Best Inexpensive Stocks To Invest In

In an era of economic uncertainty, many investors are seeking opportunities to grow their wealth without breaking the bank. Identifying inexpensive stocks with strong potential for growth is a strategy gaining traction among both novice and seasoned investors. But navigating the complexities of the stock market requires careful research and a clear understanding of risk.

This article will explore some of the best inexpensive stocks to consider investing in, providing insights into their potential and the factors driving their growth.

Understanding "Inexpensive" Stocks

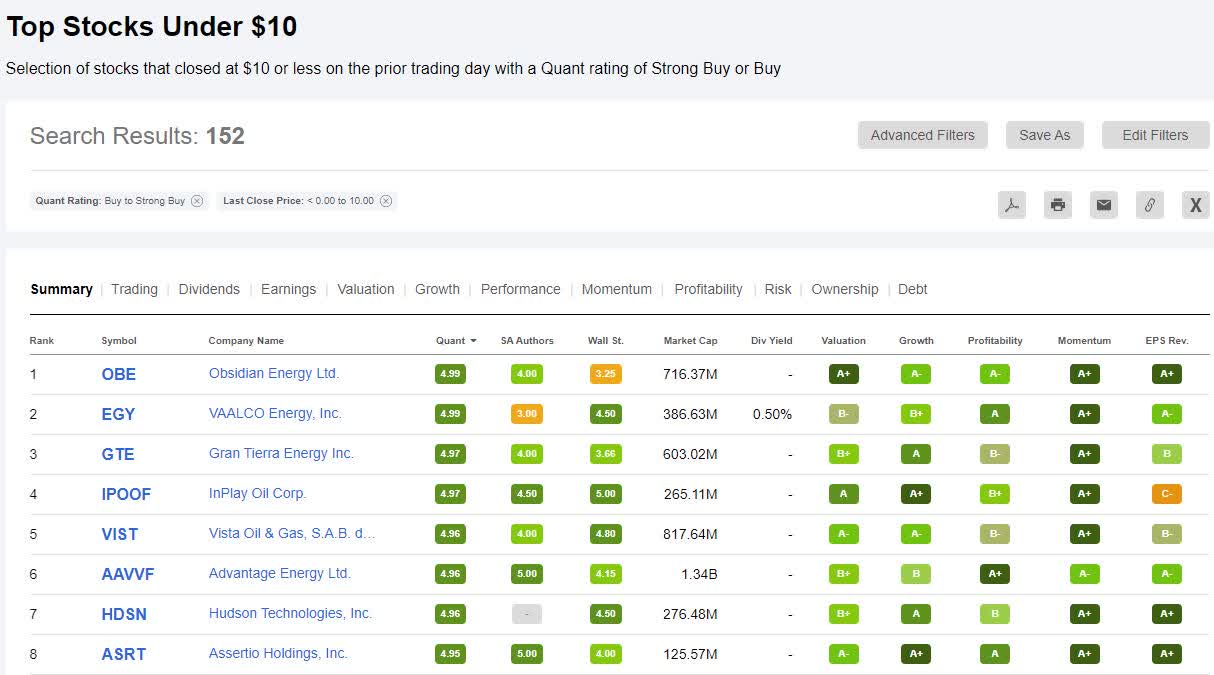

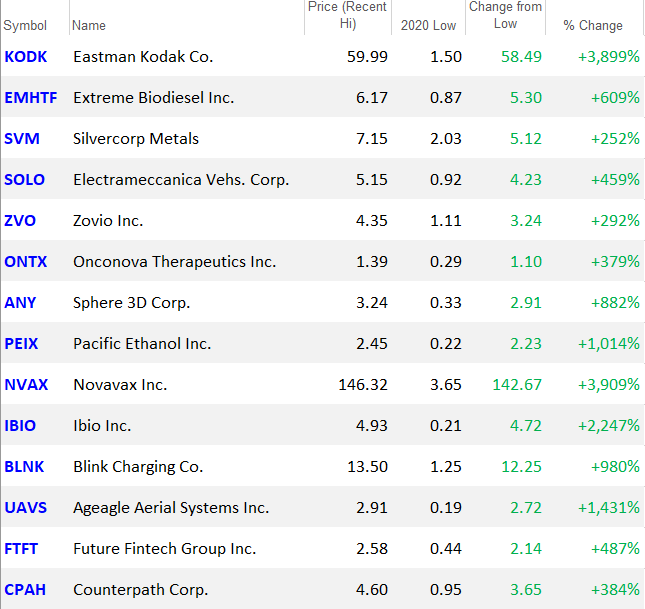

The term "inexpensive stock" generally refers to stocks with a low share price, often under $20 or even $10. However, a low share price doesn't automatically equate to a good investment. Investors must delve deeper into the company's fundamentals, including its financial health, growth prospects, and industry position.

