Can Someone Under 18 Open A Bank Account

Opening a bank account is often seen as a rite of passage, a crucial step toward financial independence and responsibility. But for those under the age of 18, the path isn't always straightforward. Navigating the complexities of banking regulations and institutional policies can leave both teens and parents with a lot of questions.

The core question is: Can a minor open a bank account? While the answer is generally yes, the 'how' and 'under what conditions' are critical factors to consider, making the process multifaceted and requiring careful planning. This article delves into the specifics, exploring the nuances, requirements, and potential benefits and drawbacks associated with minors opening bank accounts.

The Legality and Practicality

In most jurisdictions, individuals under 18, legally classified as minors, cannot enter into binding contracts. This contractual incapacity traditionally posed a barrier to opening bank accounts, which are essentially agreements between the individual and the financial institution.

However, banking regulations and institutional practices have evolved to address this issue, recognizing the importance of early financial literacy. The standard solution is to offer custodial or joint accounts, which provide a framework for minors to participate in banking activities under adult supervision.

Custodial Accounts: A Common Pathway

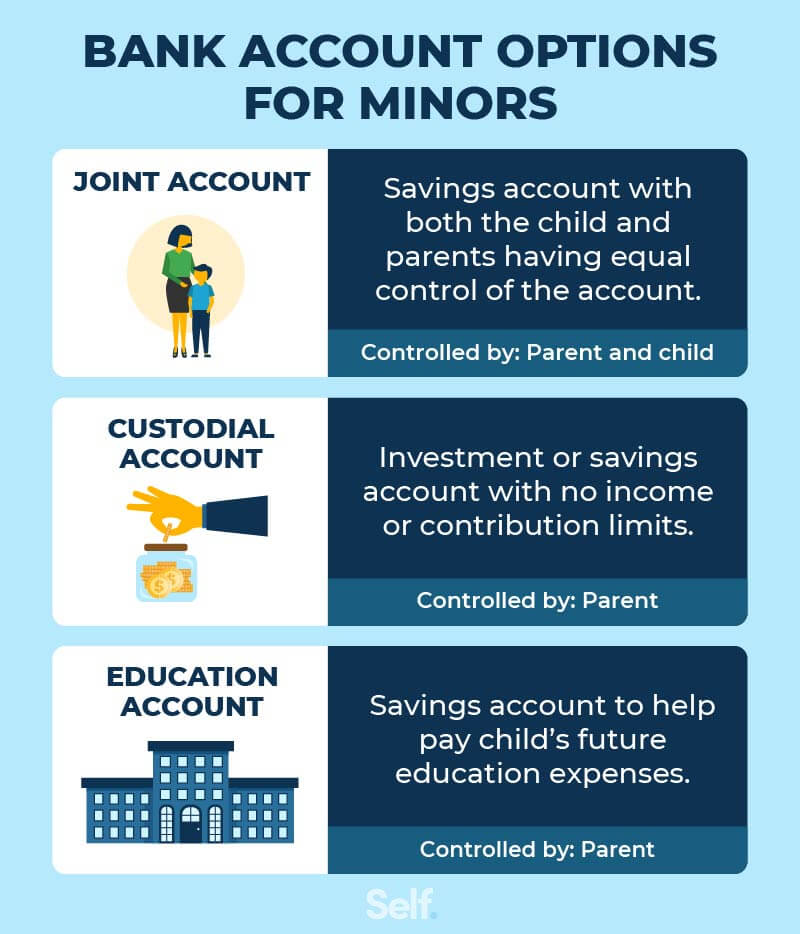

Custodial accounts, often established under the Uniform Transfers to Minors Act (UTMA) or the Uniform Gifts to Minors Act (UGMA), are a common vehicle. These accounts are held in the minor's name but managed by an adult custodian, typically a parent or guardian.

The custodian has the authority to make transactions, manage the funds, and ensure the account is used for the minor's benefit. The American Bankers Association emphasizes the importance of custodians understanding their fiduciary responsibility in managing these accounts.

Upon reaching the age of majority, the assets in the custodial account transfer fully to the individual. This transfer gives the now-adult complete control, and the custodianship ceases.

Joint Accounts: Shared Responsibility

Another option is the joint account, where the minor and an adult are co-owners of the account. Both parties have equal access and control over the funds.

This arrangement allows the minor to gain hands-on experience with managing money while having the safeguard of adult oversight. However, it's crucial that both parties understand their responsibilities and liabilities associated with joint ownership. Fraud and disputes are possible risks.

