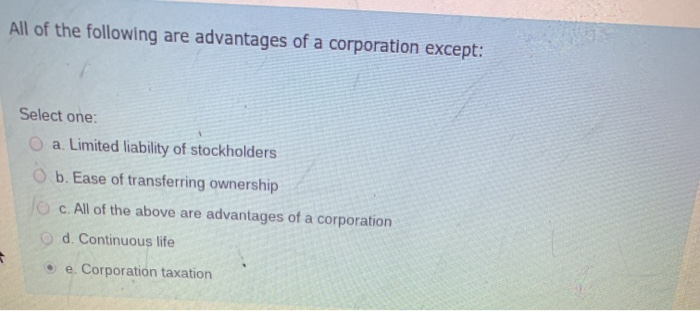

All Of The Following Are Advantages Of A Corporation Except

The allure of the corporate structure, with its promises of limited liability and perpetual existence, has long drawn entrepreneurs and investors alike. However, beneath the shiny veneer lies a complex reality, where not every perceived advantage holds true for all. The question of which characteristics are truly beneficial, and which are merely myths, is a subject of ongoing debate and crucial understanding for anyone considering incorporation.

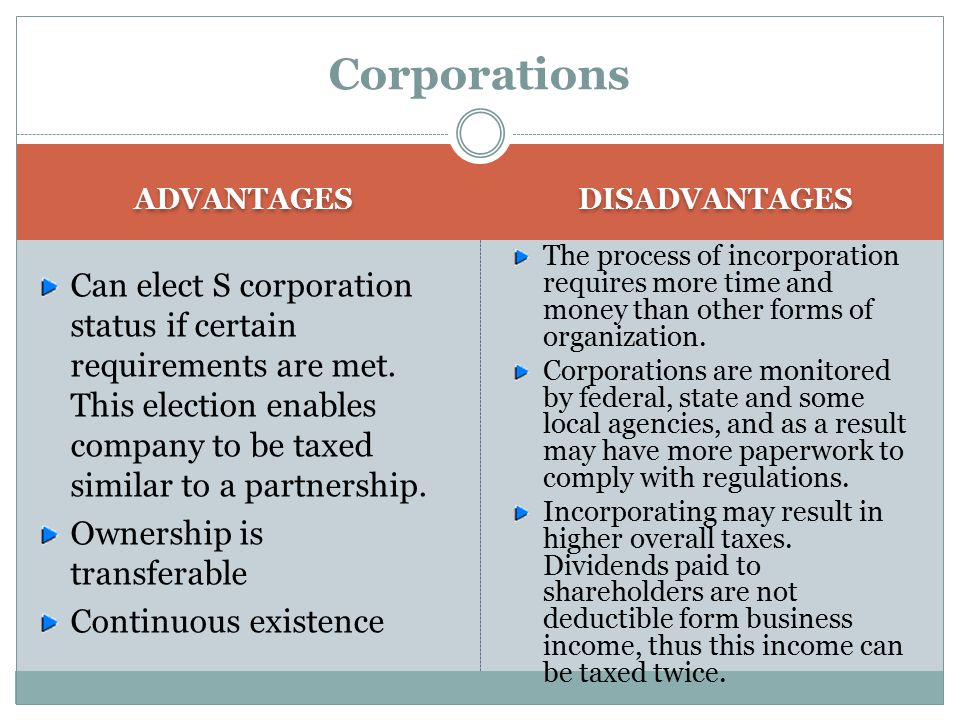

This article delves into the multifaceted advantages of corporations, dissecting common perceptions to reveal the nuances and potential drawbacks often overlooked. We'll explore aspects like limited liability, access to capital, and ease of transfer of ownership, contrasting them with potential disadvantages like double taxation and regulatory burdens. By examining these elements, we aim to provide a balanced perspective, empowering readers to make informed decisions about whether the corporate structure aligns with their specific business needs.

