Cabot Oil & Gas Stock Price

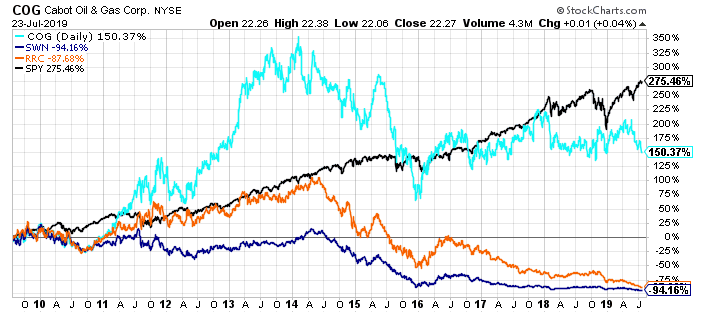

Shares of Cabot Oil & Gas, now part of Coterra Energy (CTRA), have experienced notable fluctuations in recent years, influenced by a complex interplay of factors ranging from global energy demand to company-specific operational performance.

This article examines the recent trends in Coterra Energy's stock price, the key drivers behind these movements, and the potential implications for investors and the broader energy sector.

Understanding Coterra Energy (Formerly Cabot Oil & Gas)

Cabot Oil & Gas completed its merger with Cimarex Energy in late 2021, creating Coterra Energy.

The merger was a significant consolidation move within the energy industry, aiming to create a more diversified and resilient company with operations in both natural gas and crude oil production.

This strategic shift altered the company's risk profile and investment appeal.