Market capitalization, rather than share price alone, provides a more comprehensive view of a company's true value. Smaller market cap companies with strong growth potential can offer significant returns, but also carry higher risk.

Potential Inexpensive Stocks to Consider

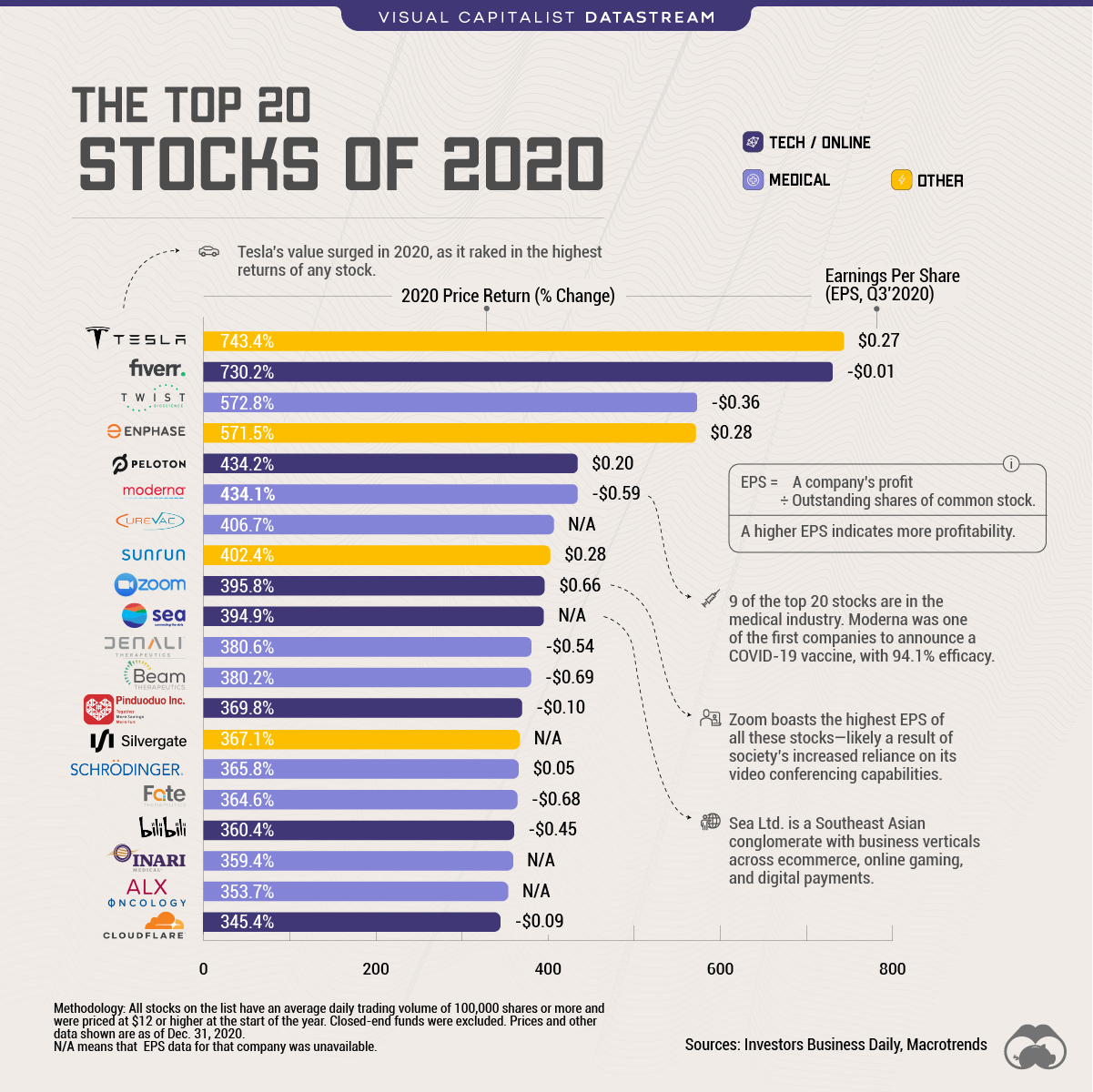

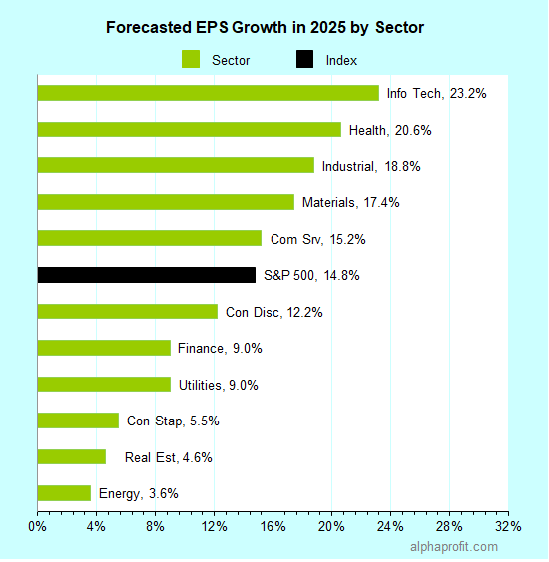

Several sectors offer opportunities for investors looking for inexpensive stocks. These include technology, healthcare, and consumer discretionary.

Technology

The technology sector is known for its rapid innovation and growth potential. Certain smaller tech companies, focusing on niche markets or emerging technologies, might be attractive options.

For example, companies specializing in cybersecurity solutions for small businesses could see increased demand as cyber threats become more prevalent. Investors should examine revenue growth, profitability, and competitive landscape.

Healthcare

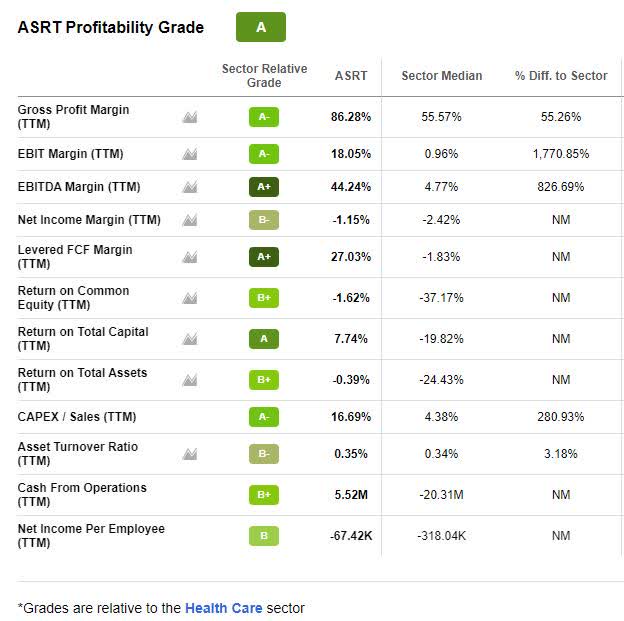

The healthcare sector is another area where inexpensive stocks can be found. Biotech companies developing novel treatments or diagnostic tools can present significant investment opportunities.

However, these investments often come with high risk, as the success of clinical trials is uncertain. Careful due diligence and an understanding of the regulatory landscape are essential.

Consumer Discretionary

The consumer discretionary sector, encompassing companies that sell non-essential goods and services, can also provide inexpensive stock opportunities. Companies that cater to specific niches or demographics, or those that have successfully adapted to changing consumer preferences, may be worth considering.

For example, small-scale e-commerce businesses with a strong online presence and loyal customer base could exhibit significant growth potential. Investors should analyze sales trends, customer acquisition costs, and competitive positioning.

Due Diligence: The Key to Successful Investing

Investing in inexpensive stocks requires thorough research and a clear understanding of the associated risks. Investors should examine a company's financial statements, including its balance sheet, income statement, and cash flow statement, to assess its financial health.

Analyzing industry trends, the competitive landscape, and the company's management team is also crucial. Furthermore, understanding the company’s debt levels and how it plans to manage its finances can help access long-term sustainability.

Consulting with a financial advisor is highly recommended, especially for those new to investing. A financial advisor can provide personalized guidance and help investors develop a diversified portfolio that aligns with their risk tolerance and financial goals.

Risk Management and Diversification

Investing in inexpensive stocks can be rewarding, but it's essential to manage risk effectively. Diversification is a key strategy, spreading investments across different sectors and asset classes to mitigate the impact of any single investment's performance.

Setting realistic expectations and understanding that not all investments will be successful is also crucial. Moreover, monitoring investments regularly and being prepared to adjust your portfolio as market conditions change is essential for long-term success.

Ultimately, the best inexpensive stocks to invest in depend on individual circumstances and risk tolerance. Through careful research, diversification, and sound financial planning, investors can potentially unlock significant growth opportunities while managing risk effectively.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/SIYOLFGHKJFSTPDA2FV7U4GUDE.png)