Arbor Realty Trust Earnings Call Transcript

Arbor Realty Trust [ABR] reports a mixed Q1 2024 earnings, revealing both challenges and strategic pivots amidst market volatility. The earnings call highlights concerns surrounding loan performance and future strategies for navigating a complex real estate environment.

Arbor Realty Trust Q1 2024 Earnings: Key Takeaways

Arbor Realty Trust held its Q1 2024 earnings call, detailing a period marked by both successes and headwinds. The call, which took place on May 3, 2024, shed light on the company's financial performance and strategic initiatives going forward.

The company's leadership addressed investor concerns regarding loan quality, particularly within its multifamily portfolio.

Financial Performance

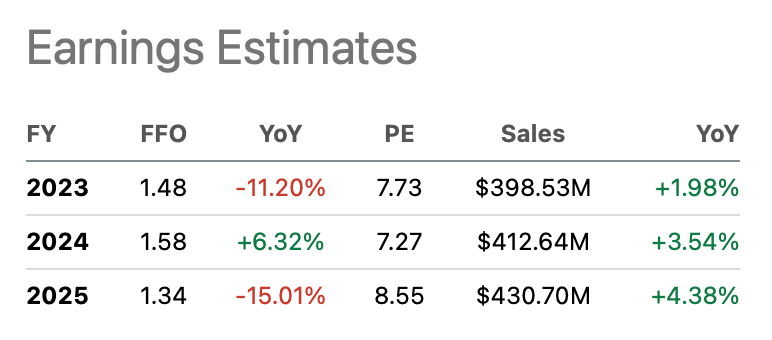

Arbor Realty Trust announced core earnings of $0.42 per diluted share, falling short of analyst expectations. This figure reflects increased provisioning for potential loan losses, a key area of concern for investors.

Revenue for the quarter totaled $120.8 million, impacted by market fluctuations and loan modifications.

The company reported a net loss of $33.2 million, a significant shift compared to the previous quarter's net income.

Loan Portfolio Analysis

Loan originations experienced a decrease, indicative of tighter lending conditions. New loan originations totaled $785 million.

The multifamily sector continues to be a focal point, with executives highlighting efforts to proactively manage potential risks.

Executives acknowledged that some borrowers are struggling due to increased interest rates and operational challenges.

Strategic Adjustments and Outlook

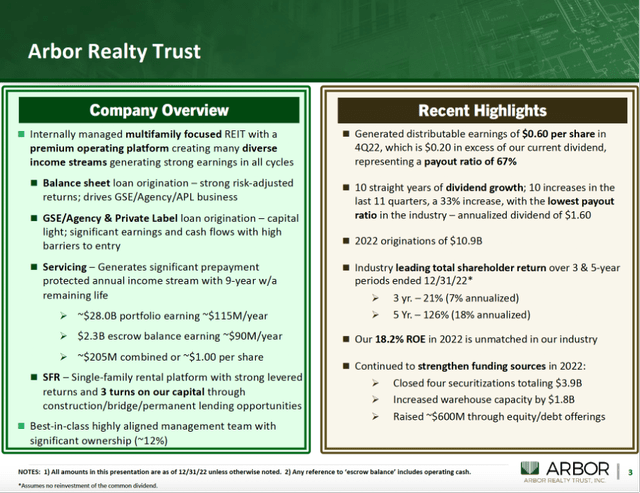

Ivan Kaufman, Arbor Realty Trust's CEO, emphasized the company's commitment to maintaining a strong balance sheet.

