Blue Cross Blue Shield Medicare Supplement Rate Increase History

The world of Medicare Supplement insurance, often referred to as Medigap, is experiencing a period of significant change, particularly concerning rate increases from major players like Blue Cross Blue Shield (BCBS). A key trend is the accelerating pace of these increases, driven by factors that demand a closer look from a business perspective.

Understanding this trend is critical for anyone involved in employee benefits, healthcare consulting, or even personal financial planning.

The Rising Tide of Rate Hikes: A Deeper Dive

BCBS, a dominant force in the Medigap market, has seen its rate increase history become increasingly pronounced in recent years.

While rate adjustments are an expected part of the insurance landscape, the *magnitude* and *frequency* of these changes are what's capturing attention.

Underlying Drivers: Healthcare Costs and Demographic Shifts

The most significant factor driving these increases is, unsurprisingly, the rising cost of healthcare itself.

Technological advancements, pharmaceutical innovations, and an aging population all contribute to higher healthcare expenditures, which insurers like BCBS must account for in their premiums.

Furthermore, the aging demographic, particularly the large cohort of baby boomers entering Medicare, places additional strain on the system.

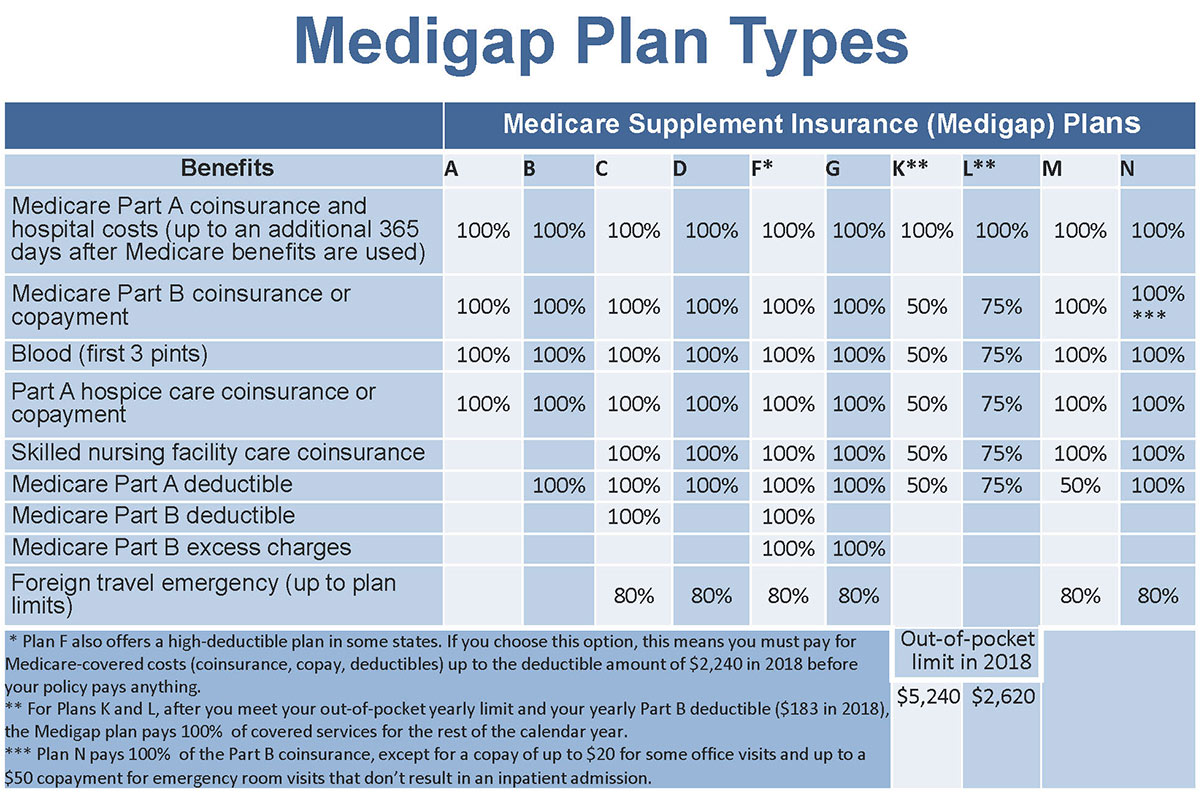

The Impact of Community Rating vs. Attained Age Rating

BCBS plans employ different rating methodologies, primarily community rating and attained age rating.

