Why Is Budgeting Important To A Business

For any business, whether a burgeoning startup or a multinational corporation, navigating the financial landscape requires a strategic approach. At the heart of that strategy lies a fundamental practice: budgeting.

A budget isn't just about numbers; it's a roadmap that guides a company toward its financial goals. This article explores the vital role budgeting plays in business success, examining its significance, key components, and potential impact.

The Importance of Budgeting: A Financial Compass

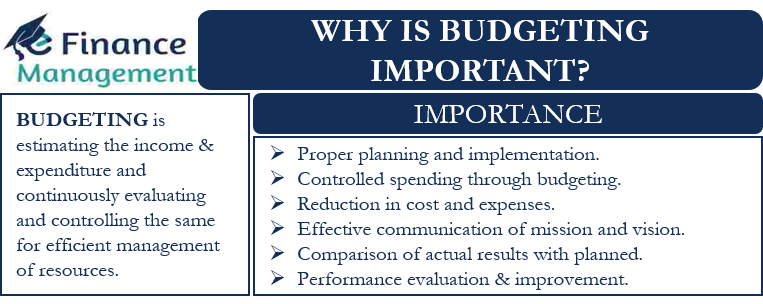

At its core, budgeting is the process of creating a financial plan. It allocates resources effectively, controlling spending, and accurately estimating revenues. Essentially, it is a financial compass that guides a business toward profitability and sustainability.

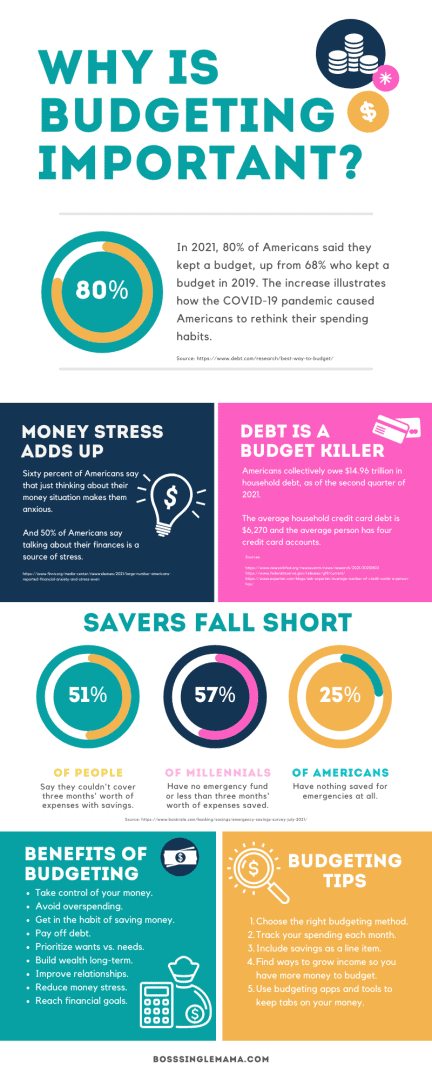

The U.S. Small Business Administration (SBA) emphasizes the crucial nature of budgeting. Without a budget, businesses risk financial instability and potential failure.

Budgeting isn't a one-size-fits-all approach. Instead, it necessitates adapting and tailoring to the unique characteristics and objectives of each individual company.

