Can I Check My Credit Score On Turbotax

In an era defined by financial vigilance, understanding one's credit score is paramount. For millions of Americans, tax season is not just about filing returns but also an opportune moment to assess their financial health. A common question arises: Can TurboTax, the popular tax preparation software, be leveraged to check your credit score?

This article delves into the capabilities of TurboTax regarding credit score access, exploring what the software offers, how it compares to other credit monitoring services, and the implications for consumers seeking to stay on top of their financial standing. Understanding the nuances of these services is crucial for informed financial decision-making.

TurboTax and Credit Score Access: What's Offered?

TurboTax does offer credit score monitoring services, but it's essential to understand the specific offerings and associated limitations. The service is typically offered as part of a premium package or as an add-on feature during the tax preparation process. It's not a standard feature included with all versions of the software.

Typically, TurboTax partners with a credit bureau, like TransUnion, to provide users with access to their credit score and credit report summary. This allows users to see a snapshot of their creditworthiness without significantly impacting their score.

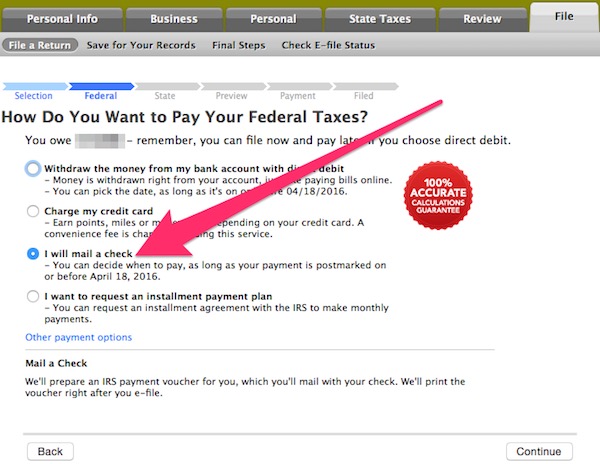

How It Works

The process is relatively straightforward. Users who opt-in to the credit monitoring service within TurboTax will be prompted to verify their identity to ensure secure access to their credit information.

Once verified, they can typically view their TransUnion VantageScore and a brief summary of their credit report directly within the TurboTax interface. Some versions may offer ongoing credit monitoring with alerts for significant changes.

Comparing TurboTax's Offering to Dedicated Credit Monitoring Services

While TurboTax provides a convenient way to access your credit score during tax season, it's not a replacement for dedicated credit monitoring services. These services often offer more comprehensive features and deeper insights into your credit profile.

Dedicated services typically provide access to credit reports from all three major credit bureaus: Equifax, Experian, and TransUnion. They offer more detailed reports, more frequent updates, and tools for disputing errors.

Additionally, many dedicated services offer identity theft protection, dark web monitoring, and fraud alerts, features that are generally not included in TurboTax's basic credit score service.

The Value Proposition: Convenience vs. Comprehensive Monitoring

The primary advantage of using TurboTax to check your credit score is convenience. It allows users to seamlessly integrate credit monitoring into their tax preparation routine.

For users who are already using TurboTax and are curious about their credit score, opting into the service can be a quick and easy way to get a general sense of their creditworthiness. However, it's crucial to consider whether the convenience outweighs the limitations of the service compared to more comprehensive options.

For individuals actively working to improve their credit or those concerned about identity theft, a dedicated credit monitoring service is often a better choice. These services provide more in-depth information, proactive alerts, and robust protection against fraud.

Potential Benefits and Drawbacks

Benefits of using TurboTax for credit score access include ease of use, integration with tax preparation, and the ability to get a quick snapshot of your credit health. Drawbacks include limited scope (typically only one credit bureau), lack of comprehensive features, and potential costs associated with premium packages or add-on services.

Users should carefully weigh these benefits and drawbacks before deciding whether to use TurboTax for credit monitoring. Consider your individual financial needs and priorities when making this decision.

Looking Ahead: The Future of Integrated Financial Services

The trend of integrating financial services into platforms like TurboTax is likely to continue. As consumers seek more convenient ways to manage their finances, we can expect to see more tax preparation software and other financial tools offering bundled services.

However, it's crucial for consumers to remain vigilant and to carefully evaluate the offerings of these integrated services. Understanding the scope of coverage, associated costs, and limitations is essential for making informed decisions and protecting your financial well-being.

Ultimately, whether TurboTax is the right choice for checking your credit score depends on your individual needs and preferences. By understanding the available options and considering your financial goals, you can make the best decision for your unique situation.

.png?sfvrsn=13320ccf_2)