Can I Use The Sezzle Virtual Card Anywhere

The allure of "buy now, pay later" (BNPL) services like Sezzle has skyrocketed, particularly among younger consumers seeking flexible payment options. But the burning question remains: can the Sezzle virtual card, a key component of its service, truly be used anywhere? The answer, as with many financial technologies, is nuanced and requires careful consideration.

At the heart of the issue lies the distinction between Sezzle's intended functionality and the practical limitations imposed by merchant acceptance, card network agreements, and evolving regulatory landscapes. Understanding these factors is crucial for consumers to make informed decisions about using Sezzle and its virtual card.

Understanding Sezzle's Virtual Card

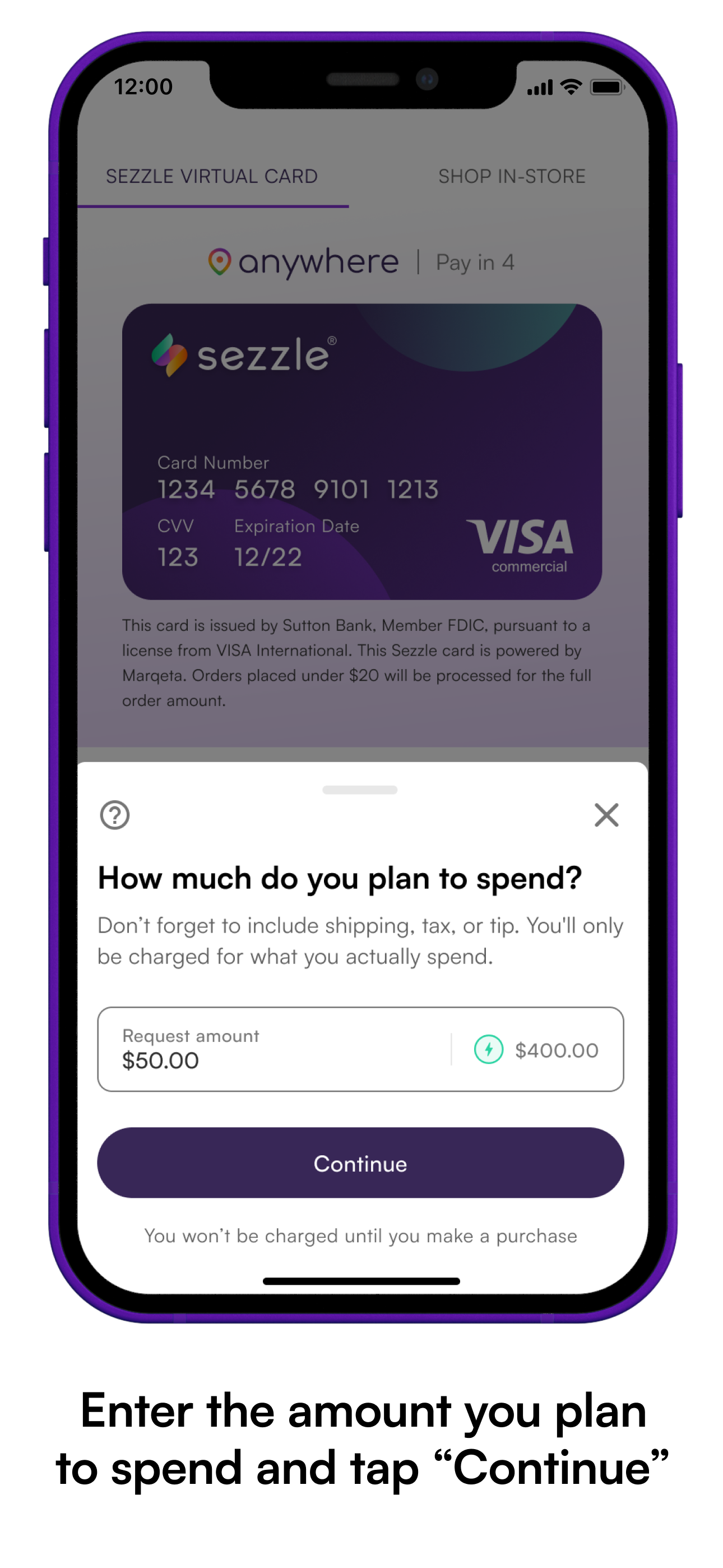

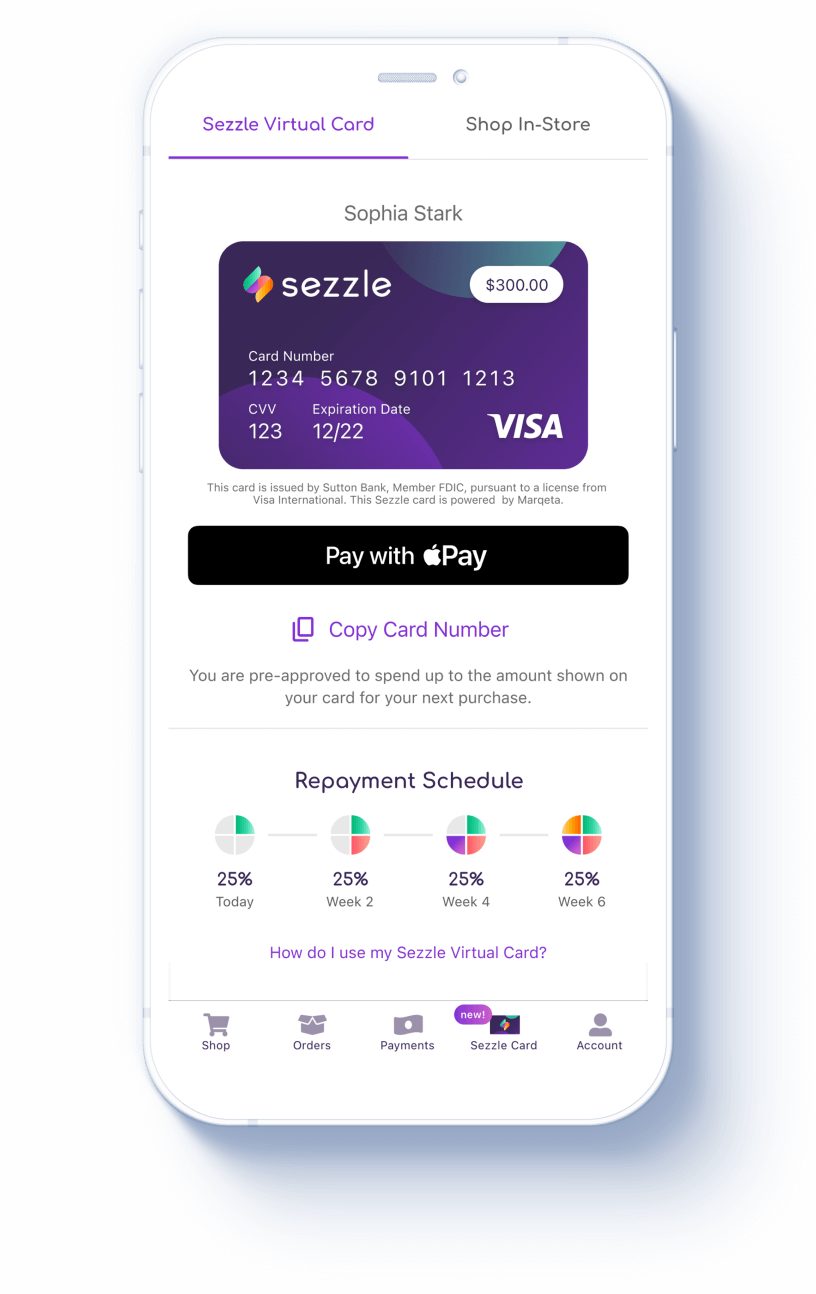

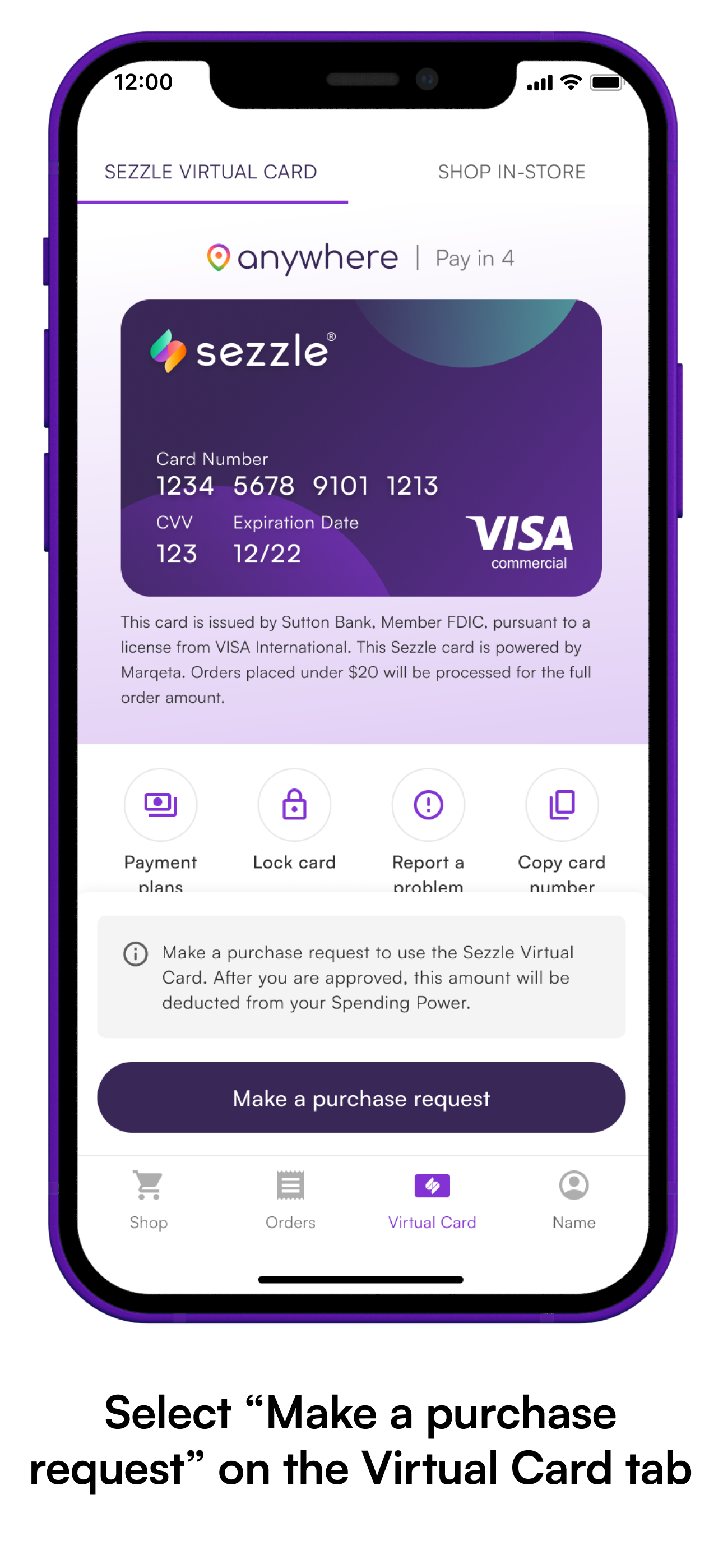

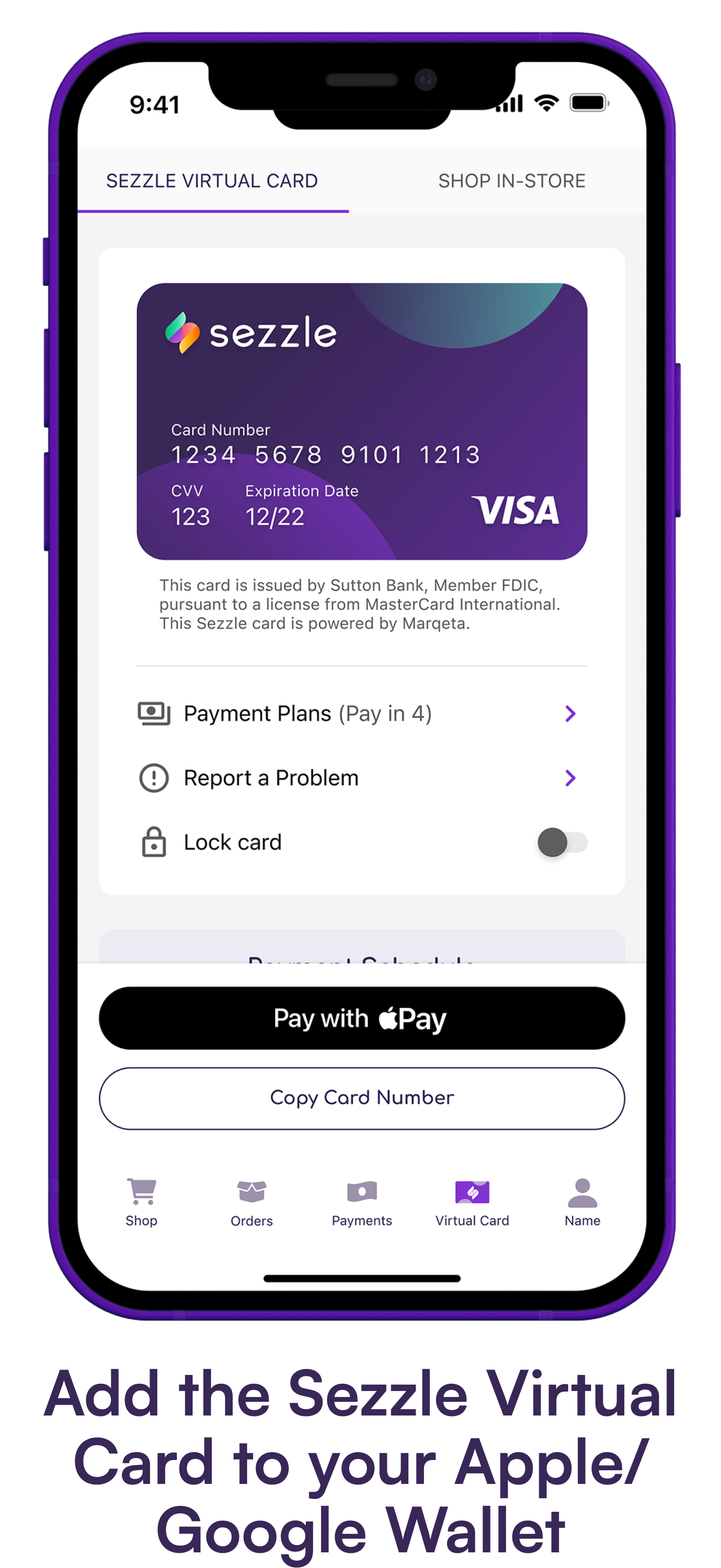

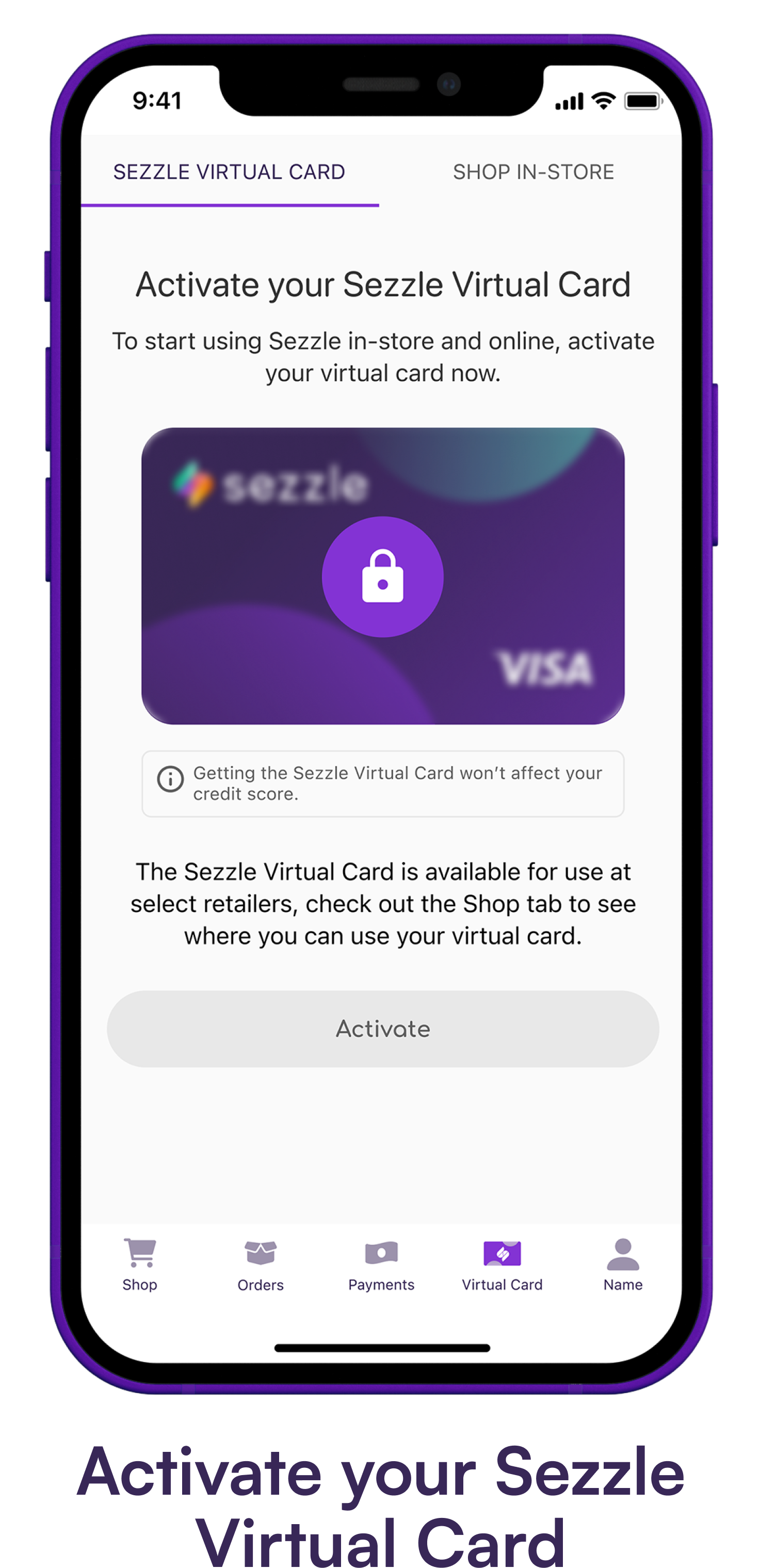

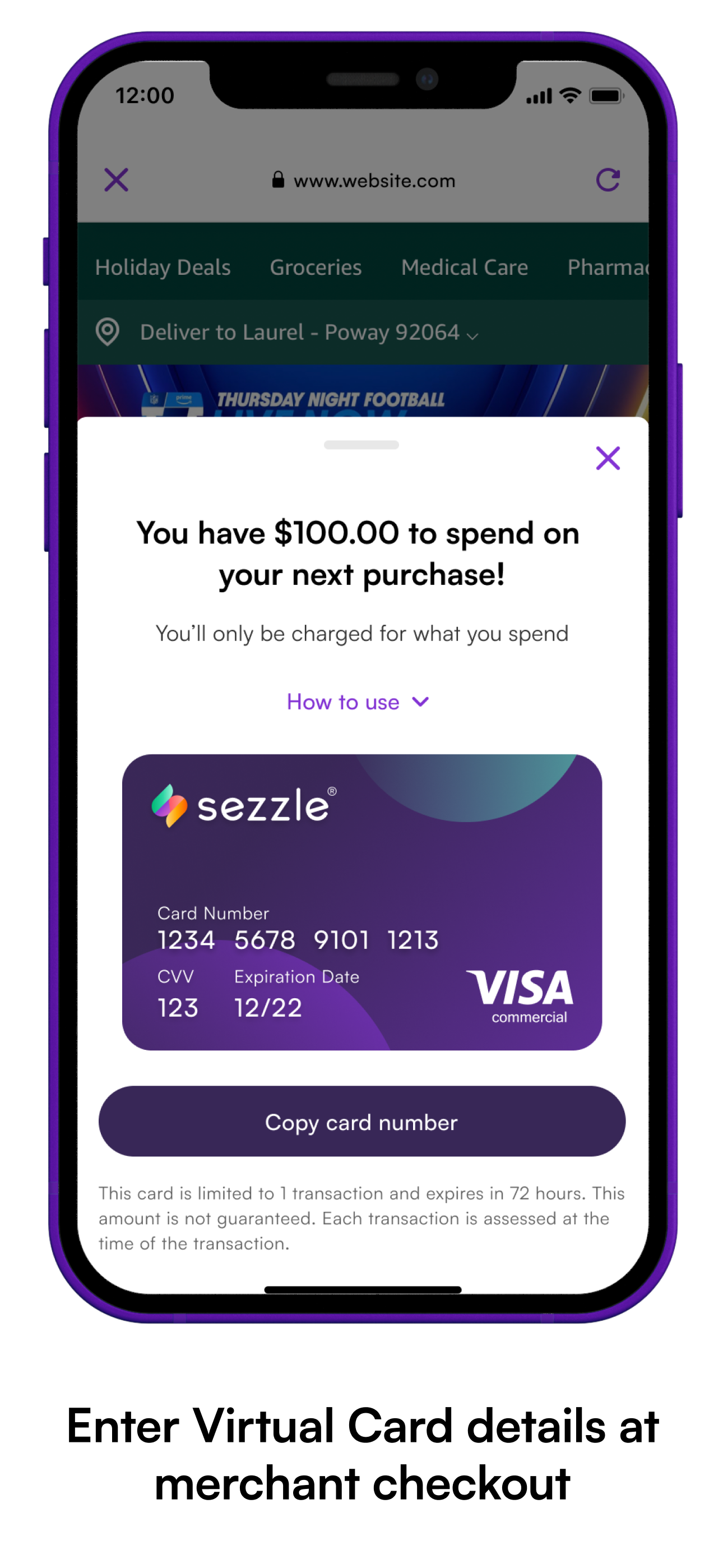