Requirements and Considerations

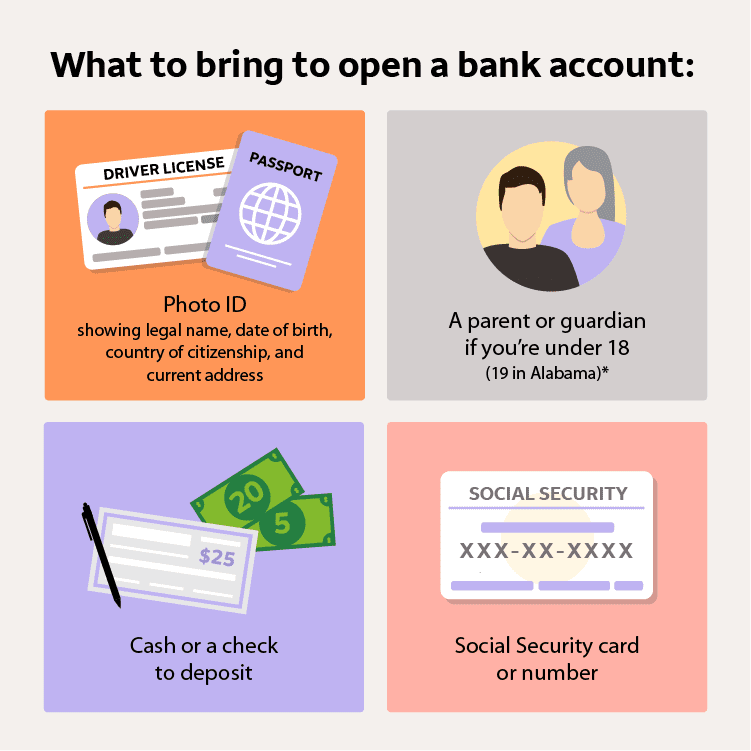

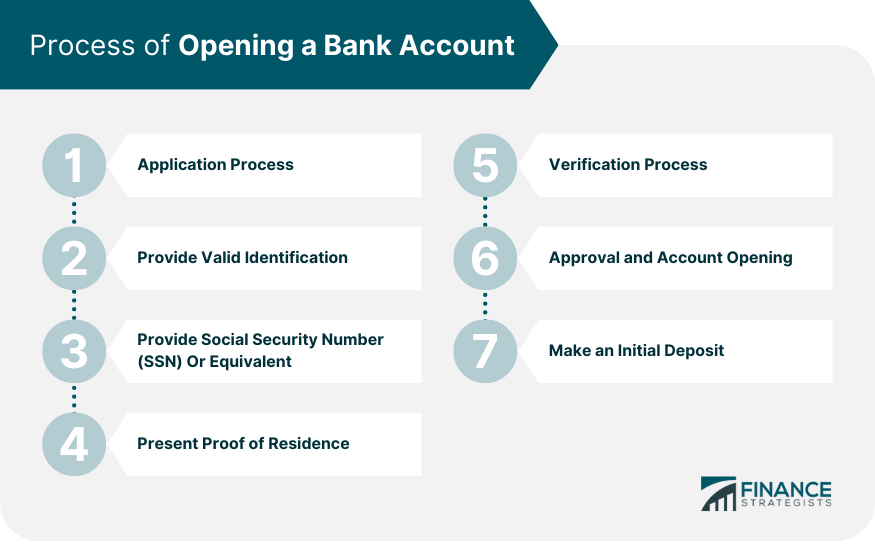

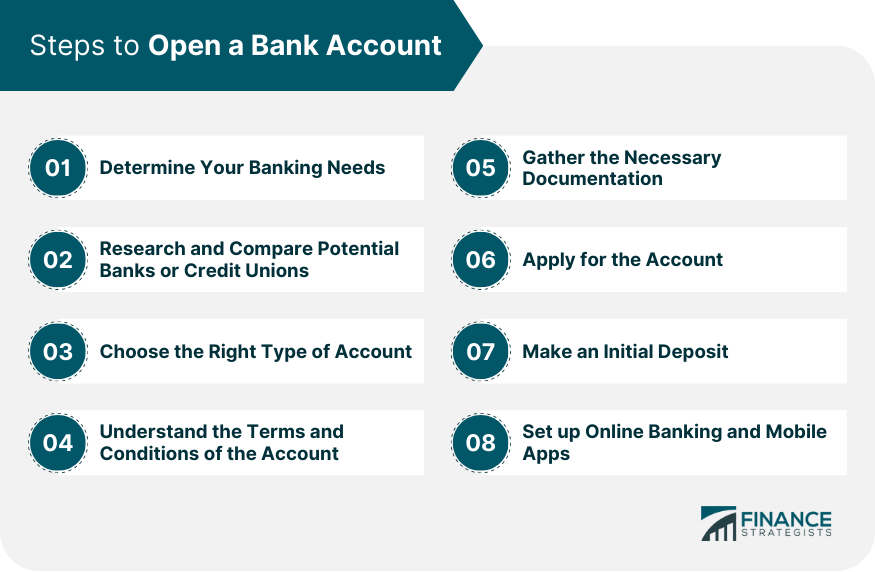

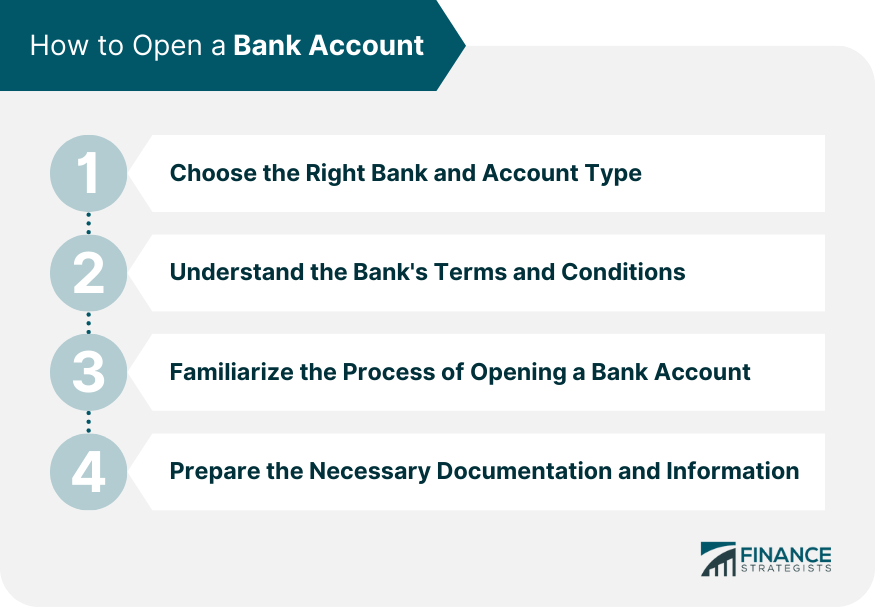

Opening a bank account for a minor typically requires specific documentation and adherence to bank policies. Common requirements include proof of identity for both the minor and the adult custodian or joint owner.

This often entails presenting a birth certificate, social security card, and driver's license or other government-issued photo ID. Banks may also require proof of address and may have specific forms to be completed.

Beyond the paperwork, parents should consider the minor's maturity level and readiness for financial responsibility. Opening a bank account should be viewed as an educational opportunity. It is not simply a matter of convenience.

Benefits and Drawbacks

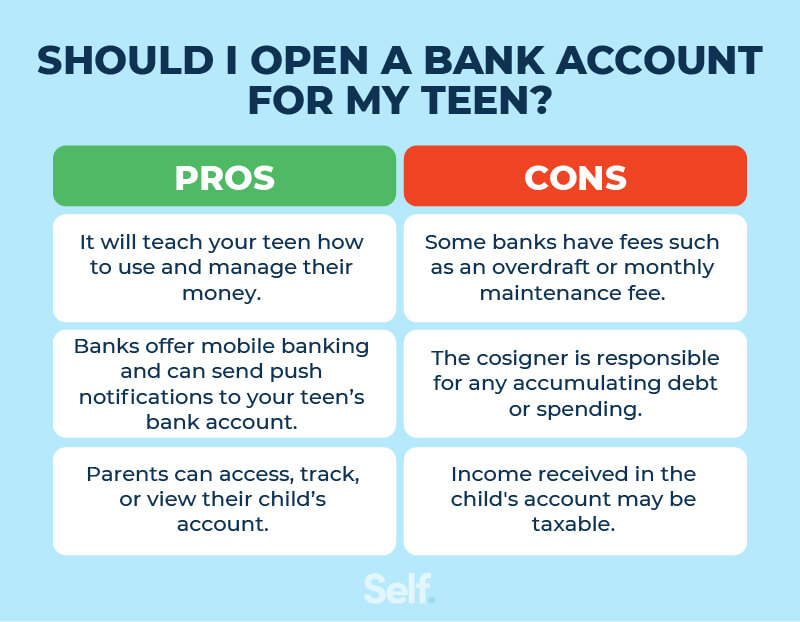

There are several advantages to minors having bank accounts. These include developing financial literacy, learning to save and budget, and understanding the basics of banking services.

Having an account can also facilitate receiving gifts or allowances electronically and managing earnings from part-time jobs. Experian highlights that early exposure to financial concepts can build a solid foundation for future financial success.

On the other hand, there are potential drawbacks. Minors might be susceptible to overspending or mismanaging their funds without proper guidance. Parents need to actively monitor the account and provide ongoing education to mitigate these risks.

Looking Ahead: Financial Literacy Initiatives

The trend towards encouraging financial literacy at a young age is likely to continue. Many banks are partnering with schools and community organizations to offer financial education programs specifically designed for young people.

These initiatives aim to equip minors with the knowledge and skills necessary to make informed financial decisions throughout their lives. The increased emphasis on financial literacy suggests that opening bank accounts for minors will become even more commonplace.

Ultimately, the decision of whether to open a bank account for a minor depends on individual circumstances, maturity levels, and parental involvement. By understanding the regulations, options, and potential benefits and drawbacks, parents can make informed choices that set their children on a path toward financial responsibility.

:max_bytes(150000):strip_icc()/how-can-i-easily-open-bank-accounts-315723-FINAL-3547624de9a648379a90fe38c68a2f7c.jpg)