Community rating, where premiums are based on the overall health of the community regardless of an individual’s age, is less susceptible to rapid increases due to individual aging. However, it can still experience upward pressure as the overall community ages and healthcare costs rise.

Attained age rating, on the other hand, directly ties premiums to an individual's age, meaning premiums increase steadily as the policyholder gets older.

The prevalence of attained age rating in many BCBS plans makes policyholders particularly vulnerable to significant rate hikes as they age.

The Challenge of Predicting Future Costs

Accurately predicting future healthcare costs is a major challenge for insurers.

Unforeseen events, such as pandemics or the introduction of expensive new treatments, can throw off actuarial models and lead to unexpected rate increases.

This uncertainty makes long-term financial planning difficult for both insurers and policyholders.

The Consumer Dilemma and Market Dynamics

These rate increases pose a significant dilemma for consumers, especially those on fixed incomes.

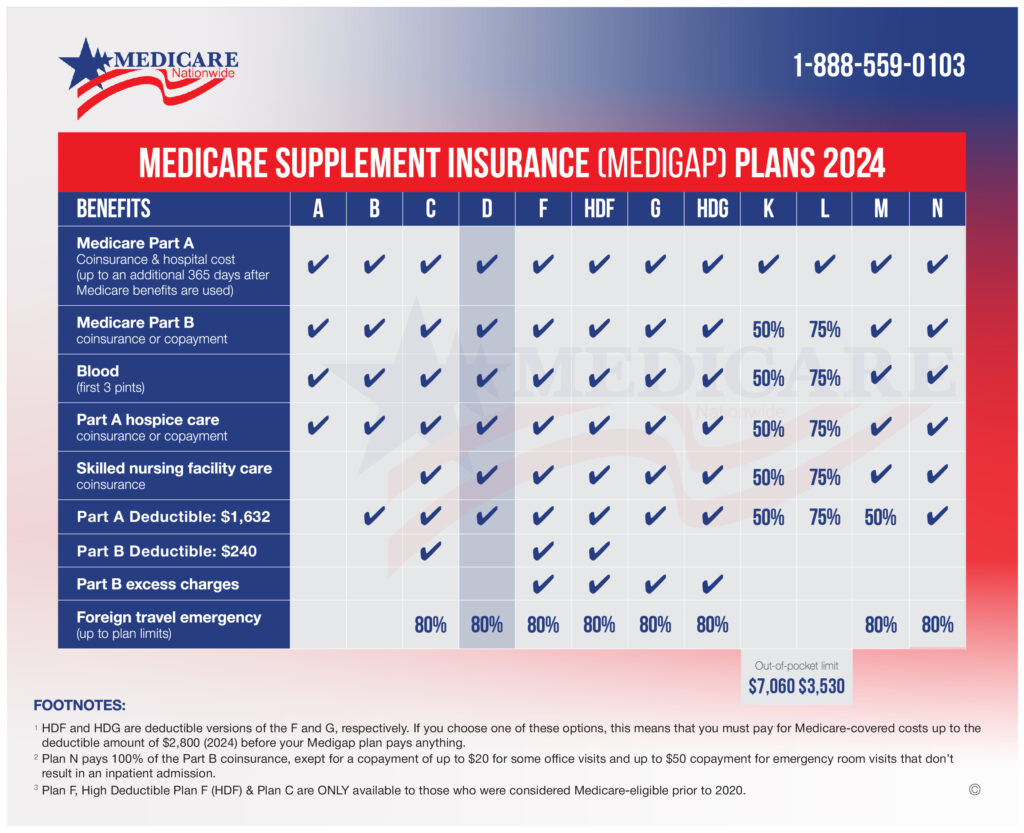

Switching Medigap plans can be difficult, as not all plans are available to new enrollees, and underwriting requirements may apply.

