Best Utility Stocks With High Dividends

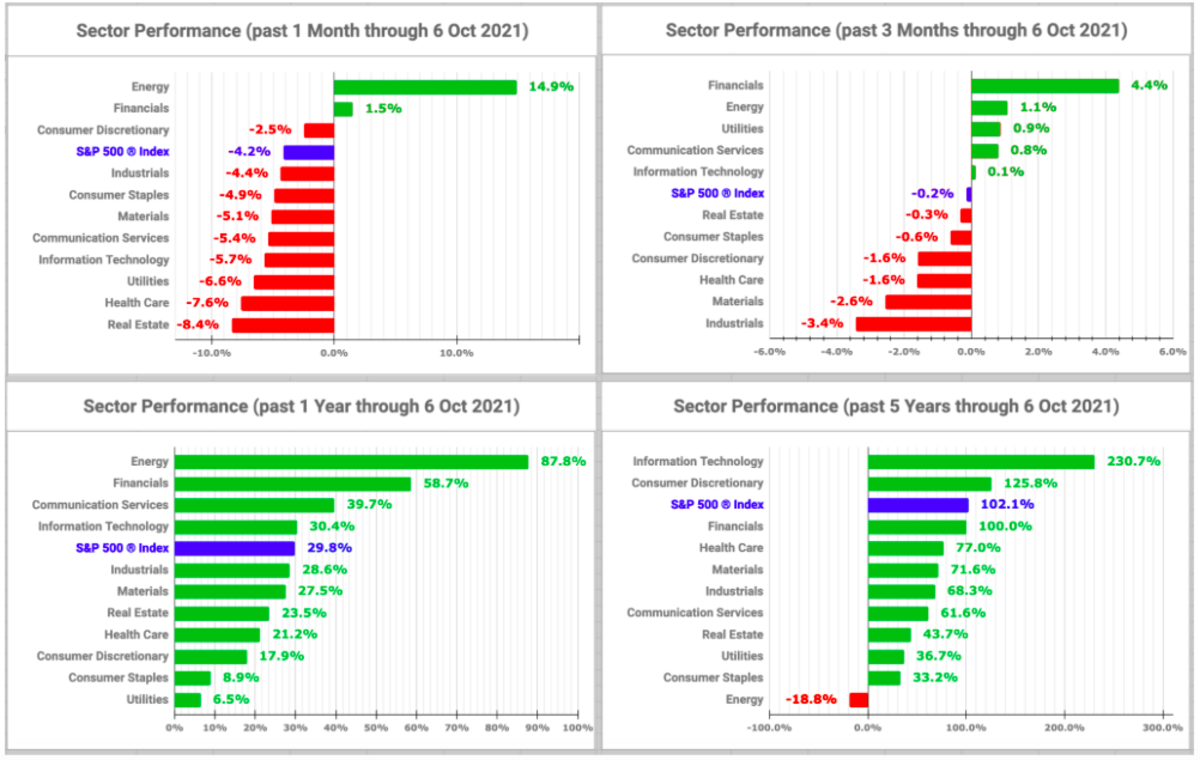

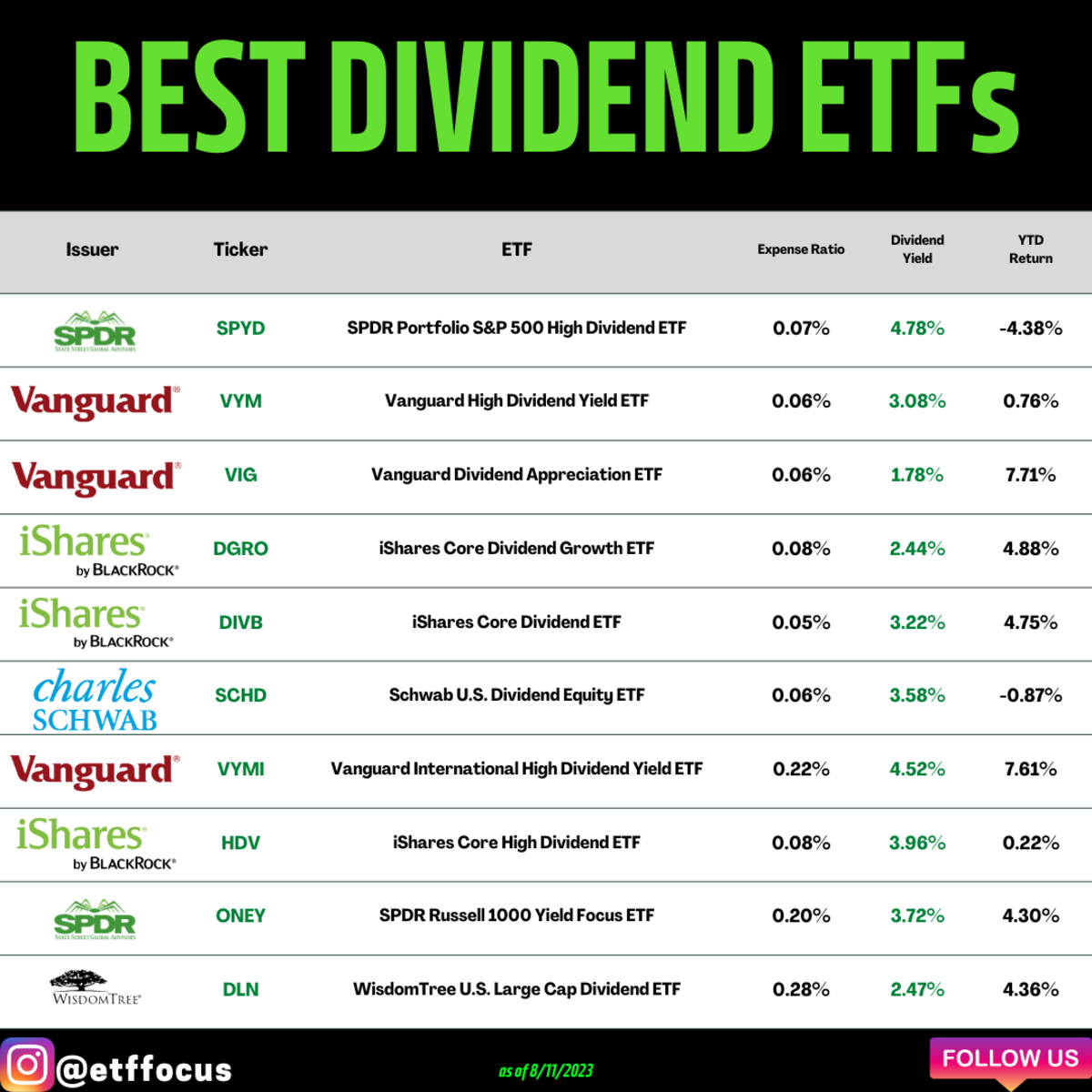

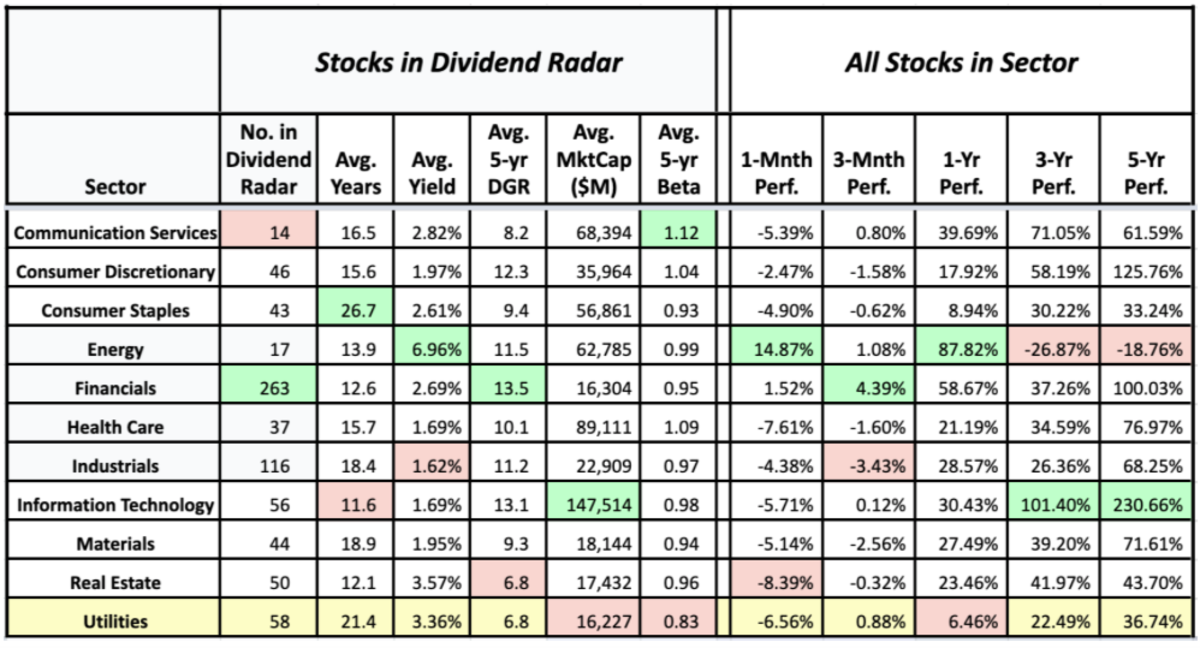

Investors seeking stability and income are turning to utility stocks. Volatility across broader markets fuels the demand for these dependable dividend payers.

This sector offers a haven amidst economic uncertainties, delivering consistent returns through high-yield dividends and essential services. The key is identifying which utility companies offer the best combination of financial strength and shareholder payouts.