Recent Stock Performance

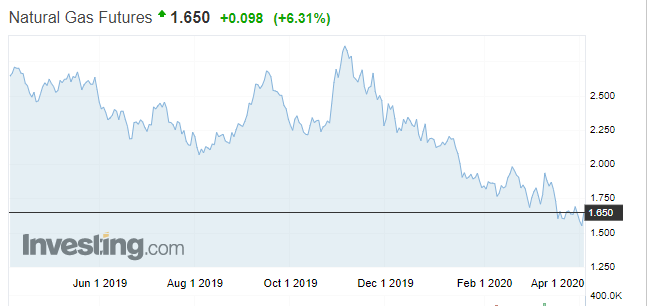

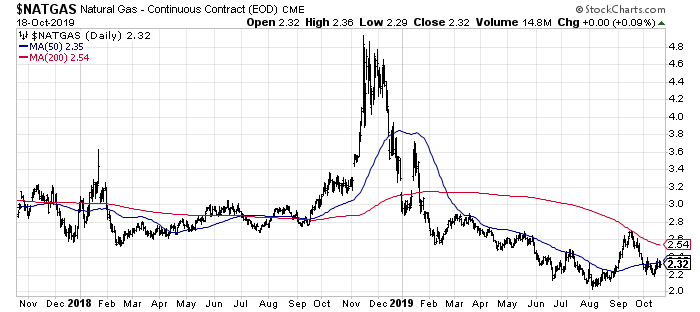

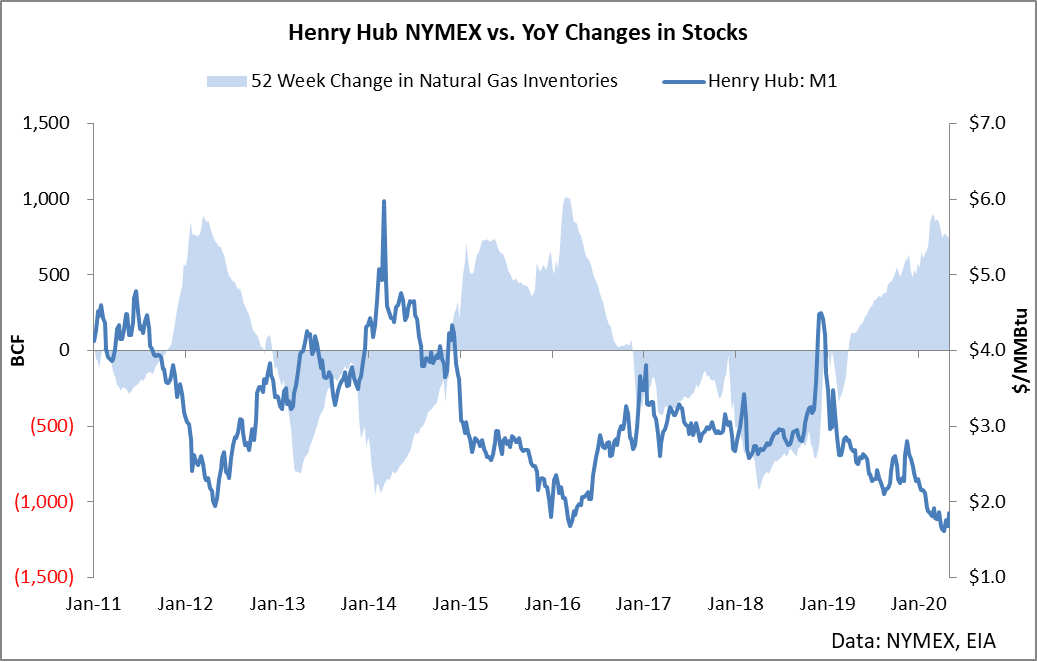

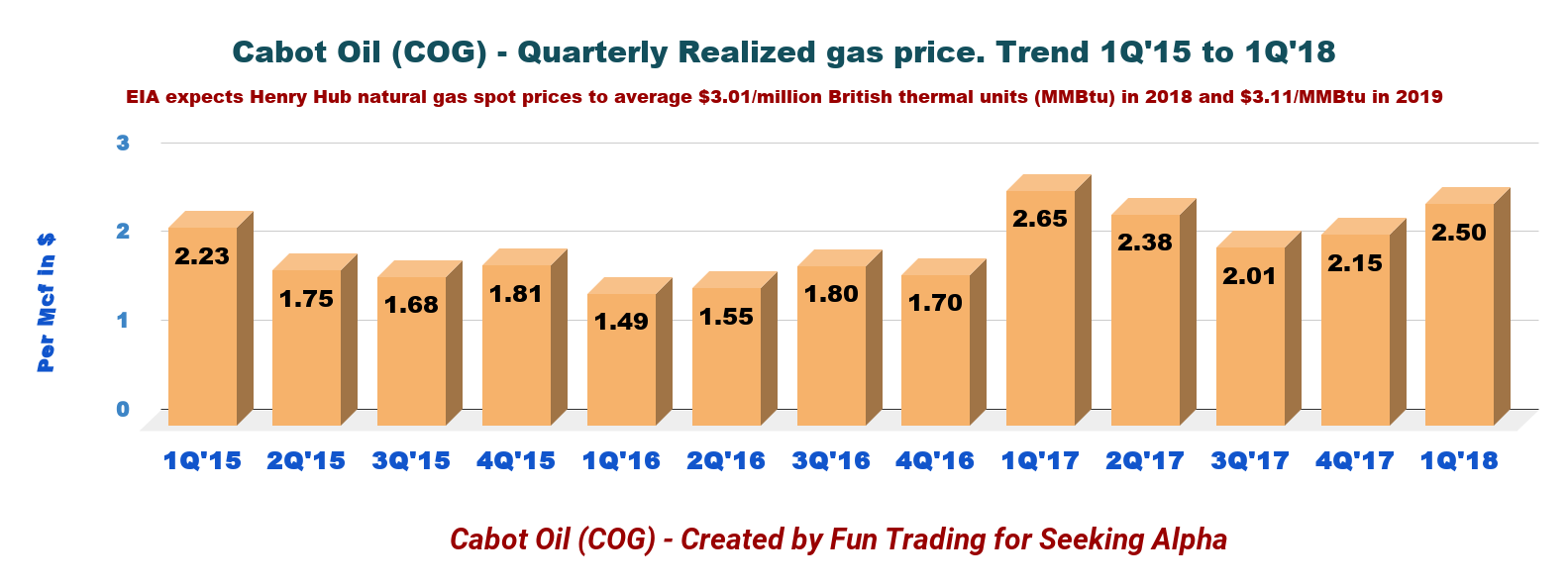

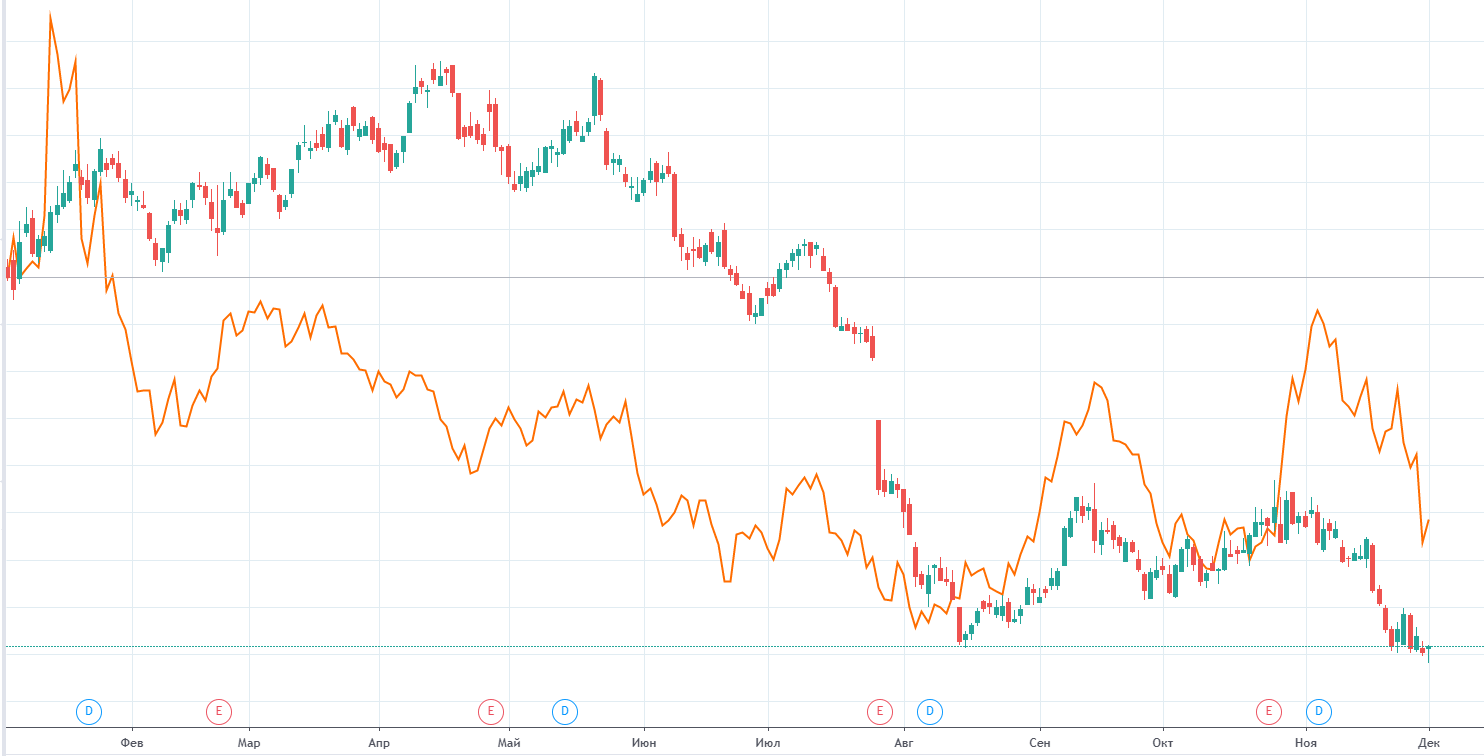