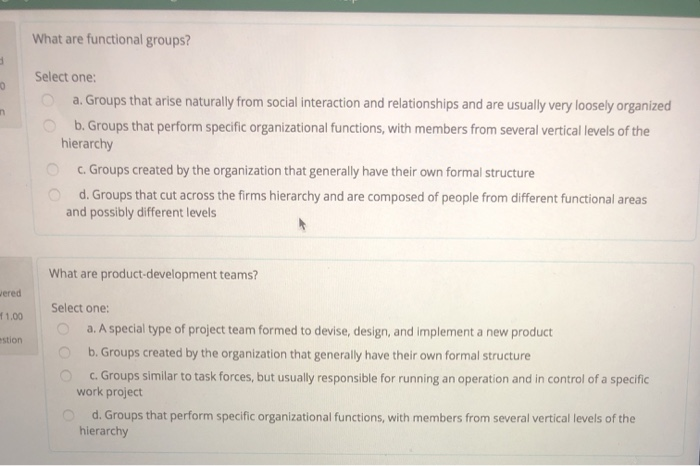

The Core Advantages: Separating Fact from Fiction

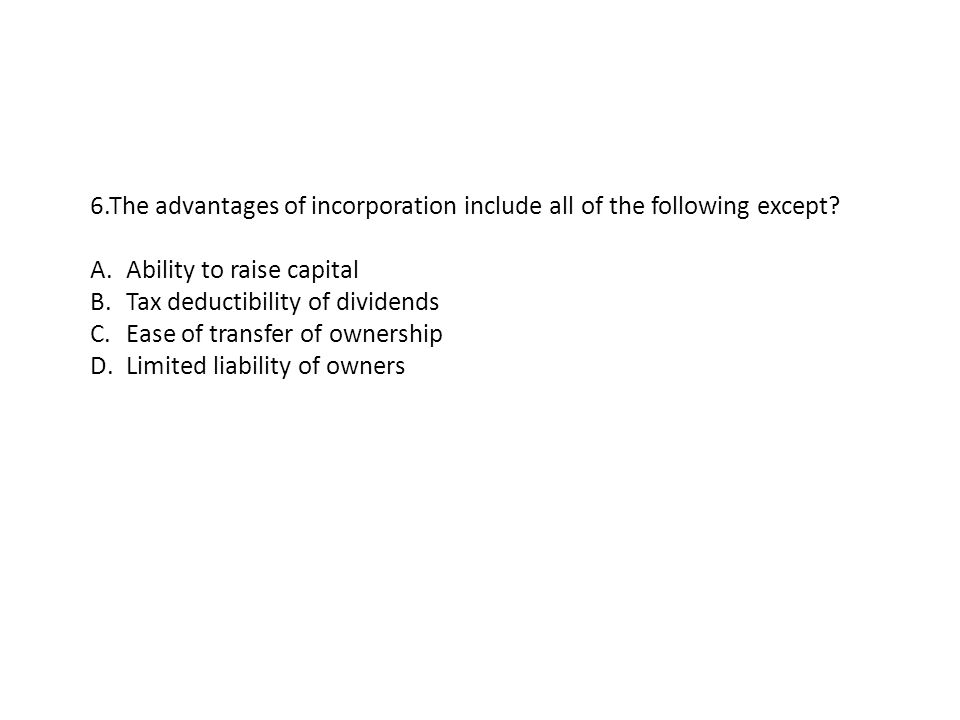

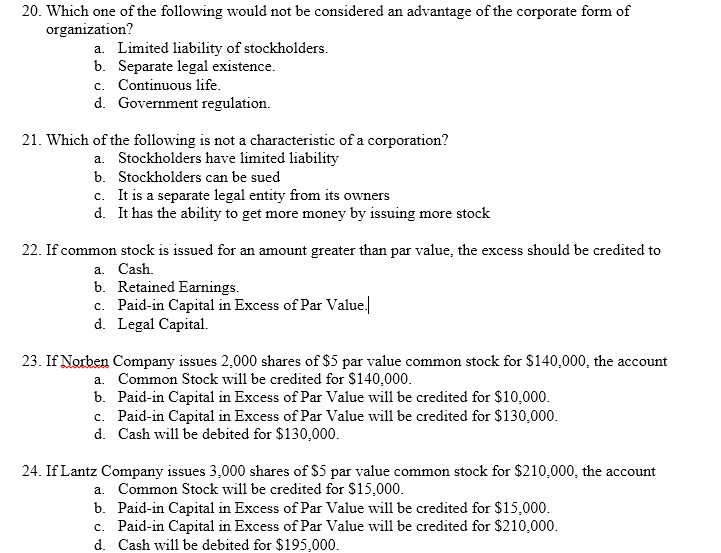

The most frequently cited advantage of a corporation is limited liability. This means that the personal assets of the shareholders are typically shielded from the company's debts and legal liabilities. However, this shield isn't impenetrable; courts can pierce the corporate veil in cases of fraud or mismanagement, holding individuals personally responsible.

