Bbmp Property Tax 2014 15 Calculator

Bangalore residents, your 2014-15 BBMP property tax deadline is fast approaching. Calculate your dues accurately to avoid penalties and ensure timely payment.

This article provides a concise guide to understanding and calculating your property tax using the 2014-15 calculator, ensuring compliance with BBMP regulations.

Understanding the 2014-15 BBMP Property Tax Calculation

The BBMP property tax system uses a Unit Area Value (UAV) system. This system considers the location, type of property, and its usage.

The tax is calculated based on the annual rental value (ARV) of your property. The ARV is derived using the UAV for your specific zone and property type.

Key Components of the Calculation:

Unit Area Value (UAV): Determined by the BBMP based on location and property type.

Property Type: Residential, commercial, or industrial, each with different tax rates.

Depreciation: Considered based on the age of the building.

Area of Property: Measured in square feet.

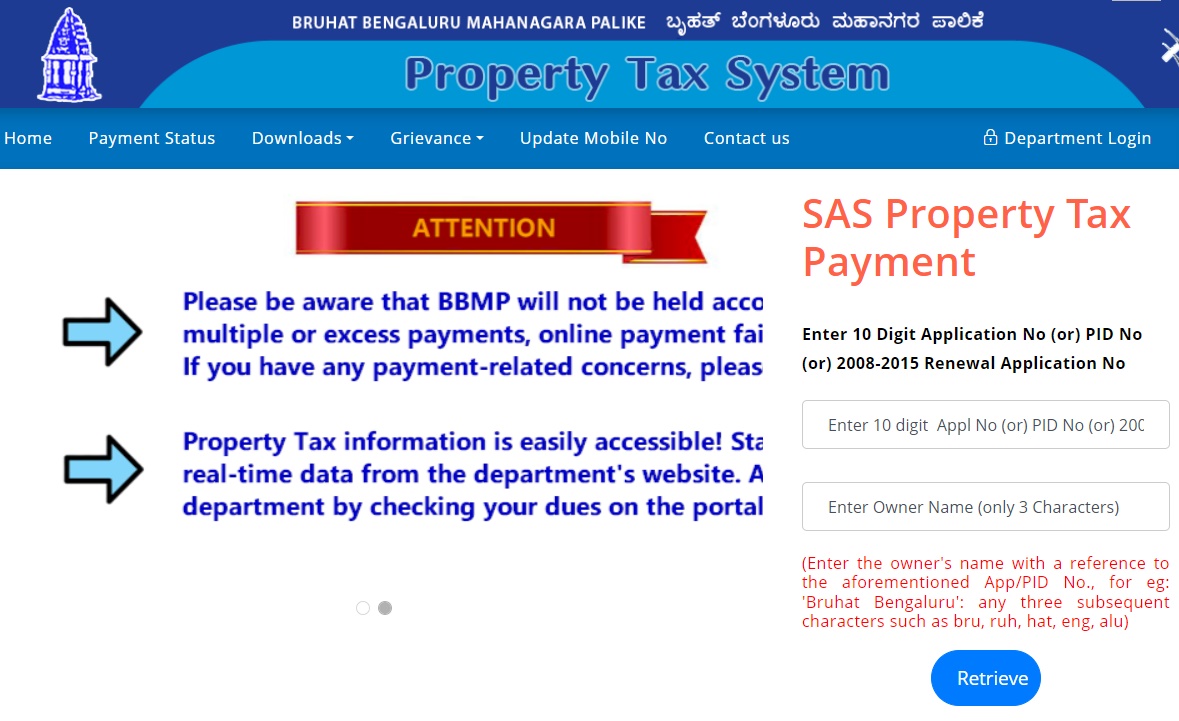

