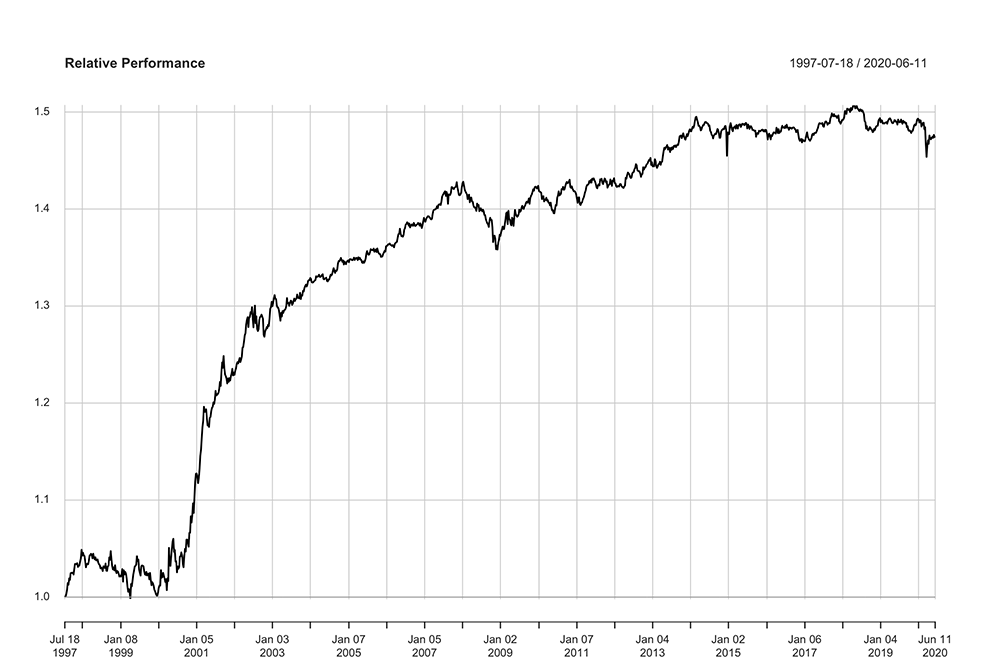

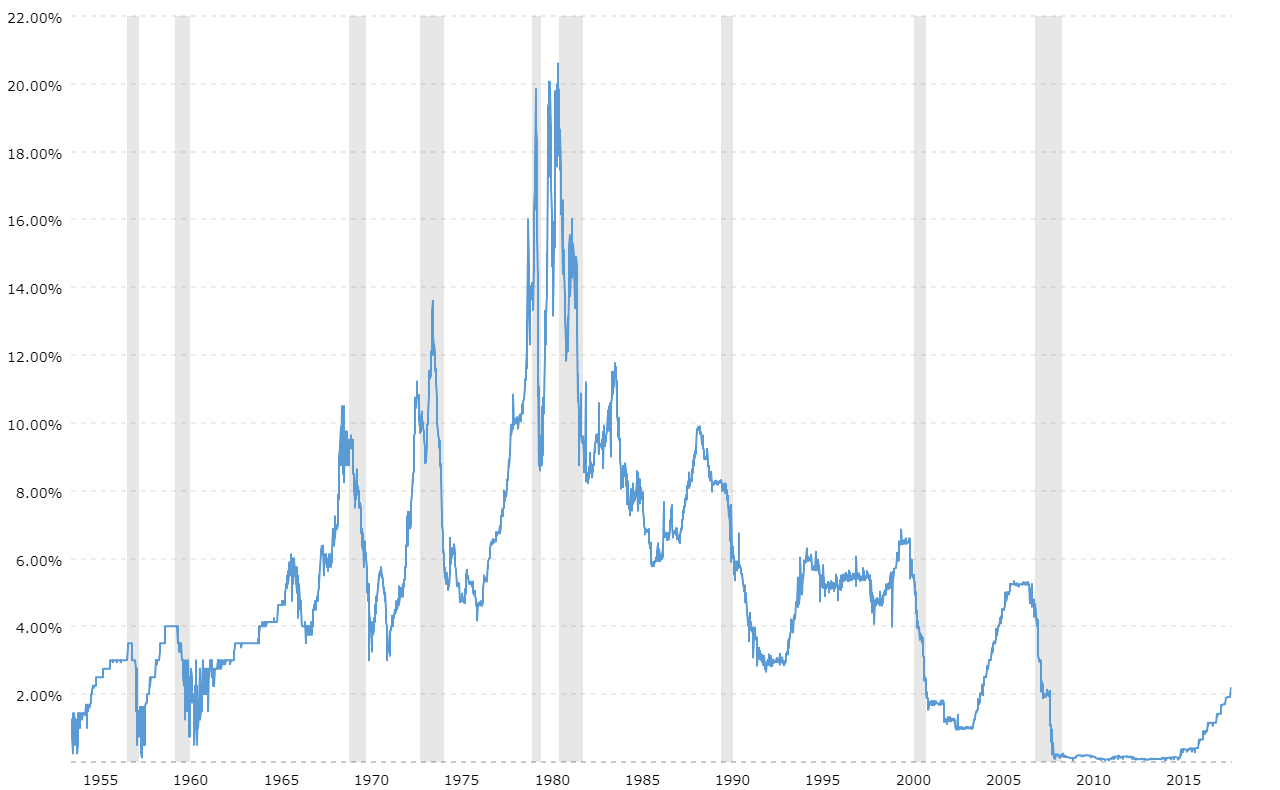

Bullseye American Ingenuity Fund Performance History Graph

The Bullseye American Ingenuity Fund, a prominent player in the actively managed fund arena, has been the subject of intense scrutiny lately. Investors and financial analysts are poring over its performance history graph, searching for answers amidst market volatility and shifting economic landscapes.

Understanding the trajectory of this fund requires a deep dive into its past performance and current strategies. This article will analyze the Bullseye American Ingenuity Fund's performance history, dissecting key periods, exploring contributing factors, and examining expert opinions to provide a comprehensive overview.

