Americanexpress Com Confirmcard Amex Mobile App

Imagine a world where forgotten passwords and frantic calls to customer service are relics of the past. A world where verifying your credit card is as simple as a tap on your phone, a seamless dance between security and convenience. This isn't a futuristic fantasy; it's the reality American Express is ushering in with its enhanced mobile app integration, specifically focusing on the Americanexpress.com/confirmcard feature.

This updated system streamlines the card verification process, making it easier than ever for new and existing cardholders to manage their accounts. By integrating directly with the Amex mobile app, the Americanexpress.com/confirmcard feature offers a secure and user-friendly alternative to traditional methods, promising a faster and more efficient experience. Ultimately saving time and improving the user experience for millions.

The Evolution of Card Verification

Historically, confirming a new or replacement American Express card often involved a multi-step process. Cardholders would typically receive a physical card in the mail, followed by a separate PIN or activation code. Next, they would be instructed to call a dedicated number or log into their online account to manually enter the information, adding friction and delays to the initial card activation.

Recognizing the need for a more modern solution, American Express began exploring avenues to leverage the power of mobile technology. According to a 2023 study by J.D. Power, customer satisfaction with mobile banking apps is significantly higher than with traditional channels like phone calls. This data underscored the importance of prioritizing mobile-first solutions. The mobile app is intuitive and safe for people to manage their credit cards.