Sezzle operates by splitting purchases into four interest-free installments, offering users a convenient alternative to traditional credit cards. The Sezzle virtual card, generated within the Sezzle app, functions similarly to a regular credit or debit card, allowing users to make online and in-store purchases. However, its usability hinges on merchant participation.

The Ideal Scenario: Widespread Acceptance

Sezzle aims for its virtual card to be accepted anywhere Visa is accepted, aligning with the ubiquitous nature of the Visa network. This vision would allow users to leverage Sezzle's installment payment plan across a vast range of retailers, both online and offline. This is a key selling point for the service, promising flexibility and convenience.

The Reality: Merchant Limitations

Despite Sezzle's aspirations, the reality is that its virtual card is not universally accepted. While theoretically usable anywhere Visa is accepted, several factors can restrict its functionality. Some merchants, for example, may not process "card-not-present" transactions, or they might have internal policies that block the use of virtual cards from BNPL providers.

Furthermore, Sezzle partners with specific merchants, offering a seamless integration within their online stores. These partnerships often provide a more reliable and predictable Sezzle experience. Outside of these partnerships, acceptance can become more unpredictable.

Factors Affecting Sezzle Virtual Card Acceptance

Several variables determine whether a Sezzle virtual card transaction will be successful. Understanding these factors empowers users to anticipate potential issues and plan accordingly.

Merchant Category Codes (MCC)

Merchants are assigned MCCs based on their primary business activity. Sezzle may restrict usage of its virtual card within certain MCCs, potentially due to higher risk of fraud or regulatory concerns. This could include categories like gambling, adult entertainment, or certain financial services.

