Can I Buy A House With A 665 Credit Score

Imagine standing on the threshold of a home, sunlight streaming through the windows, the scent of fresh paint filling the air. For many, this is the ultimate dream. But what if a number – a three-digit credit score – seems to stand in the way? Can that dream still become a reality with a 665 credit score?

The short answer is yes, it's possible to buy a house with a 665 credit score. While it might not unlock the best interest rates, it's a viable score that can open doors to homeownership through various loan programs and strategies. Understanding the landscape of mortgage options and financial preparation is key to navigating this journey successfully.

Understanding Credit Scores and Mortgage Eligibility

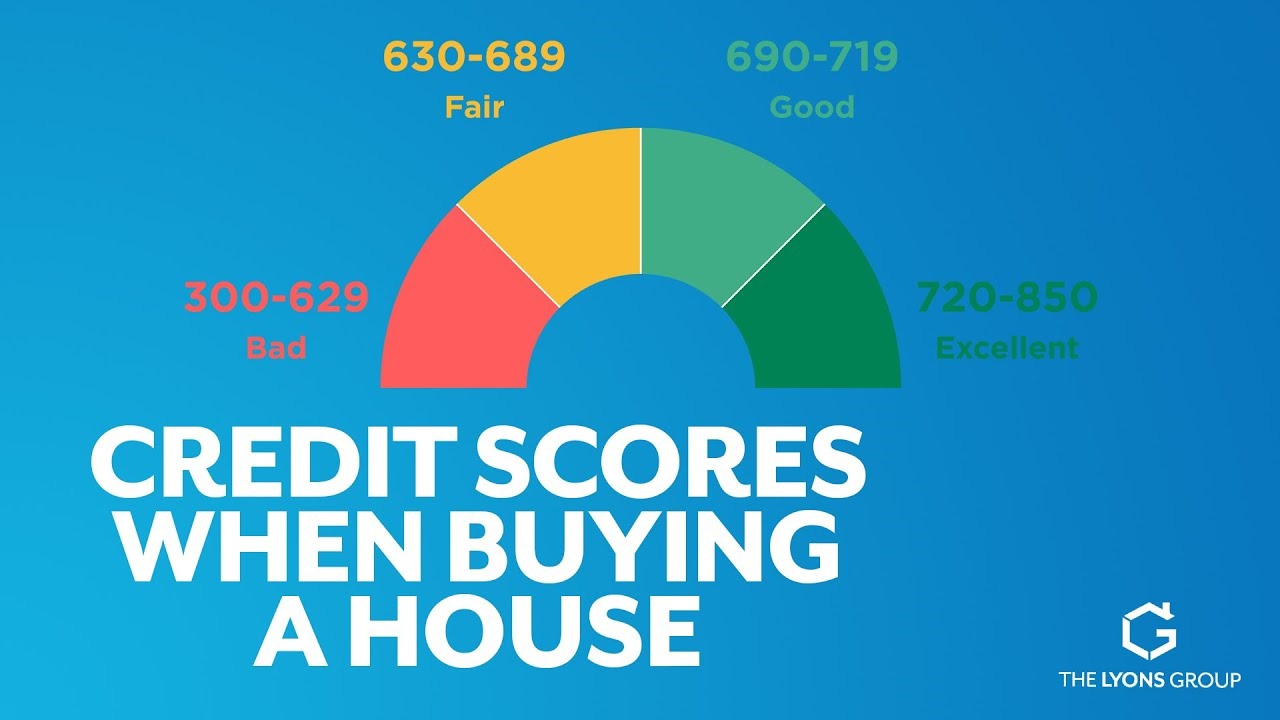

A 665 credit score generally falls into the "fair" credit range. Lenders use credit scores to assess the risk associated with lending money. A lower score typically signals higher risk, leading to potentially higher interest rates or stricter loan terms.

However, a 665 isn't a barrier to entry. It simply means you need to be strategic in your approach. It might involve exploring different loan types and focusing on strengthening other areas of your financial profile.

