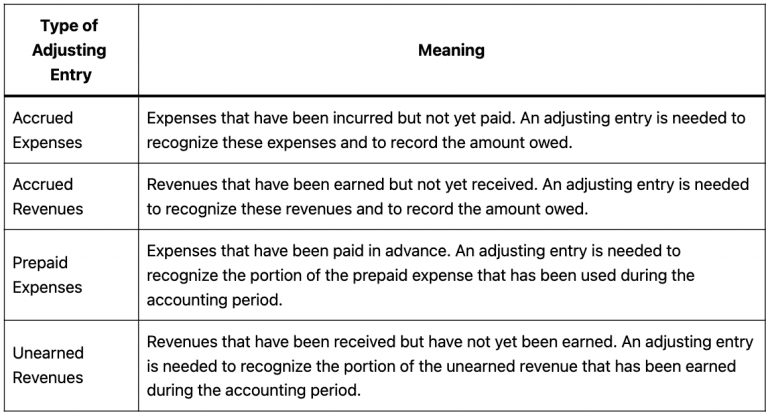

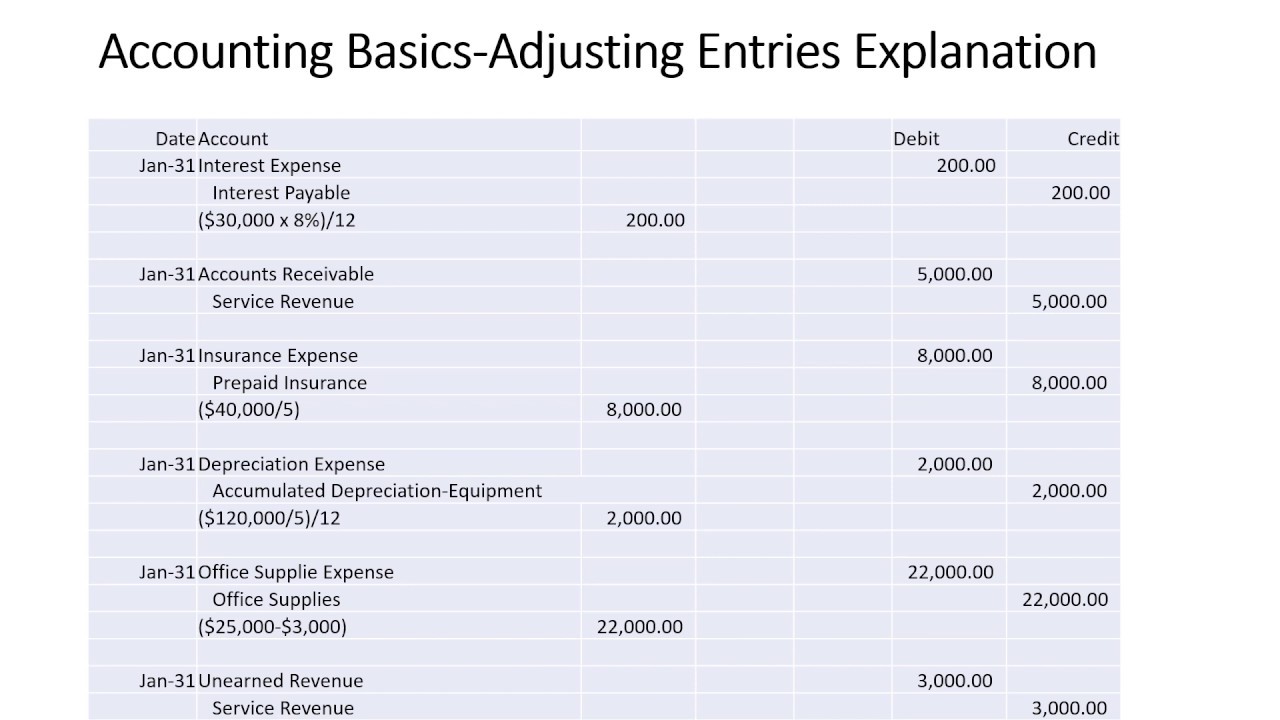

Accrued Revenues

These entries recognize revenue that has been earned but for which cash hasn't yet been received.