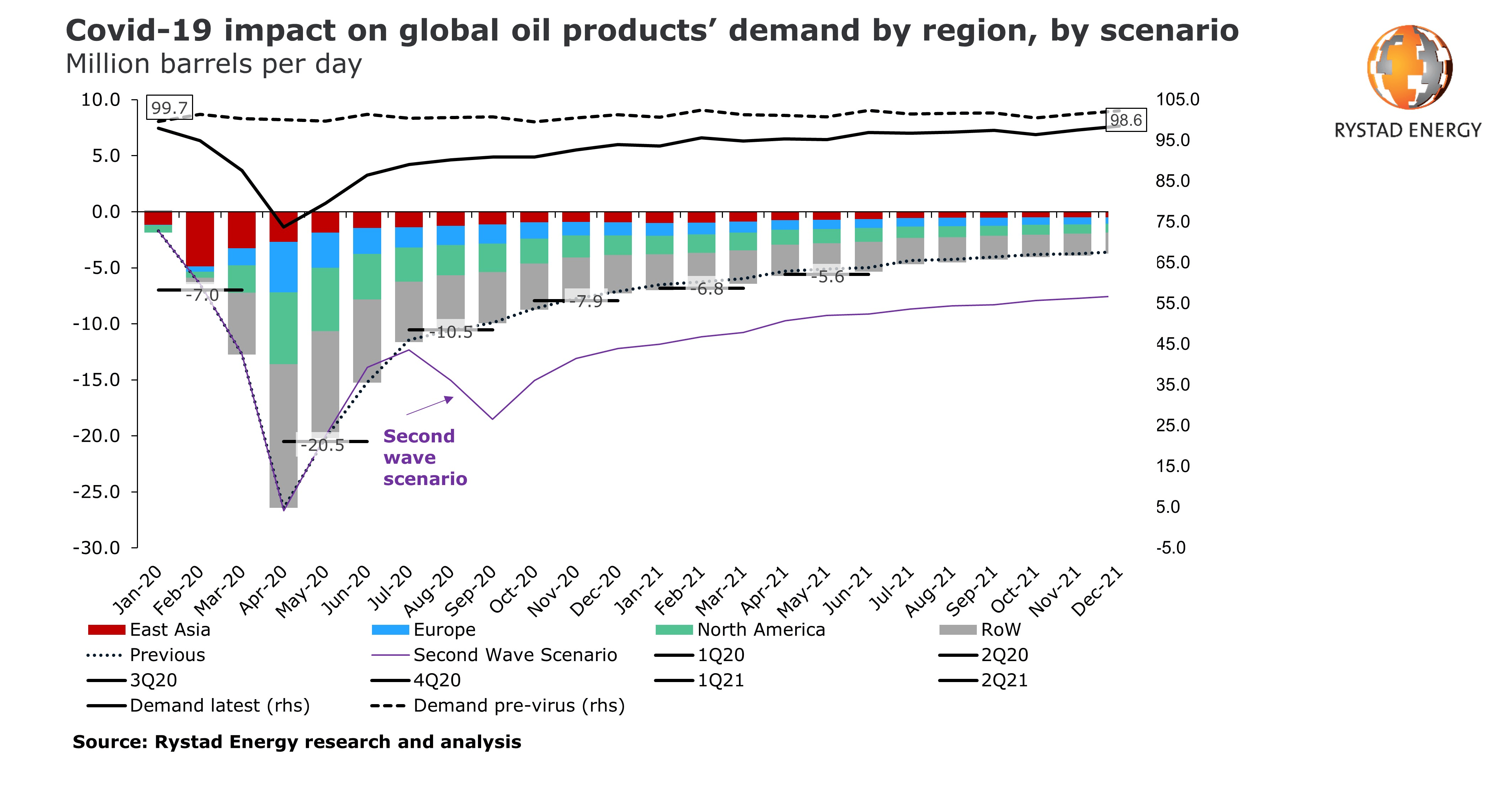

Coterra Energy's stock price has mirrored, to some extent, the volatility within the broader energy market.

Fluctuations in natural gas and oil prices have directly impacted investor sentiment and trading activity.

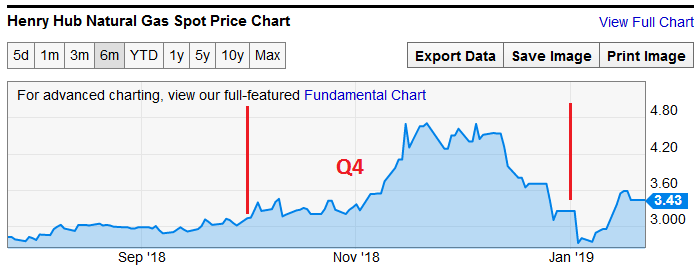

For instance, surges in natural gas prices during periods of high demand, such as peak winter months or geopolitical instability affecting supply, have often correlated with upticks in CTRA's stock value.

