An Accrued Expense Can Best Be Described As An Amount

Imagine a small bakery, the aroma of fresh bread swirling in the air. Flour dusts the counters, and the oven hums a constant, warm tune. The owner, Maria, meticulously records every transaction, ensuring her business stays afloat. But there's something less tangible, something that doesn't involve a cash register ringing: it’s her monthly electricity bill. It is an obligation accrued over time, a silent partner in her daily bread-making dance.

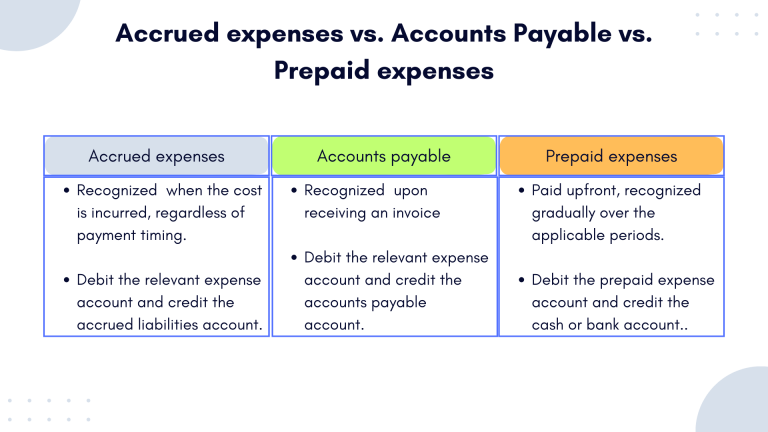

The focus of this story isn't just Maria's bakery but the broader concept of an accrued expense. In essence, an accrued expense can best be described as an amount. More specifically, it's an expense that has been incurred but not yet paid. Understanding this concept is crucial for any business, large or small, to have a true picture of its financial health.