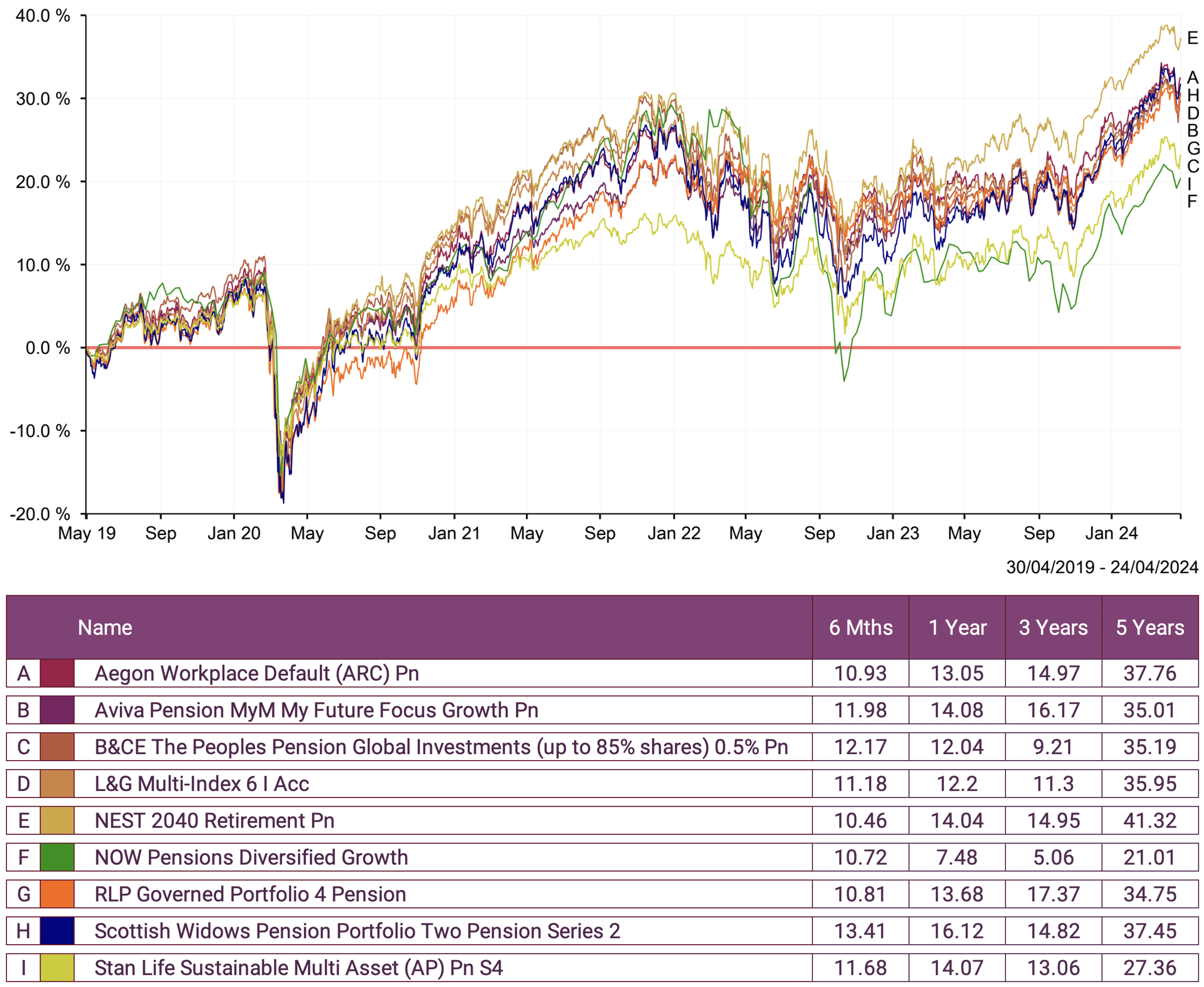

A Look at the Historical Performance

The Bullseye American Ingenuity Fund boasts a performance history spanning over a decade. Early years witnessed impressive growth, fueled by strategic investments in emerging technology sectors.

