Can I Invest In Vanguard Through Fidelity

The world of investing can often feel like navigating a complex maze, especially when trying to understand the compatibility of different brokerage platforms. A common question for investors is whether they can access Vanguard funds, known for their low-cost investment options, through a competitor like Fidelity. This seemingly simple question involves understanding brokerage agreements, fund availability, and potential transaction fees, all of which can significantly impact investment returns.

This article will delve into the intricacies of investing in Vanguard funds through Fidelity. We will examine the availability of Vanguard ETFs (Exchange Traded Funds) on the Fidelity platform, the potential limitations on accessing Vanguard mutual funds, and the associated costs investors might encounter. We will also explore alternative strategies for achieving similar investment goals using Fidelity's offerings.

Vanguard ETFs on Fidelity: A Straightforward Path

For investors primarily interested in Vanguard's ETFs, the good news is that these are generally readily available for trading on Fidelity's platform. ETFs are traded like stocks, meaning they can be bought and sold throughout the trading day on major exchanges.

Fidelity, like most major brokerages, allows clients to purchase Vanguard ETFs without commission fees. This makes it a cost-effective way to gain exposure to Vanguard's popular investment strategies without directly using a Vanguard brokerage account.

It's essential to check Fidelity's platform to confirm the availability of specific Vanguard ETFs before investing. While most are available, there might be rare exceptions or temporary restrictions.

Mutual Funds: A More Complex Landscape

The situation becomes more complex when considering Vanguard's mutual funds. Unlike ETFs, mutual funds are typically bought and sold directly through the fund provider or through brokerage platforms that have specific agreements in place.

Generally, Fidelity does not offer the full range of Vanguard mutual funds directly on its platform. This is because Vanguard prefers investors to purchase their mutual funds directly through their own brokerage or through specific partner brokerages.

However, there might be limited exceptions. Fidelity could offer certain Vanguard mutual funds through its brokerage platform, but these are generally subject to transaction fees or other restrictions.