Conversely, periods of declining energy prices, driven by oversupply or weakening global demand, have typically led to downward pressure on the stock.

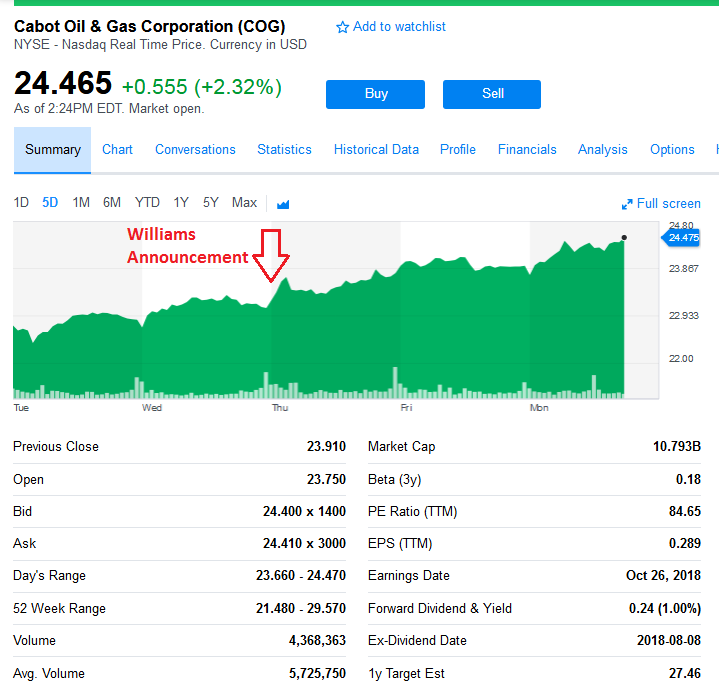

Beyond commodity prices, company-specific announcements have also played a crucial role.