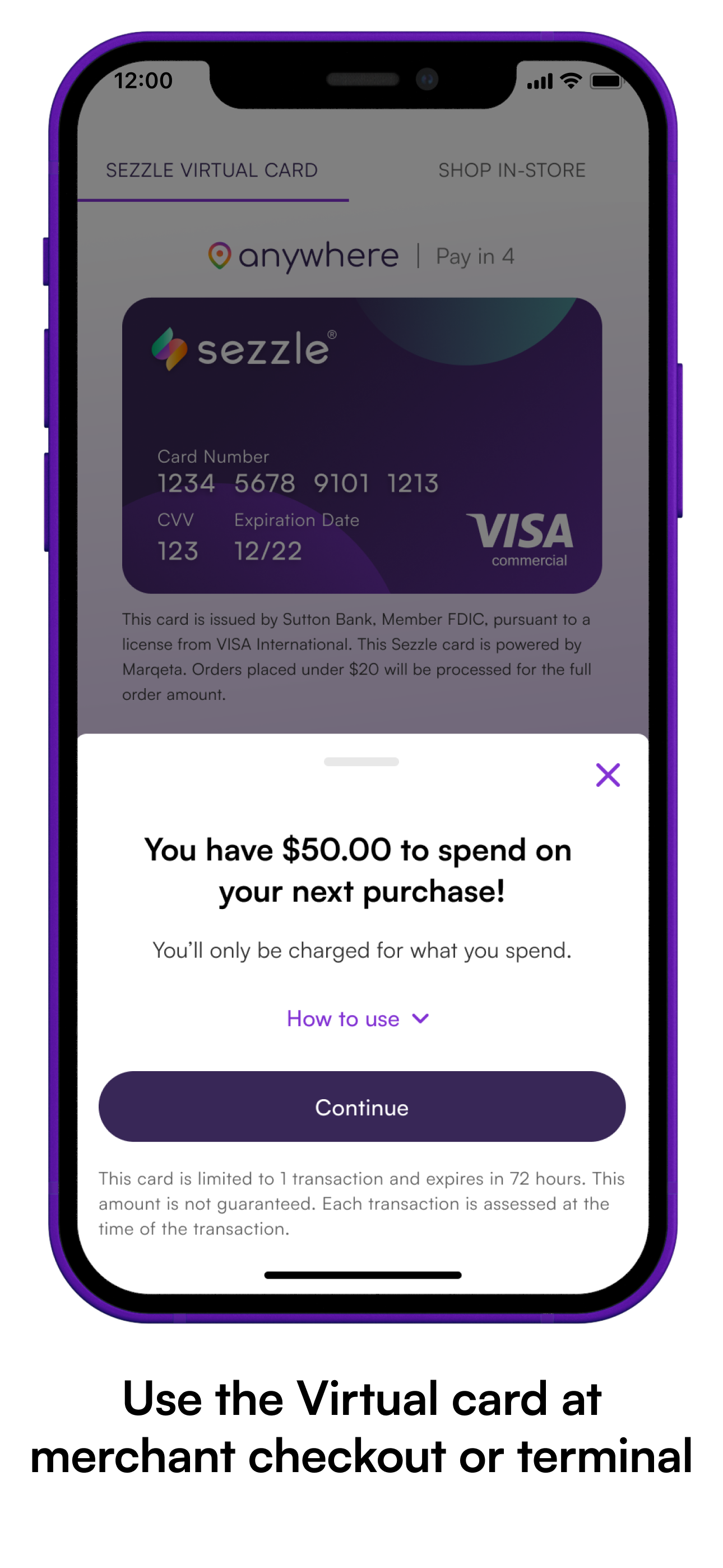

Transaction Size and Limits

Sezzle imposes spending limits on its users, which can vary based on individual creditworthiness and usage history. If a purchase exceeds the user's approved limit, the transaction will be declined, regardless of merchant acceptance. These limits are intended to manage risk and prevent overspending.

Geographic Restrictions

Sezzle's availability and functionality may be limited in certain geographic regions. While expanding its global footprint, Sezzle may not be fully operational or offer the same level of service in all countries. Users should verify availability within their specific location.

Fraud Prevention Measures

Sezzle employs robust fraud detection systems to protect itself and its users from unauthorized transactions. These systems may flag and decline transactions deemed suspicious, even if the merchant technically accepts Visa. Such measures are crucial for maintaining the integrity of the platform.

Alternative Perspectives and Criticisms

While Sezzle promotes its virtual card as a versatile payment tool, some critics argue that its limitations are not always transparently communicated. This can lead to frustration and confusion for users who expect universal acceptance.

"The promise of 'buy now, pay later' can be enticing, but consumers need to be fully aware of the potential drawbacks and limitations," warns Jane Doe, a consumer finance advocate.

Some also raise concerns about the potential for overspending and debt accumulation associated with BNPL services. The ease of making purchases through installment plans can tempt individuals to spend beyond their means.

The Future of BNPL and Virtual Cards

The BNPL industry is rapidly evolving, with increasing competition and regulatory scrutiny. As the market matures, we can expect to see further developments in virtual card technology and usage.

Increased transparency and standardization of merchant acceptance policies are likely to emerge. This would provide greater clarity for consumers regarding where they can and cannot use their virtual cards.

Moreover, regulatory bodies are paying close attention to the BNPL sector, potentially leading to stricter rules and consumer protections. These regulations could impact the features and functionality of virtual cards, ensuring responsible lending practices.

In conclusion, while the Sezzle virtual card strives for widespread acceptance, practical limitations exist. Users should carefully consider merchant policies, spending limits, and potential restrictions before relying on Sezzle as their primary payment method. A thorough understanding of these factors is essential for navigating the complexities of the BNPL landscape and making informed financial decisions.