Can Thinkorswim Do Automated Trading

The dream of fully automated trading, where algorithms execute trades without human intervention, has captivated investors for years. For users of Thinkorswim, TD Ameritrade's (now part of Schwab) popular trading platform, the question remains: can this powerful tool truly be set on autopilot?

This article delves into Thinkorswim's capabilities regarding automated trading, exploring its limitations, and shedding light on the strategies traders employ to achieve varying degrees of automation. We'll examine the tools available within the platform, compliance considerations, and the practical realities of implementing algorithmic trading strategies.

Thinkorswim's Automation Tools: A Closer Look

Thinkorswim provides several tools that can be leveraged for semi-automated trading. However, achieving fully automated, hands-off trading is more complex than it appears.

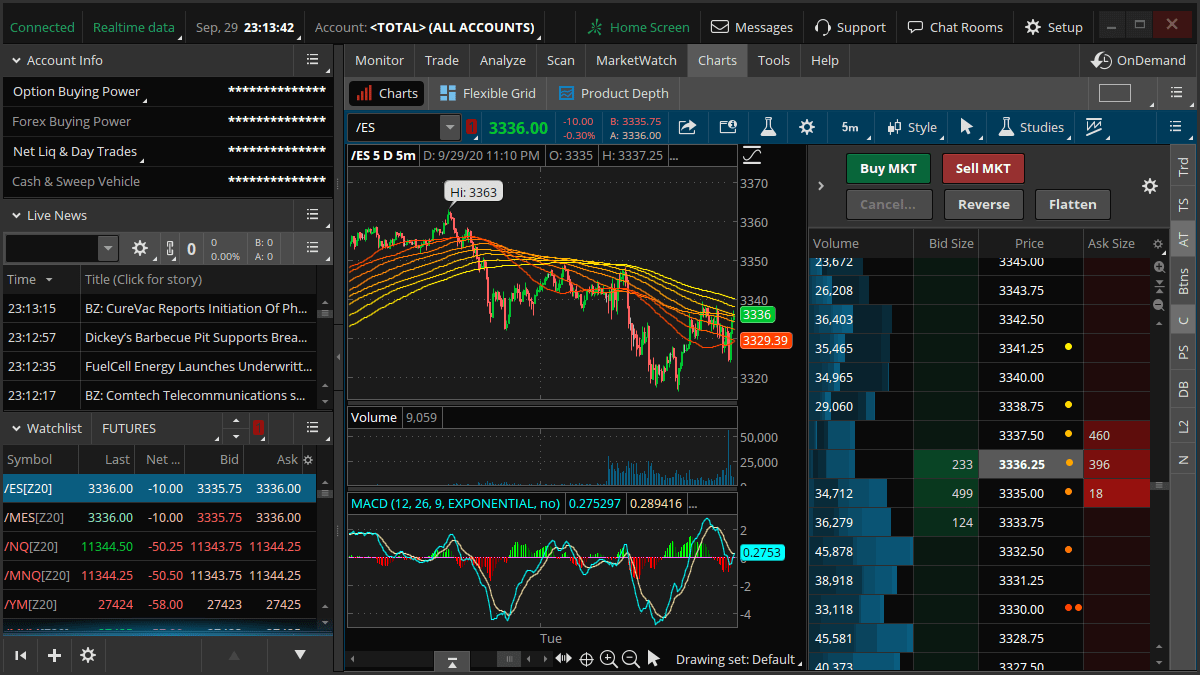

One key feature is its scripting language, thinkScript. This allows users to create custom indicators, scans, and strategies, but it's primarily designed for alert generation and order entry assistance, not continuous autonomous execution.

Order templates are another valuable tool. Users can predefine order types, quantities, and price parameters, enabling quick execution of planned trades. This minimizes manual input, but still requires human initiation.

The Limits of Full Automation

Despite its powerful scripting capabilities, Thinkorswim doesn’t offer a straightforward, built-in solution for completely hands-off, 24/7 automated trading. The platform isn’t built to run scripts constantly in the background, automatically entering and exiting positions based on pre-defined rules without any user intervention.

Schwab has not officially promoted Thinkorswim as a platform intended for fully automated trading. Customer service representatives often clarify that true algorithmic trading requires third-party solutions or custom development.

The platform's design prioritizes user control and risk management. This design includes several safeguards against unintended or errant trades, thus limiting full automation.

