Can Hsa Be Used For Chiropractor

Imagine your back aches after a long day hunched over a computer, a nagging reminder of modern life. You consider seeing a chiropractor, picturing relief and improved posture. But then the practical question arises: can you use your Health Savings Account (HSA) to cover the cost? It's a common query, blending wellness aspirations with financial realities.

The core question we're exploring is whether chiropractic care qualifies as a medical expense reimbursable through a Health Savings Account (HSA). The answer, thankfully, is generally yes, but with some nuances and conditions that individuals should be aware of. This article delves into the specifics, providing clarity and guidance for those seeking to use their HSA for chiropractic services.

Understanding Health Savings Accounts (HSAs)

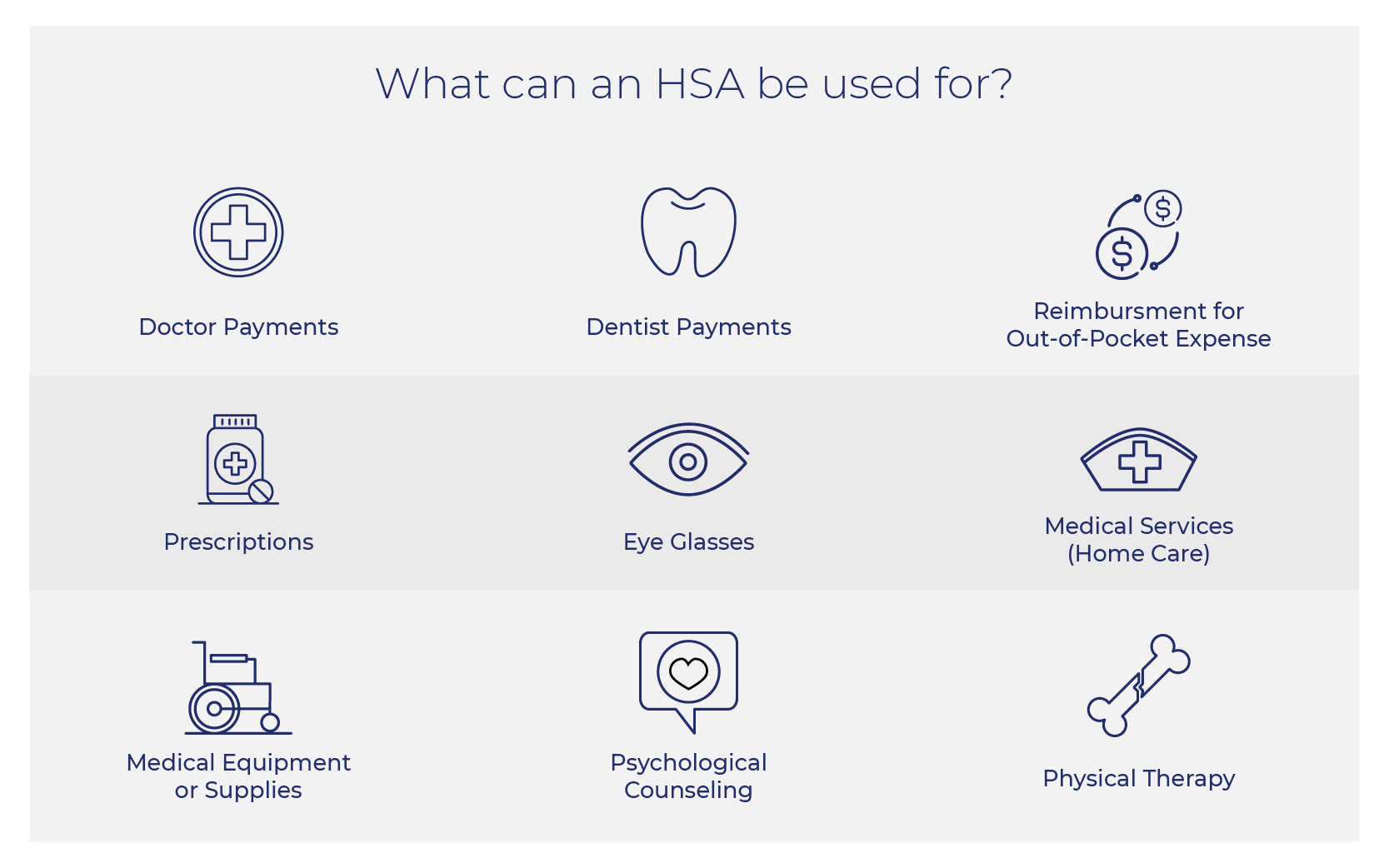

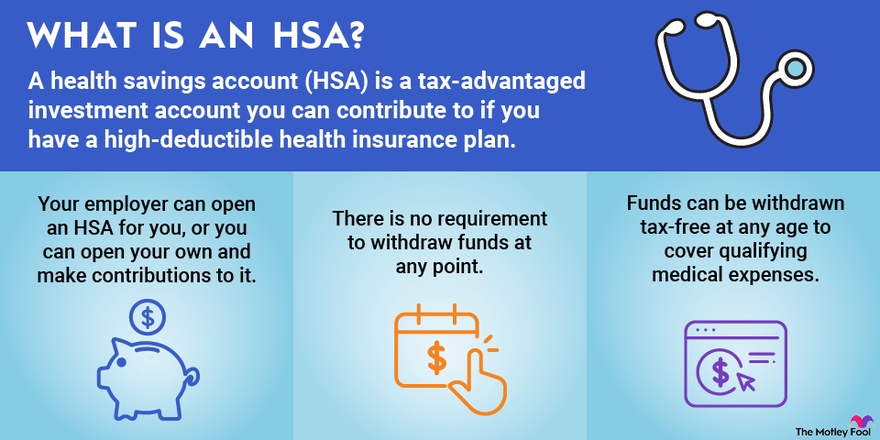

An HSA is a tax-advantaged savings account that can be used to pay for qualified medical expenses. It's available to individuals who are enrolled in a high-deductible health plan (HDHP). Contributions to an HSA are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are also tax-free.

This triple tax advantage makes HSAs a powerful tool for managing healthcare costs and saving for the future. Understanding the eligible expenses is key to maximizing the benefits of an HSA.

Chiropractic Care as a Qualified Medical Expense

The Internal Revenue Service (IRS) defines qualified medical expenses as those incurred for the diagnosis, cure, mitigation, treatment, or prevention of disease, or for the purpose of affecting any structure or function of the body. This definition is broad enough to generally include chiropractic care.

According to IRS Publication 502, which outlines medical and dental expenses, payments for medical services provided by licensed chiropractors are considered eligible medical expenses. This includes adjustments, manipulations, and other treatments performed by a chiropractor.

However, it's crucial that the chiropractic care is deemed medically necessary. The IRS does not allow HSA funds to be used for expenses that are solely for cosmetic reasons or for general health improvement.

Navigating the Nuances

While chiropractic care is generally HSA-eligible, some situations may require extra attention. For instance, some HSA administrators may require documentation to substantiate the medical necessity of the treatment.

This might include a letter from your chiropractor outlining the condition being treated and the plan of care. Keeping detailed records of your appointments and treatments is always a good practice.

Another aspect to consider is the specific services offered by the chiropractor. Some chiropractors offer additional services that may not be considered qualified medical expenses.

What is Covered and What is Not

Covered: Chiropractic adjustments, spinal manipulations, and related therapeutic procedures aimed at treating musculoskeletal conditions are typically HSA-eligible. These services directly address a specific medical need.