Delving into Accrued Expenses

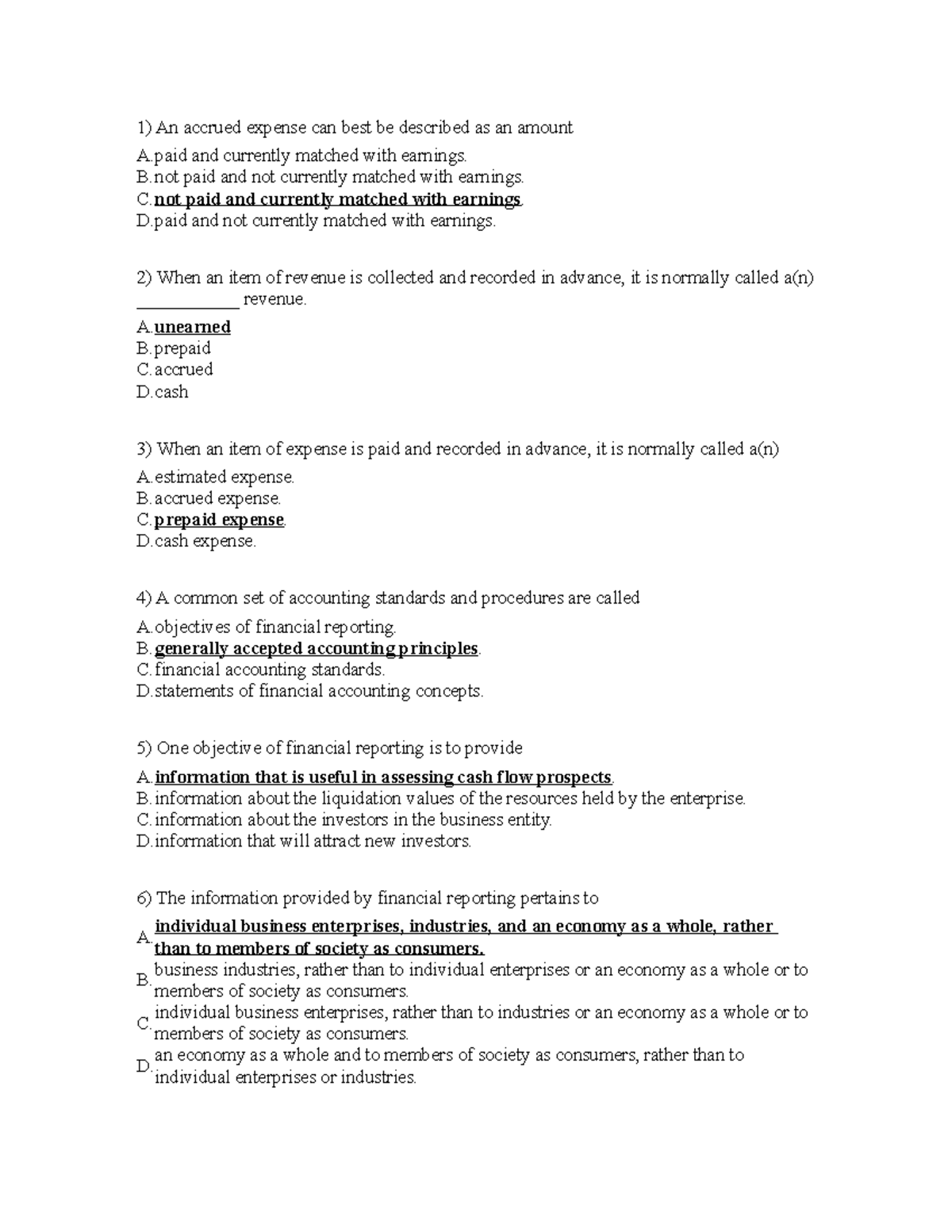

Accrued expenses, sometimes also referred to as accrued liabilities, represent obligations that a company has incurred but hasn't yet received a bill or made a payment for. These expenses are recognized on the balance sheet because of the matching principle in accounting. The matching principle dictates that expenses should be recognized in the same period as the revenue they helped generate.

The Essence of Accrual Accounting

To fully understand accrued expenses, it's important to grasp the concept of accrual accounting. Unlike cash accounting, which recognizes revenue and expenses only when cash changes hands, accrual accounting recognizes revenue when it's earned and expenses when they're incurred. This method provides a more accurate representation of a company's financial performance over a specific period.

According to the Financial Accounting Standards Board (FASB), the Generally Accepted Accounting Principles (GAAP) require the use of accrual accounting for most public companies. This is because it offers a more complete and transparent view of a company's financial position. Accrual accounting can highlight potential issues that might be missed under a cash-based system.