This leaves many individuals feeling trapped, forced to absorb higher premiums or risk losing coverage.

The Rise of Medicare Advantage as an Alternative

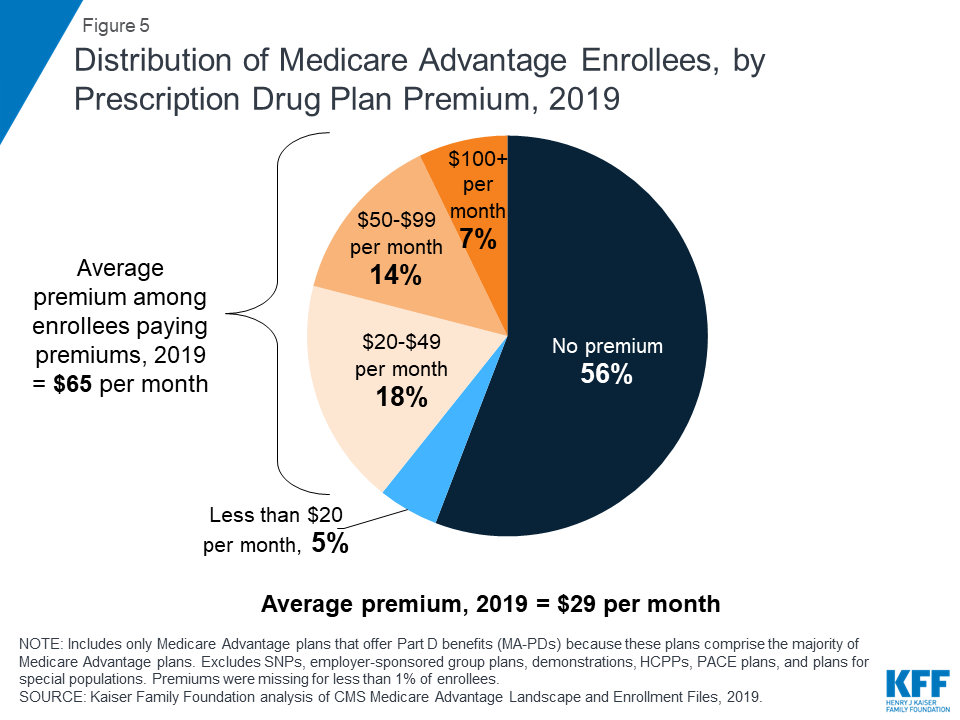

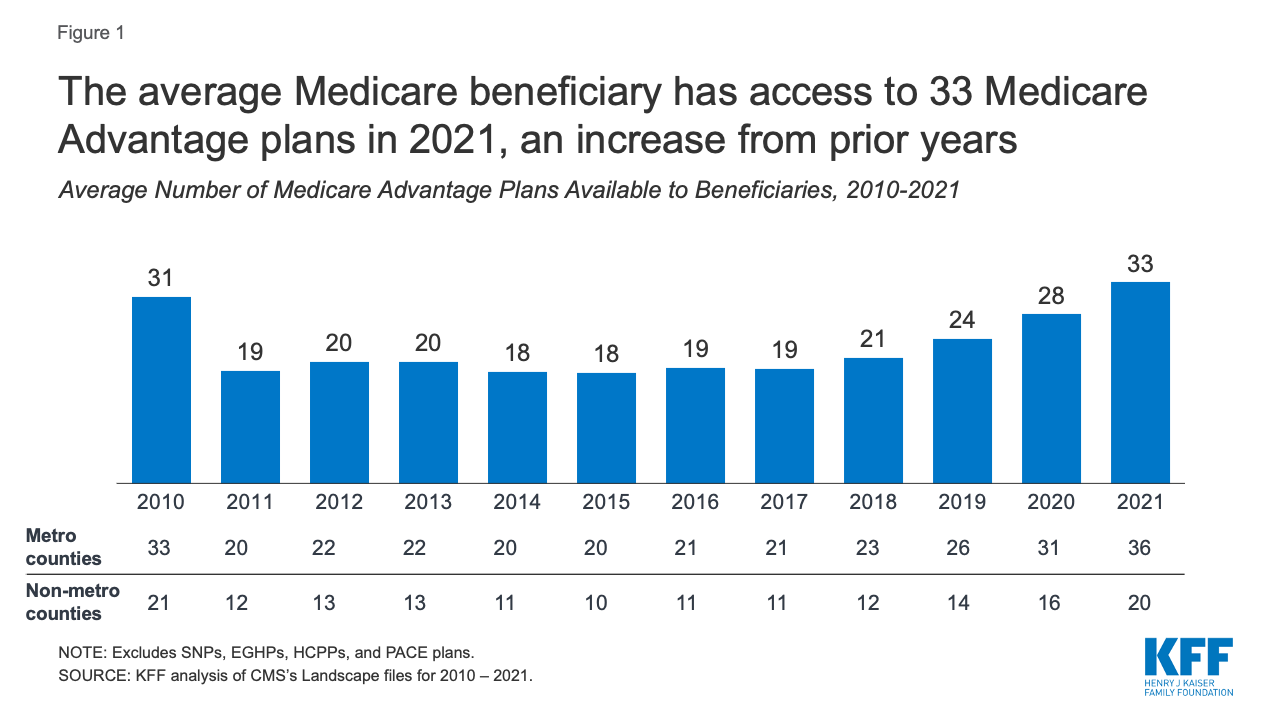

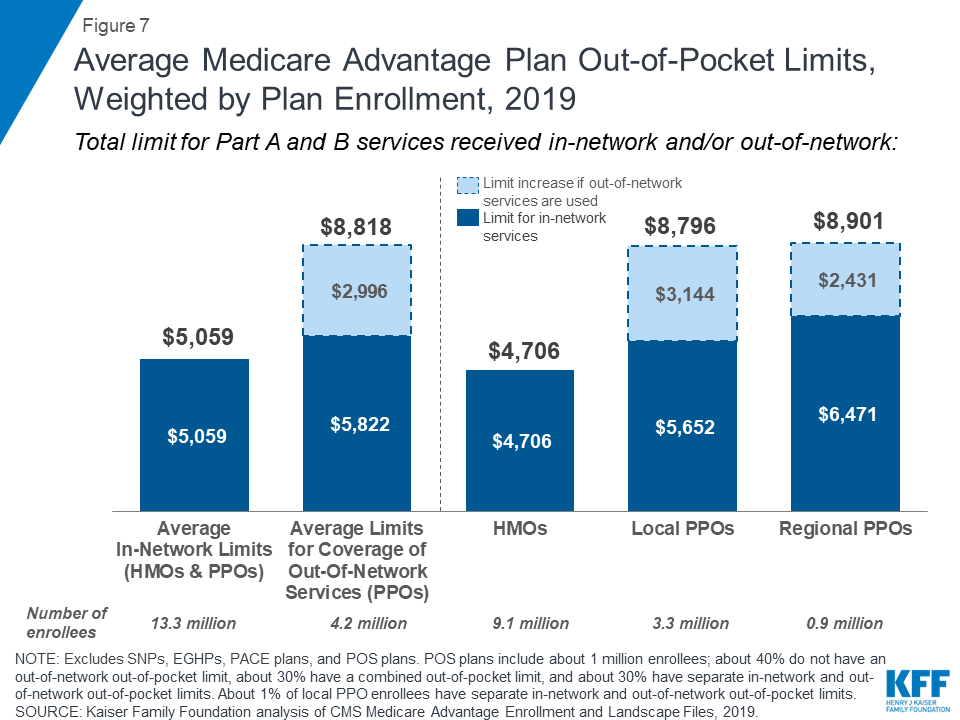

