Authorized Vs Issued Vs Outstanding Shares

In the complex world of corporate finance, a firm's share structure is a foundational element dictating ownership, control, and potential for growth. Understanding the distinctions between authorized, issued, and outstanding shares is critical for investors, analysts, and anyone seeking to grasp a company's financial health and strategic direction. Confusion in these definitions can lead to misinterpretations of a company's market capitalization, equity value, and overall investment appeal.

This article breaks down the nuances of authorized, issued, and outstanding shares, explaining their significance, interrelationships, and impact on stakeholders. We will explore how these share categories influence corporate governance, fundraising strategies, and shareholder value. By clarifying these concepts, we aim to provide a solid foundation for informed decision-making in the financial markets.

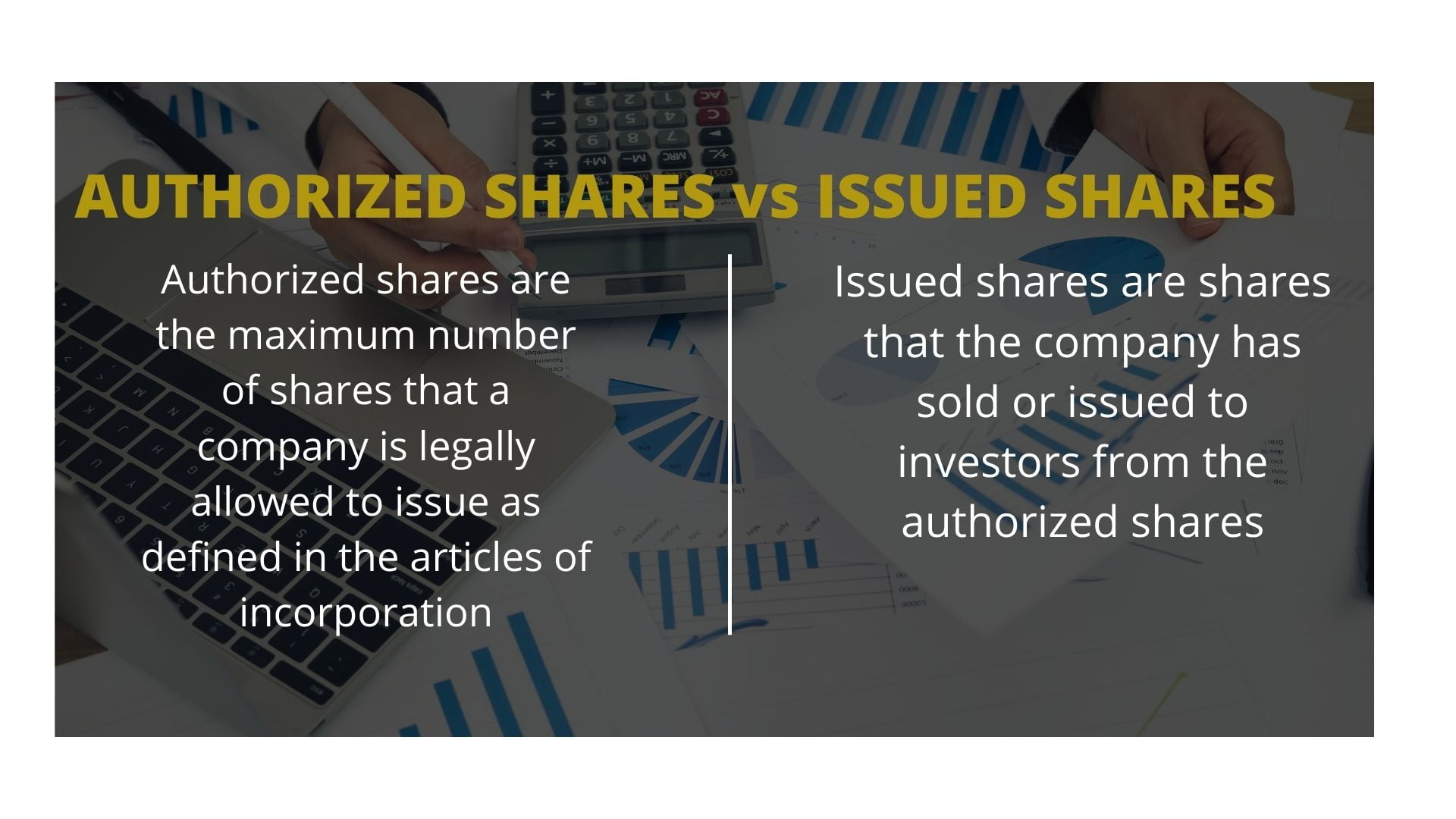

Understanding Authorized Shares

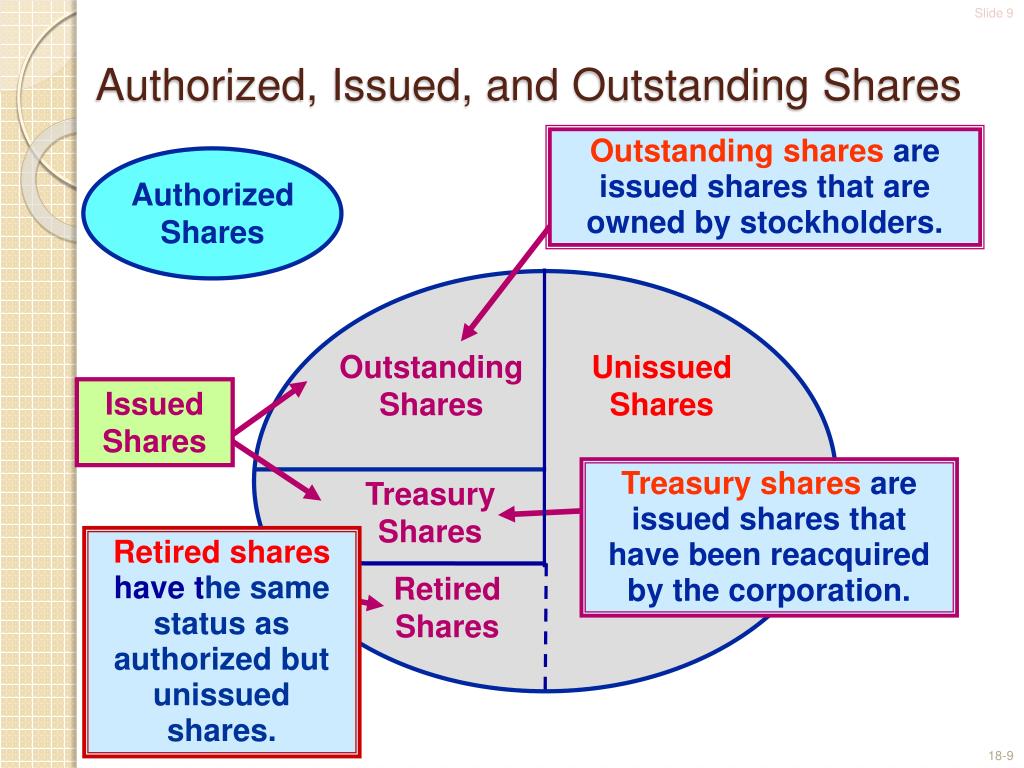

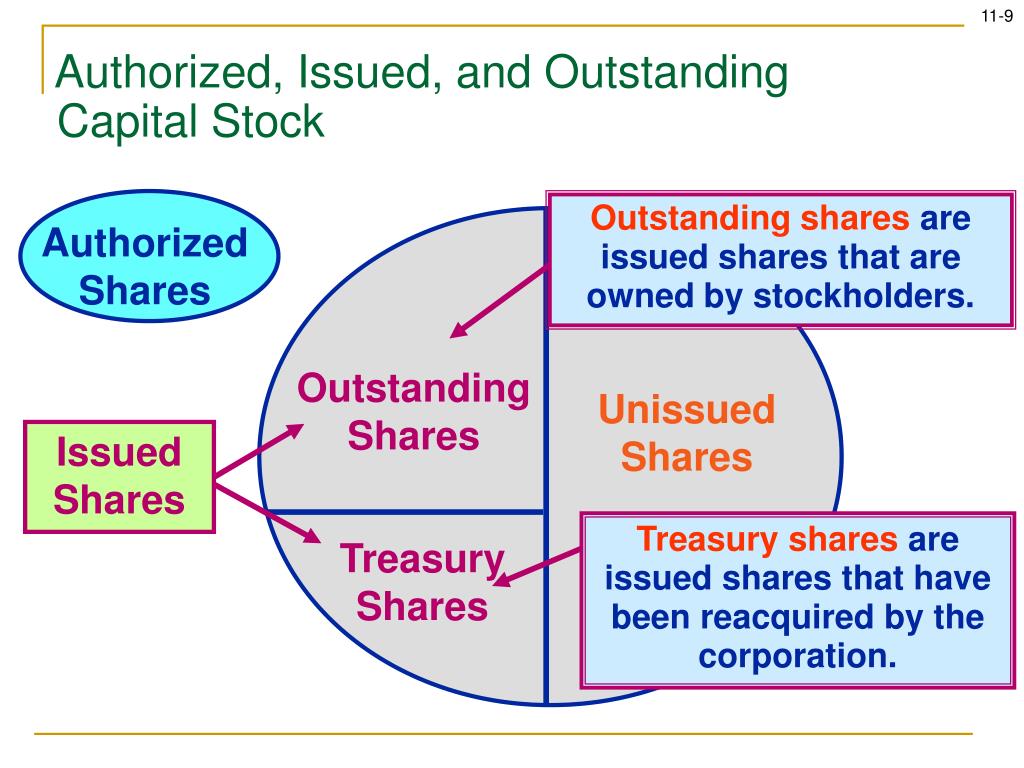