For example, imagine Sweet Surrender catered a small event at the end of the month, but hasn't yet sent the invoice. The revenue has been earned and should be recognized in that month, even though payment is pending.

Accrued Expenses

These entries recognize expenses that have been incurred but haven't yet been paid.

Perhaps Sweet Surrender received its electricity bill at the beginning of the following month. The electricity was used in the current period, so the expense needs to be recorded in the current period through an accrued expense.

Deferred Revenues (Unearned Revenues)

These entries adjust for situations where cash has been received for goods or services that haven't yet been provided.

Let's say Sweet Surrender sells gift certificates. The cash is received upfront, but the revenue isn't earned until the gift certificate is redeemed. The adjusting entry transfers a portion of the unearned revenue to earned revenue as the certificates are used.

Deferred Expenses (Prepaid Expenses)

These entries allocate the cost of assets over their useful life.

Sweet Surrender might have purchased insurance coverage for a year. An adjusting entry is needed each month to allocate a portion of the prepaid insurance expense to the current period's income statement.

Depreciation

Depreciation is a special type of deferred expense.

It recognizes the decline in value of long-term assets like ovens and mixers over their useful life. Each period, an adjusting entry records depreciation expense and reduces the asset's book value on the balance sheet.

The Importance of Consistency

Consistently applying adjusting entries is crucial for maintaining the integrity of financial reporting.

Using accrual accounting is the foundation of consistency. The specific methods used for depreciation or revenue recognition should also be consistently applied from one period to the next.

This allows stakeholders to compare financial statements across different periods and make informed decisions.

External Standards and Regulations

The need for adjusting entries isn’t arbitrary. It’s driven by established accounting standards.

In the United States, the Financial Accounting Standards Board (FASB) sets these standards.

These standards ensure that financial statements are prepared using a consistent and transparent framework. International Financial Reporting Standards (IFRS) serves a similar purpose globally.

Real-World Impact

Adjusting entries have a tangible impact on how businesses are perceived and valued.

Accurate financial statements are essential for securing loans, attracting investors, and making informed business decisions. Banks and investors will only lend to a company or invest in a company if they have an accurate assessment of the company's operations and health.

A company that consistently applies adjusting entries is more likely to present a credible financial picture, instilling confidence in stakeholders.

Challenges and Considerations

While essential, preparing adjusting entries can present challenges.

It requires a deep understanding of accounting principles and a careful analysis of transactions. Small businesses often struggle to apply these principles.

Judgment is also involved in estimating certain amounts, such as depreciation expense or bad debt expense. Consulting with a qualified accountant is a good idea.

Beyond the Numbers: The Ethical Dimension

The process of preparing adjusting entries also carries an ethical responsibility.

Accountants and business owners must ensure that these entries are made in good faith and not used to manipulate financial results.

Transparency and integrity are paramount to maintaining public trust and ensuring the long-term health of the business.

Looking Ahead: The Future of Adjusting Entries

As technology evolves, the process of preparing adjusting entries is becoming more automated.

Accounting software can now automatically generate many of these entries, reducing the risk of errors and improving efficiency. However, human oversight remains crucial to ensure accuracy and compliance.

As accounting standards evolve, so too will the specific rules and guidelines surrounding adjusting entries.

Back to Sweet Surrender

Back at Sweet Surrender, Sarah understands that the success of her bakery isn't just about delicious treats; it's also about sound financial management.

By diligently preparing adjusting entries, she ensures that her financial statements accurately reflect the bakery's performance and position, providing her with the information she needs to make informed decisions and continue bringing joy to her community.

So, the next time you enjoy a pastry from your favorite local bakery, remember the silent partner working behind the scenes: adjusting entries, ensuring that the business's true story is accurately told.