What Are The Best Stocks To Purchase Right Now

Navigating the stock market can feel like charting a course through turbulent waters, especially with ongoing economic uncertainties. Investors are constantly searching for opportunities that offer both stability and growth potential. But where should you put your money now?

This article aims to provide a balanced overview of sectors and specific stocks that financial analysts currently view as promising. It's crucial to remember that investing always involves risk, and past performance is not indicative of future results. Diversification and consultation with a qualified financial advisor are always recommended.

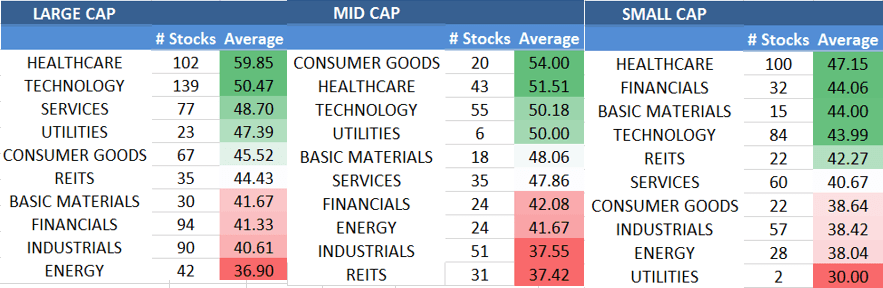

Understanding the Current Market Landscape

The current economic climate is characterized by a mix of factors, including inflation, interest rate hikes, and geopolitical instability. These elements influence investor sentiment and impact the performance of various sectors.

Analysts are closely monitoring these trends to identify areas of potential growth and resilience.

Technology Sector: A Long-Term Play?

The technology sector, while volatile, remains a key area of interest for many investors. Companies driving innovation in areas like artificial intelligence, cloud computing, and cybersecurity are particularly attractive.

Microsoft (MSFT) and Amazon (AMZN) are often cited as examples of established players with significant growth potential due to their dominance in cloud services and diverse revenue streams.

However, smaller, more specialized tech companies also present opportunities, albeit with higher risk.

Healthcare: A Defensive and Growing Sector

The healthcare sector is often considered a defensive play during economic downturns, as demand for healthcare services remains relatively stable.

Companies involved in pharmaceuticals, medical devices, and healthcare services can offer a degree of stability and potential for long-term growth.

Johnson & Johnson (JNJ) and UnitedHealth Group (UNH) are frequently mentioned as strong contenders within this sector.

Energy Sector: Balancing Opportunity and Risk

The energy sector has experienced significant volatility in recent years, driven by geopolitical events and fluctuating demand.

While the sector can offer attractive returns, it is also subject to political and environmental risks.

ExxonMobil (XOM) and Chevron (CVX) are considered major players, but the long-term outlook for fossil fuels remains uncertain. Investing in renewable energy companies may offer a more sustainable long-term approach.

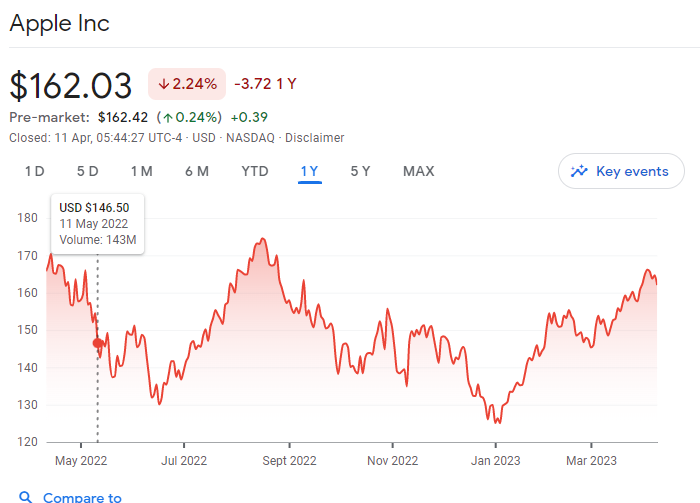

Beyond Sectors: Individual Stock Highlights

Beyond broader sectors, specific companies are often highlighted for their unique growth prospects or strong fundamentals.