Key Drivers Affecting Stock Price

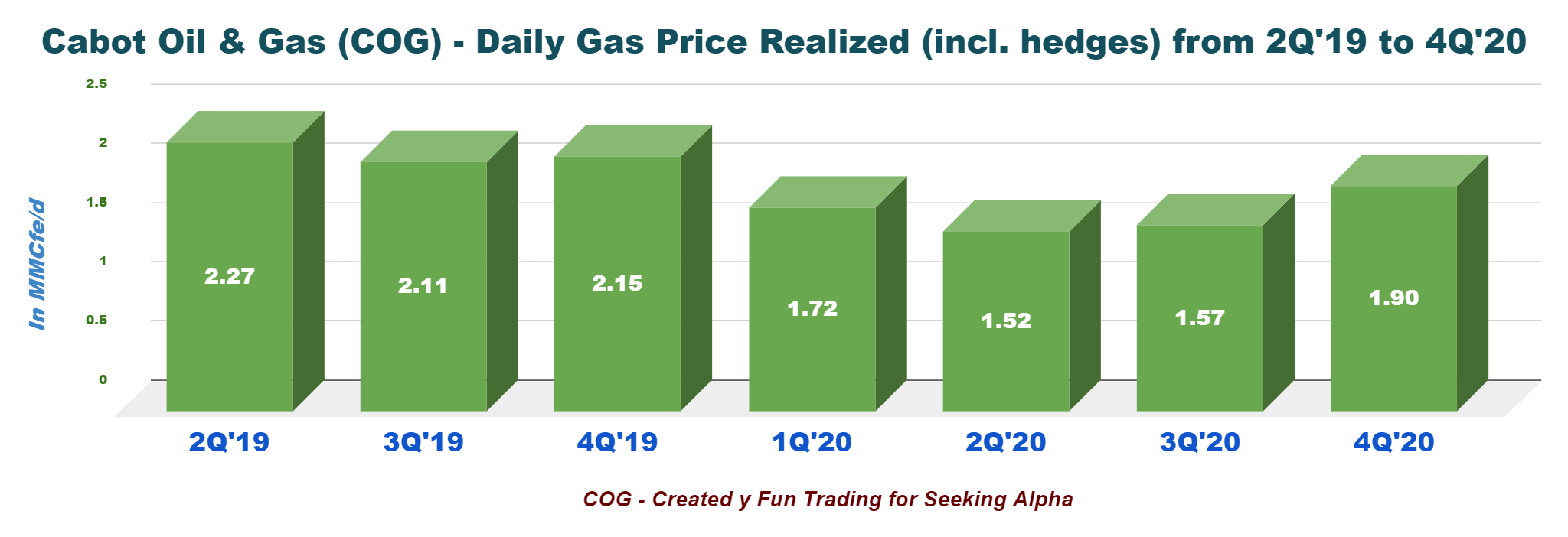

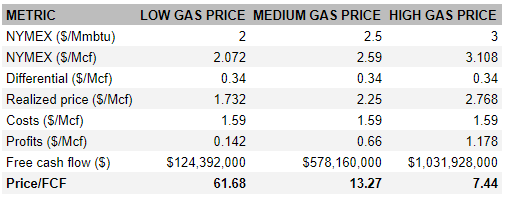

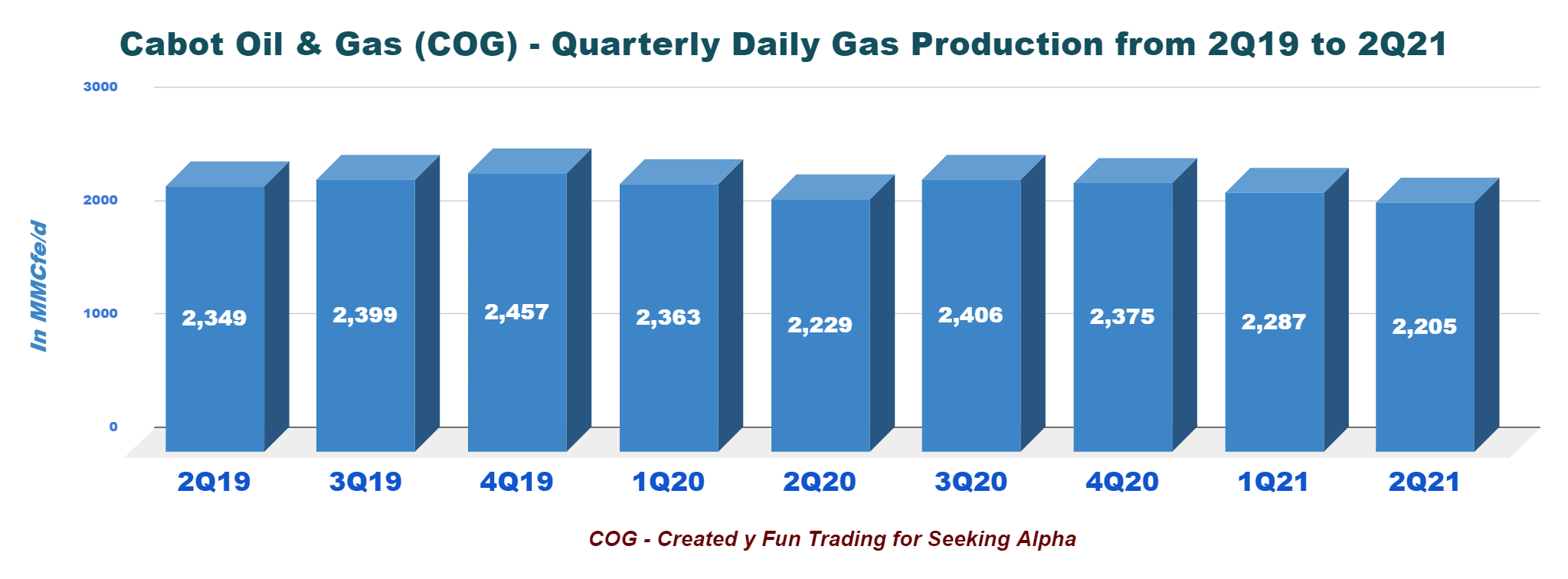

Several factors have demonstrably influenced Coterra Energy's stock price. Production levels and operating efficiency are paramount.

Announcements of increased production or reduced operating costs tend to boost investor confidence.

Conversely, production shortfalls or unexpected operational expenses can negatively impact the stock.

