What Documents I Need To Open A Bank Account

Time is money! Opening a bank account requires specific documents, and being unprepared can lead to frustrating delays.

This guide provides a concise overview of the essential documents needed to streamline the account opening process, ensuring you’re ready when you visit the bank.

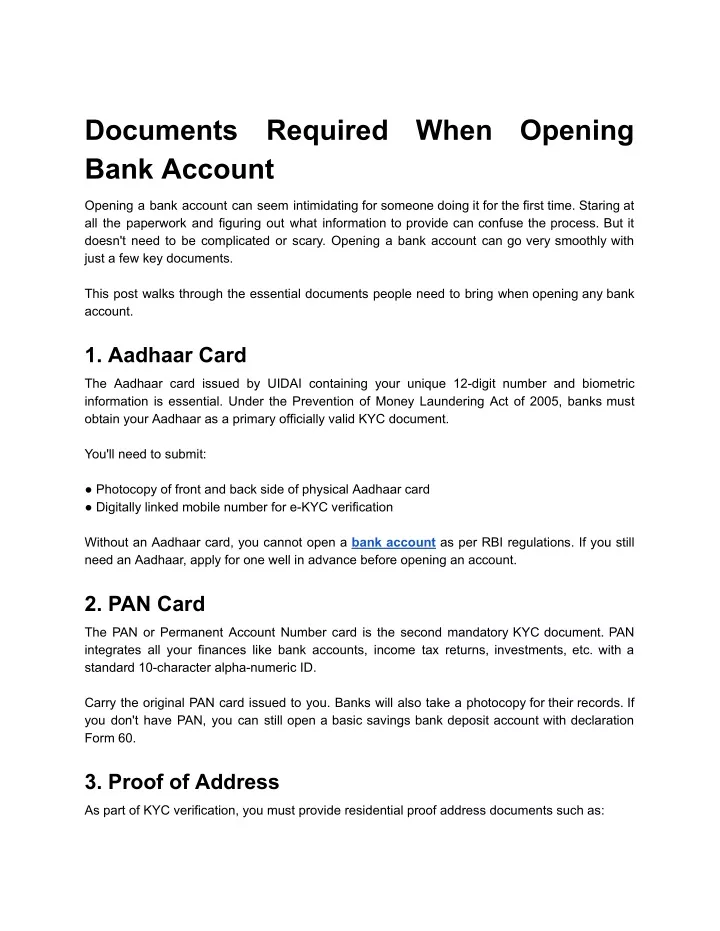

Identification Requirements

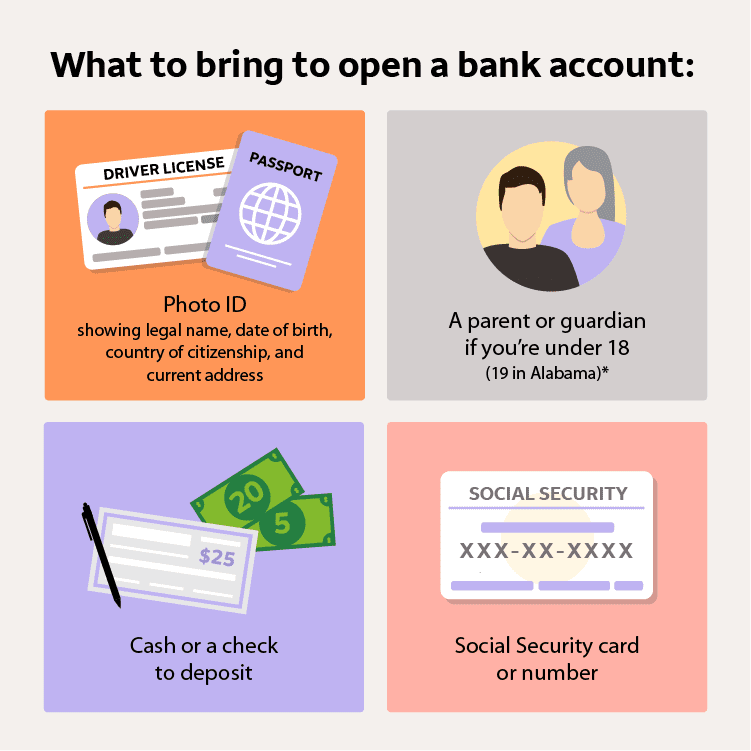

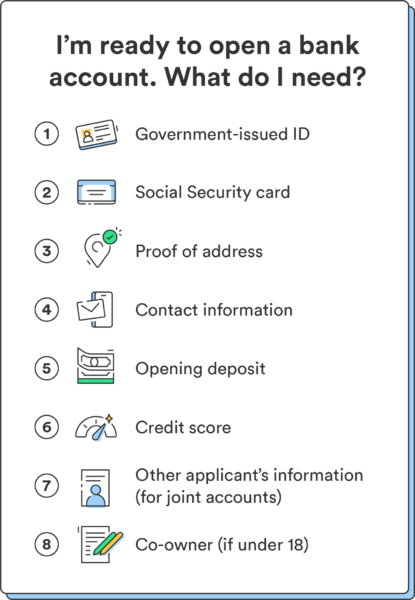

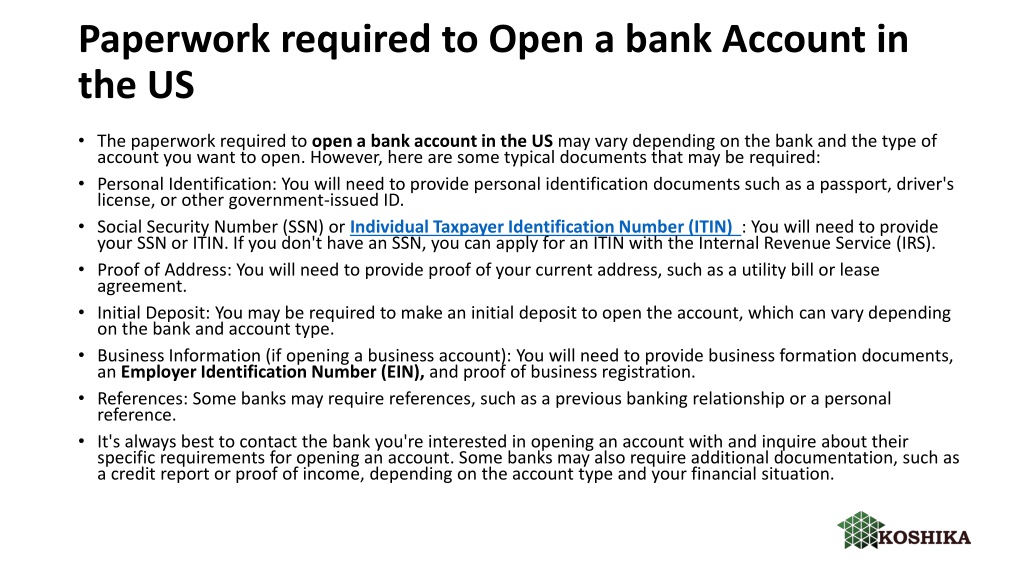

The primary document required is a valid, government-issued photo ID. This verifies your identity and is a non-negotiable step.

Acceptable forms typically include a driver's license, state-issued identification card, or a passport. Make sure your ID is current and hasn't expired!

Some banks may accept a military ID or a permanent resident card (Green Card) as valid identification.

Proof of Address

Banks need to confirm your current residential address. A recent utility bill is often the most straightforward proof.