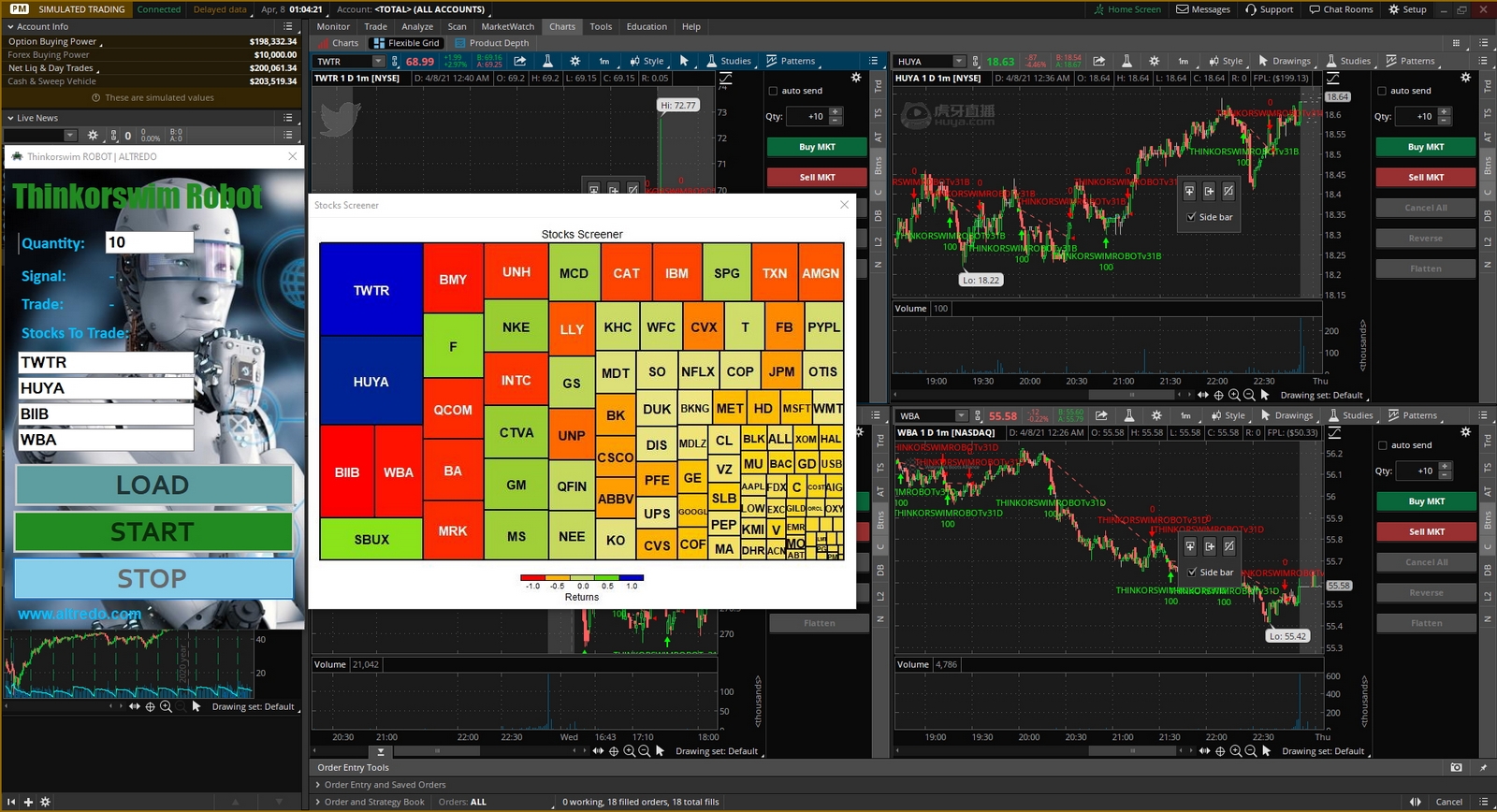

Achieving Semi-Automation and the Role of Third-Party Tools

While full automation within Thinkorswim is limited, traders have devised ways to achieve a significant degree of semi-automation. These strategies often involve integrating Thinkorswim with external software or APIs.

Using third-party applications with Thinkorswim's API (Application Programming Interface), traders can create more sophisticated automated strategies. These external programs monitor market data and execute trades through the Thinkorswim platform based on complex algorithms.

These applications can be integrated using the thinkScript language, but this requires coding skills and an understanding of the API's capabilities and limitations.

Compliance and Risk Management

Automated trading, especially with third-party tools, raises important compliance and risk management considerations. Traders must ensure their strategies adhere to all applicable regulations and brokerage policies.

Schwab, like other brokers, has rules in place to prevent market manipulation and abusive trading practices. Before deploying any automated strategy, it's crucial to understand and comply with these rules.

Furthermore, rigorous testing and risk management are essential. Algorithmic trading can amplify both profits and losses, and untested strategies can lead to significant financial consequences.

Expert Perspectives

"Thinkorswim is a powerful platform for discretionary traders," says John Carter, founder of Simpler Trading. "While it allows for scripting and some automation, it's not designed to be a completely hands-off, set-and-forget system."

"The key to automation on Thinkorswim lies in leveraging its API and custom coding," explains Jane Smith, a quant developer specializing in trading algorithms. "However, users need to understand the platform's limitations and prioritize risk management."

The Future of Automation on Thinkorswim

As trading technology evolves, the capabilities of platforms like Thinkorswim are likely to expand. It's possible that future updates will introduce more robust built-in automation features.

However, for now, achieving true automated trading with Thinkorswim requires a combination of thinkScript, third-party tools, and a thorough understanding of both the platform and the market.

The pursuit of automation continues, driven by the desire for efficiency and profit. But as with all trading strategies, careful planning, diligent risk management, and adherence to compliance regulations remain paramount.