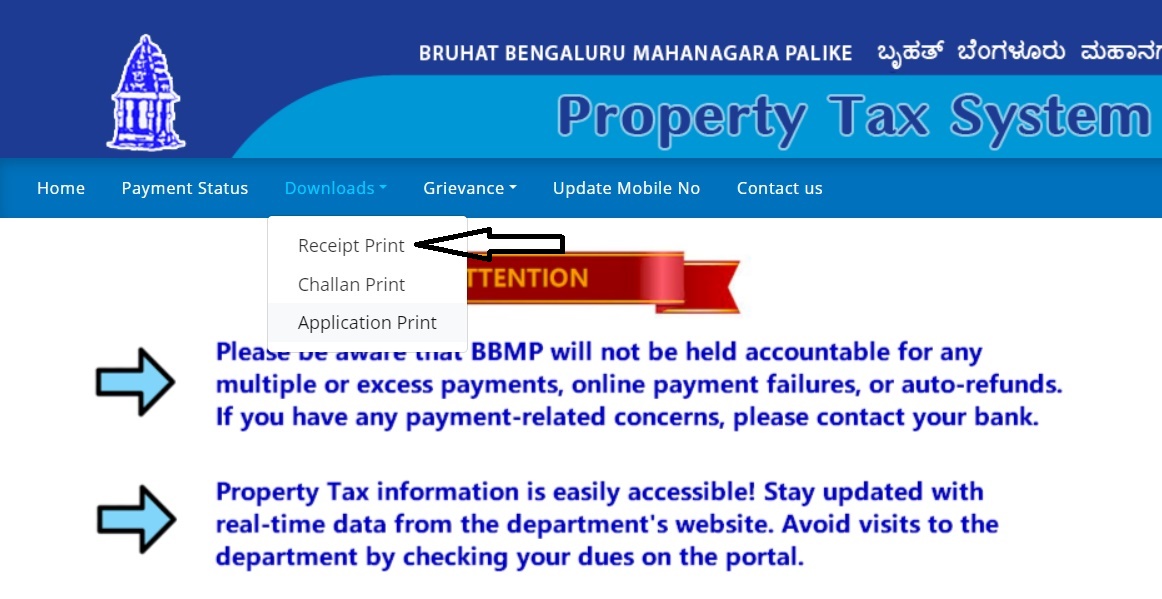

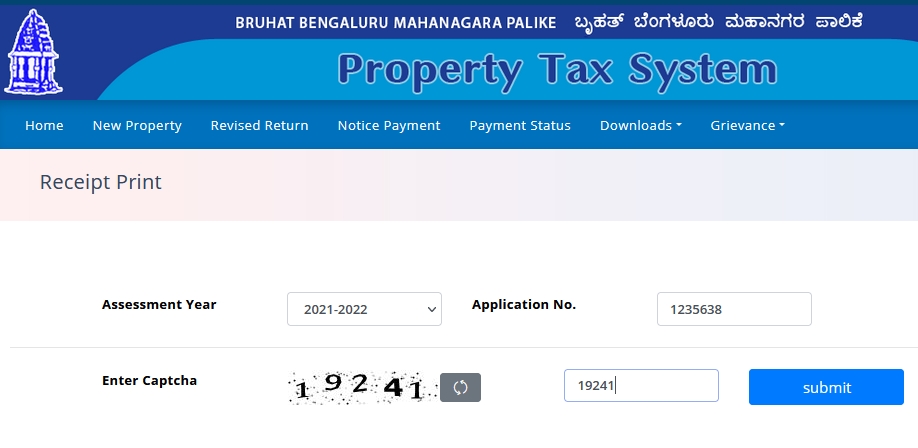

Accessing the 2014-15 Property Tax Calculator

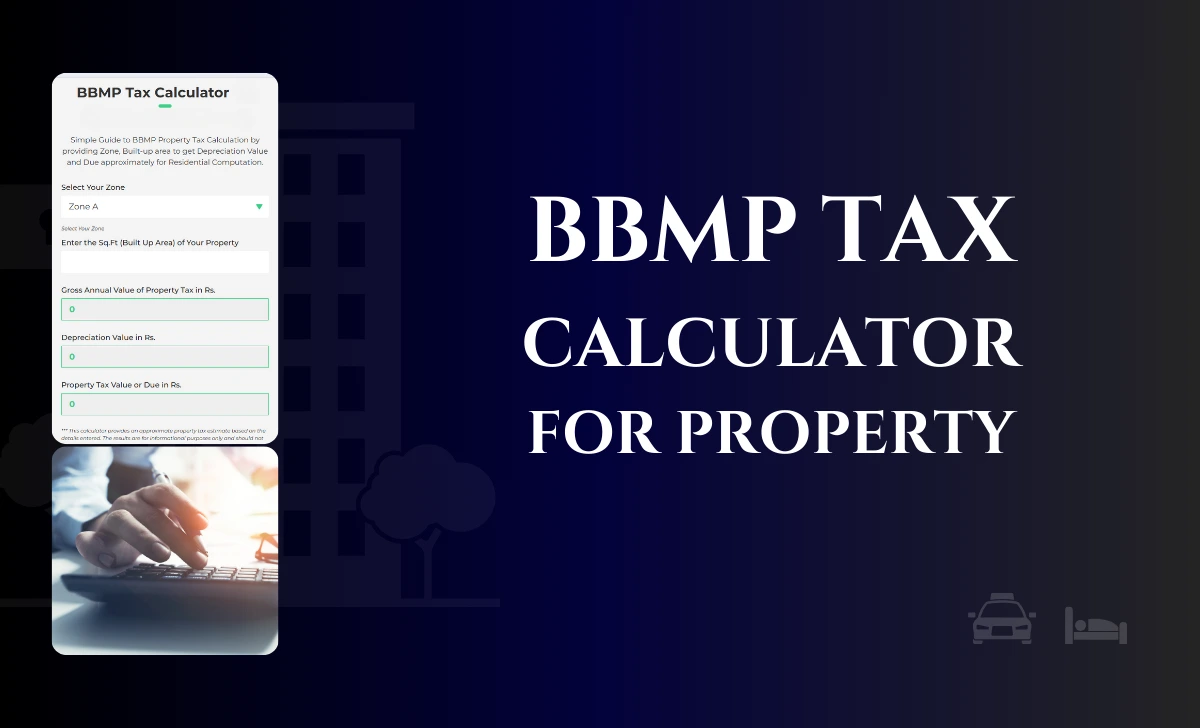

While the official BBMP website might not directly host a dedicated 2014-15 calculator anymore, the underlying principles remain the same. Utilize online calculators available from reputable real estate portals.

These calculators often use similar UAV rates and calculation methods from the 2014-15 period. Ensure the calculator is from a trusted source.

Input the required information accurately, including property location, type, usage, and area.

Steps for Accurate Calculation

First, determine your property's zone. This impacts the UAV applied.

Next, identify the correct property type – residential, commercial, or industrial.

Then, measure your property's built-up area precisely in square feet.

Finally, apply the depreciation factor based on the age of your building as per BBMP guidelines.

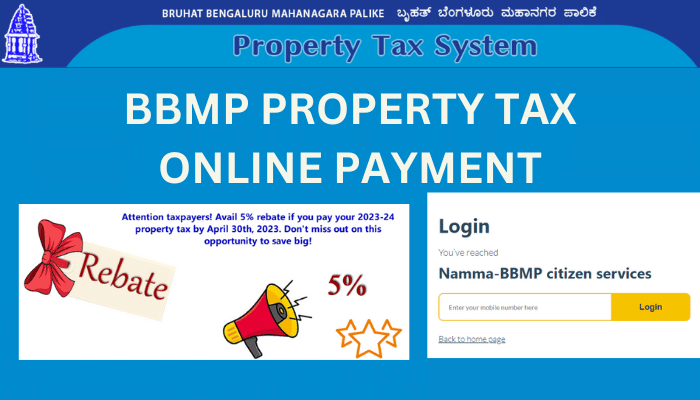

Paying Your BBMP Property Tax

The BBMP offers various payment methods. These methods include online payment through their official portal and offline payments at designated banks or BBMP offices.

Ensure you have your property identification number (PID) readily available. This is crucial for accurate payment processing.

Keep a record of your payment confirmation for future reference.

Important Considerations

Penalties apply for late payments. Pay close attention to the deadlines announced by the BBMP.

If you believe there is an error in your assessment, file an objection with the BBMP within the stipulated timeframe.

Stay updated on any changes to the BBMP property tax regulations.

Next Steps

Calculate your 2014-15 property tax immediately to avoid late fees.

Gather all necessary property details for accurate calculation.

Contact the BBMP helpdesk for clarification or assistance if needed.

Disclaimer: While this information is intended to be helpful, consult official BBMP sources for the most accurate and up-to-date details.