Bethpage Federal Credit Union Home Equity Loan Rates

Homeowners in the New York metropolitan area considering tapping into their home equity may find current rates from Bethpage Federal Credit Union a compelling option, although careful evaluation is crucial. The credit union, one of the largest in the region, is actively promoting its home equity loan and home equity line of credit (HELOC) products. Understanding the nuances of these offerings is essential for making informed financial decisions.

Bethpage Federal Credit Union's home equity products allow eligible homeowners to borrow against the equity they've built in their homes. The specific interest rates, terms, and fees associated with these loans can vary significantly based on individual creditworthiness, loan amount, and loan-to-value (LTV) ratio. This article delves into the details of Bethpage's current home equity loan offerings, helping potential borrowers understand the landscape.

Understanding Home Equity Loans and HELOCs

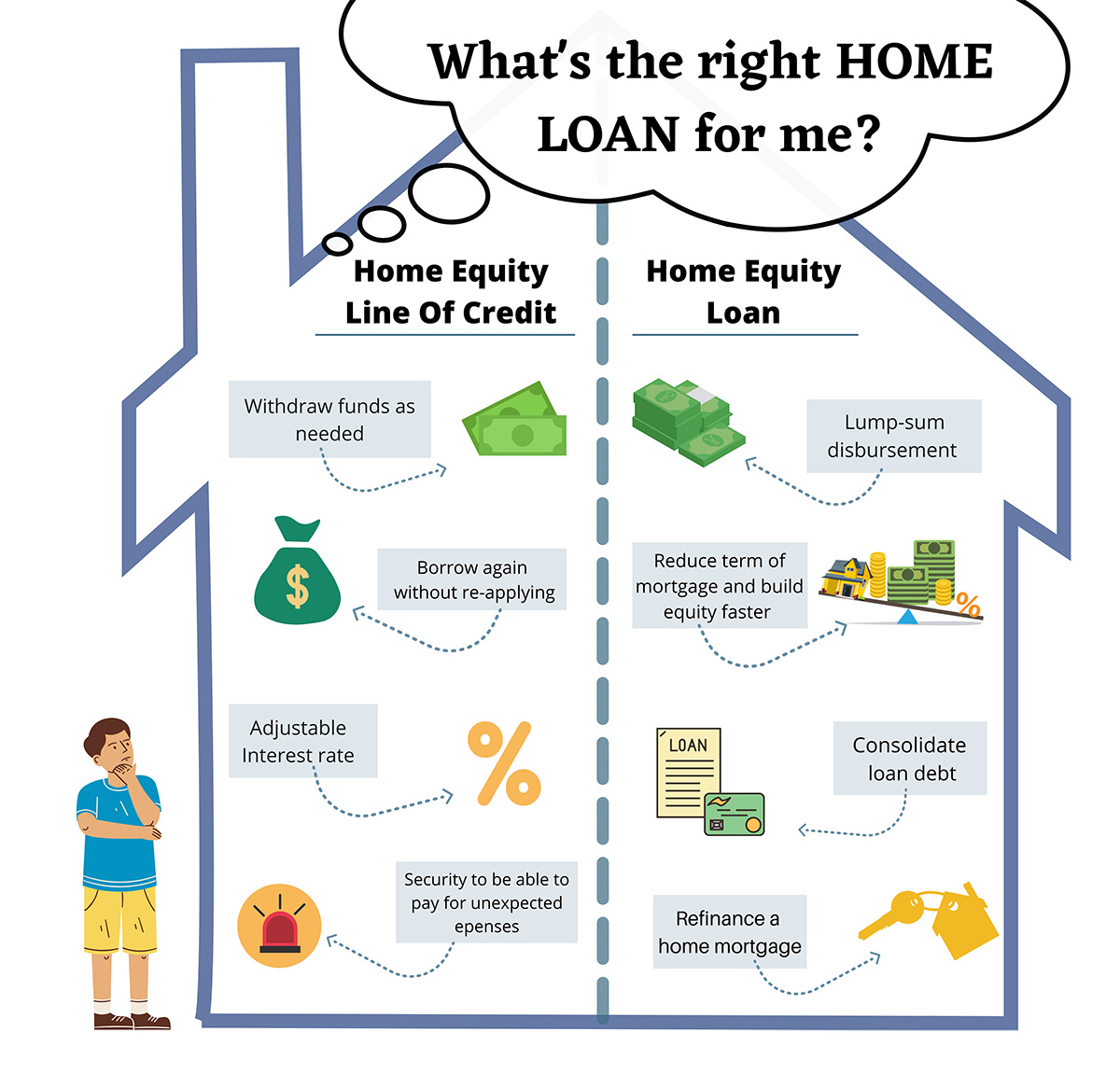

Home equity loans provide a lump sum of money that is repaid over a fixed term with a fixed interest rate. HELOCs, on the other hand, offer a revolving line of credit, allowing borrowers to draw funds as needed during a specified draw period.