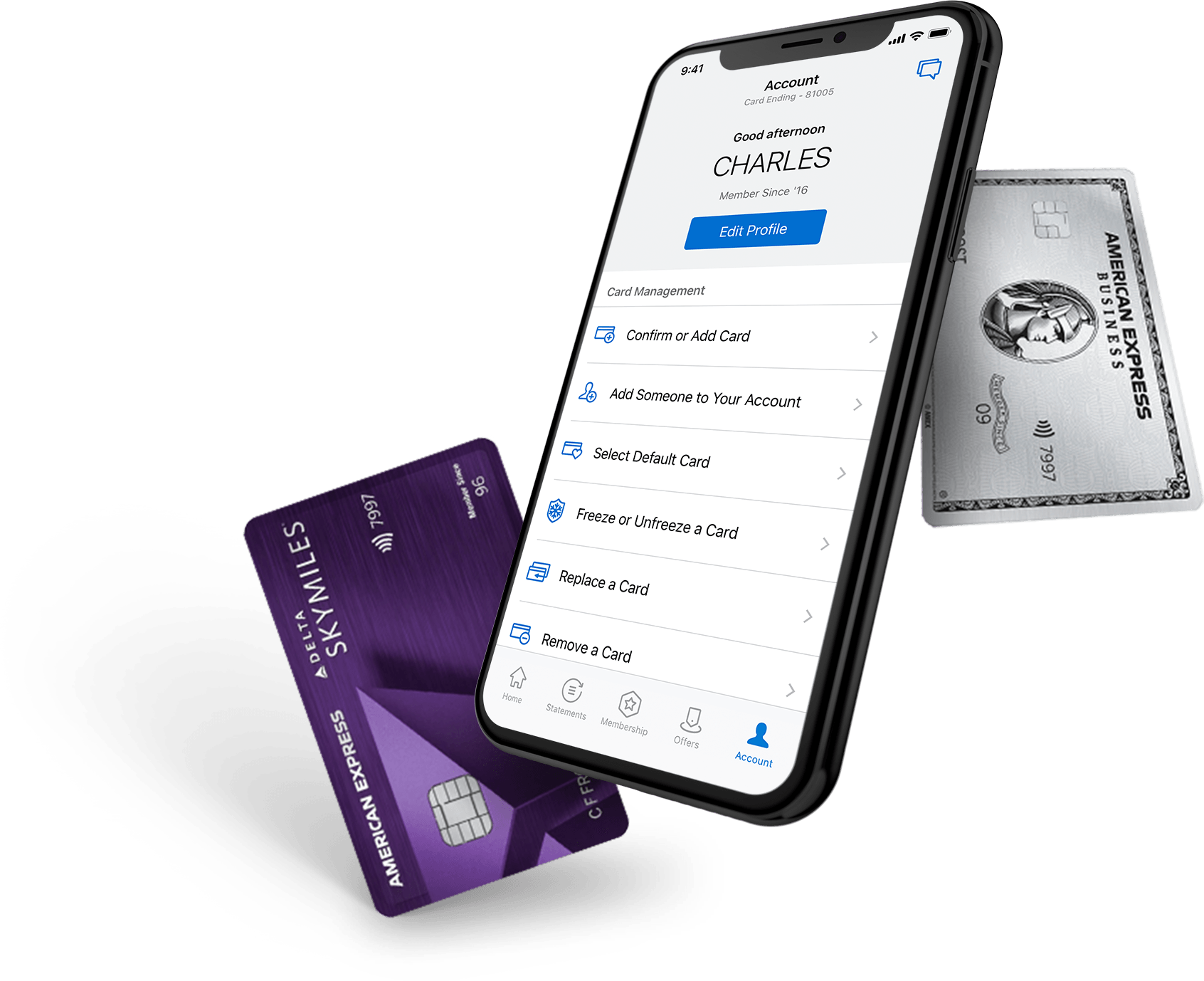

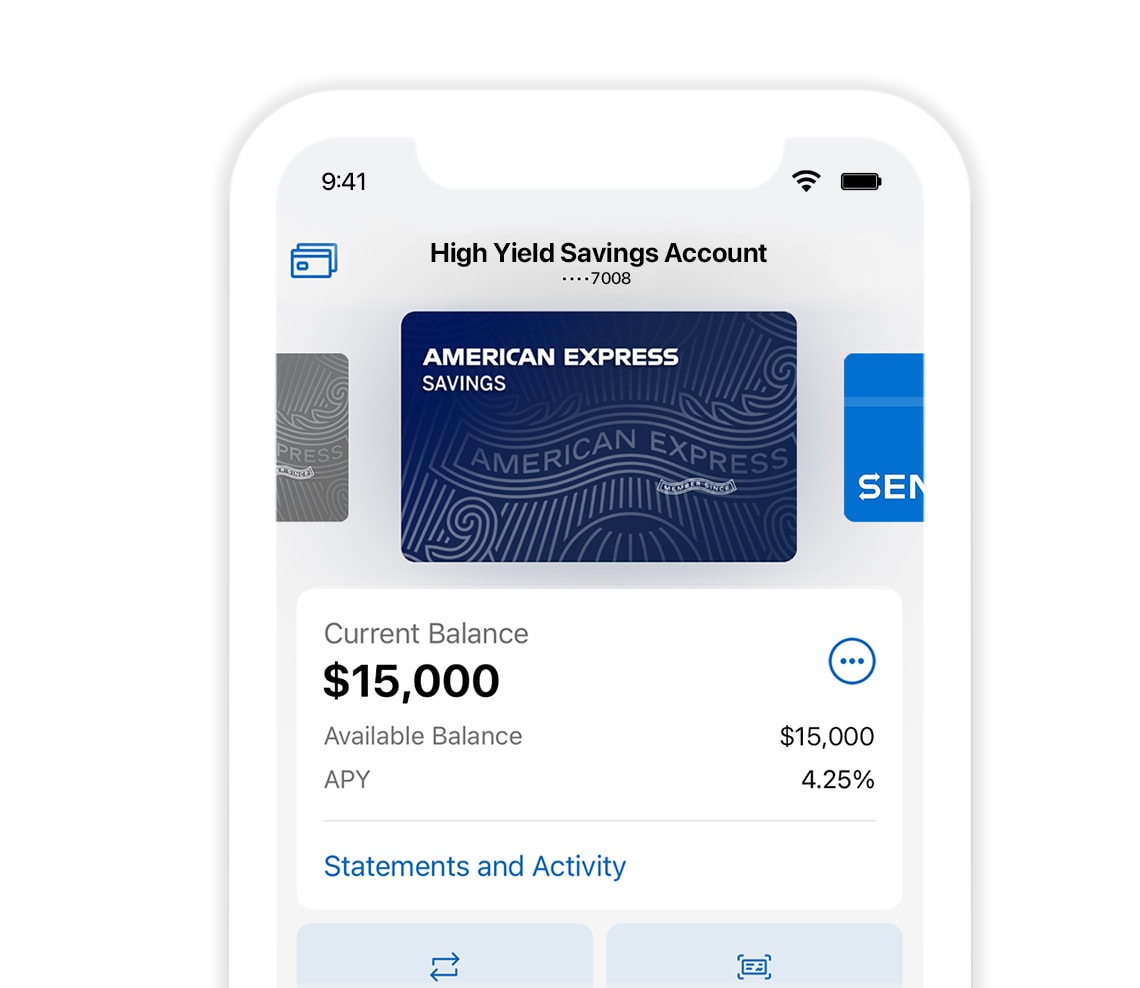

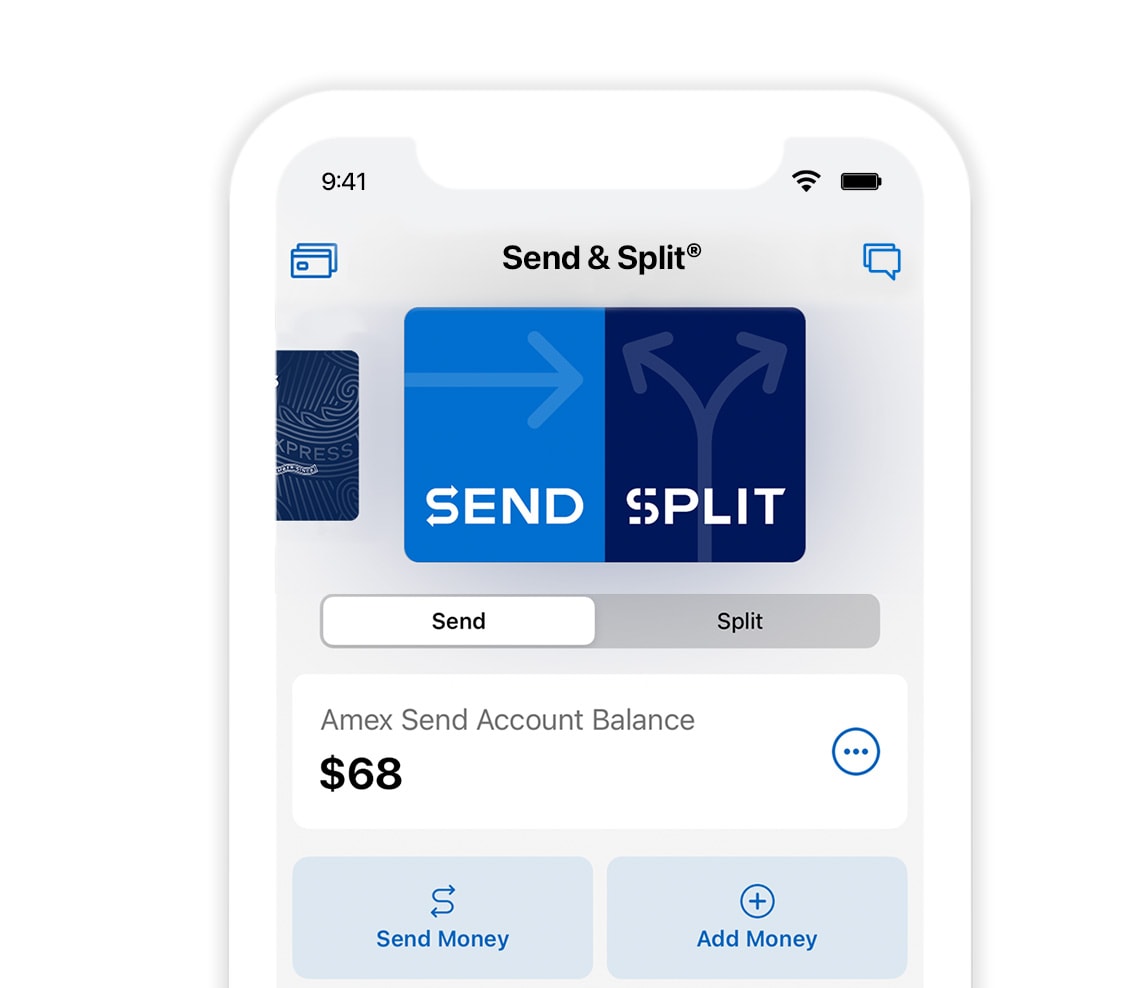