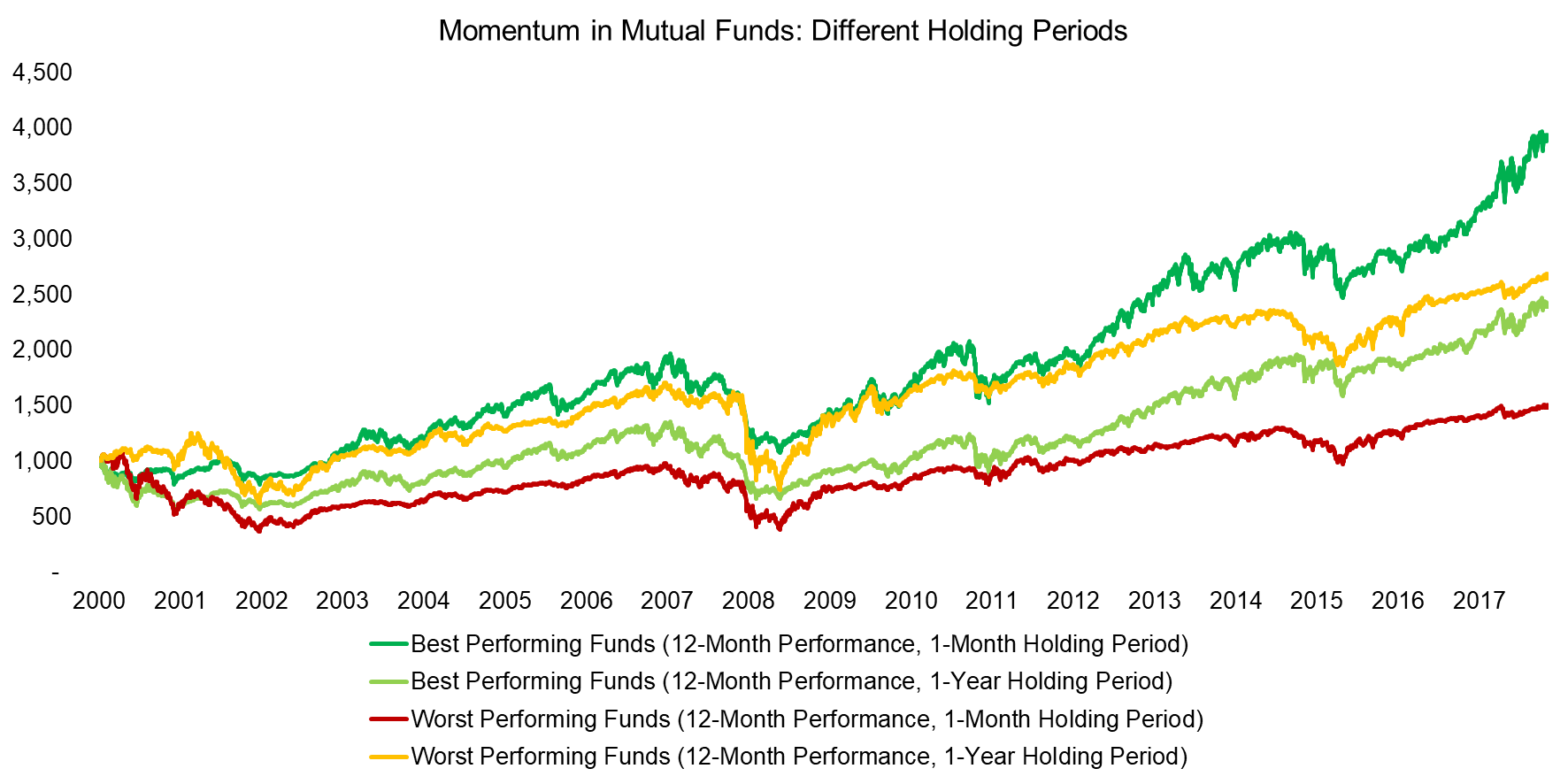

However, the graph reveals periods of both outperformance and underperformance relative to its benchmark, the S&P 500.

Periods of Significant Growth

During the period of 2015-2018, the fund experienced a surge in value, exceeding the S&P 500's returns by a significant margin. This growth was largely attributed to successful bets on companies disrupting traditional industries.

Portfolio managers skillfully identified and invested in companies with high growth potential, reaping substantial rewards.

Periods of Underperformance

The years 2020 and 2022 presented challenges for the fund, resulting in a noticeable dip on the performance graph. Global economic uncertainty and sector-specific downturns negatively impacted its holdings.

The fund's exposure to certain sectors, such as renewable energy, which experienced volatility during these periods, contributed to the decline.

Analyzing Contributing Factors

Several factors influenced the Bullseye American Ingenuity Fund's performance, including market conditions, investment strategies, and management decisions.

Understanding these factors provides valuable insights into the fund's strengths and weaknesses.

