Can I Buy A Car With 520 Credit Score

For many Americans, owning a car is not a luxury but a necessity for commuting, errands, and overall independence. But what happens when your credit score falls below the "good" threshold? The question looms large: can you buy a car with a 520 credit score?

The answer isn't a simple yes or no. This article will delve into the complexities of securing auto financing with a low credit score, exploring the potential challenges, available options, and strategies for improving your chances of driving off the lot.

Understanding the Credit Score Landscape

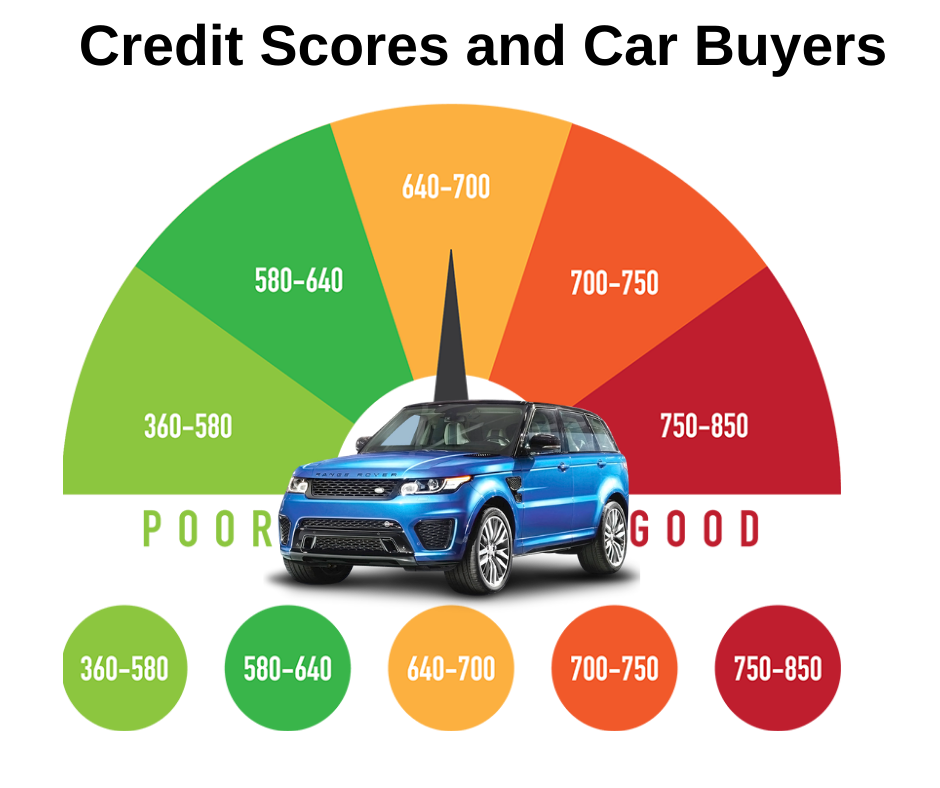

A 520 credit score typically falls within the "poor" or "very poor" range according to most credit scoring models like FICO and VantageScore. This rating indicates a higher risk to lenders, suggesting a history of missed payments or other credit mismanagement. Experian data shows that individuals with scores in this range often face significant hurdles when seeking financing.

The Challenges of Auto Loans with Poor Credit

Lenders primarily use credit scores to assess the likelihood of loan repayment. A low score translates to higher interest rates. According to a report by NerdWallet, borrowers with poor credit scores often pay significantly more in interest over the life of the loan compared to those with excellent credit.

This disparity can add thousands of dollars to the total cost of the vehicle. Some lenders may flat-out deny applications from borrowers with scores as low as 520, seeing the risk as too great.

Exploring Financing Options

While challenging, securing a car loan with a 520 credit score is not impossible. Several avenues can be explored. Subprime lenders specialize in working with individuals who have less-than-perfect credit histories.

These lenders often have more lenient approval criteria than traditional banks or credit unions. However, expect higher interest rates and potentially less favorable loan terms from subprime lenders. Some car dealerships offer in-house financing options, sometimes called "buy here, pay here" dealerships.

These dealerships typically don't rely heavily on credit scores but instead focus on factors like income and employment history.

Strategies for Securing Approval

Even with a low credit score, there are steps you can take to improve your chances of approval. Increasing your down payment can significantly reduce the lender's risk. A larger down payment demonstrates your commitment and reduces the loan amount.

Consider asking a friend or family member with good credit to co-sign the loan. A co-signer guarantees repayment if you default, making the loan less risky for the lender. Gathering proof of stable income and employment can also strengthen your application. Lenders want to see that you have the means to repay the loan consistently.

Before applying for a loan, check your credit report for errors and dispute any inaccuracies. Correcting errors can potentially boost your credit score.

The Long-Term Perspective

While securing a car loan with a 520 credit score may be possible, it's crucial to consider the long-term financial implications. High interest rates can trap you in a cycle of debt. It might be more prudent to focus on improving your credit score before taking out a car loan.

Consider delaying the purchase and using that time to pay down existing debts, make timely payments, and build a positive credit history. Secured credit cards, where you provide a cash deposit as collateral, are also a good option.

Several free resources are available to help you understand and improve your credit score. Organizations like the Consumer Financial Protection Bureau (CFPB) offer educational materials and tools for managing your finances.

The Bottom Line

Purchasing a car with a 520 credit score is a challenge, but not an insurmountable one. Subprime lenders and "buy here, pay here" dealerships may offer options, but come with high interest rates. Improving your credit score, increasing your down payment, and securing a co-signer can increase your chance.

Ultimately, carefully weigh the financial implications and consider if delaying the purchase to improve your credit is a more financially responsible decision. Evaluate if the short term solution could cause a larger problem.

Consult with a financial advisor for personalized guidance on managing your debt and improving your creditworthiness.

.png)

:max_bytes(150000):strip_icc()/Heres-how-get-car-no-down-payment_final-1c94e62ad4644532a18289cf826f6cce.png)