The Amex Mobile App: A Central Hub

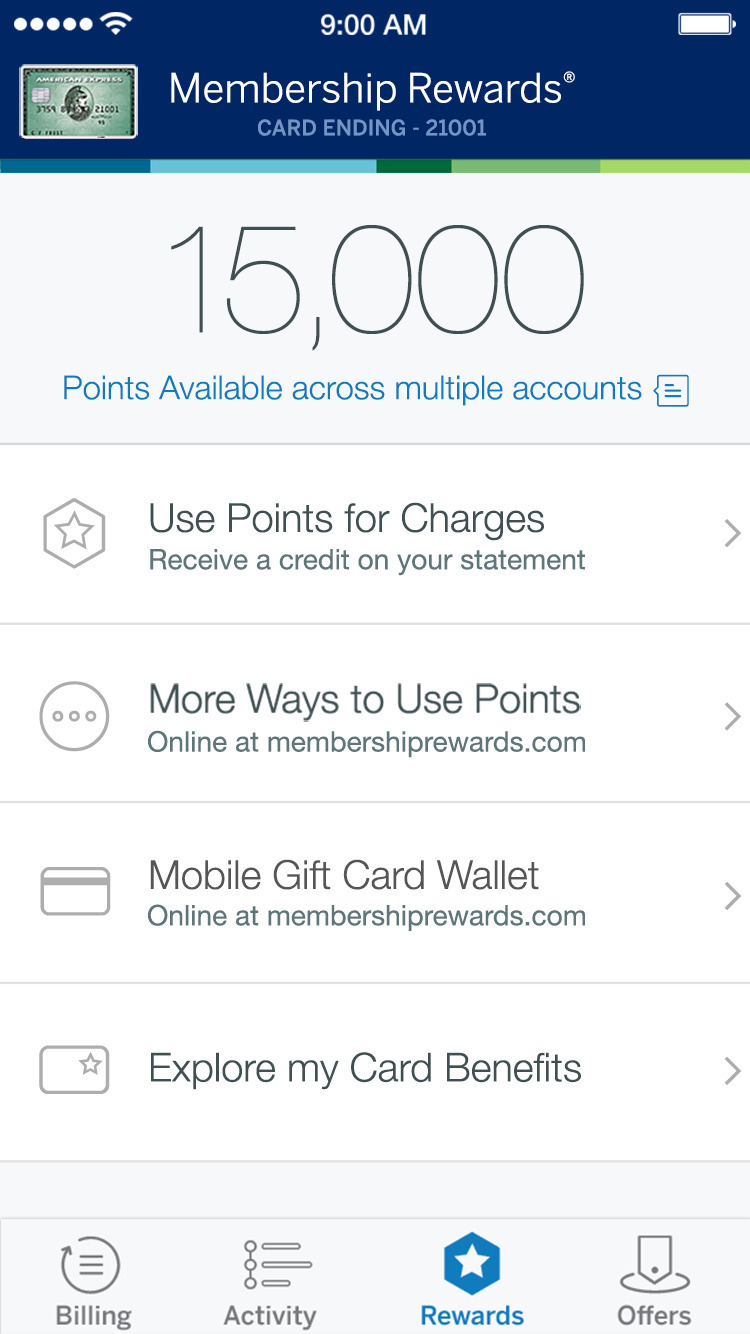

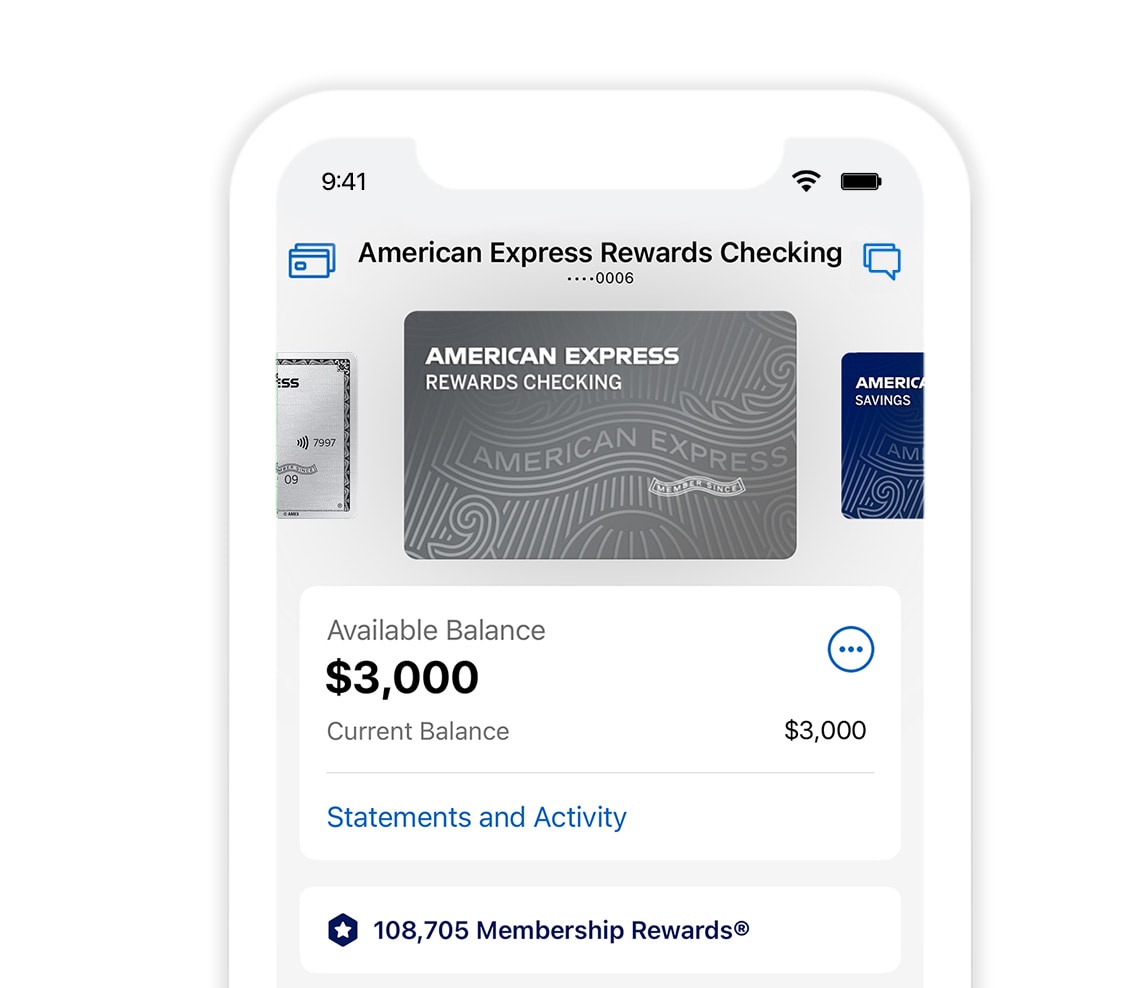

The Amex mobile app has become a central hub for cardholders to manage their accounts, track spending, and access a range of benefits. Integrating the card confirmation process directly into the app makes perfect sense. It provides a unified and convenient experience. It is convenient for all the users.