Market Conditions

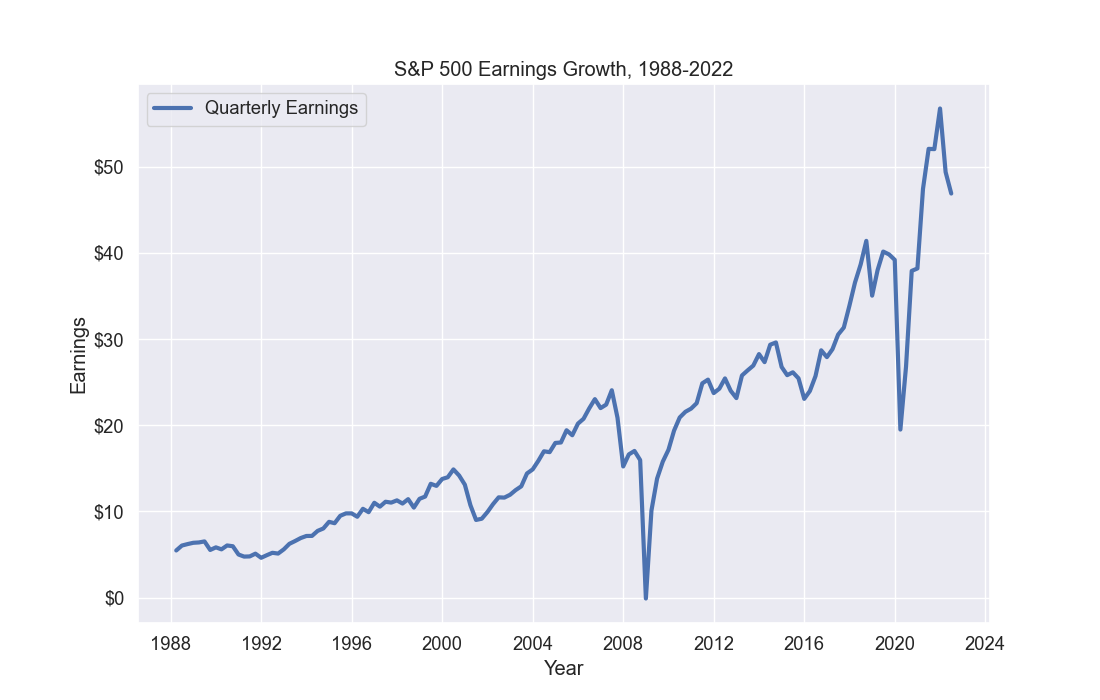

The overall health of the stock market plays a crucial role in the performance of any investment fund. Bull markets tend to lift all boats, while bear markets can drag down even the most well-managed funds.

The Bullseye American Ingenuity Fund experienced fluctuations in performance that correlated with broader market trends.