Top Utility Stocks to Watch Now

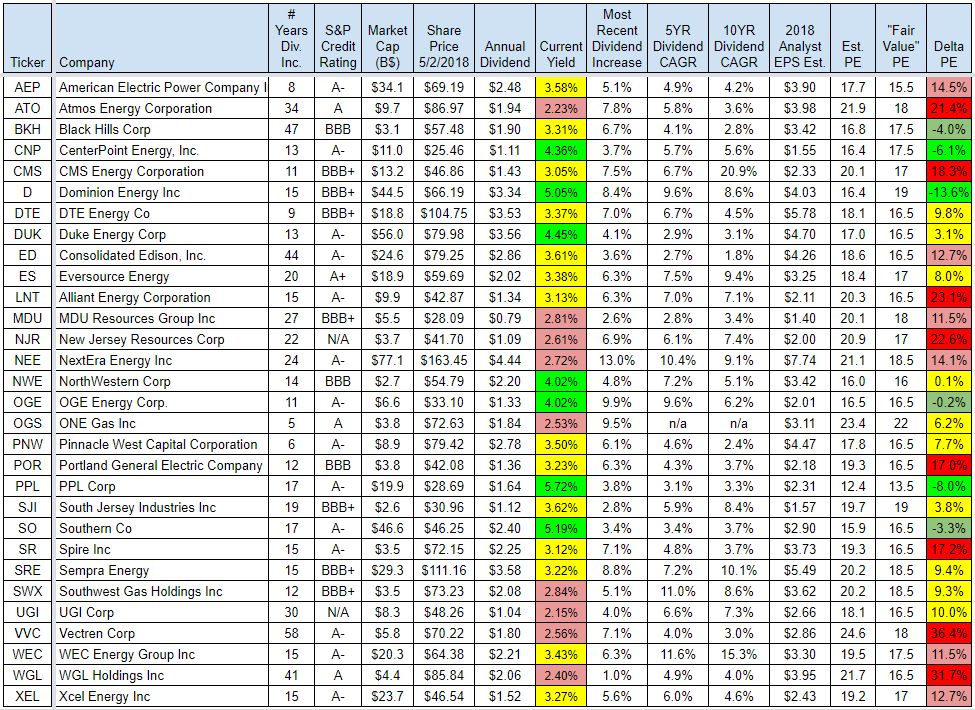

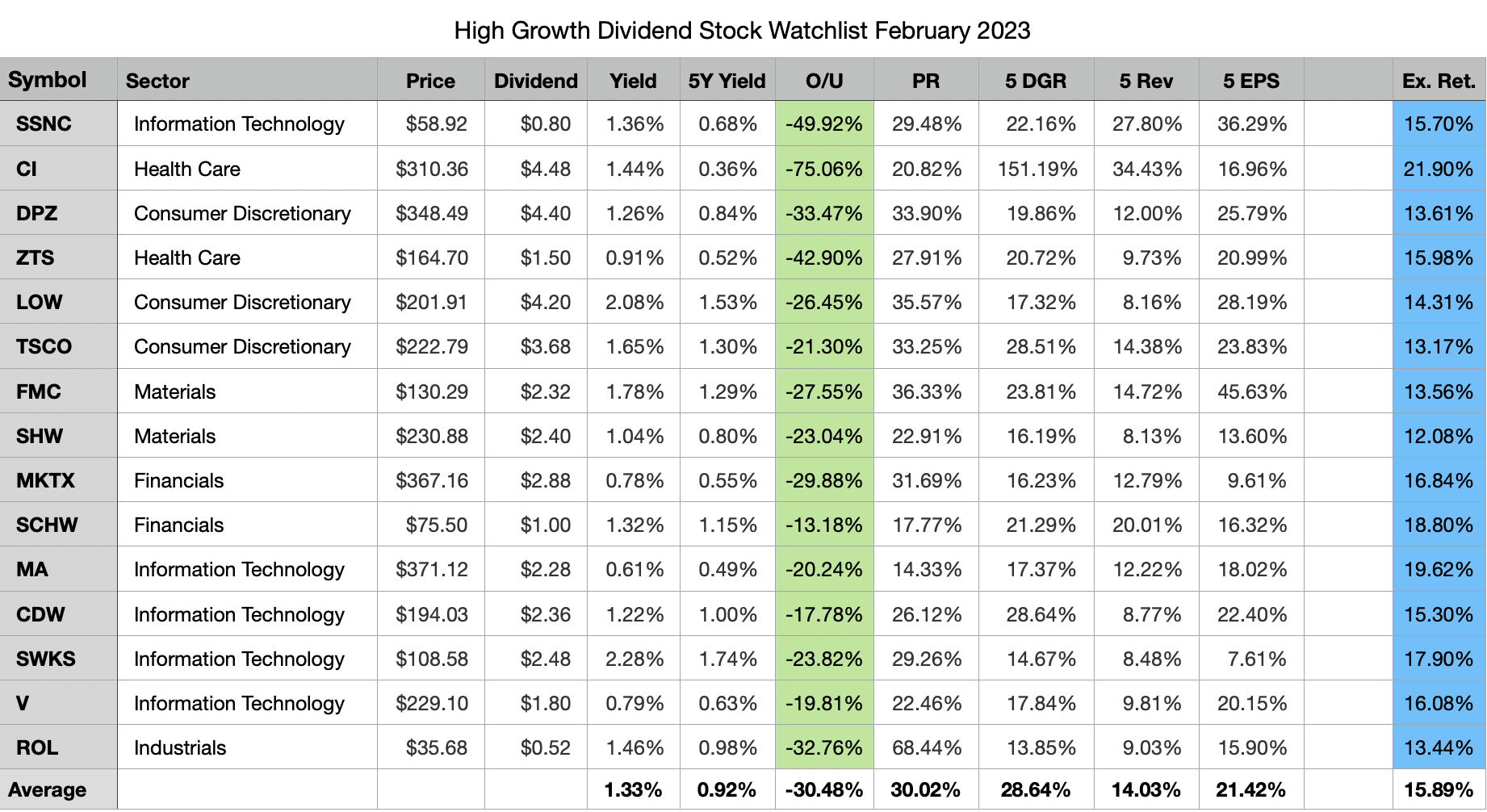

Several utility stocks stand out for their strong dividend yields and solid financial foundations. Consider these leaders for potentially high returns:

