Sales Tax In Santa Ana California

In the heart of Orange County, Santa Ana's sales tax landscape is undergoing intense scrutiny, impacting residents, businesses, and the city's financial future. The current rate, a combined 7.75%, is a constant subject of debate, with some arguing for adjustments to boost economic activity while others emphasize the need to maintain essential public services.

This article dives deep into the complexities of Santa Ana's sales tax, examining its impact on the local economy, the arguments for and against potential changes, and the possible future trajectory of this crucial revenue stream. Understanding the nuances of this issue is vital for anyone invested in the prosperity of Santa Ana.

The Current State of Affairs

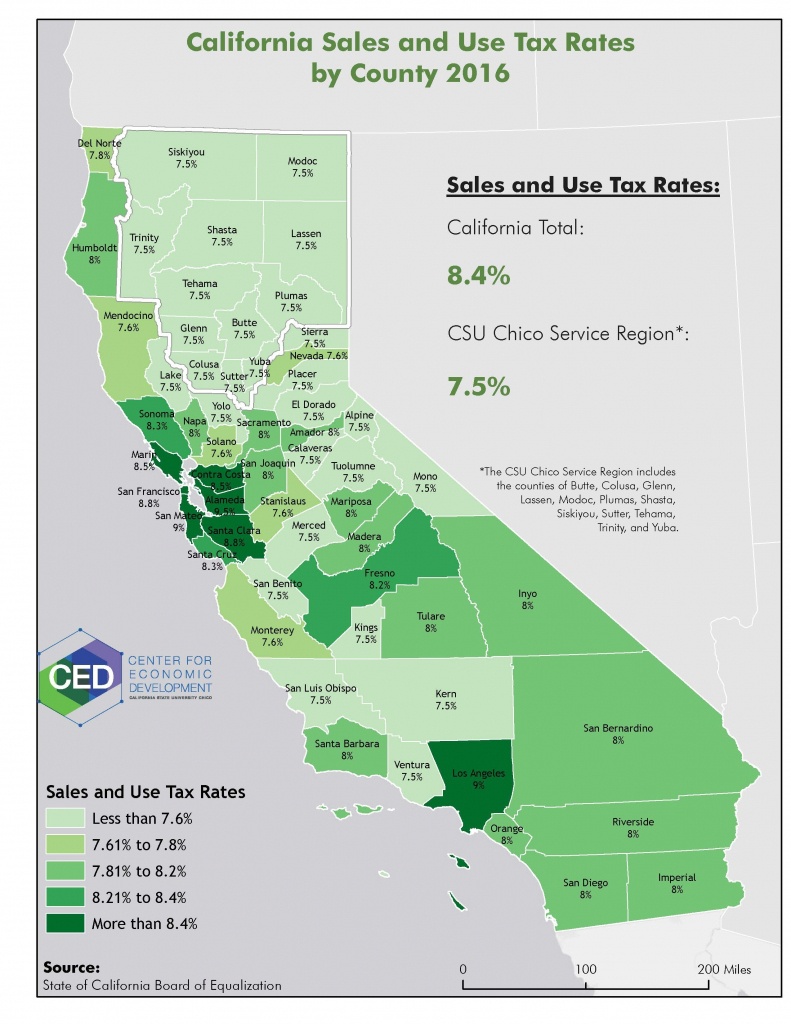

Currently, Santa Ana's sales tax rate stands at 7.75%. This rate is a combination of the statewide base rate of 7.25%, plus a 0.50% uniform local sales tax.

According to data from the California Department of Tax and Fee Administration (CDTFA), sales tax is a significant source of revenue for the city, funding essential services such as public safety, infrastructure maintenance, and community programs.

However, the rate is also a point of contention, with some arguing that it puts Santa Ana at a disadvantage compared to neighboring cities with lower rates, potentially driving consumers and businesses elsewhere.

Economic Impact and Business Perspective

The economic impact of the sales tax on Santa Ana is multifaceted. On one hand, the revenue generated is vital for the city's budget, enabling it to provide essential services.

On the other hand, businesses, particularly small businesses, often argue that a high sales tax can deter customers and make it harder to compete with online retailers who don't always collect sales tax, or with businesses in areas with lower tax rates.

"The sales tax is a double-edged sword," says Maria Hernandez, president of the Santa Ana Chamber of Commerce. "While it provides crucial funding for the city, it also creates a barrier for local businesses trying to thrive in a competitive market."

The Retail Sector

The retail sector in Santa Ana is particularly sensitive to sales tax fluctuations. Higher taxes can lead to reduced sales, especially for big-ticket items like electronics and furniture.

"Customers are often aware of the sales tax rate," explains David Chen, owner of an electronics store in downtown Santa Ana. "They may choose to shop in a neighboring city or online to save a few dollars, which adds up over time."

This highlights the need for the city to carefully consider the impact of sales tax on the local retail environment.

The Service Sector

Unlike retail, the service sector is often less directly affected by sales tax. Services like haircuts, legal advice, and medical care are generally not subject to sales tax in California.

However, some services that involve the sale of tangible goods, such as auto repair shops or printing services, are subject to sales tax on those goods.

This means that the service sector's overall impact on sales tax revenue is less pronounced than that of the retail sector.

Arguments for and Against Changes

The debate surrounding Santa Ana's sales tax often revolves around the question of whether it should be increased, decreased, or remain the same. Proponents of maintaining or increasing the rate emphasize the importance of funding essential city services.

"Without adequate sales tax revenue, we risk cutting crucial programs that benefit the community," argues Councilmember John Smith. "This includes public safety, infrastructure maintenance, and services for seniors and youth."

Opponents, on the other hand, argue that a high sales tax can harm the local economy and make Santa Ana less attractive to businesses and consumers.

"Lowering the sales tax could stimulate economic activity and attract more businesses to Santa Ana," says local economist Dr. Emily Carter. "This, in turn, could lead to increased job creation and overall economic growth."

Potential Changes

Several potential changes to Santa Ana's sales tax have been discussed in recent years. One possibility is the implementation of a local sales tax increase specifically earmarked for certain projects, such as infrastructure improvements or affordable housing.

Another option is to explore ways to make the city more attractive to businesses, such as offering tax incentives or streamlining the permitting process.

Ultimately, any decision regarding sales tax will require careful consideration of the potential impacts on both the city's finances and the local economy.

Looking Ahead

The future of Santa Ana's sales tax remains uncertain. The city is facing increasing pressure to balance the need for revenue with the need to support local businesses and attract consumers.

One possible scenario is that the city will explore alternative revenue streams, such as property taxes or user fees, to reduce its reliance on sales tax.

Another possibility is that the city will work with neighboring cities to create a more uniform sales tax rate across the region, which could help to level the playing field for businesses and reduce the incentive for consumers to shop elsewhere.

Ultimately, the decisions made regarding Santa Ana's sales tax will have a significant impact on the city's future. A balanced approach that considers the needs of both the city and the community will be essential for ensuring the long-term prosperity of Santa Ana.