Examples in Everyday Business

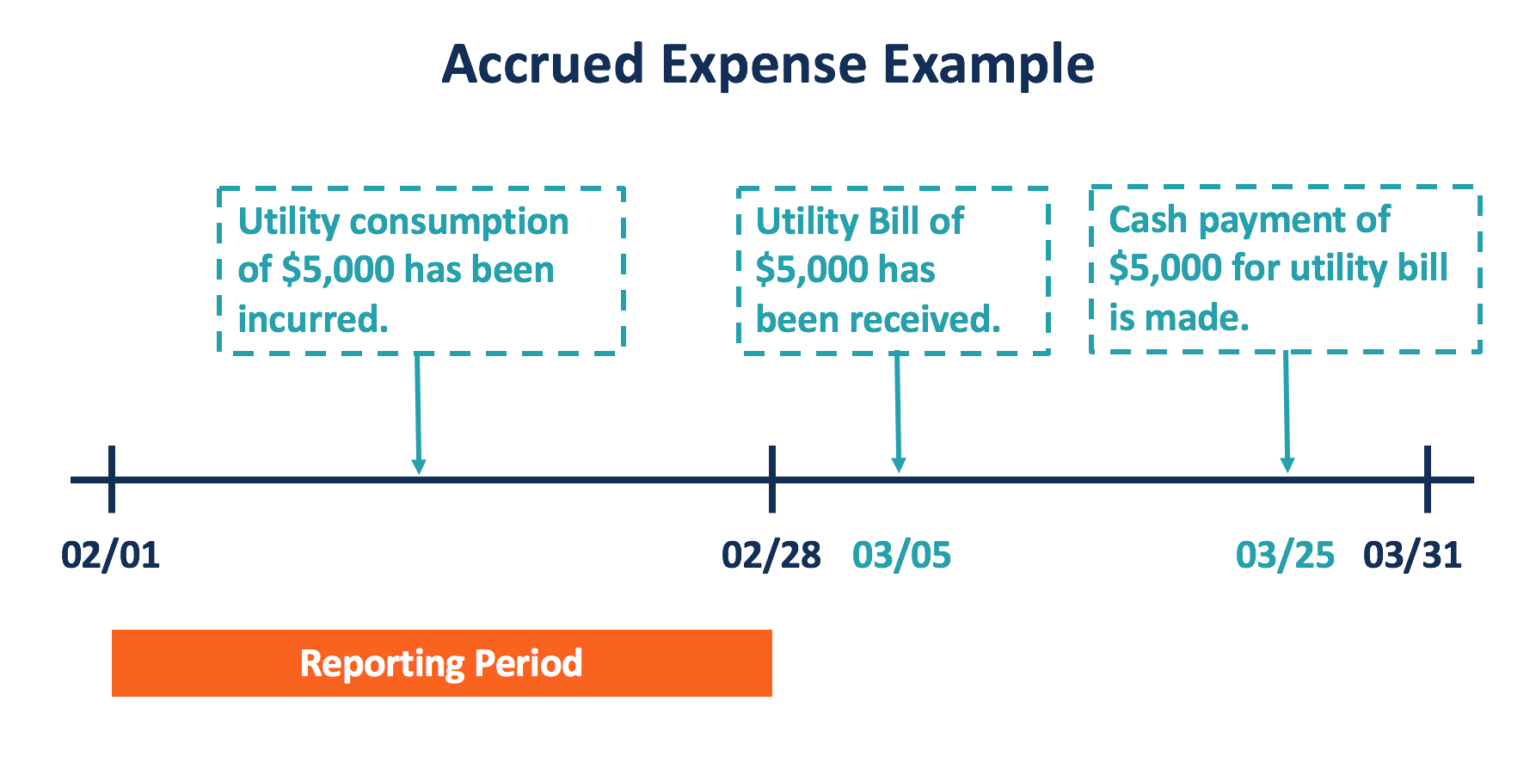

Back to Maria's bakery: her electricity bill provides a perfect example of an accrued expense. She uses electricity throughout the month. The bill might not arrive until the following month.

She has incurred the cost of that electricity in the current month, even though she hasn't paid for it yet. Therefore, she needs to record an accrued expense to accurately reflect her business's financial situation. This keeps her books accurate and in accordance with accounting standards.

Other common examples of accrued expenses include salaries owed to employees, interest on loans, and taxes. In the case of salaries, employees may work for a portion of a pay period before receiving their paycheck. The wages earned but not yet paid represent an accrued expense for the company.

The Mechanics of Recording Accrued Expenses

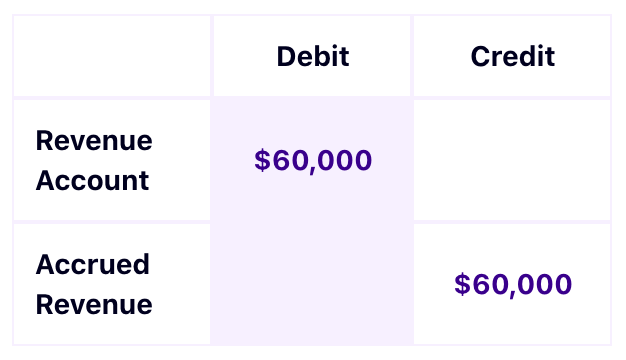

Recording an accrued expense involves making an adjusting journal entry at the end of an accounting period. This entry will typically increase an expense account (like utilities expense) and increase a liability account (like accrued expenses payable). The increase reflects that the company now owes that money.