Another touted benefit is the corporation's ability to raise capital more easily than other business structures. Corporations can issue stock, attracting a wider pool of investors. This access to capital fuels growth and expansion.

Furthermore, corporations offer perpetual existence, meaning they can continue to operate even if the founders or original shareholders leave or pass away. This stability is attractive to investors and lenders alike.

The Counterpoints: Disadvantages Often Overlooked

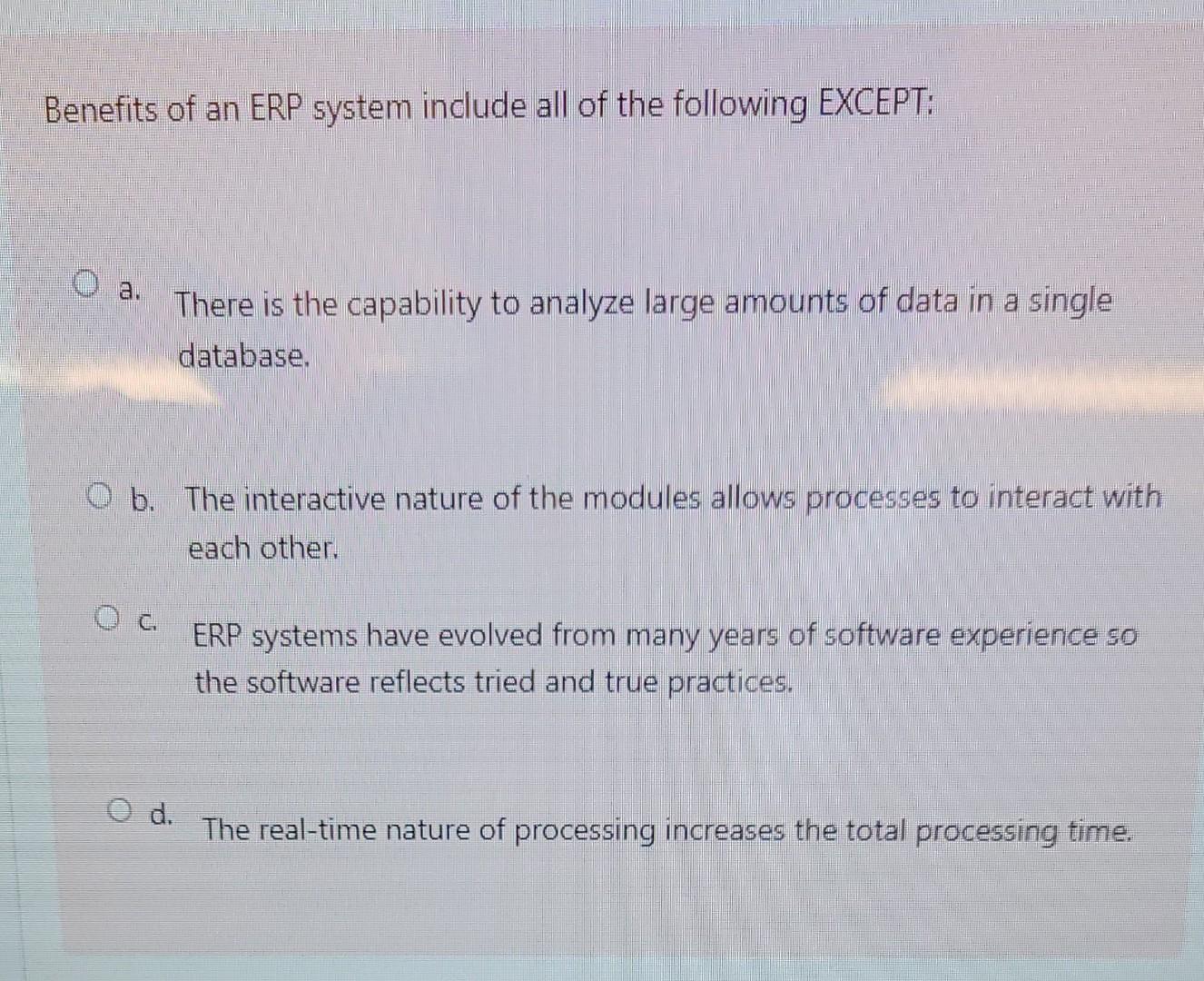

Despite the advantages, corporations face significant drawbacks, most notably double taxation. The corporation pays taxes on its profits, and then shareholders pay taxes again on dividends received. This can significantly reduce the overall return on investment.

The regulatory burden placed on corporations is also substantial. They must adhere to a complex web of laws and regulations, requiring significant time and resources for compliance. Smaller businesses may find this particularly challenging.

Maintaining corporate formalities, such as holding regular board meetings and keeping detailed records, is crucial. Failure to do so can jeopardize the corporation's legal standing and potentially expose shareholders to personal liability.

