Benefits Of Cost Sec On Mon On Minth Lease

The real estate market is witnessing a surge in the adoption of cost-segregation studies on newly constructed or renovated properties financed through "month-to-month" or minimal-term leases. This trend, driven by potential tax benefits, is attracting attention from property owners and investors across various sectors.

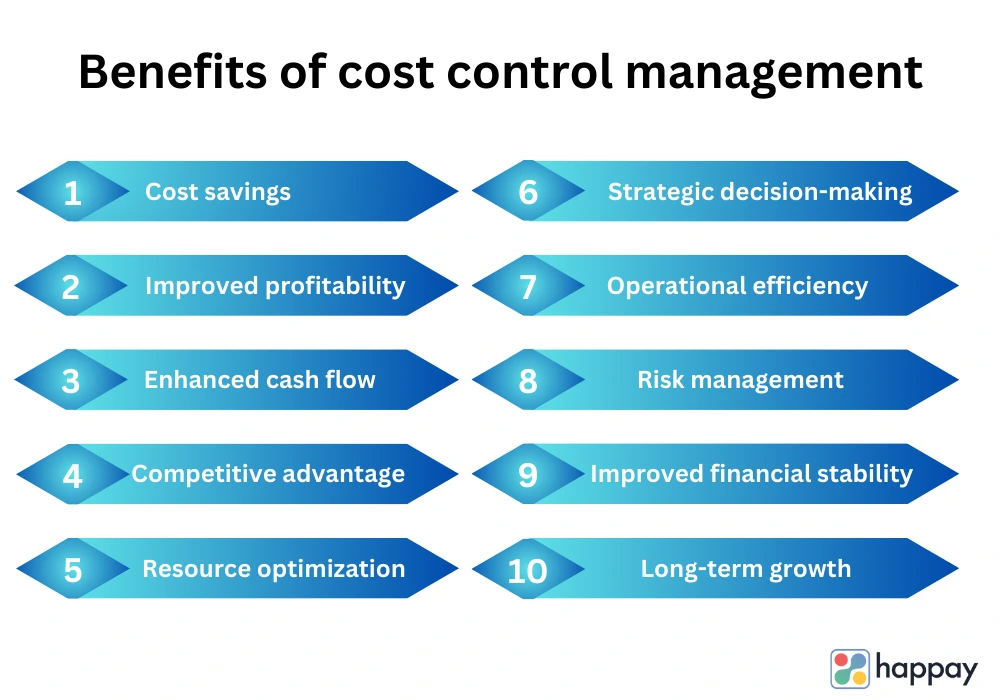

Cost segregation, a tax planning strategy, allows businesses to accelerate depreciation deductions by reclassifying certain building components from real property (39 years for nonresidential, 27.5 years for residential) to personal property (5, 7, or 15 years). This acceleration translates into immediate tax savings.

Understanding the Trend

The growing popularity of cost segregation within the context of short-term leases reflects a strategic response to evolving business models and financial incentives. Experts note that while cost segregation is widely used, its application to properties under leases with minimal terms requires careful consideration.

"We're seeing more clients explore cost segregation even when the lease terms are relatively short," explains Sarah Chen, a partner at a national accounting firm specializing in real estate taxation. "The key is whether the tenant or owner made significant investments in the property that would qualify for accelerated depreciation."

Who is Benefitting?

The primary beneficiaries are typically property owners who retain ownership of the building while leasing it out. Tenants making substantial improvements can also benefit under specific lease agreements.

Retail businesses, restaurants, and light manufacturing facilities are frequently cited as examples where significant personal property assets might be incorporated into the building during construction or renovation. These might include specialized flooring, electrical systems dedicated to equipment, or decorative elements.

According to data from the American Society of Cost Segregation Professionals (ASCSP), requests for cost segregation studies have increased by approximately 15% in the last year, with a noticeable portion related to properties under short-term leases.

Key Details and Considerations

The success of cost segregation hinges on a detailed engineering analysis and a thorough understanding of tax regulations. A qualified cost segregation specialist is essential to identify eligible assets and document their appropriate classifications.

It is crucial to note that the "lease term" itself doesn't automatically disqualify a property from cost segregation. The focus is on the nature of the improvements and who owns them.

The Internal Revenue Service (IRS) provides guidance on cost segregation through various publications and court cases. Taxpayers must ensure their studies comply with these guidelines to avoid potential audits or penalties.

Potential Impact and Challenges

The potential impact of this trend includes increased cash flow for businesses, leading to further investment and job creation. By accelerating depreciation, businesses reduce their taxable income in the early years of an asset's life.

However, some potential challenges include the complexity of the studies themselves and the need for accurate documentation. Improperly conducted cost segregation studies can attract unwanted scrutiny from the IRS.

Furthermore, the benefits of cost segregation may be limited for smaller businesses or those with lower tax liabilities. It's essential to weigh the cost of the study against the potential tax savings.

"It's not a one-size-fits-all solution," cautions David Lee, a real estate consultant. "A thorough cost-benefit analysis is always necessary before proceeding with a cost segregation study, especially for properties with minimal leases."

A Human-Interest Angle

For small business owners, the additional cash flow generated by cost segregation can be a lifeline. It allows them to invest in expansion, hire new employees, or simply weather unexpected economic downturns.

One such example is Maria Rodriguez, owner of a local bakery, who utilized cost segregation after renovating her leased space. "The tax savings allowed me to purchase a new oven and expand my product line," she said. "It made a real difference for my business."

Conclusion

The application of cost segregation to properties under short-term leases represents an evolving landscape in tax planning. While it offers potential benefits for businesses, careful planning and expert guidance are essential to ensure compliance and maximize tax savings.

As the trend continues to gain traction, it's expected that the demand for qualified cost segregation professionals will also increase, further solidifying its role in the real estate and tax industries.

Property owners and tenants should consult with their tax advisors to determine if cost segregation is a suitable strategy for their specific circumstances. Understanding the intricacies of the regulations and conducting a comprehensive cost-benefit analysis are paramount to achieving optimal outcomes.

(1).png)