For example, if Maria estimates her electricity expense for the month to be $200, she would debit (increase) her utilities expense account by $200 and credit (increase) her accrued expenses payable account by $200. When the actual bill arrives and she pays it, she will then debit the accrued expenses payable account and credit her cash account.

The initial entry helps to match the expense with the period in which it was incurred. The second entry, when the bill is paid, clears the liability from the balance sheet. Proper recording ensures that the financial statements accurately reflect the company's obligations.

Why Accrued Expenses Matter

Understanding and properly accounting for accrued expenses is vital for several reasons. First and foremost, it allows for a more accurate assessment of a company's profitability. By recognizing expenses in the same period as the revenue they generate, businesses gain a clearer picture of their true earnings.

This is particularly important for businesses with significant time lags between incurring costs and receiving payment. Accurately accounting for accrued expenses also ensures compliance with accounting standards. Following GAAP principles is essential for publicly traded companies and often a requirement for securing loans or attracting investors.

Moreover, a thorough understanding of accrued expenses facilitates better financial planning and decision-making. By recognizing these obligations, companies can anticipate future cash outflows and manage their finances more effectively. This anticipation reduces surprises and strengthens overall stability.

Potential Pitfalls and Best Practices

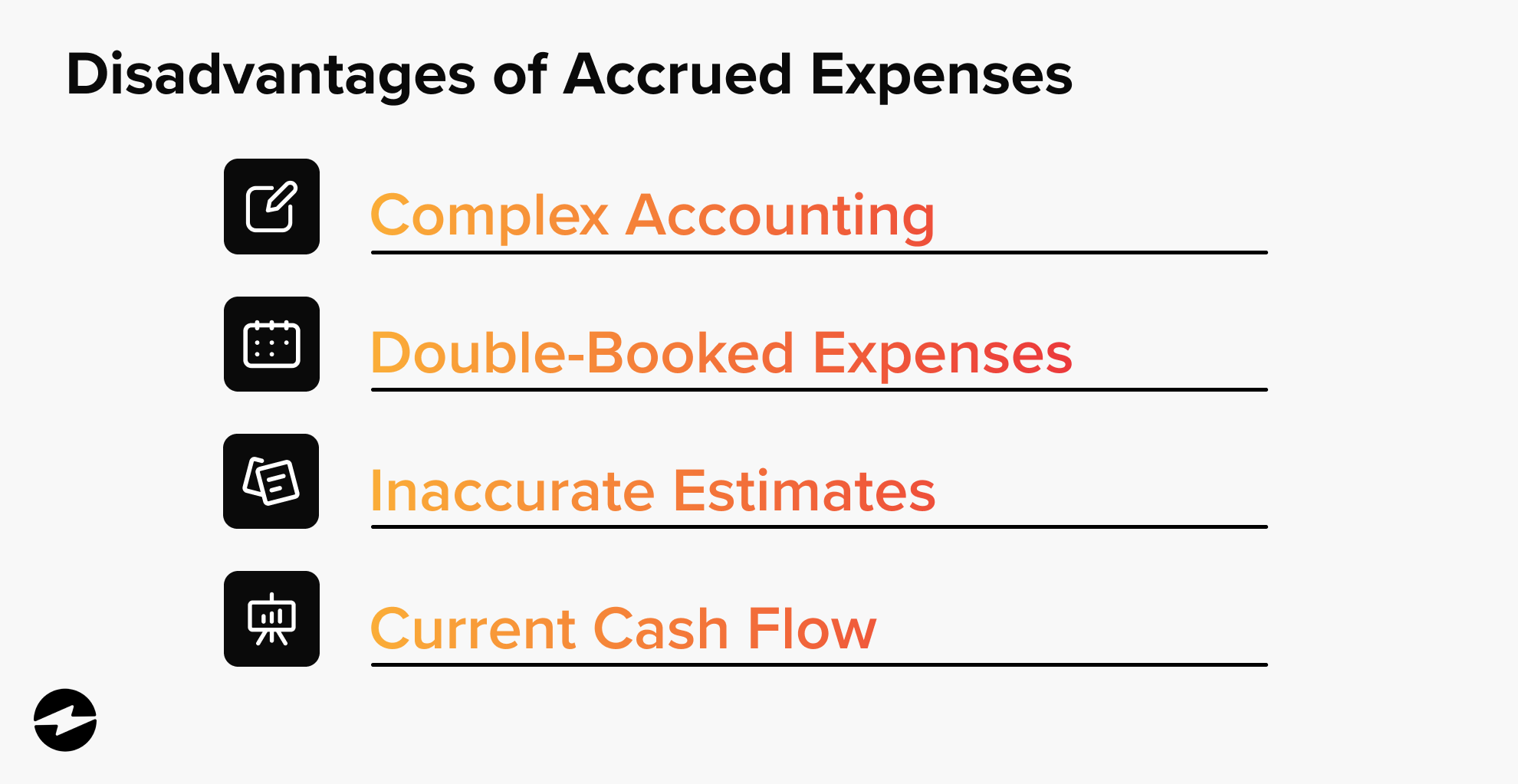

While the concept of accrued expenses may seem straightforward, there are potential pitfalls to be aware of. Estimating the amount of an accrued expense can sometimes be challenging. For example, predicting the exact amount of utility usage or potential warranty claims can involve some degree of guesswork.

Furthermore, consistent tracking and documentation are crucial to avoid errors or omissions. Failure to accurately record accrued expenses can lead to inaccurate financial statements and potentially misleading information for stakeholders. Therefore, maintaining organized records and regularly reviewing accrued expense entries are vital.