Loan Options Available

Several loan programs cater to borrowers with credit scores in the mid-600s. FHA loans, insured by the Federal Housing Administration, are a popular choice. These often require a lower down payment and are more forgiving regarding credit scores than conventional loans.

The USDA loan is an option for eligible rural and suburban homebuyers and often doesn't require a down payment. VA loans, backed by the Department of Veterans Affairs, offer favorable terms to eligible veterans and active-duty service members.

Conventional loans, not backed by a government agency, are also an option. While they typically require a higher credit score, some lenders might still work with borrowers in the upper 600s, especially with a larger down payment.

Improving Your Chances

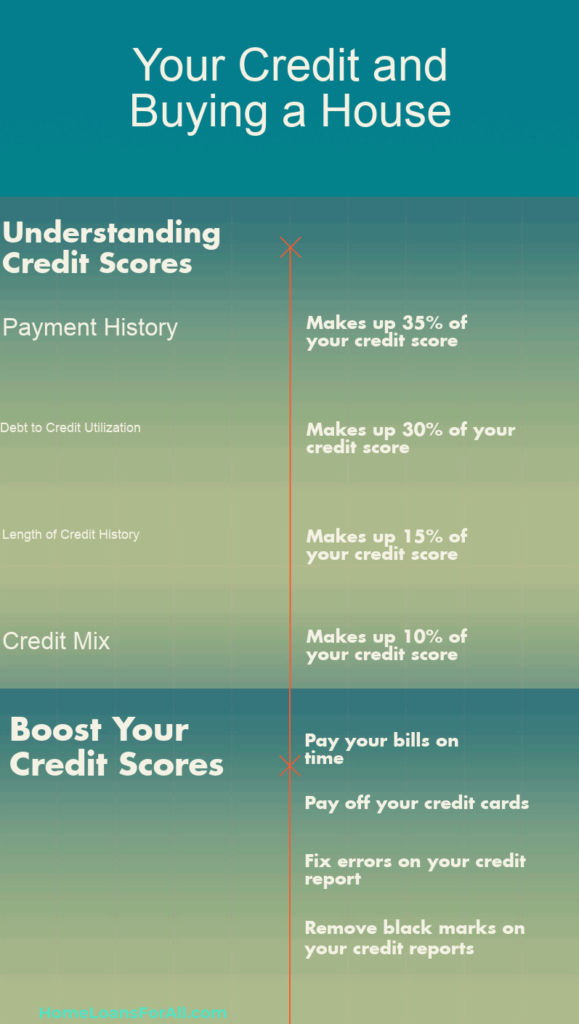

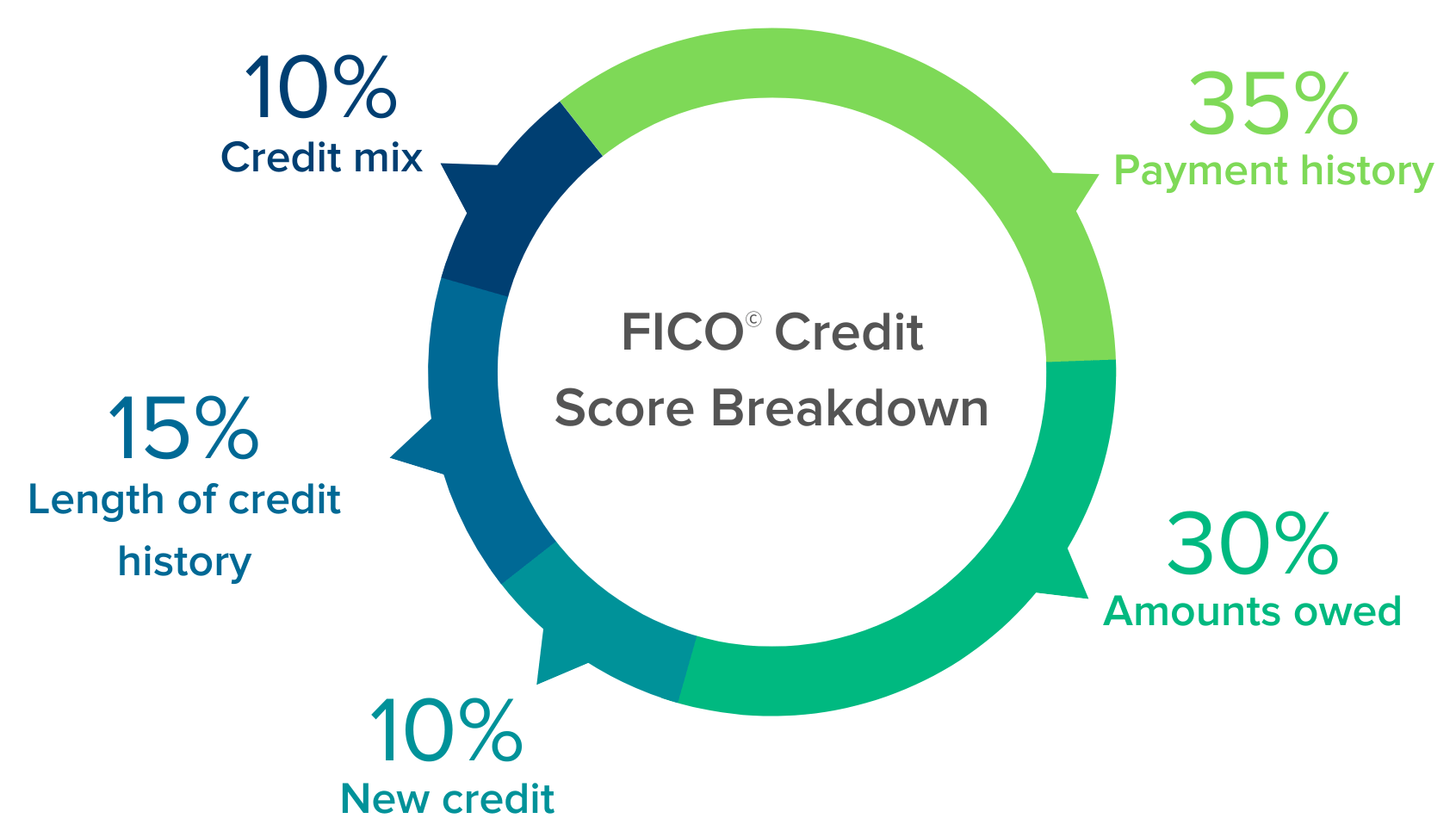

Even with a 665 credit score, there are steps you can take to improve your chances of approval and secure better loan terms. One crucial step is to reduce your debt-to-income ratio (DTI). This involves paying down existing debts, like credit card balances and car loans.

Saving for a larger down payment can also make a significant difference. A larger down payment reduces the lender's risk, potentially leading to more favorable terms. Also, verify the accuracy of your credit report. Dispute any errors you find with the credit bureaus.

Demonstrating a stable employment history is critical. Lenders want to see consistent income over time. Avoid making any major financial changes, like opening new credit accounts or taking out large loans, in the months leading up to your mortgage application.

Seeking Expert Advice

Navigating the mortgage process can be complex. Consulting with a mortgage broker or financial advisor can provide valuable guidance. They can assess your individual situation, recommend the best loan options, and help you navigate the application process.

A housing counselor can also provide valuable assistance. Many non-profit organizations offer free or low-cost housing counseling services. These counselors can help you understand the home buying process, improve your financial literacy, and connect you with resources.

"Homeownership is a journey, not a destination," says Sarah Johnson, a financial advisor specializing in first-time homebuyers. "Focus on building a strong financial foundation, and your credit score will naturally improve over time."

Looking Ahead

Buying a home with a 665 credit score is achievable with careful planning and informed decision-making. It requires research, discipline, and a willingness to explore different options.

While it might not be the easiest path, the reward of homeownership can be well worth the effort. Remember to stay patient, persistent, and proactive in your pursuit of the American dream. Don't be discouraged by the number, instead, let it motivate you to take control of your finances and make informed decisions. Your dream home might be closer than you think.