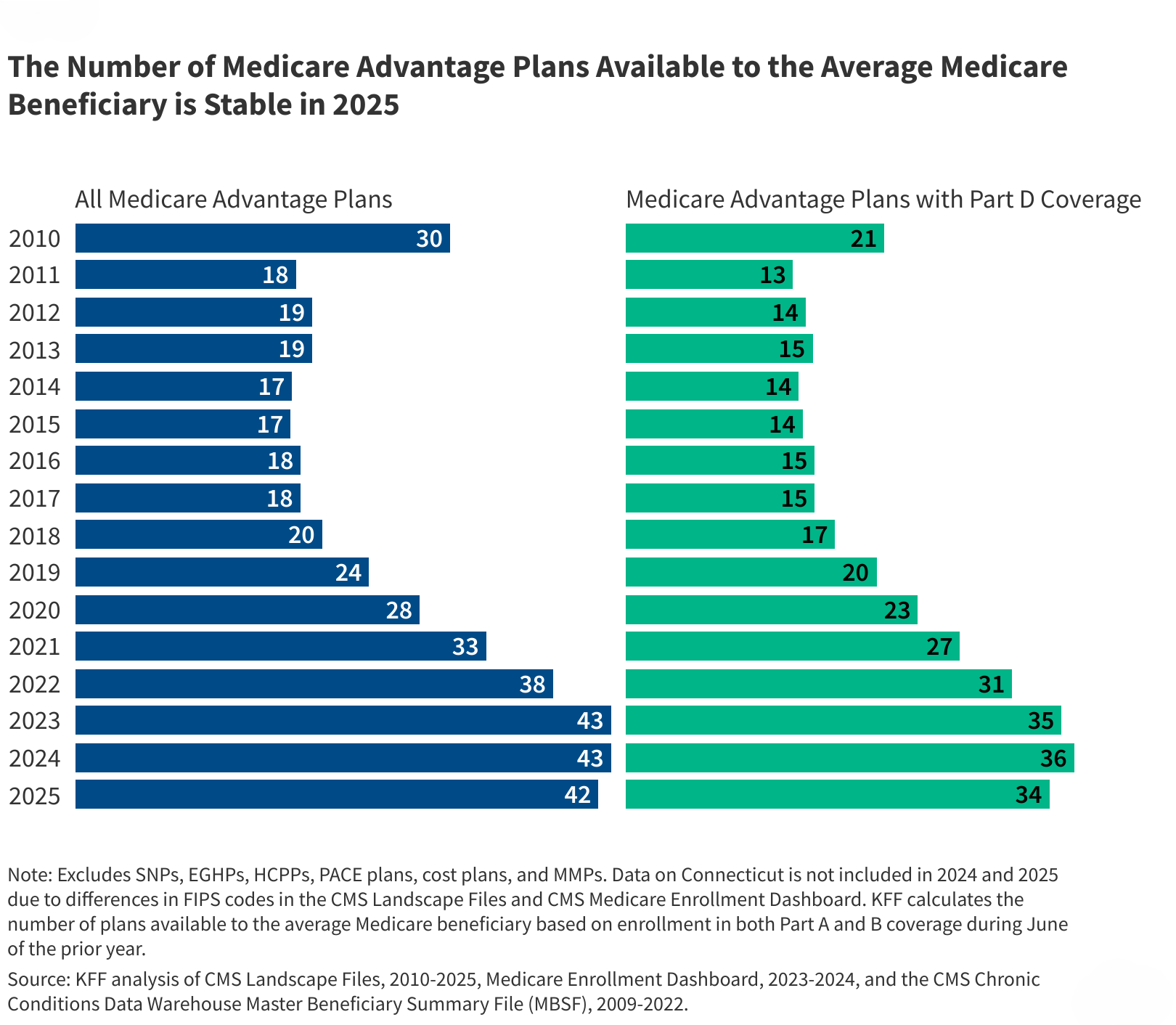

The increasing cost of Medigap plans is driving some individuals to consider Medicare Advantage plans as an alternative.