To ensure accuracy, businesses should establish clear policies and procedures for identifying and recording accrued expenses. Regularly auditing these processes and consulting with accounting professionals can also help to minimize errors. Staying informed about changes in accounting standards is also imperative to maintain compliance.

Beyond the Balance Sheet: A Broader Perspective

Accrued expenses offer a glimpse into the dynamics of a business. They highlight the relationships between resources consumed and obligations incurred. They also speak to a company's ability to manage its finances responsibly.

These entries aren’t just about crunching numbers but also about providing a comprehensive picture of financial reality. Accrued expenses offer a framework for honest accounting and informed financial management. Such honesty and information can foster confidence and improve performance.

"Accounting is the language of business,"

as Warren Buffett famously said, and accrued expenses are a key part of that language. They represent a commitment to accuracy and transparency. Accrued expenses are an essential element of a financially healthy enterprise.

The concept is particularly relevant in today's rapidly changing business environment, where companies are increasingly relying on subscription models and long-term contracts. Properly accounting for accrued expenses becomes even more critical. These models may have revenue and expenses spread over extended periods.

Conclusion

Returning to Maria’s bakery, we see that understanding accrued expenses isn't merely an accounting exercise but a vital component of running a successful business. It enables her to see the full picture of her financial health. It allows her to make informed decisions about pricing, investments, and future growth.

An accrued expense, that simple amount, reveals a broader commitment to responsible financial management. It allows businesses to thrive in the long run. Like the silent hum of the oven, the accrual system quietly sustains and supports the ongoing operation.

The next time you enjoy a pastry or a freshly baked loaf of bread, remember the accrued expenses diligently recorded in the background. These records play a vital role in making such delightful experiences possible. They are a silent and essential part of the business landscape.

:max_bytes(150000):strip_icc()/TermDefinitions_AccuredExspense_recirc_3-2-ab4e70486db34a81bf9098e2b1da6407.jpg)