Investment Strategies

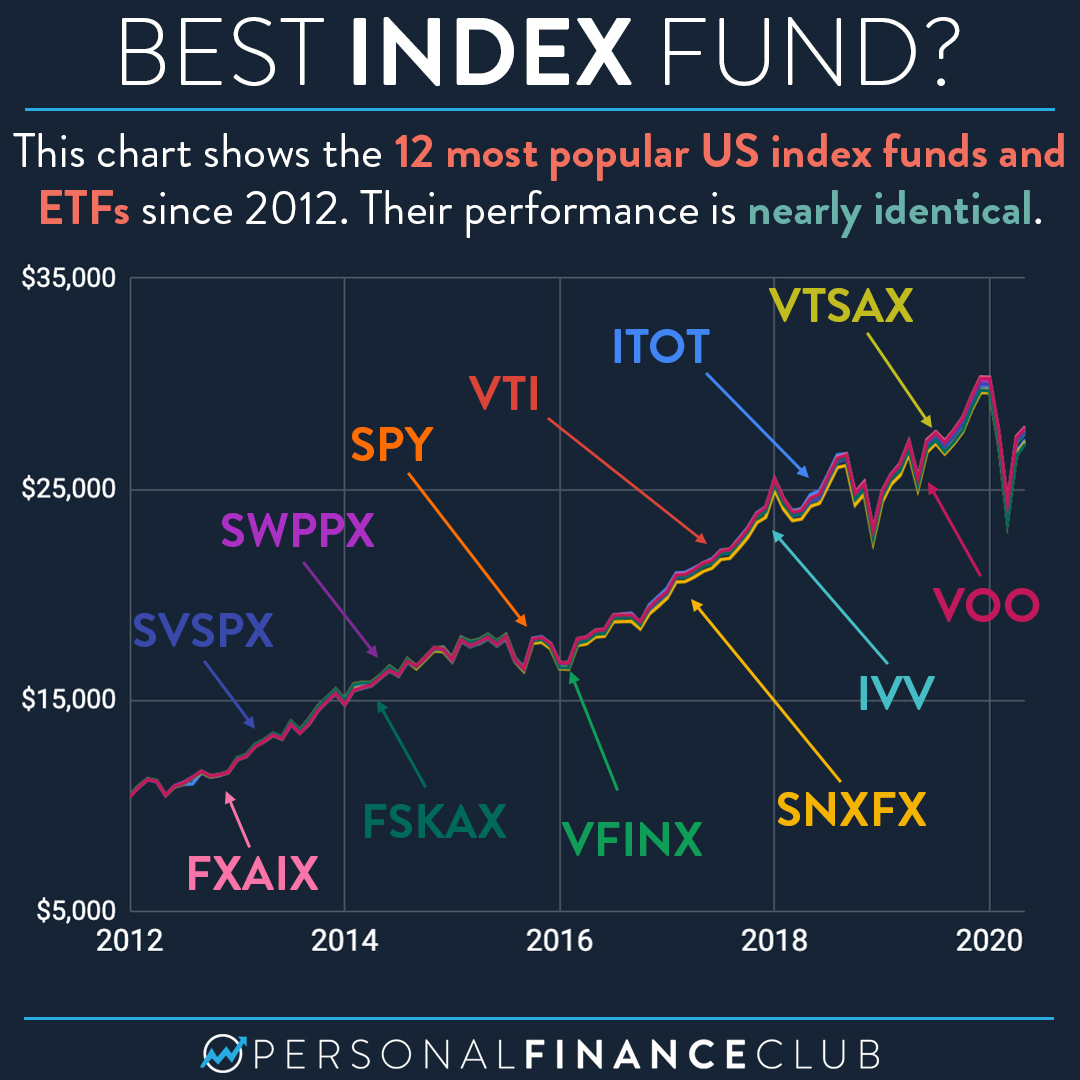

The fund employs an active management strategy, relying on the expertise of its portfolio managers to identify undervalued or high-growth opportunities. This strategy carries both potential rewards and risks.

Successful stock picking can lead to significant outperformance, while poor investment choices can result in underperformance.

Management Decisions

Key decisions made by the fund's management team, such as asset allocation and risk management strategies, directly impact performance. Changes in the management team or investment philosophy can also affect returns.

The fund's management has adapted its strategy over time to address evolving market conditions and investor preferences.