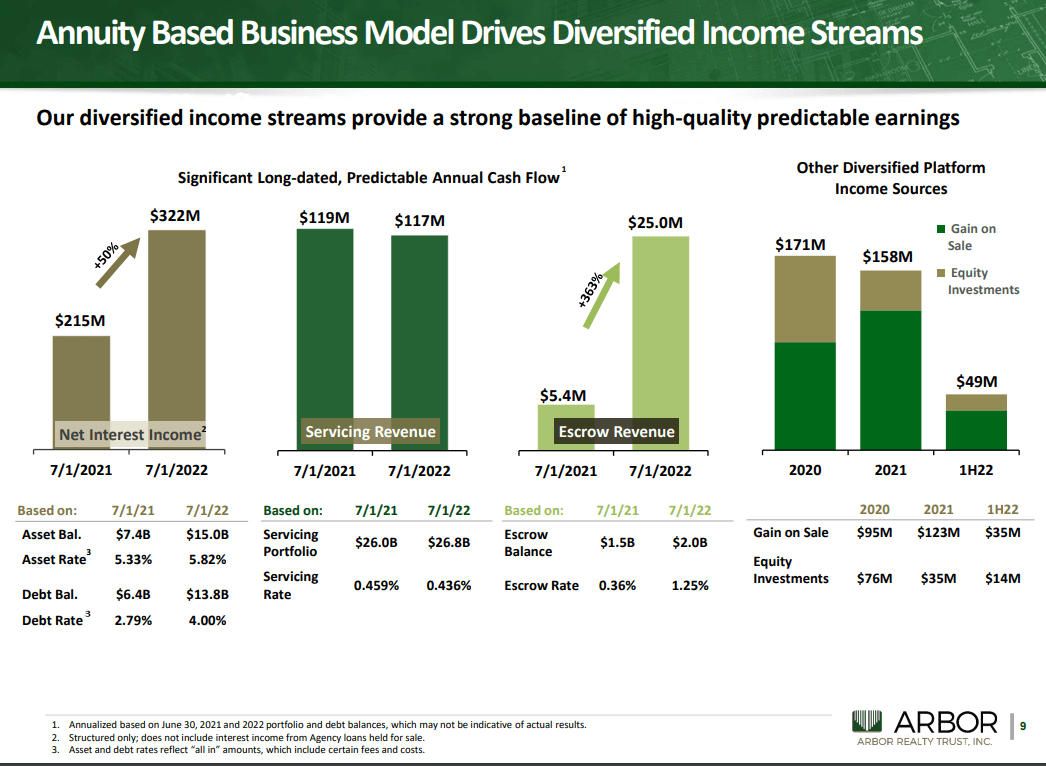

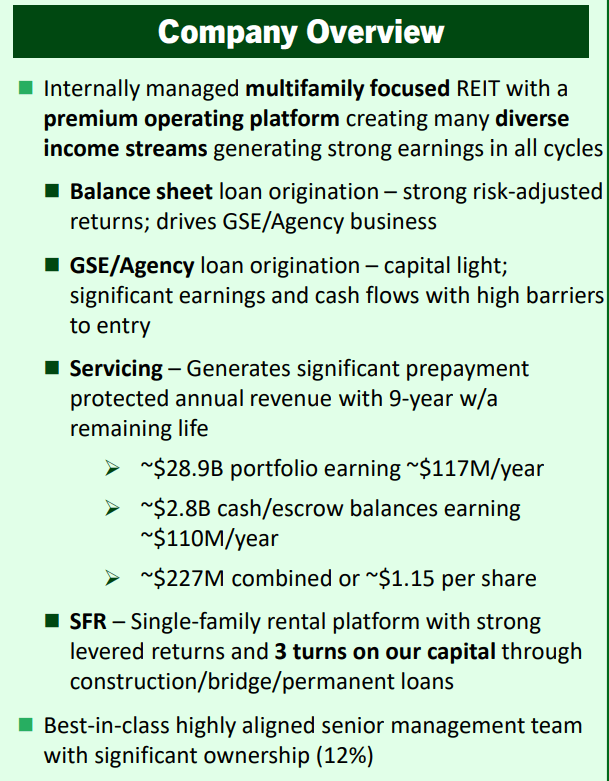

The company plans to focus on strengthening its servicing platform and managing existing assets effectively.

Arbor is also strategically reducing its exposure to higher-risk loans while continuing to pursue opportunities in more stable sectors.

Dividend Declaration

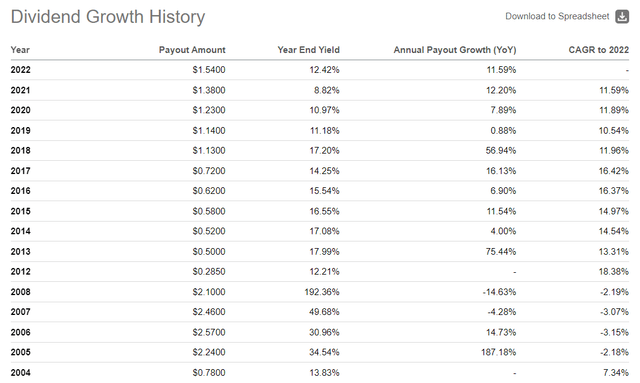

Despite the challenging environment, Arbor Realty Trust declared a dividend of $0.43 per share for the quarter. This decision underscores the company's commitment to shareholder returns.

However, analysts questioned the sustainability of the dividend given the current earnings performance.

The company defended its dividend policy, citing its long-term confidence in its business model.

Concerns and Challenges

Loan performance remains a primary concern, particularly with rising interest rates affecting borrowers' ability to repay.

Increased provisioning for loan losses negatively impacted the company's bottom line. The exact amount for the quarter hasn't been specifically stated, but was significant.

Market volatility and uncertainty continue to present challenges for the company's investment strategy.

Analyst Reactions

Analysts on the call pressed management for details on the company's strategies for mitigating loan losses.

Several analysts lowered their price targets for ABR following the earnings release, reflecting concerns about the company's near-term prospects.

The focus of analysts seemed to be on the need for the company to aggressively manage its risk profile.

Management Commentary

Ivan Kaufman reiterated the company's focus on disciplined underwriting and proactive asset management.

Management expressed confidence in its ability to navigate the current market environment.

However, they also acknowledged that the coming quarters will be challenging.

Future Steps

Arbor Realty Trust will continue to monitor its loan portfolio closely and make adjustments as needed.

The company plans to focus on optimizing its capital structure and reducing its exposure to riskier assets.

Investors will be closely watching Arbor's performance in the coming quarters to assess the effectiveness of its strategies.