Interest rates on HELOCs are often variable, meaning they can fluctuate with market conditions. This distinction is crucial when comparing the two products.

Key Details of Bethpage's Home Equity Offerings

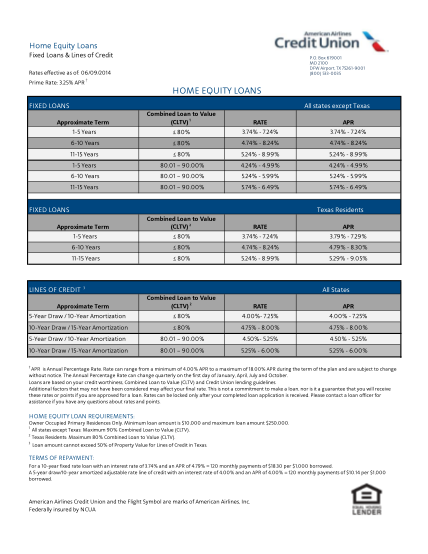

According to Bethpage Federal Credit Union's website and recent promotional materials, interest rates on home equity loans are competitive, though specifics require a personalized quote. Factors influencing these rates include the borrower’s credit score, the amount of equity available, and the desired loan term.

Fees associated with the loans, such as appraisal fees, origination fees, and recording fees, should also be carefully considered. Bethpage publishes a fee schedule that outlines these potential costs.

The maximum loan-to-value (LTV) ratio that Bethpage allows is another important factor. This ratio represents the amount of the loan relative to the appraised value of the home.

The Significance of Current Rates

In a fluctuating interest rate environment, the rates offered on home equity loans and HELOCs can significantly impact the total cost of borrowing. Keeping an eye on benchmark rates and comparing offers from multiple lenders is always advised.

Homeowners can use a home equity loan or HELOC for various purposes, including home improvements, debt consolidation, or unexpected expenses. The decision to borrow against home equity should be carefully considered.

Increased home values in many areas have boosted homeowners' equity, making these products more attractive. However, economic uncertainty requires prudent financial planning.

Potential Impact on Borrowers

For those seeking to finance home renovations, a home equity loan can provide access to funds at potentially lower rates than unsecured personal loans. This can lead to significant savings over the life of the loan.

Debt consolidation is another common use case. Borrowers can use a home equity loan to pay off higher-interest debt, such as credit card balances, potentially simplifying their finances and lowering their overall interest payments.

However, it's crucial to remember that a home equity loan is secured by the borrower's home. Failure to repay the loan could result in foreclosure.

Expert Advice and Considerations

Financial advisors often recommend thoroughly evaluating one's ability to repay the loan before borrowing against home equity. Creating a realistic budget and assessing potential risks is crucial.

Consulting with a financial advisor can help borrowers understand the long-term implications of taking out a home equity loan or HELOC. They can assess an individuals financial situation and help them decide if a home equity loan is the right solution.

It's also wise to compare offers from multiple lenders. Don't settle on the first offer.

A Word of Caution

While home equity loans can be a valuable financial tool, they should be used responsibly. Overextending oneself financially can lead to serious consequences.

Consider the potential for interest rate increases, especially with HELOCs. Plan accordingly to mitigate risks.

Bethpage Federal Credit Union encourages potential borrowers to speak with a loan officer to discuss their individual needs and financial situation before applying.

Ultimately, Bethpage Federal Credit Union's home equity loan rates present an opportunity for homeowners to access capital, but careful research and prudent financial planning are paramount. Consider all factors before making a decision.

:fill(white):max_bytes(150000):strip_icc()/bethpage_federal_credit_union_3x1_FINAL-5c588432c9e77c000102d05d.png)