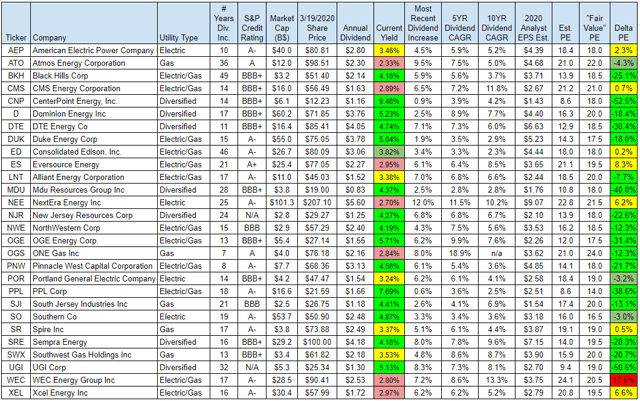

Duke Energy (DUK)

Duke Energy, traded on the NYSE, is a major player in the electric power and natural gas industries. Currently, DUK boasts a dividend yield of approximately 4%.

The company serves millions of customers across the Southeast and Midwest, ensuring a stable revenue stream for consistent dividend payments.

Southern Company (SO)

Southern Company, another energy giant on the NYSE, delivers electricity to a vast service area. Its dividend yield hovers around 4.2%, making it attractive to income-seeking investors.

SO's commitment to renewable energy projects bolsters its long-term sustainability and dividend-paying potential.

Consolidated Edison (ED)

Consolidated Edison, a key player in New York's energy landscape, boasts a reliable dividend history. Investors can see a yield of approximately 3.8%.

ED's regulated business model in a densely populated area provides a predictable revenue base that supports its strong dividend payouts.

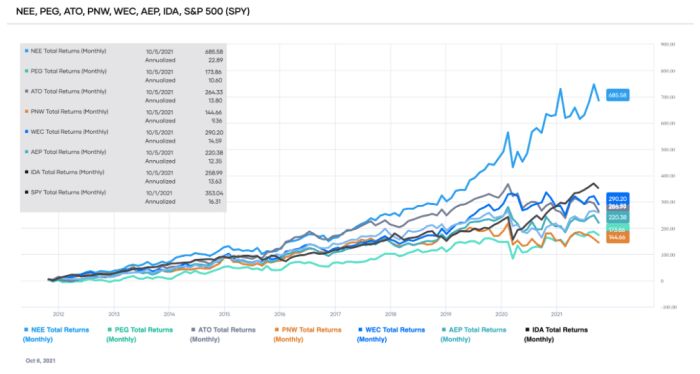

NextEra Energy (NEE)

NextEra Energy is one of the largest electric power companies in the United States. NEE's focus on renewable energy positions it for future growth and sustainable dividend payments.

Though its current yield is slightly lower than others, around 2.7%, its consistent dividend growth rate makes it a solid long-term investment.

Dominion Energy (D)

Dominion Energy, trading on the NYSE under symbol D, is another strong option. This diversified energy company has a dividend yield around 5%.

Dominion Energy's diverse energy portfolio and strategic investments aim to strengthen its ability to deliver long-term shareholder value.

Key Considerations Before Investing

Before investing, investors should evaluate a utility's payout ratio. A high payout ratio could indicate that the dividend is unsustainable.

Also, analyze the company's debt levels. High debt can strain a company's finances and potentially impact its ability to maintain dividend payments.

Finally, consider the regulatory environment. Regulatory changes can impact a utility's profitability and dividend outlook.

Looking Ahead

Monitor upcoming earnings reports for insights into each company's financial performance. Keep tabs on industry news and regulatory developments affecting the utility sector.

Analysts' ratings and price targets can provide further guidance for investment decisions. The utility sector remains a vital area for investors looking for stability and dependable income during uncertain times.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/Z3NKCHQ22BFJXIDC45PDJETEKM.png)