Expert Opinions and Investor Sentiment

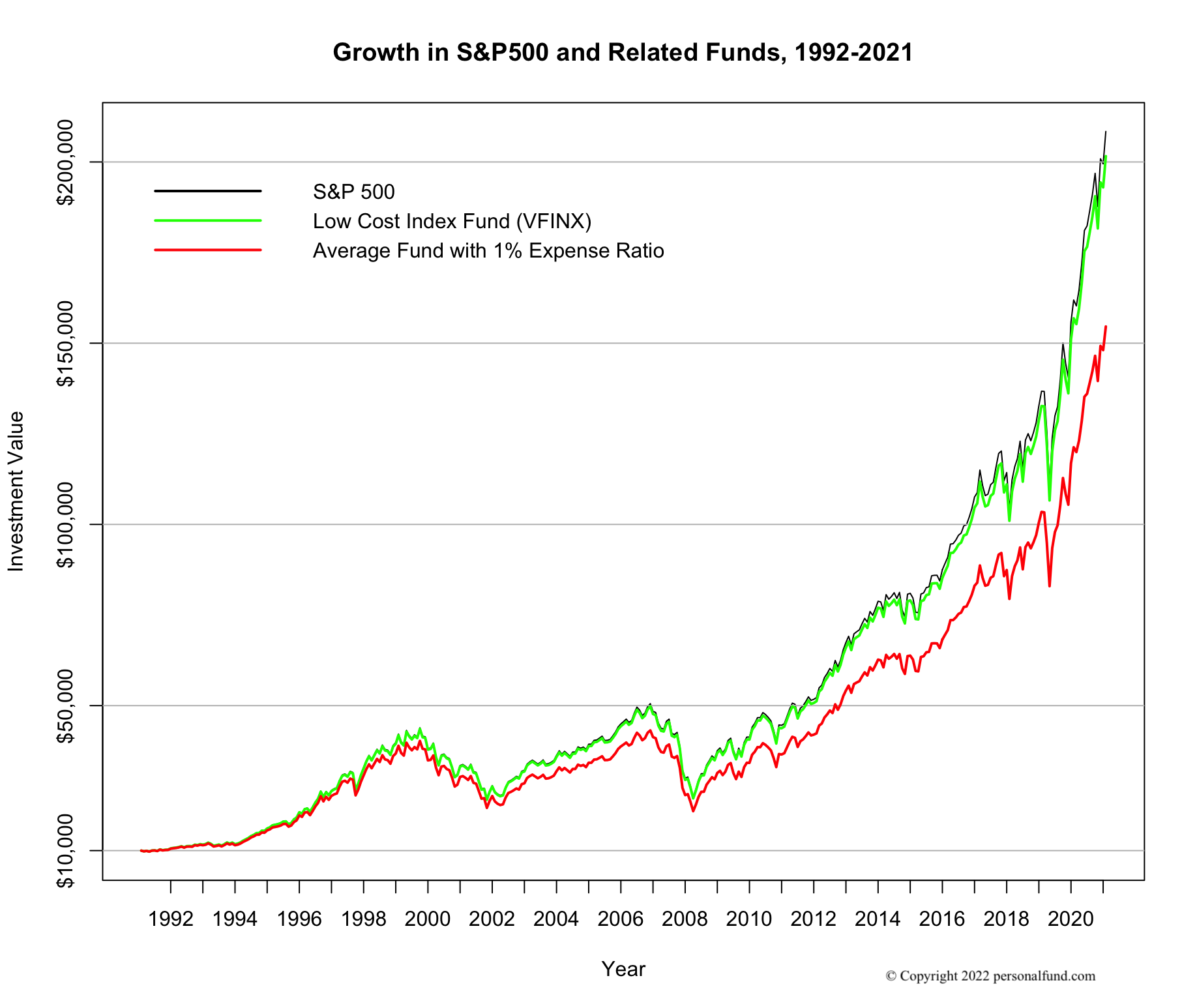

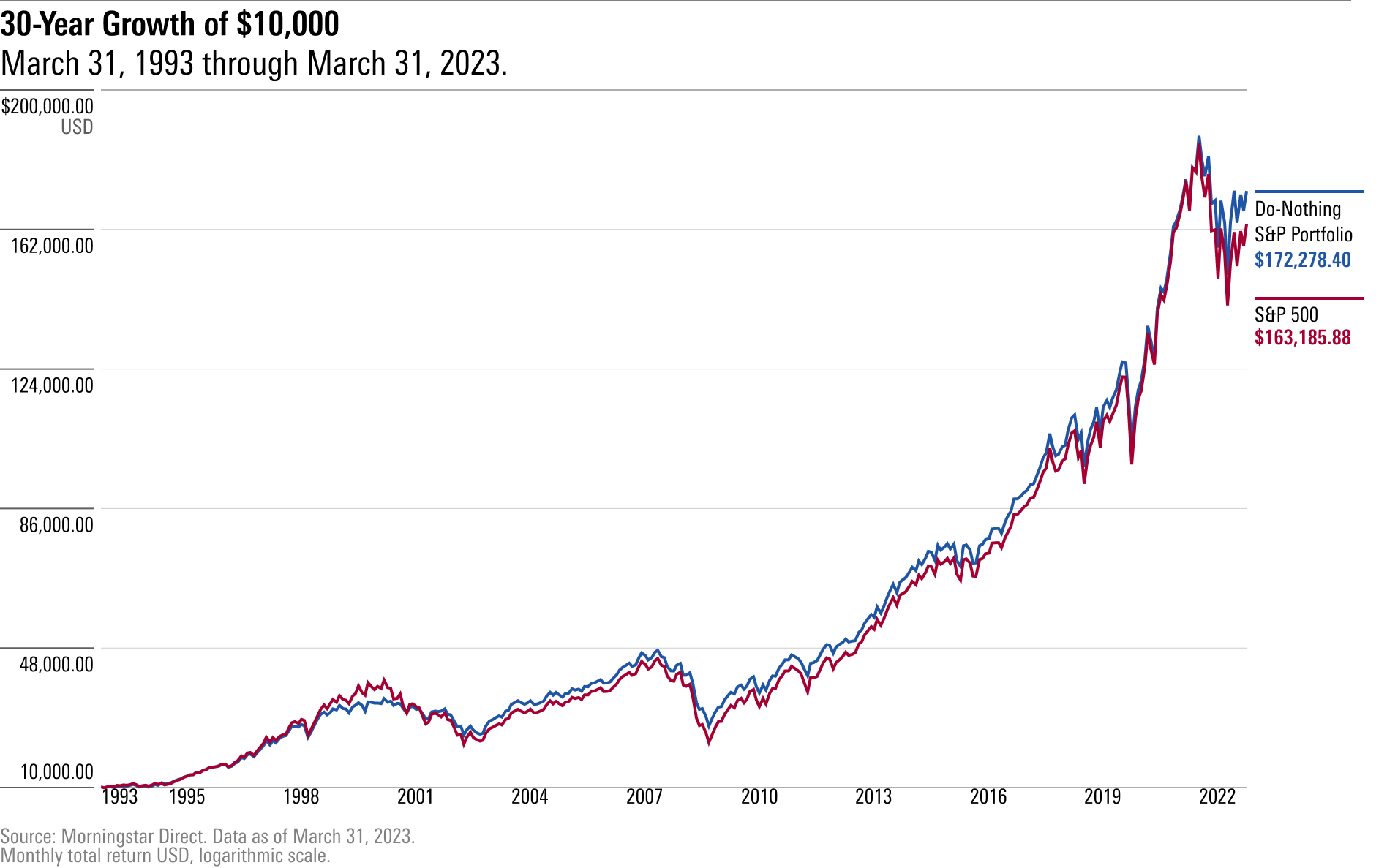

Financial analysts offer varied perspectives on the Bullseye American Ingenuity Fund's performance. Some praise its ability to generate alpha during favorable market conditions, while others express concerns about its volatility and expense ratio.

Investor sentiment towards the fund is also mixed, with some investors remaining loyal due to its past successes, and others seeking alternative investment options.

"The Bullseye American Ingenuity Fund has demonstrated the potential for significant returns, but investors should be aware of its inherent risks," says Jane Doe, a financial analyst at Morningstar.

"The fund's high expense ratio is a concern, especially during periods of underperformance," adds John Smith, a portfolio manager at Vanguard.

The Future Outlook

Looking ahead, the Bullseye American Ingenuity Fund faces both opportunities and challenges. The fund's ability to adapt to changing market dynamics and capitalize on emerging investment trends will determine its future success.

Investors should carefully consider their risk tolerance and investment goals before investing in this fund.

The fund's management team is focused on identifying new growth opportunities and managing risk effectively. They believe the fund is well-positioned to deliver long-term value to investors.

Ultimately, the Bullseye American Ingenuity Fund's performance history graph serves as a valuable tool for investors seeking to understand its past performance and assess its potential for future growth. Careful analysis and informed decision-making are essential for navigating the complexities of the investment world.