Bright Minds Biosciences Stock Forecast 2025

The promise of psychedelic medicine to revolutionize mental health treatment has captivated investors and researchers alike. Bright Minds Biosciences (DRUG:CSE), a biotechnology company focused on developing novel serotonergic therapeutics for neuropsychiatric disorders, stands at the forefront of this emerging field. But with a volatile market and the inherent uncertainties of drug development, predicting the company's stock performance by 2025 requires a nuanced understanding of its pipeline, regulatory landscape, and financial health.

This article delves into the potential trajectory of Bright Minds Biosciences' stock by 2025. It examines key factors such as their drug development progress, clinical trial outcomes, market competition, and overall investment climate. We will analyze expert opinions, financial data, and company statements to provide a balanced perspective on the potential risks and rewards for investors.

Understanding Bright Minds Biosciences' Pipeline

Bright Minds Biosciences is primarily focused on developing next-generation serotonergic drugs. These drugs target specific serotonin receptors in the brain to treat conditions like epilepsy, pain, and various neuropsychiatric disorders.

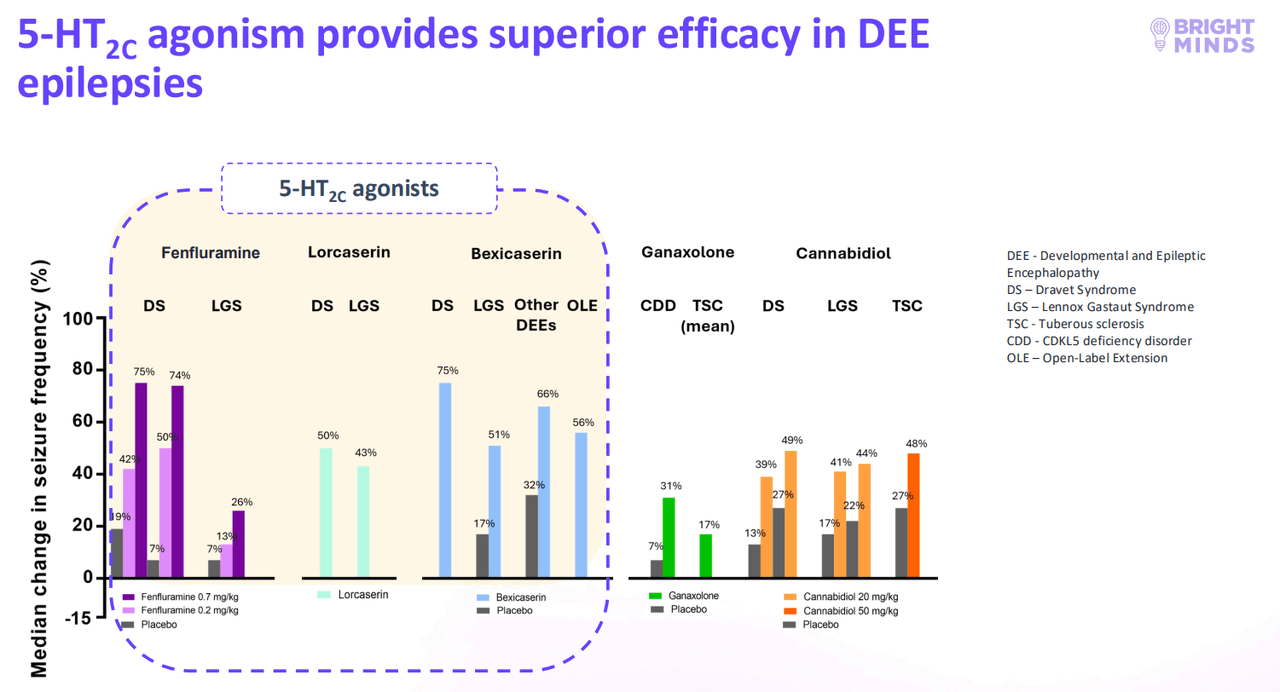

Their lead compound, BMB-101, is a 5-HT2C receptor agonist currently being investigated for Dravet syndrome and other forms of severe epilepsy. Positive results from preclinical and early clinical trials are crucial for the company's future.

The success of these trials will significantly influence investor confidence and, consequently, the stock price. Failure to meet endpoints could lead to a decline in valuation.

The Regulatory Landscape and Clinical Trial Hurdles

The path to market for any pharmaceutical company is fraught with regulatory hurdles. Bright Minds Biosciences must navigate the strict approval processes of regulatory bodies like the FDA in the United States and similar agencies globally.

Clinical trials are expensive and time-consuming. There is no guarantee that BMB-101 or any other drug in their pipeline will successfully complete Phase III trials and receive regulatory approval.

Delays in the clinical trial timeline or unexpected adverse events could negatively impact the stock price. However, accelerated approval pathways, if granted, could expedite the process and boost investor sentiment.