This could be a water bill, electricity bill, or gas bill issued within the last few months. Ensure the bill is in your name and matches the address you provide on the application.

Alternatively, a bank statement or a lease agreement showing your name and address can serve as proof. Some banks might also accept an official government document, such as a property tax bill.

Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

Providing your Social Security Number (SSN) is typically required for U.S. citizens and permanent residents. This is used for tax reporting purposes.

Non-residents may need to provide an Individual Taxpayer Identification Number (ITIN). The bank needs either one of them.

Having your Social Security card handy can expedite the process, though most banks only need the number itself.

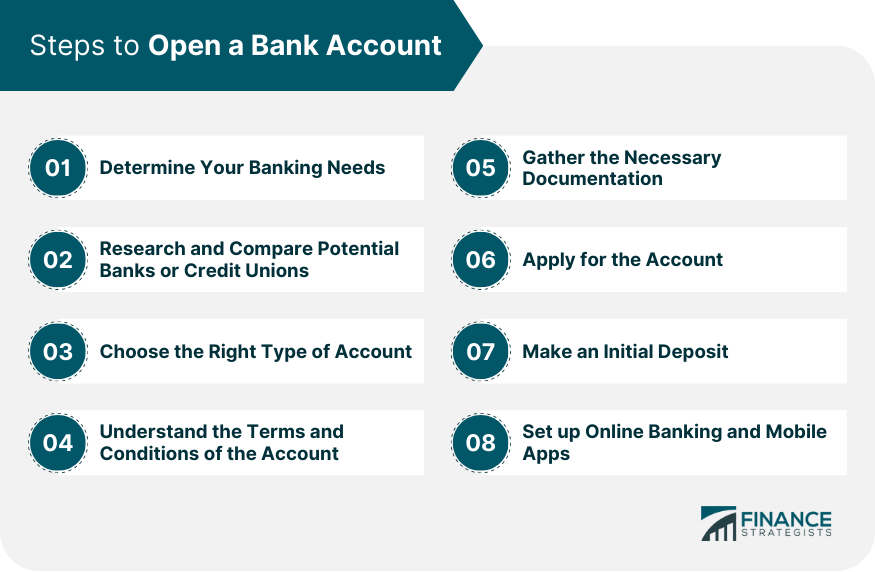

Opening Deposit

Almost all banks require an initial deposit to activate your new account. The amount varies depending on the bank and the account type.

