American Express Pre Approved Offers

Imagine opening your mailbox on a sunny afternoon. Amidst the usual bills and flyers, a crisp, neatly printed envelope catches your eye – an invitation from American Express. The promise inside hints at a world of rewards, travel perks, and financial flexibility, all seemingly tailored just for you.

This isn't just another marketing ploy; it's a pre-approved offer from American Express, a signal that you're one step closer to accessing their coveted line of credit cards. But what does pre-approval really mean, and how significant is it in your financial journey?

Decoding the Pre-Approval Process

A pre-approved offer from American Express indicates that, based on a preliminary review of your credit profile, you meet their initial criteria for a credit card. This review is typically conducted using information from credit bureaus like Experian, Equifax, and TransUnion.

These offers aren't plucked out of thin air. American Express uses sophisticated algorithms and data analysis to identify potential cardholders who align with their target demographic and risk tolerance.

Receiving one of these offers can feel like a pat on the back, acknowledging your responsible credit behavior. However, it's crucial to understand that pre-approval isn't a guarantee of final approval.

The Fine Print: What You Need to Know

While a pre-approved offer suggests a good chance of approval, it’s not a done deal. American Express still conducts a more thorough review of your credit history, income, and other financial factors when you formally apply.

Factors like a recent change in employment, a dip in your credit score, or a high debt-to-income ratio could impact the final decision. Always read the terms and conditions of the offer carefully, paying close attention to interest rates, fees, and rewards programs.

According to Experian, checking pre-approved offers doesn't hurt your credit score. Lenders use what's called a "soft inquiry" to check your credit for pre-approved offers, which doesn't affect your credit score as a "hard inquiry" would.

The Significance of an Amex Offer

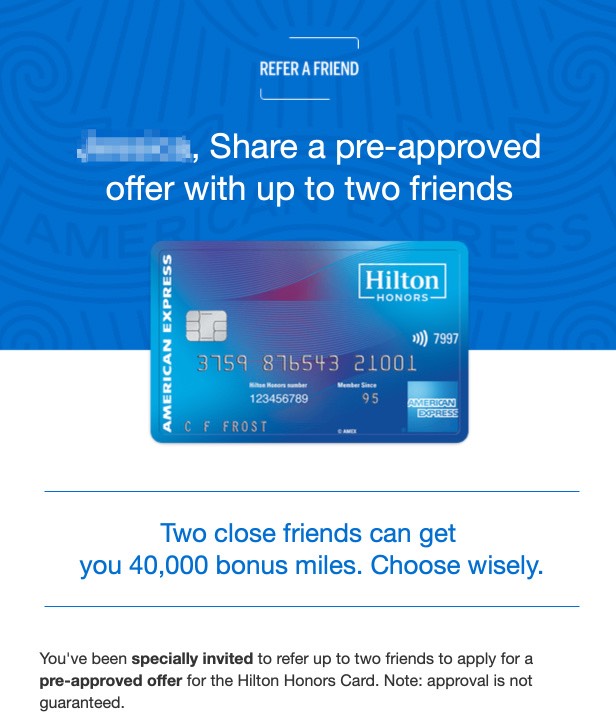

Beyond the immediate opportunity to acquire a new credit card, a pre-approved offer from American Express can hold deeper significance. It reflects positively on your creditworthiness and financial responsibility.

For individuals looking to build or rebuild their credit, receiving such an offer can be a confidence booster and a stepping stone toward more significant financial goals. Gaining access to Amex cards can unlock valuable travel and spending rewards, enhancing your financial lifestyle.

A 2023 study by J.D. Power found that American Express consistently ranks high in customer satisfaction among credit card issuers. This suggests that beyond the initial offer, the card itself is likely to deliver a positive experience.

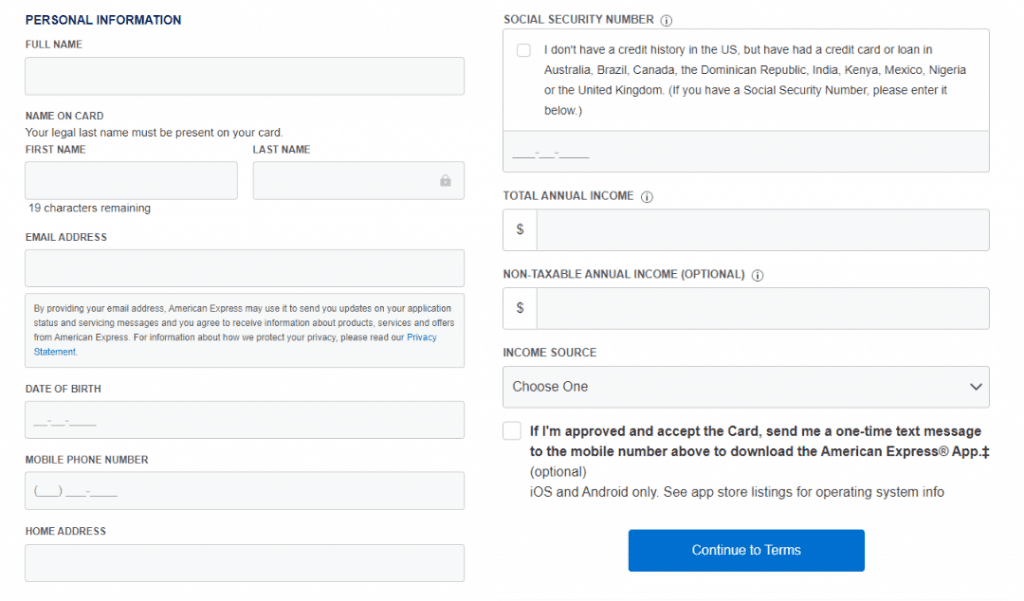

Navigating the Application Process

If you decide to pursue a pre-approved offer, the application process is usually straightforward. You'll typically need to provide personal information, such as your Social Security number, income details, and employment history.

Be truthful and accurate when completing the application. Discrepancies can raise red flags and potentially lead to rejection.

Once submitted, American Express will conduct its final review, and you'll typically receive a decision within a few days or weeks.

Final Thoughts

A pre-approved offer from American Express is more than just a piece of mail; it's a testament to your financial standing and a potential gateway to a world of rewards and benefits. Approach it with informed optimism, understanding its nuances and implications.

Remember that responsible credit card usage is key to maintaining a healthy financial profile. Paying your bills on time and keeping your credit utilization low will ensure that these opportunities continue to come your way.

So, the next time you find that familiar envelope in your mailbox, take a moment to appreciate the recognition of your financial diligence and explore the possibilities it holds. The journey to financial well-being is paved with smart choices, and sometimes, it begins with a simple invitation.

![American Express Pre Approved Offers [YMMV] American Express Business Platinum 150,000/200,000 Pre-Approved](https://www.doctorofcredit.com/wp-content/uploads/2023/05/american-express-business-platinum-1024x479.png)

![American Express Pre Approved Offers [YMMV] American Express Platinum 100,000 Offer Available Via AmEx Pre](https://www.doctorofcredit.com/wp-content/uploads/2016/01/amex-pre-approved-offers.png)

![American Express Pre Approved Offers [Dead] American Express Pre-Approval Referral Offers (No Lifetime](https://www.doctorofcredit.com/wp-content/uploads/2019/10/deal.png)