Market Competition and the Psychedelic Renaissance

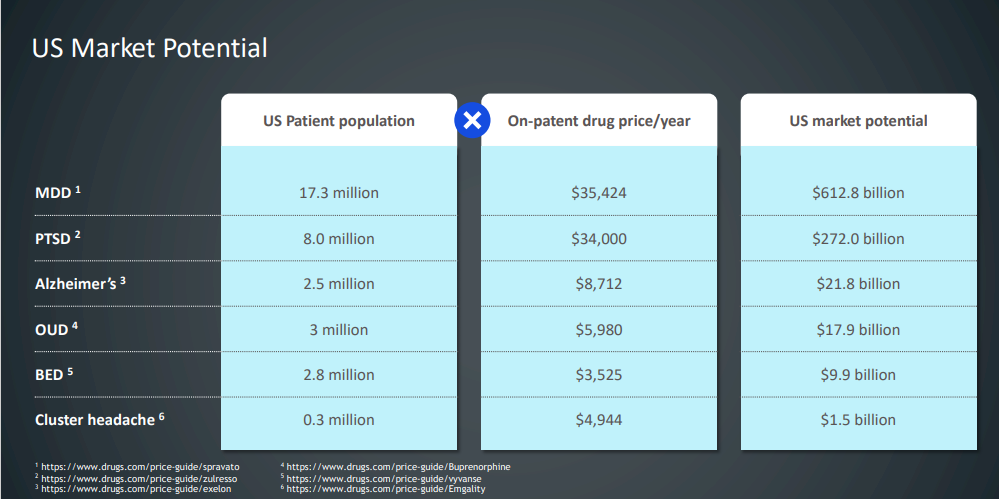

The psychedelic medicine market is becoming increasingly competitive. Several companies are developing psychedelic-based therapies for a range of mental health conditions, from depression to PTSD.

Companies like Compass Pathways (CMPS) and Atai Life Sciences (ATAI) are considered major players in the broader psychedelic space. Bright Minds Biosciences must differentiate itself to capture a significant market share.

The increasing acceptance of psychedelic therapies, fueled by positive clinical data and changing public perception, presents both opportunities and challenges. Bright Minds must demonstrate the unique value proposition of its compounds.

Financial Health and Investment Climate

Bright Minds Biosciences' financial position plays a critical role in its ability to fund research and development. The company's cash runway, burn rate, and ability to secure additional funding are important considerations for investors.

A strong balance sheet provides the company with the flexibility to advance its pipeline. Conversely, a lack of capital could force the company to seek dilutive financing or partner with larger pharmaceutical companies, potentially reducing shareholder value.

The overall investment climate, including interest rates and investor appetite for biotech stocks, also influences Bright Minds' stock performance. A recession or market downturn could negatively impact the company's valuation, regardless of its progress.

Analyst Perspectives and Potential Scenarios

Financial analysts offer a range of perspectives on Bright Minds Biosciences' future. These opinions vary depending on their assessment of the company's technology, market opportunity, and management team.

Some analysts are optimistic, citing the potential of BMB-101 to address unmet medical needs and the growing interest in psychedelic medicine. They predict significant upside potential for the stock if the company achieves its milestones.

Other analysts are more cautious, highlighting the risks associated with drug development and the competitive landscape. They recommend a more conservative approach, emphasizing the need for positive clinical trial data to justify a higher valuation.

Possible Stock Price Scenarios for 2025

Predicting a specific stock price for 2025 is inherently speculative. However, we can outline a few potential scenarios based on key factors:

Best-Case Scenario:

BMB-101 demonstrates strong efficacy and safety in Phase II trials, leading to regulatory breakthrough therapy designation. The company secures partnerships with major pharmaceutical companies and receives positive media coverage, resulting in increased investor interest and a significantly higher stock price.

Base-Case Scenario:

The company continues to progress through clinical trials, albeit with some delays. BMB-101 shows promise but faces challenges in demonstrating superiority over existing treatments. The stock price experiences moderate growth, reflecting the gradual advancement of the pipeline.

Worst-Case Scenario:

Clinical trials for BMB-101 fail to meet endpoints or reveal significant safety concerns. The company struggles to secure additional funding and faces increased competition. The stock price declines sharply, reflecting the loss of confidence in the company's prospects.

Conclusion: A High-Risk, High-Reward Investment

Investing in Bright Minds Biosciences is a high-risk, high-reward proposition. The company's success hinges on the successful development and commercialization of its novel serotonergic drugs.

While the potential for groundbreaking treatments and significant financial gains exists, investors must be aware of the inherent uncertainties of drug development, regulatory hurdles, and market competition. A thorough understanding of these factors is essential for making informed investment decisions.

Ultimately, the future of Bright Minds Biosciences' stock by 2025 depends on the company's ability to execute its strategy, navigate the regulatory landscape, and deliver on the promise of its innovative pipeline. Monitoring clinical trial results, financial performance, and market developments will be crucial for investors seeking to capitalize on this emerging field.