Can I Deposit Cash To Someone Else's Account

The ability to deposit cash into someone else's bank account is a common need, yet the process isn't always straightforward. Varying bank policies, identification requirements, and potential security concerns can create confusion for both depositors and recipients. Understanding these nuances is crucial for anyone looking to facilitate this type of transaction.

Navigating the world of banking regulations can feel daunting, particularly when dealing with cash deposits. This article explores the various methods for depositing cash into another person's account, the identification required, and the potential challenges involved. It aims to provide a comprehensive overview, ensuring individuals are informed and prepared before attempting such a transaction.

Methods for Depositing Cash

Several avenues exist for depositing cash into someone else's bank account. The most common method is directly at a bank branch.

Visiting a branch of the recipient's bank usually allows for a relatively seamless transaction. You'll generally need the recipient's account number and the bank's routing number. In some instances, the full name of the account holder might be required.

Another option is utilizing a deposit slip at the bank. These slips require the account number and often the account holder's name.

Some banks offer ATM deposits for accounts within the same institution. However, this method is less common for depositing into accounts belonging to different individuals, particularly if the depositor doesn't have an account with that bank.

Identification and Security Concerns

Identification is a critical aspect of depositing cash into another person's account. Banks are mandated to comply with "Know Your Customer" (KYC) regulations under the Bank Secrecy Act.

According to the Financial Crimes Enforcement Network (FinCEN), these regulations are designed to prevent money laundering and other illicit activities. Banks are required to verify the identity of individuals conducting transactions, especially those involving significant amounts of cash.

Typically, expect to present a valid government-issued photo ID, such as a driver's license or passport. The teller may ask for your name, address, and potentially your social security number, especially for larger deposits.

Banks are wary of large, anonymous cash deposits. Suspicious Activity Reports (SARs) are often filed for transactions that raise red flags. This is to prevent criminal activity such as money laundering.

Bank-Specific Policies

Each bank has its own specific policies regarding third-party cash deposits. It is always best to check with the bank directly.

Some banks may have stricter requirements than others. Wells Fargo, for example, may have slightly different procedures than Chase. It's always a good idea to call the bank or check their website before heading to a branch.

Credit unions, while similar to banks, may have differing policies. Membership requirements could affect the ability to deposit cash into a member's account if you aren't a member yourself.

Potential Challenges and Alternatives

Challenges can arise when depositing cash into someone else's account. One issue is distance from the recipient's bank.

If the recipient banks with a small, regional institution, finding a branch to make a deposit might be difficult. This is especially true when you are not near the bank.

Another challenge is the risk of fraud. Sending cash can leave you open to being scammed.

Alternatives to cash deposits exist. Mobile payment apps like Venmo or Zelle provide a convenient way to transfer funds electronically. However, these typically require both parties to have accounts with the service.

Money transfer services like Western Union or MoneyGram are another option. While they often involve fees, they can be a reliable way to send money, especially internationally.

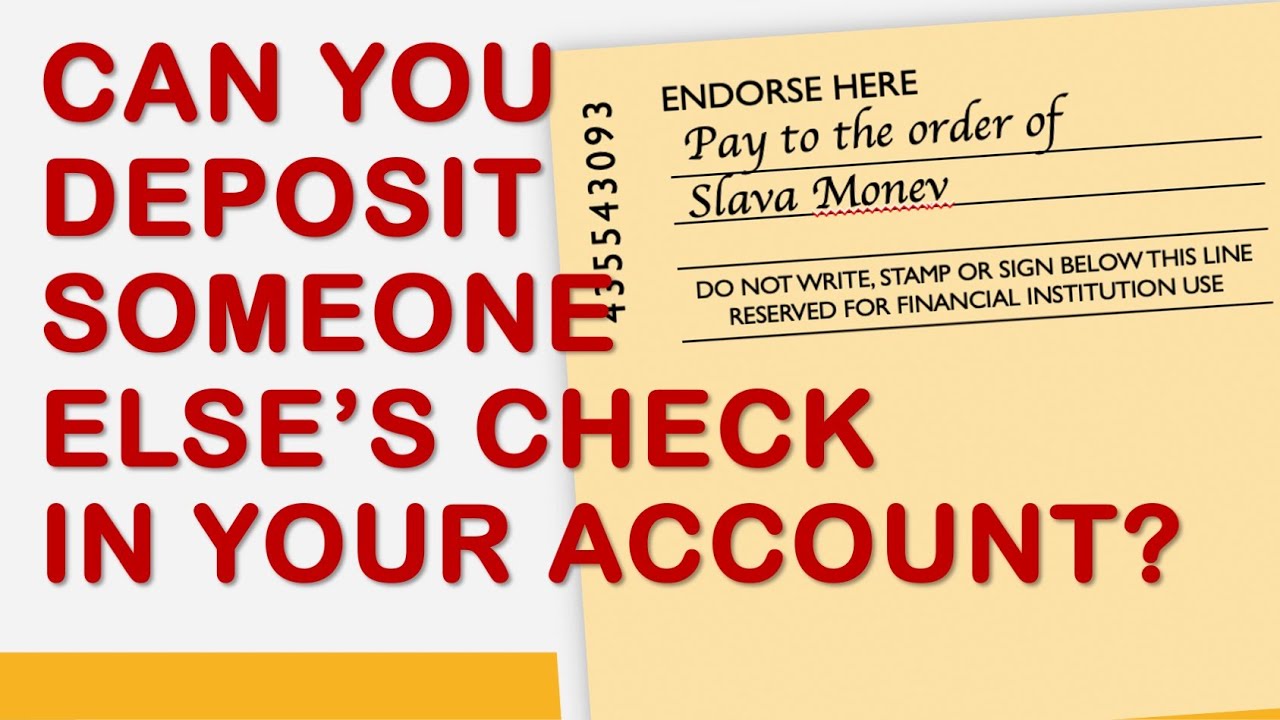

For scenarios where a physical check is feasible, consider writing a check instead. It provides a paper trail and added security compared to cash.

Conclusion

Depositing cash into someone else's account is feasible, but it requires careful attention to bank policies and identification requirements. Always prioritize security and be aware of potential red flags that could trigger scrutiny from the bank.

Understanding these procedures is vital for conducting smooth and compliant transactions. When in doubt, contacting the recipient's bank directly will provide the most accurate and up-to-date information.

By following these guidelines, individuals can confidently navigate the process of depositing cash into another person's account. Always ensure you're informed about the bank's specific requirements, for a successful and secure transaction.