The Americanexpress.com/confirmcard feature within the app utilizes advanced security protocols, including biometric authentication (fingerprint or facial recognition) and device verification, to ensure that only the legitimate cardholder can activate the card. This enhanced security layer minimizes the risk of fraud and unauthorized access.

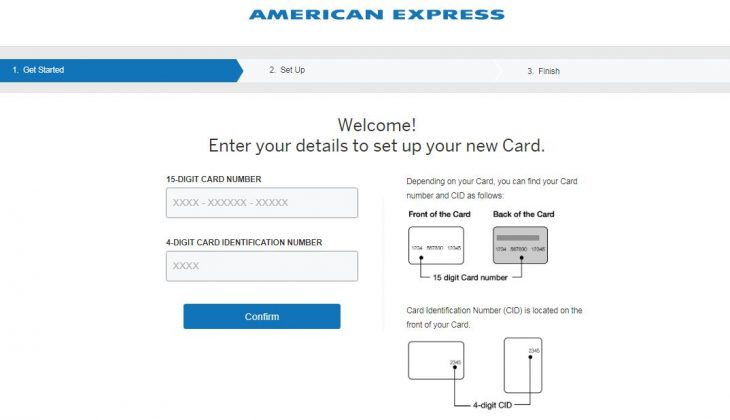

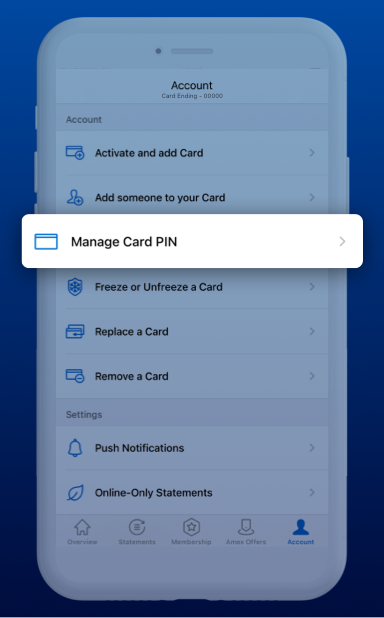

How It Works: A Step-by-Step Guide

The process is remarkably straightforward. Once a new card arrives, the cardholder simply opens the Amex mobile app. After a cardholder opens the app, they will navigate to the 'Confirm Card' section. The app will then guide them through a series of security checks, such as confirming personal information or scanning the card using the device's camera.

Upon successful verification, the card is immediately activated and ready for use. This eliminates the waiting period associated with traditional activation methods and allows cardholders to start enjoying their Amex benefits right away. According to American Express internal data, the app-based confirmation process reduces card activation time by an average of 75%.

The new feature of Americanexpress.com/confirmcard also addresses a common pain point for travelers. Imagine arriving in a new country and realizing you've forgotten to activate your replacement card. With the Amex mobile app, you can complete the activation process within minutes, regardless of your location. It is convenient and simple to do.

The implementation of the Americanexpress.com/confirmcard feature reflects American Express's commitment to innovation and customer-centricity. By embracing mobile technology and prioritizing security, the company is setting a new standard for card management. They are reducing friction and enhancing the overall customer experience.

In a world where time is precious and convenience is key, the ability to instantly confirm your American Express card through the mobile app is a significant advantage. It is a small change that will create ripples of positive impacts. It makes card management easier, safer, and more accessible for everyone.