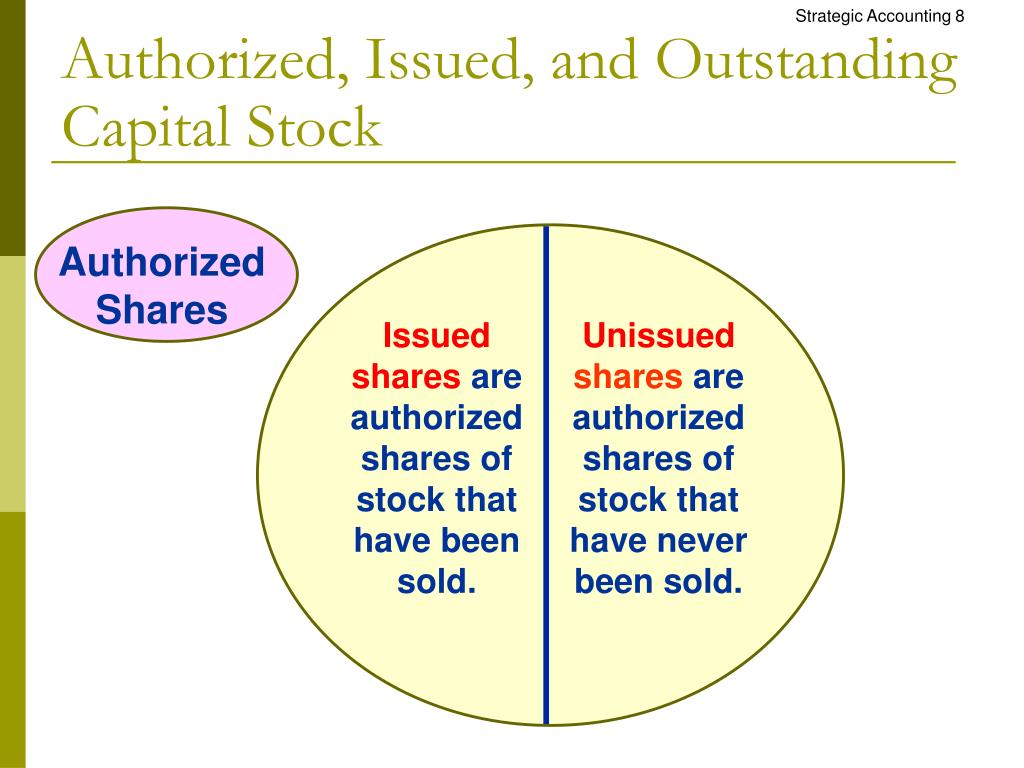

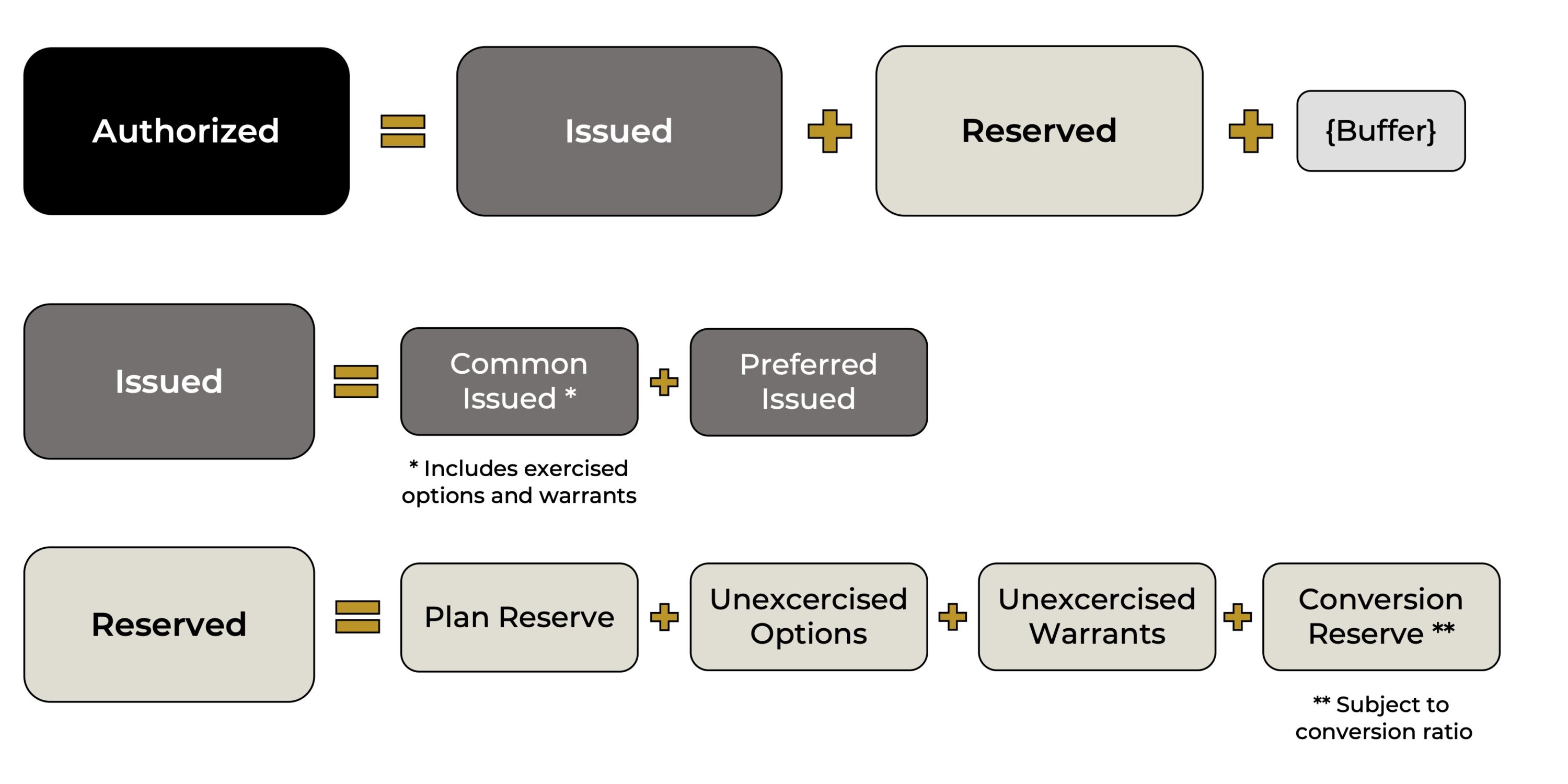

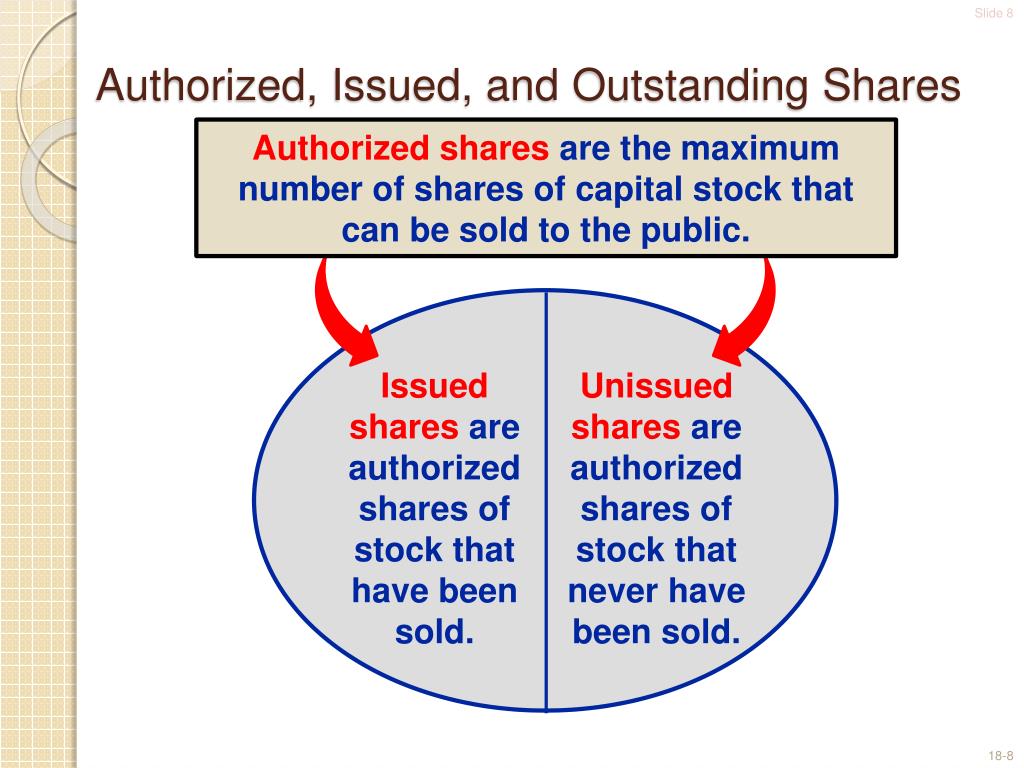

Authorized shares represent the maximum number of shares a company is legally permitted to issue, as defined in its corporate charter or articles of incorporation. This figure is not a fixed number and can be increased with shareholder approval, but initially sets the ceiling for equity issuance.

The authorized share count provides a company with flexibility for future fundraising, stock splits, and employee stock option plans. A high authorized share count might signal growth potential, while a low count could restrict future actions without amending the corporate charter.

However, a large number of authorized but unissued shares can also be viewed with caution. It could potentially lead to dilution of existing shareholders' ownership if the company decides to issue a significant number of new shares in the future.

The Nuances of Issued Shares

Issued shares refer to the total number of shares a company has actually sold or granted to investors, employees, or other parties. This number is always equal to or less than the number of authorized shares.

Issued shares represent the portion of authorized shares that are actively in circulation, representing ownership stakes in the company. Issued shares create the initial capitalization structure of the firm.

The difference between authorized and issued shares indicates the potential for further equity financing without needing to seek further shareholder approval to increase the authorized share count. Company actions which increase the issued share count can have both positive and negative effects.