Financial Planning and Control

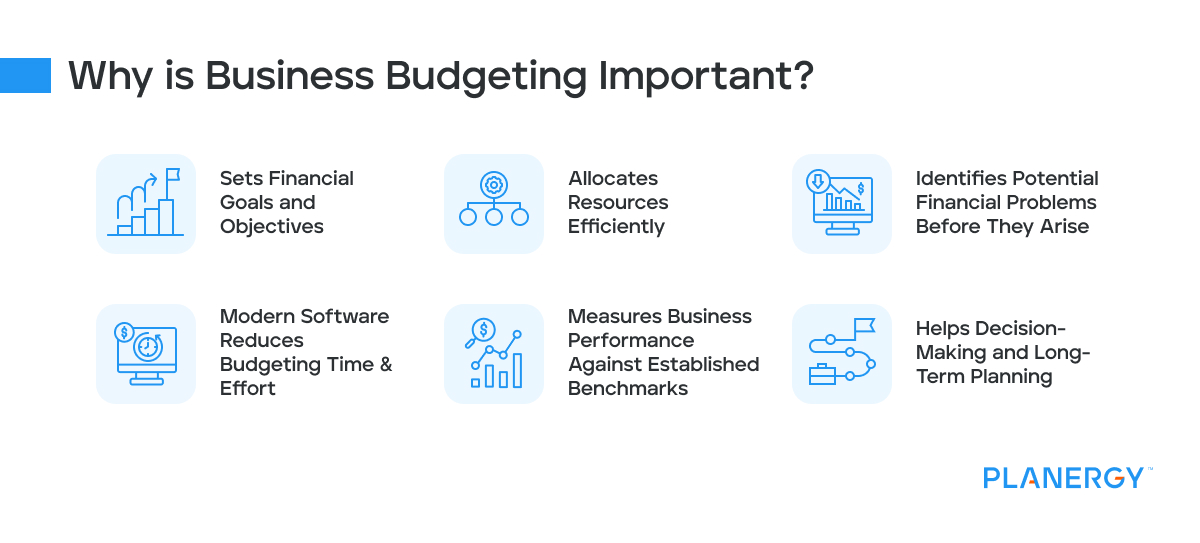

Budgeting provides a framework for effective financial planning. It allows businesses to anticipate future revenues and expenses. This proactive approach helps organizations prepare for potential challenges and opportunities.

Effective budgeting facilitates stringent financial control. By setting spending limits and monitoring actual expenditures, companies can ensure resources are utilized efficiently.

According to the Chartered Institute of Management Accountants (CIMA), budgeting drives fiscal discipline and supports effective resource allocation.

Performance Measurement and Accountability

A well-defined budget serves as a benchmark for evaluating performance. It sets clear targets for various departments and employees. This allows management to identify areas where performance is exceeding expectations or falling short.

Budgeting promotes accountability within the organization. Department heads and managers are responsible for adhering to their budgets and achieving the outlined objectives.

Budget variances, or deviations from the budget, trigger investigation and corrective action. They also enhance operational efficiency by helping to pinpoint possible problem areas.

Attracting Investment and Securing Funding

A robust budget demonstrates financial responsibility to potential investors. It shows that a company has a clear understanding of its financial position and growth prospects.

Lenders often require businesses to provide budgets as part of the loan application process. This enables them to assess the company's ability to repay the loan and manage its finances responsibly.

As the Financial Accounting Standards Board (FASB) guidance highlights, transparent and well-structured budgets enhance a company's credibility in the financial markets.

Strategic Decision-Making

Budgeting supports informed decision-making. By analyzing financial projections, businesses can assess the potential impact of various strategic initiatives.

When companies consider expansions, new product launches, or marketing campaigns, a budget helps to evaluate the financial implications of each action.

According to a Deloitte survey, businesses that effectively use budgeting are more likely to achieve their strategic goals. Budgeting allows them to allocate resources to the most promising opportunities.

A Real-World Perspective

Take, for instance, a small bakery aiming to expand its operations. Without a budget, the bakery might overspend on equipment or underestimate the cost of ingredients, leading to financial strain.

However, with a detailed budget, the owner can project revenues, estimate expenses, and secure necessary funding from a local bank. The budget also becomes a tool to monitor progress and ensure profitability.

Budgeting is not only for large corporations or investors, but also applicable for the local level small business.

Conclusion

Budgeting is an indispensable element of effective business management. It provides a framework for financial planning, control, and performance measurement. Furthermore, budgeting fosters accountability, attracts investment, and supports strategic decision-making.

By embracing budgeting as a core practice, businesses can navigate the complexities of the financial world with confidence and achieve lasting success. Ultimately, budgeting transforms financial aspirations into tangible results.