Not Covered: Services that are considered solely for general health improvement or cosmetic purposes are usually not HSA-eligible. This might include certain types of massage therapy or nutritional supplements sold by the chiropractor, unless they are prescribed to treat a specific medical condition.

It's always advisable to check with your HSA administrator to confirm whether a specific service is covered before using your HSA funds. This can prevent unexpected tax implications.

Documenting Your Expenses

Proper documentation is crucial when using HSA funds for any medical expense, including chiropractic care. Keep records of all payments made to the chiropractor.

Also retain copies of any documentation provided by the chiropractor, such as treatment plans or letters of medical necessity. These documents can be essential if you are ever audited by the IRS.

Most HSA administrators provide online portals where you can upload and store your documentation. This makes it easy to track your expenses and maintain a complete record of your healthcare spending.

The Broader Impact of HSA Eligibility

The fact that chiropractic care is generally HSA-eligible has a significant impact on accessibility and affordability. It allows individuals with HSAs to seek chiropractic treatment without incurring a large out-of-pocket expense.

This can be particularly beneficial for those with chronic back pain or other musculoskeletal conditions who rely on chiropractic care for ongoing management. The ability to use pre-tax dollars to pay for these services can make a real difference in their overall healthcare budget.

Moreover, it encourages individuals to take a proactive approach to their health and wellness. By making chiropractic care more accessible, it promotes early intervention and preventative care.

Seeking Professional Advice

While this article provides general information, it is not a substitute for professional advice. It is always best to consult with a qualified tax advisor or financial planner to discuss your specific situation.

They can help you understand the rules and regulations governing HSAs and ensure that you are using your account in a tax-compliant manner. They can also provide guidance on how to maximize the benefits of your HSA and integrate it into your overall financial plan.

Furthermore, your chiropractor may also be able to provide information about the medical necessity of your treatment and help you obtain any necessary documentation.

Conclusion

The general consensus is that you can indeed use your HSA for eligible chiropractic services. The IRS's broad definition of qualified medical expenses allows for the inclusion of treatments aimed at addressing musculoskeletal conditions. However, as with any healthcare expenditure, it's paramount to ensure medical necessity, maintain thorough documentation, and, when in doubt, consult with both your HSA administrator and a qualified tax professional.

By understanding the rules and regulations surrounding HSAs and chiropractic care, individuals can confidently utilize their accounts to invest in their well-being. In doing so, they embrace a proactive approach to health, combining fiscal responsibility with a commitment to a pain-free, active lifestyle.