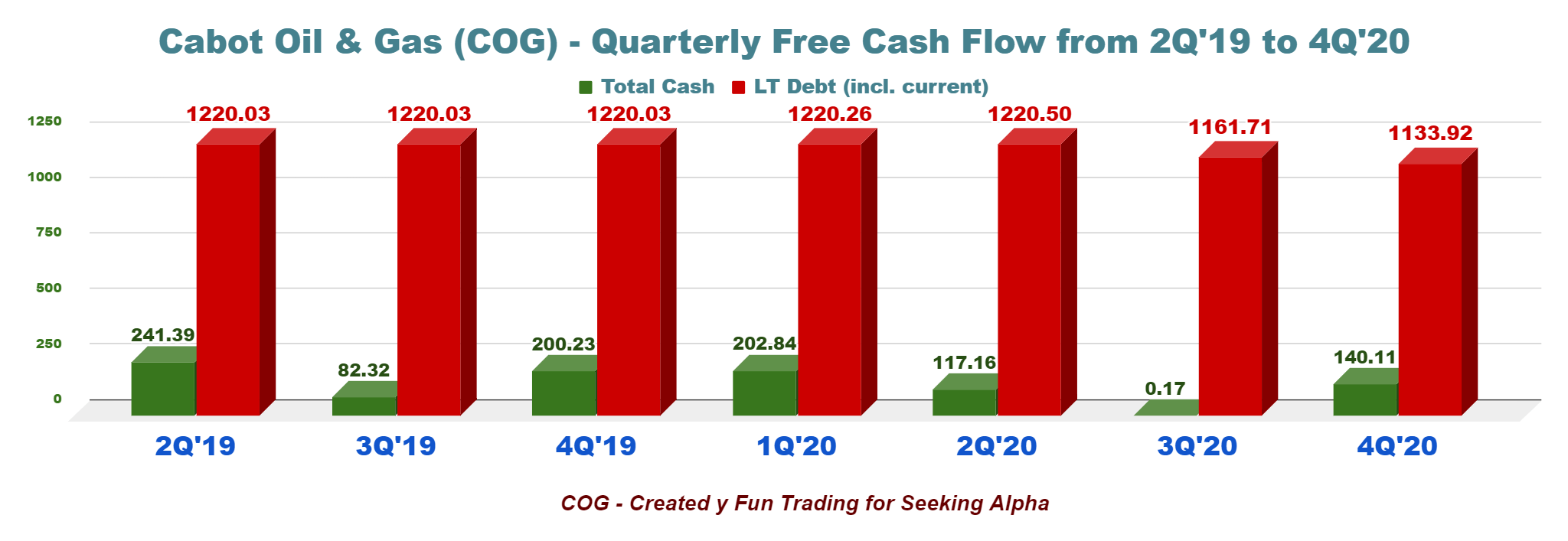

Financial performance is also closely scrutinized. Quarterly earnings reports, revenue figures, and profitability metrics are all key indicators that investors use to assess the company's financial health and growth prospects.

Positive earnings surprises typically drive the stock higher, while disappointing results can trigger sell-offs.

Mergers and acquisitions (M&A) activity, like the formation of Coterra itself, has been a major catalyst. The integration of Cabot and Cimarex had immediate and ongoing effects on the stock.

The success of the integration, the realization of synergies, and the overall strategic rationale behind the merger continue to be evaluated by the market.

Regulatory changes and environmental concerns also play a crucial role. Increased regulatory scrutiny or environmental regulations could add to costs.

The energy sector is heavily regulated, and changes in government policies or environmental regulations can significantly impact the company's operations and profitability.

Increasing investor focus on environmental, social, and governance (ESG) factors also puts pressure on companies to adopt sustainable practices, which can affect their attractiveness to certain investors.