Apple (AAPL) continues to impress, with loyal customers. Berkshire Hathaway (BRK.B) is often seen as a safe haven.

However, thorough research is crucial before investing in any individual stock, and considering your own risk tolerance is essential.

"Investing in the stock market requires careful consideration of your financial goals, risk tolerance, and investment timeline." - Financial Planning Association

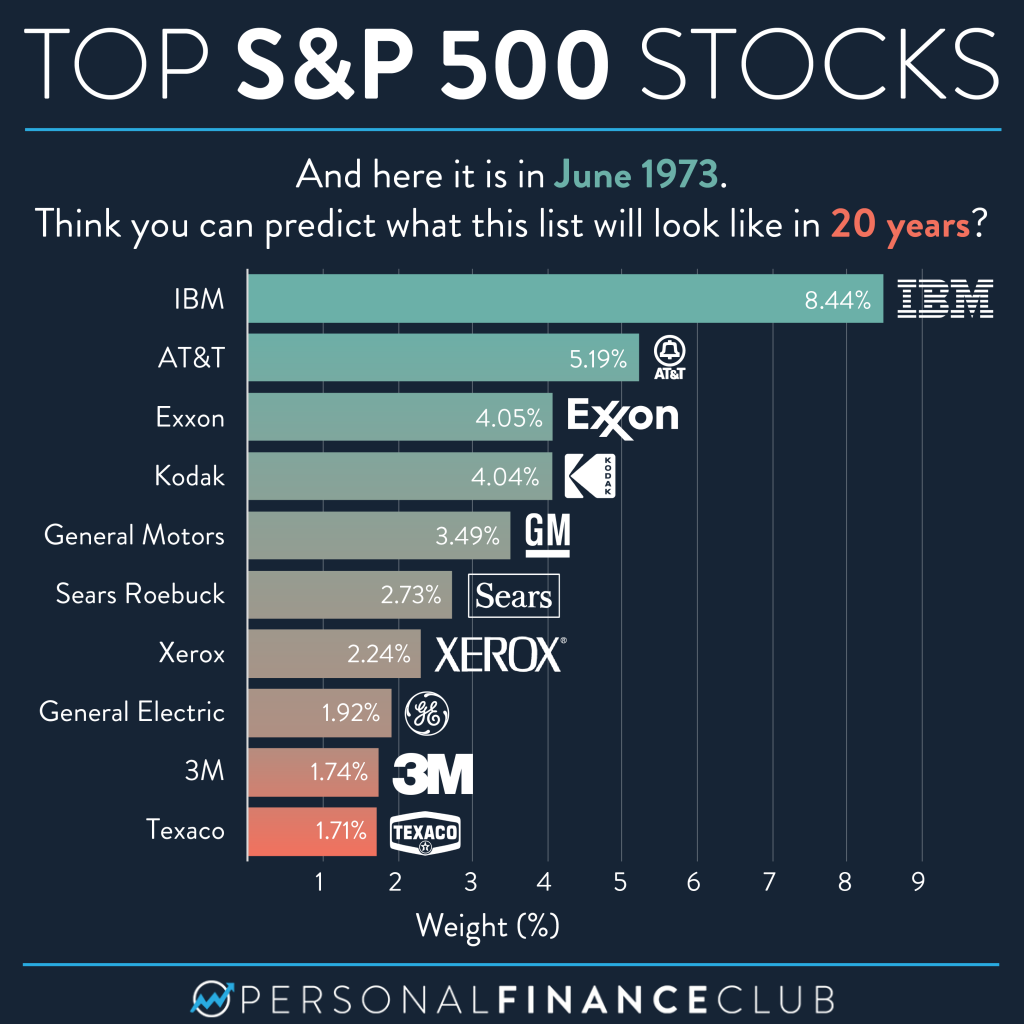

The Importance of Due Diligence and Diversification

Ultimately, there is no single "best" stock to purchase right now. The optimal investment strategy depends on individual circumstances and risk appetite.

Diversification across different sectors and asset classes is essential to mitigate risk. Consider consulting with a qualified financial advisor to develop a personalized investment plan.

Remember that market conditions can change rapidly, and continuous monitoring of your portfolio is crucial. Staying informed and adaptable is key to successful long-term investing.