Best Stock To Invest In On Coinbase

The question of which stock represents the “best” investment on Coinbase is a recurring theme among both novice and experienced cryptocurrency and traditional stock market participants. With Coinbase offering access to a limited but growing selection of traditional stocks alongside its core cryptocurrency offerings, investors are keenly analyzing potential opportunities.

This article explores factors to consider when evaluating stocks available on Coinbase, examining company performance, market trends, and expert opinions to provide a balanced perspective. It is crucial to remember that all investments carry risk, and no single stock can guarantee profits.

Evaluating Stocks on Coinbase: A Multifaceted Approach

Coinbase, primarily known as a cryptocurrency exchange, has expanded its offerings to include fractional shares of traditional stocks. This expansion has opened the door for users to diversify their portfolios within the Coinbase ecosystem.

However, the platform's selection is currently limited compared to traditional brokerage accounts. Therefore, careful evaluation is crucial before making any investment decisions.

Key Considerations for Investors

Several factors should be considered when assessing the potential of a stock listed on Coinbase. These include the company's financial health, industry trends, and analyst ratings.

Examining the company's revenue growth, profitability, and debt levels provides insight into its stability and potential for future growth. Understanding the broader industry context is also essential, as companies operating in high-growth sectors may offer greater returns, albeit with potentially higher risk.

Analyst ratings from reputable financial institutions can provide an additional layer of insight. These ratings often reflect in-depth analysis of a company's prospects and can help investors make more informed decisions.

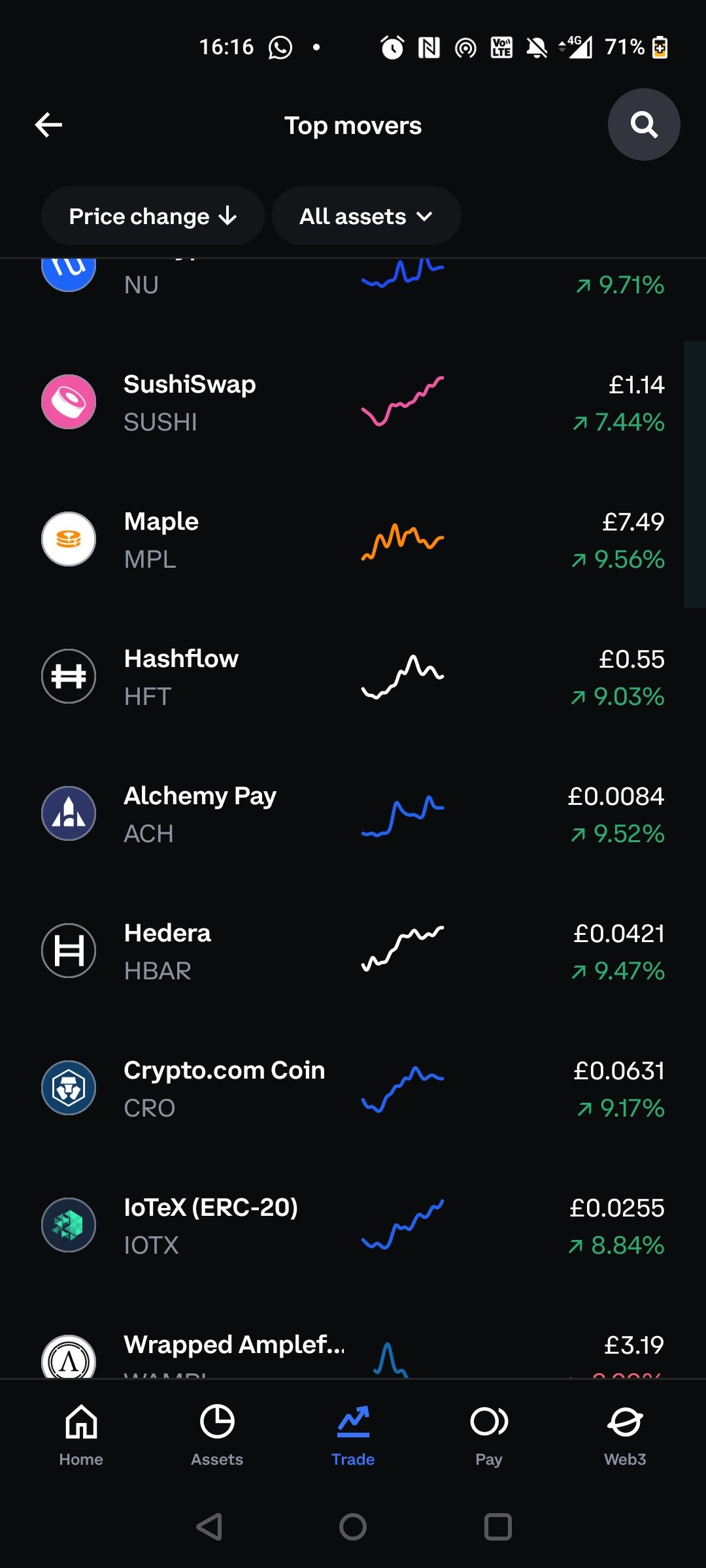

Popular Stocks on Coinbase and Their Performance

While specific stock recommendations vary depending on individual risk tolerance and investment goals, certain stocks on Coinbase have garnered considerable attention. These often include companies in the technology, consumer discretionary, and financial sectors.

For example, companies like Tesla (TSLA), known for its innovation in electric vehicles and energy solutions, are frequently discussed. Similarly, companies like Apple (AAPL), with its strong brand recognition and diverse product portfolio, remain popular choices.

Alphabet (GOOGL), the parent company of Google, also attracts investors due to its dominance in search, advertising, and cloud computing. It's essential to research recent performance and financial news related to these and other stocks available on Coinbase before investing.

Risk Management and Diversification

Regardless of the chosen stock, risk management is paramount. Diversification, spreading investments across multiple assets, can help mitigate potential losses.

Coinbase users can diversify by investing in a mix of stocks and cryptocurrencies. This approach can help balance risk and reward within their portfolios.

Furthermore, it's crucial to understand the risks associated with each investment. Stocks, even those of established companies, can experience volatility and potential downturns.

The Importance of Due Diligence

Ultimately, the "best" stock to invest in on Coinbase is a highly personal decision. It depends on individual financial goals, risk tolerance, and investment time horizon.

Relying solely on recommendations without conducting thorough research can be detrimental. Investors should consult multiple sources, including company filings, financial news reports, and expert analyses, before making any investment decisions.

Furthermore, it's advisable to consult with a qualified financial advisor. They can provide personalized guidance based on individual circumstances and help develop a well-rounded investment strategy.

In conclusion, navigating the stock market on Coinbase requires a diligent and informed approach. By carefully evaluating company performance, market trends, and personal risk tolerance, investors can make more confident and potentially profitable investment choices.