Can I File Multiple Years With Turbotax

Tax season can be stressful, especially when dealing with past-due filings. Many taxpayers wonder if they can use popular software like TurboTax to catch up on multiple years of unfiled returns.

The answer is a bit nuanced, depending on the specific year and TurboTax version, but generally, you cannot file multiple past years directly through the software in one go.

The Limitations of Filing Multiple Years with TurboTax

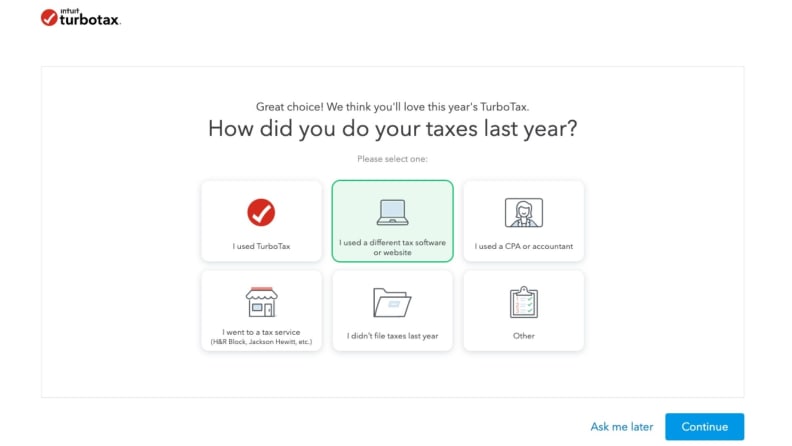

While TurboTax is user-friendly for current year filings, its primary function is to guide users through the process for the most recent tax year. This article explores the intricacies of filing past-due returns using TurboTax.

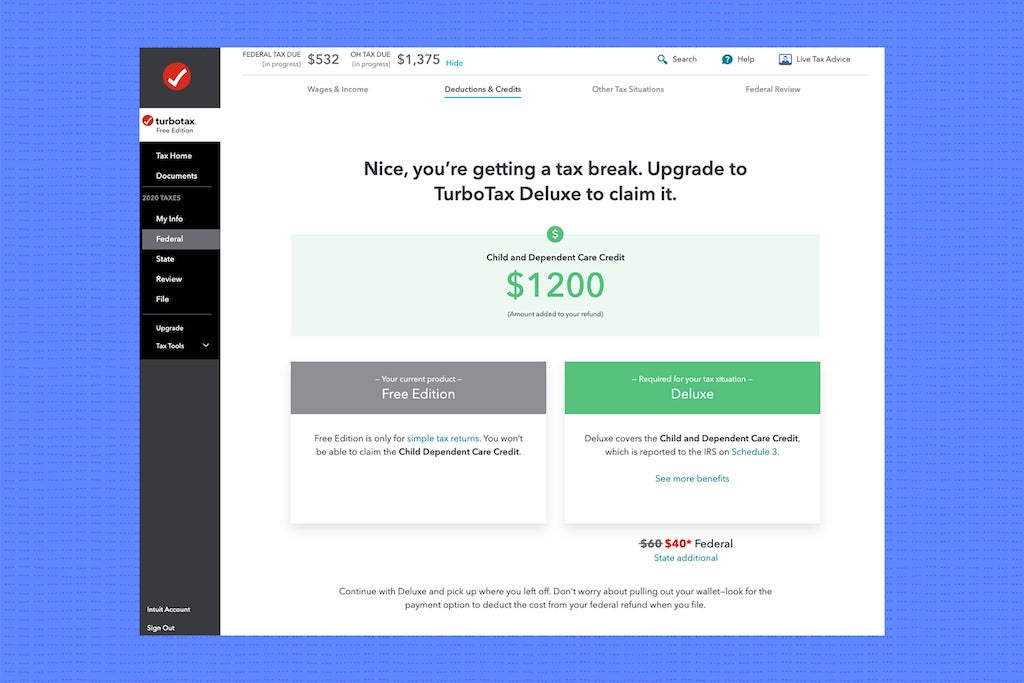

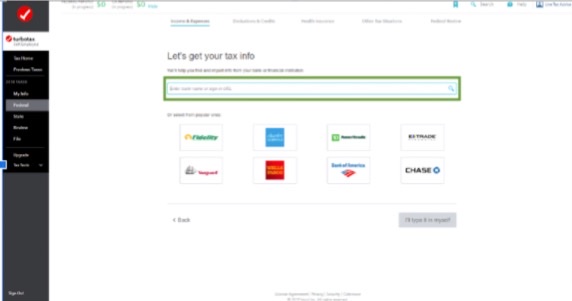

Here's the breakdown: TurboTax typically only supports filing the current tax year electronically. According to the TurboTax website and official documentation, past years' versions of the software are often available for download, but electronic filing is usually disabled after a certain date (typically around mid-October of the filing year).