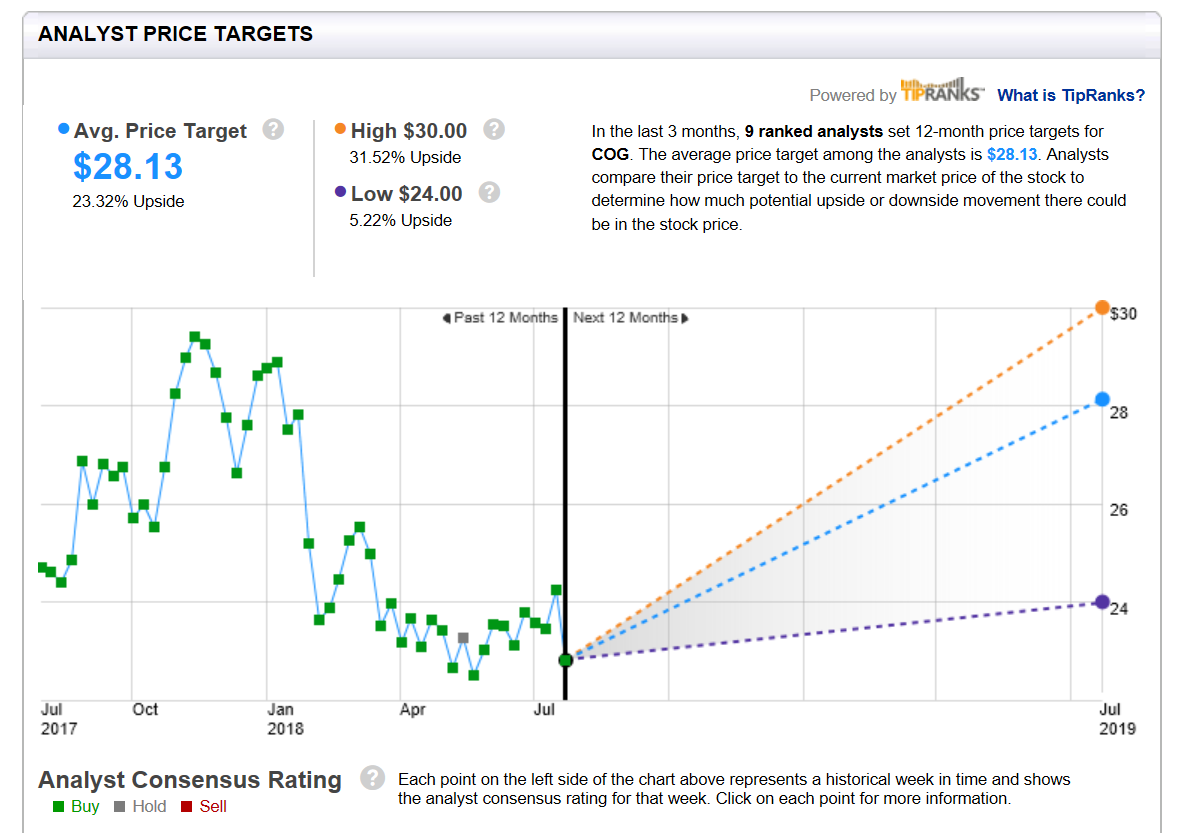

Analyst Ratings and Market Sentiment

Analyst ratings and market sentiment play a significant role in shaping the perception of Coterra Energy and its stock.

Analysts at major investment banks and research firms regularly issue ratings on CTRA, ranging from "buy" to "sell," based on their assessment of the company's prospects.

Positive ratings and price target upgrades can attract new investors, while downgrades can trigger selling pressure.

Market sentiment, which reflects the overall mood and expectations of investors, can also influence the stock price.

Optimistic sentiment toward the energy sector or natural gas in particular can create a favorable environment for CTRA.

Pessimistic sentiment can lead to a more cautious approach from investors.

Potential Impact and Future Outlook

The movements in Coterra Energy's stock price have implications for a wide range of stakeholders.

Investors who hold CTRA shares are directly impacted by the stock's performance, as fluctuations in price affect the value of their investments.

The company's employees and management are also affected, as stock performance can influence compensation packages and overall job security.

The broader energy sector is impacted as well, as Coterra Energy's performance can signal broader trends in the industry.

Looking ahead, Coterra Energy's stock price will likely remain susceptible to the same factors that have influenced it in the past.

Global energy demand, geopolitical events, and company-specific operational and financial performance will continue to be key drivers.

Investors should carefully monitor these factors and conduct their own due diligence before making any investment decisions related to CTRA.

:max_bytes(150000):strip_icc()/cog2-1903868ff87d4d9cbebb0aacfc16f139.png)