The Myth of Universal Suitability: When a Corporation Isn't the Answer

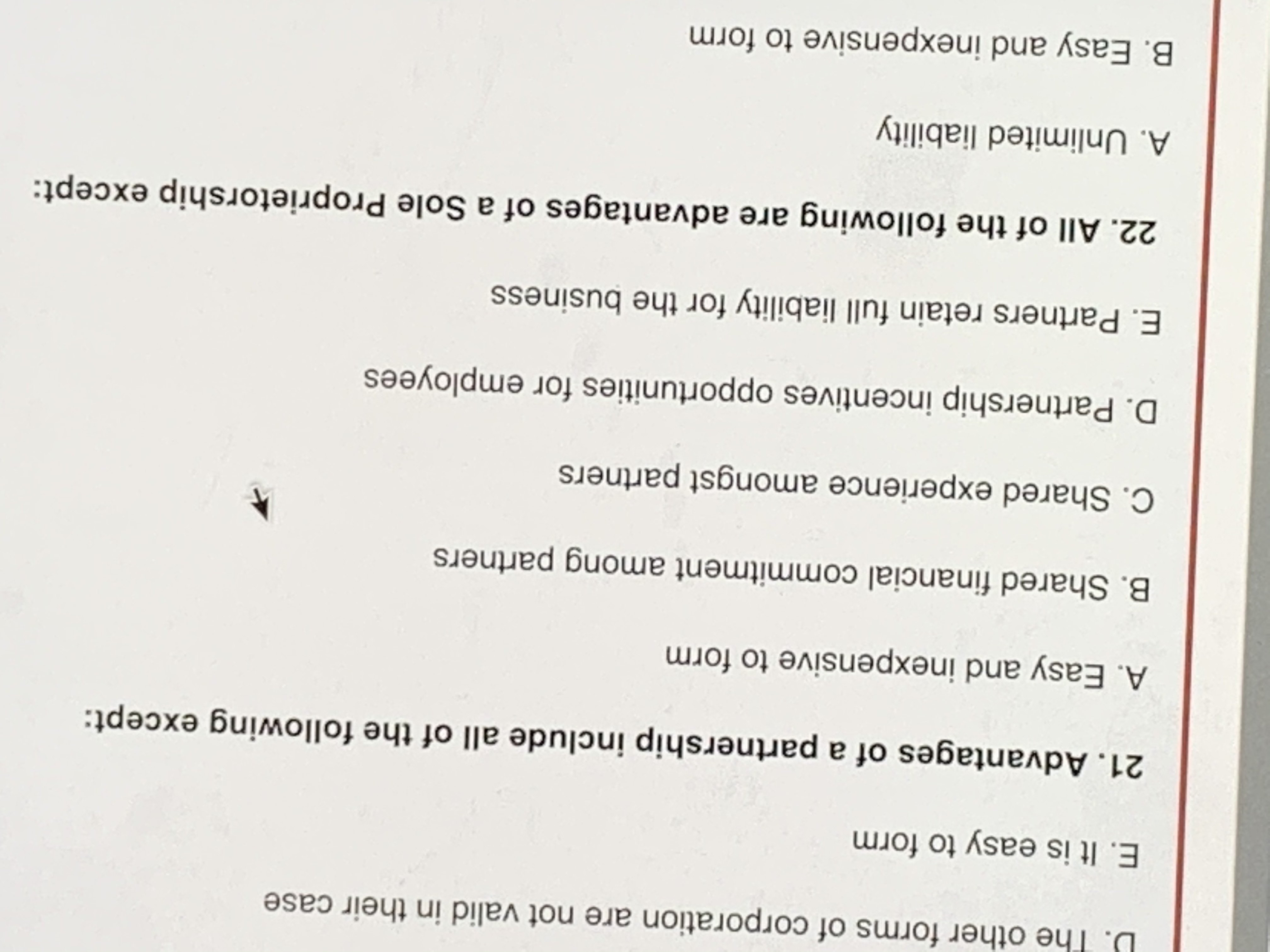

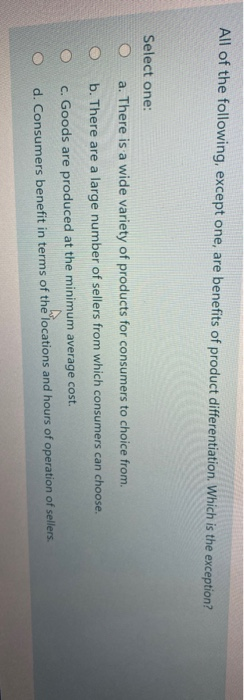

One common misconception is that a corporation is the best structure for all businesses. This isn't necessarily true. For small businesses with few owners, other structures like partnerships or limited liability companies (LLCs) may offer a better balance of liability protection and tax efficiency.

An LLC, for example, provides limited liability like a corporation but allows for pass-through taxation, avoiding the double taxation issue. The choice depends heavily on the specific circumstances and goals of the business.

Consider the words of legal scholar

"The corporate form is a powerful tool, but it's not a one-size-fits-all solution. Careful consideration must be given to the potential costs and benefits before making a decision."

Examining the "Advantages" that Aren't Always Advantages

The perceived ease of transferring ownership in a corporation, through the sale of stock, can also be a double-edged sword. While it facilitates liquidity, it can also lead to instability if ownership changes frequently or if new shareholders have conflicting interests.

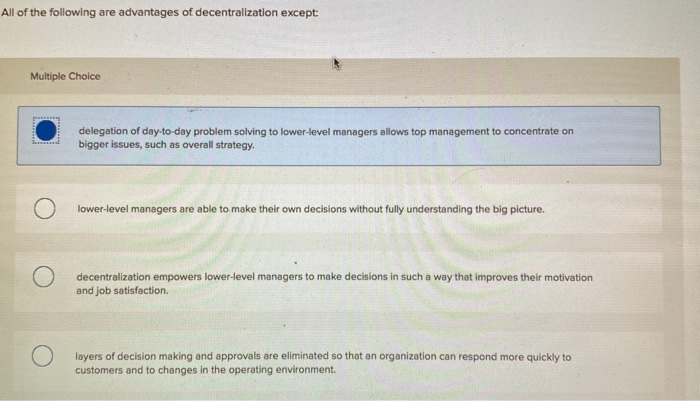

Similarly, the formal structure of a corporation, with its defined roles and responsibilities, can be seen as both an advantage and a disadvantage. While it provides clarity and accountability, it can also stifle innovation and flexibility, particularly in smaller companies.

Another possible disadvantage is separation of ownership and control. The shareholders are the owners, but the managers and directors control the business. This separation can lead to agency problems, where managers act in their own interests rather than the shareholders' interests.

Future Trends: The Evolving Landscape of Corporate Structures

The legal and regulatory landscape surrounding corporations is constantly evolving. New types of corporate structures, such as benefit corporations (B Corps), are emerging, reflecting a growing emphasis on social and environmental responsibility. These new structures are being built to avoid the disadvantages of the original form.

Technology is also playing a significant role, enabling greater transparency and accountability in corporate governance. Blockchain technology, for instance, could potentially revolutionize shareholder voting and record-keeping.

Ultimately, the decision of whether to incorporate remains a complex one, requiring careful consideration of the specific advantages and disadvantages in light of the business's unique circumstances. As the business world continues to evolve, understanding the nuances of corporate structures will become increasingly crucial for success.