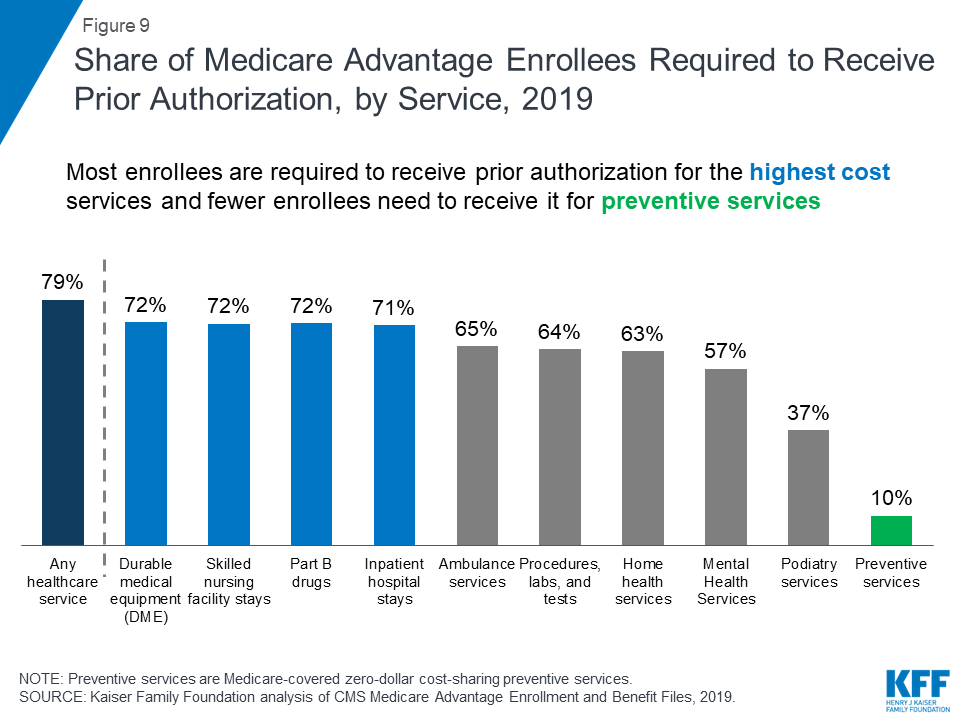

Medicare Advantage plans often have lower premiums (and sometimes even zero premiums), but they typically involve networks of providers and require prior authorizations for certain services.

This trade-off between cost and flexibility is a key consideration for consumers.

Opportunities for Innovation and Cost Containment

Despite the challenges, there are opportunities for innovation and cost containment within the Medigap market.

BCBS and other insurers could explore strategies such as negotiating lower rates with healthcare providers, implementing proactive wellness programs, and utilizing data analytics to identify and manage high-cost patients.

Furthermore, exploring value-based care models that reward quality and efficiency could help curb rising healthcare costs.

Strategic Implications for Businesses and Individuals

For businesses offering retiree healthcare benefits, understanding BCBS Medicare Supplement rate increase history is essential for budgeting and financial planning.

Companies should carefully evaluate their retiree healthcare strategies, considering options such as providing stipends for retirees to purchase their own coverage or exploring group Medicare Advantage plans.

Individuals approaching Medicare eligibility should carefully research their options, considering both Medigap and Medicare Advantage plans, and comparing premiums, benefits, and network restrictions.

Consulting with a financial advisor or insurance broker can help individuals make informed decisions that align with their financial situation and healthcare needs.

Staying informed about the evolving landscape of Medicare Supplement insurance is critical for navigating the complexities of healthcare in retirement.