Why the Restrictions?

The IRS (Internal Revenue Service) updates its systems annually. E-filing specifications change to reflect new tax laws, forms, and security protocols.

Consequently, older versions of TurboTax become incompatible with the current IRS e-filing system. This incompatibility makes it necessary to file prior year returns via mail using physical forms.

Intuit, the maker of TurboTax, emphasizes that downloading previous versions of the software is mainly for preparing the returns; filing them requires printing and mailing to the appropriate IRS address.

How to File Prior Year Returns

If you need to file returns for previous years, here’s the process:

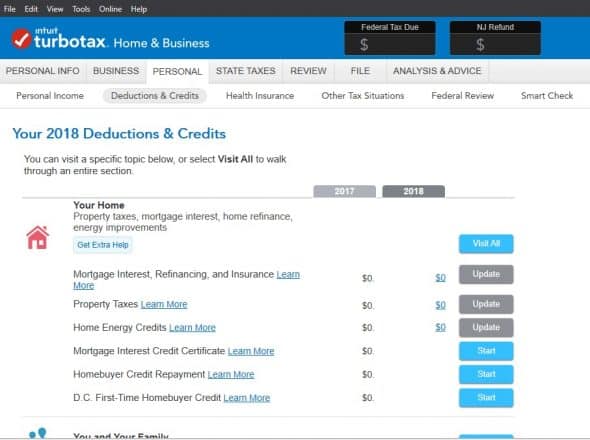

1. Obtain the Correct Forms: Visit the IRS website (irs.gov) to download the tax forms and instructions for each specific year you need to file. Ensure you download the forms applicable to that particular tax year.

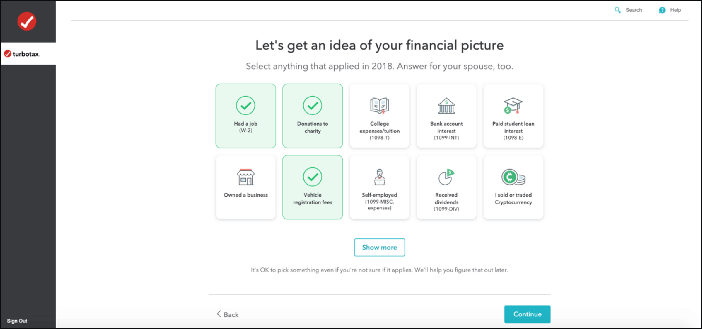

2. Prepare the Returns: You can use prior year versions of TurboTax to help you prepare the returns. However, remember that you'll need to manually enter the data and print the completed forms.

3. Mail the Returns: Consult the IRS instructions to determine the correct mailing address for the tax year and the state you lived in during that year. Mail each return separately with the necessary supporting documentation (e.g., W-2s, 1099s).

4. Payment Options: If you owe taxes, you can pay online through the IRS website, by mail (check or money order), or through the Electronic Federal Tax Payment System (EFTPS).

Potential Impact and Considerations

Filing back taxes can have several implications. The IRS can assess penalties and interest on unpaid taxes, so it's crucial to file as soon as possible to minimize these charges.

Additionally, delaying tax filings could impact your eligibility for certain credits or refunds. There's a statute of limitations on claiming refunds, typically three years from the date the return was originally due.

Consider consulting with a qualified tax professional for personalized guidance, particularly if you have complex tax situations or if you are unsure about how to handle prior year filings.

The Bottom Line: While TurboTax is a valuable tool for filing current year taxes, it is not designed for electronically submitting multiple prior year returns. Taxpayers needing to file past-due returns must obtain the necessary forms, prepare them (potentially using past year software versions), and mail them to the IRS. Prompt action is essential to minimize penalties and interest, and professional advice can be beneficial in navigating complex situations.