Be prepared to deposit cash, a check, or make an electronic transfer from another account. Check the minimum deposit requirement beforehand.

Some banks offer accounts with no minimum deposit requirement, but these might come with other restrictions.

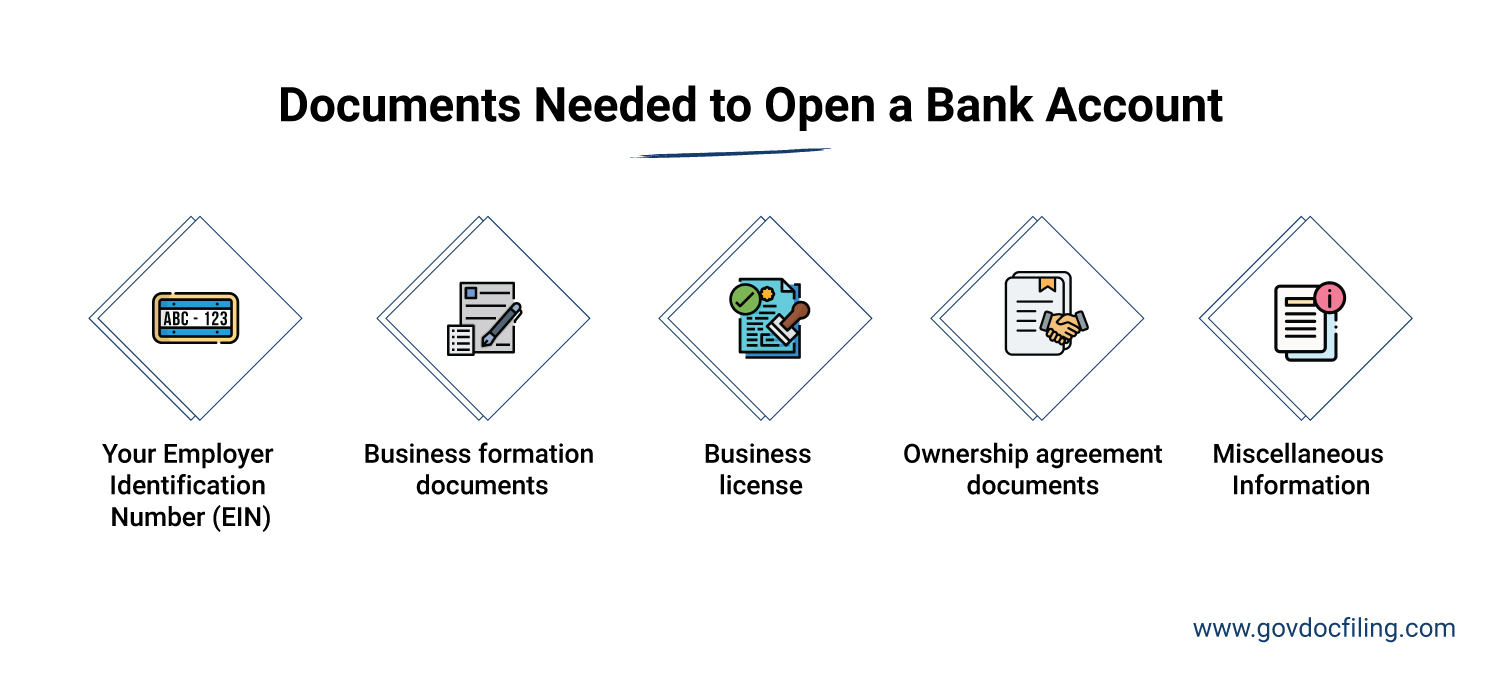

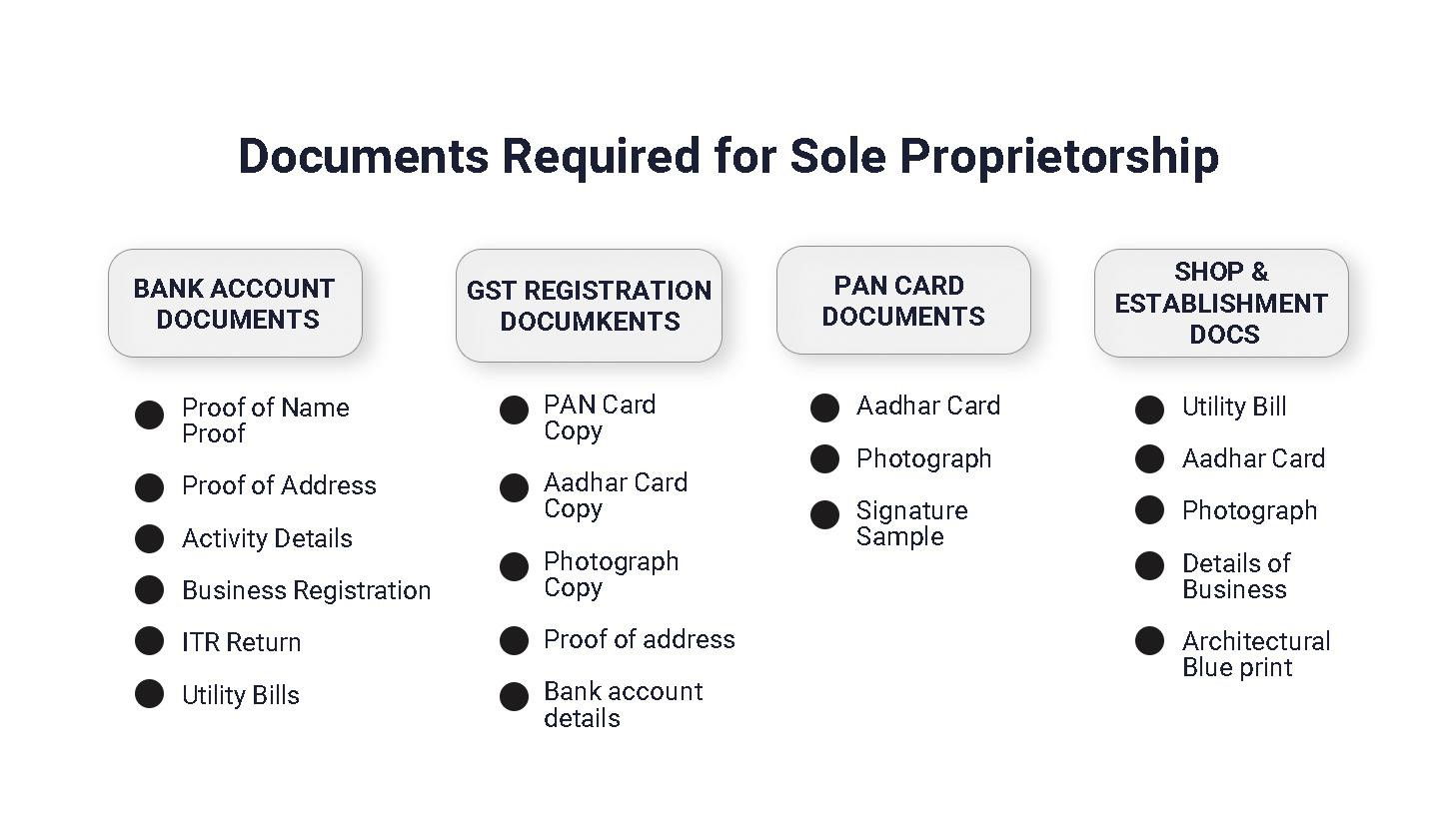

Additional Documents (Potentially Required)

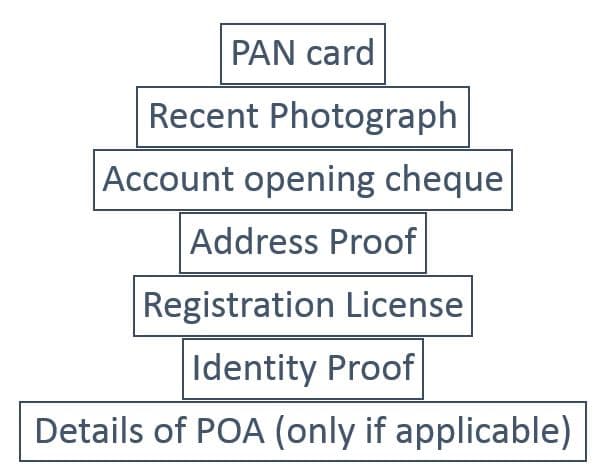

Depending on the bank and the type of account you're opening, you might need additional documentation. This is more common for business accounts.

For example, if you're opening a business account, you'll likely need your Employer Identification Number (EIN). Also bring your business license or articles of incorporation.

Students might need a student ID or proof of enrollment for student-specific accounts.

International Customers

If you are not a U.S. citizen or resident, the requirements may differ slightly. Banks often require a passport and visa.

You may also need to provide proof of residency in the United States, even if temporary. Some banks require an ITIN regardless of your residency status.

Contact the bank directly to confirm the specific documents needed for international customers to avoid delays.

Next Steps

Before heading to the bank, call ahead or check their website for a complete list of required documents. This will save you time and prevent unnecessary trips.

Gather all your documents in advance and ensure they are current and valid. Being prepared is key to a smooth account opening experience.

Don't delay! Start gathering your documents today.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)