Transaction Fees and Alternatives

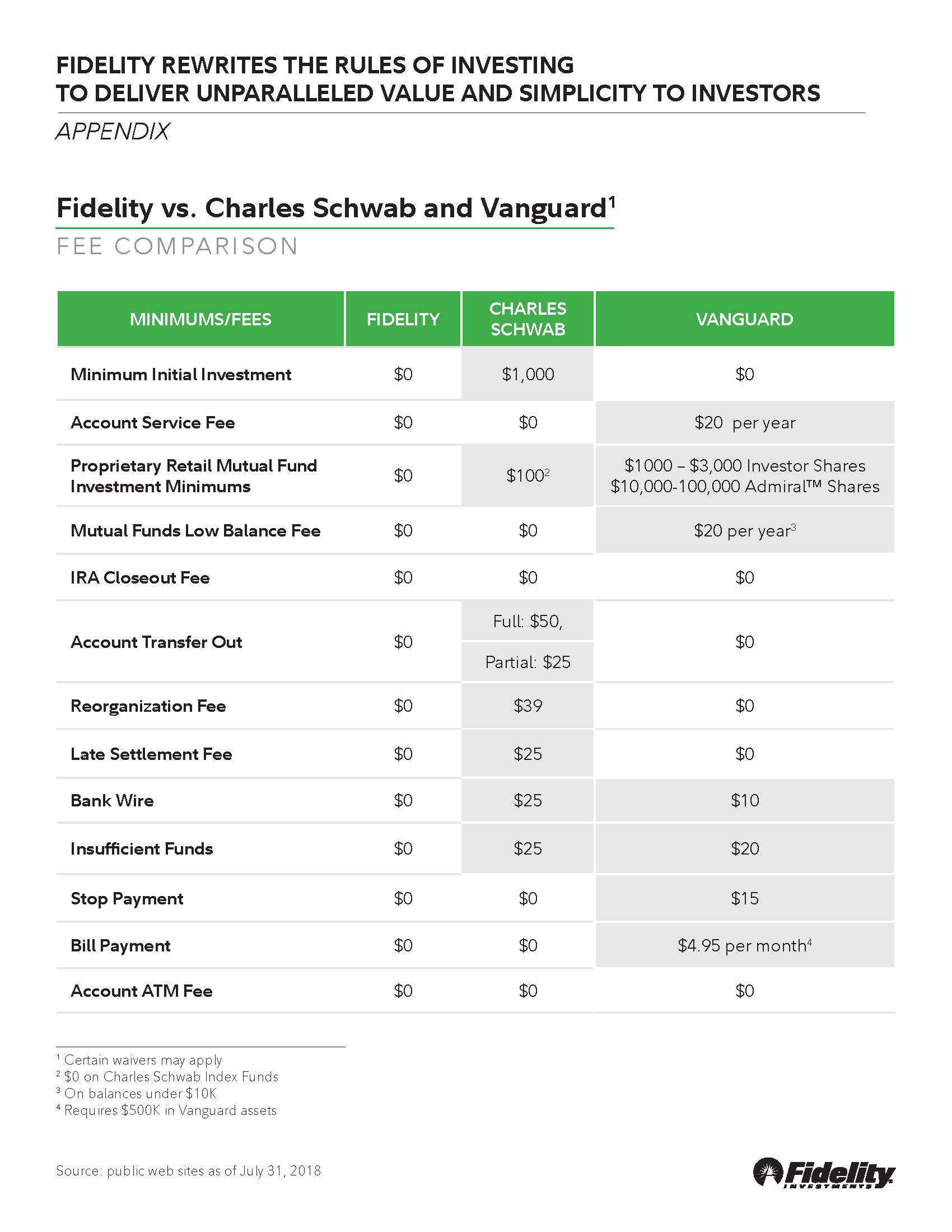

When Vanguard mutual funds are available on Fidelity, they often come with transaction fees. These fees can significantly eat into investment returns, especially for smaller investments or frequent trades.

Investors should carefully weigh the cost of these fees against the benefits of holding a specific Vanguard mutual fund within their Fidelity account. In many cases, alternative options within Fidelity's own fund offerings or other ETFs may provide similar investment exposure at a lower cost.

Fidelity offers a wide array of low-cost index funds and ETFs that can serve as substitutes for Vanguard mutual funds. Many of these funds track similar market indexes, providing comparable returns with the added benefit of commission-free trading on the Fidelity platform.

Weighing Your Options: Direct vs. Indirect Investment

The decision of whether to invest directly through Vanguard or indirectly through Fidelity depends on individual investment preferences and needs. If an investor primarily wants access to Vanguard mutual funds, opening an account directly with Vanguard might be the most straightforward option.

However, if an investor prefers the convenience of consolidating their investments within a single Fidelity account and is comfortable with ETFs or alternative funds, Fidelity can be a suitable choice. Consider the totality of your holdings.

It's also crucial to consider the overall cost. Compare the transaction fees for accessing Vanguard funds through Fidelity versus the expense ratios of alternative Fidelity funds. A few basis points in expense ratio difference can outweigh other considerations.

"Investors should always prioritize low costs and diversification when making investment decisions," advises a financial advisor from XYZ Financial Planning. "Carefully evaluate the fees and expenses associated with each investment option before committing your capital."

Looking Ahead: The Evolving Brokerage Landscape

The brokerage landscape is constantly evolving, with firms continually adjusting their offerings and pricing structures. While currently, access to Vanguard mutual funds on Fidelity is limited and often comes with fees, this could change in the future.

It's always a good idea to stay informed about the latest developments in the brokerage industry and to periodically re-evaluate your investment strategy. Regularly reviewing your portfolio and comparing the available options can help ensure you're maximizing your returns while minimizing costs.

Ultimately, the best approach is to conduct thorough research, compare your options carefully, and choose the investment strategy that aligns with your individual financial goals and risk tolerance. Whether you invest directly with Vanguard or leverage the offerings of Fidelity, the key is to make informed decisions and stay committed to your long-term investment plan.

/vanguard-vs-fidelity-79ef56a1f0b14abf9b51368e4c5185d0.jpeg)