Outstanding Shares: The Key Metric for Investors

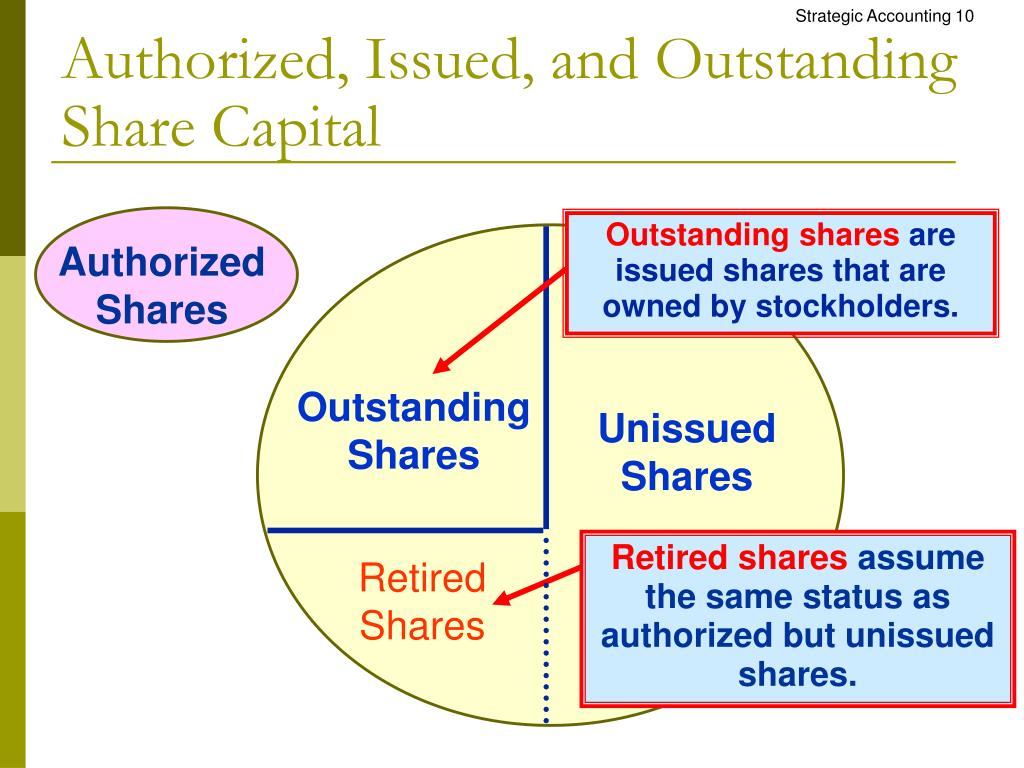

Outstanding shares are the total number of shares currently held by investors, including both retail and institutional shareholders. It excludes any shares that the company has repurchased and are held in its treasury (treasury stock).

This metric is paramount for investors as it directly impacts key calculations such as earnings per share (EPS) and market capitalization. Market capitalization, a crucial valuation metric, is calculated by multiplying the outstanding shares by the current market price per share.

A change in outstanding shares directly affects the ownership percentage each share represents. Stock buybacks reduce the number of outstanding shares, potentially increasing EPS and boosting the stock price.

The Interplay Between Share Categories

The relationship between authorized, issued, and outstanding shares is dynamic and influences a company's financial strategy. For example, a company with a large gap between authorized and issued shares has the potential to raise capital through future equity offerings without amending its charter.

If a company repurchases its own shares, the issued shares remain constant, but the outstanding shares decrease. These repurchased shares become treasury stock and are not considered outstanding until they are reissued.

A company may increase its authorized shares to facilitate a merger or acquisition, stock split, or other corporate actions. For example, Tesla increased its authorized shares in 2022 to enable a potential stock split (as stated in their SEC filings).

Impact on Corporate Governance and Shareholder Value

The share structure significantly impacts corporate governance. A high concentration of outstanding shares in the hands of a few large shareholders can give them considerable control over the company's decisions.

Conversely, a dispersed shareholder base makes it more difficult for any single shareholder to exert undue influence. This is typically seen as beneficial from a corporate governance perspective.

Share buybacks, which reduce outstanding shares, can boost shareholder value by increasing EPS and potentially driving up the stock price. Companies with consistently increasing EPS due to well-executed buybacks, such as Apple, are often favored by investors.

Potential Pitfalls and Considerations

While a high number of authorized but unissued shares can provide flexibility, it can also be a red flag. It could indicate a potential for future share dilution, which decreases the value of existing shares.

Investors need to carefully analyze the reasons behind a company's decision to issue new shares. If the funds are used for profitable investments or acquisitions, it can be a positive sign. But if the funds are used to cover operating losses, it raises concerns.

According to a report by PwC, "companies need to clearly articulate the rationale behind any significant changes to their share structure to maintain investor confidence."

Looking Ahead: Monitoring Share Structure Changes

Monitoring a company's share structure is crucial for investors. Changes in authorized, issued, or outstanding shares can signal strategic shifts and impact shareholder value.

Reviewing a company's SEC filings, particularly 10-K and 10-Q reports, provides valuable insights into its share structure and any recent changes. Pay attention to any announcements related to stock splits, buybacks, or equity offerings.

By understanding the nuances of authorized, issued, and outstanding shares, investors can make more informed decisions and better assess a company's financial health and growth potential. Diligence is key to sound investment and success in stock market activities.