Can You Buy Groceries With Sezzle

Imagine pushing your grocery cart down the aisle, the vibrant colors of fresh produce catching your eye. The aroma of freshly baked bread fills the air, a symphony of sensory delights. But then, the reality of rising grocery bills hits, a quiet anxiety creeping in as you calculate the total in your head.

This scenario is increasingly common, but a new question arises: Can you use Sezzle, the "buy now, pay later" service, to ease the strain on your wallet at the grocery store? The answer is a nuanced one, dependent on partnerships and evolving payment landscapes, which we'll unpack here.

The Rise of Buy Now, Pay Later (BNPL)

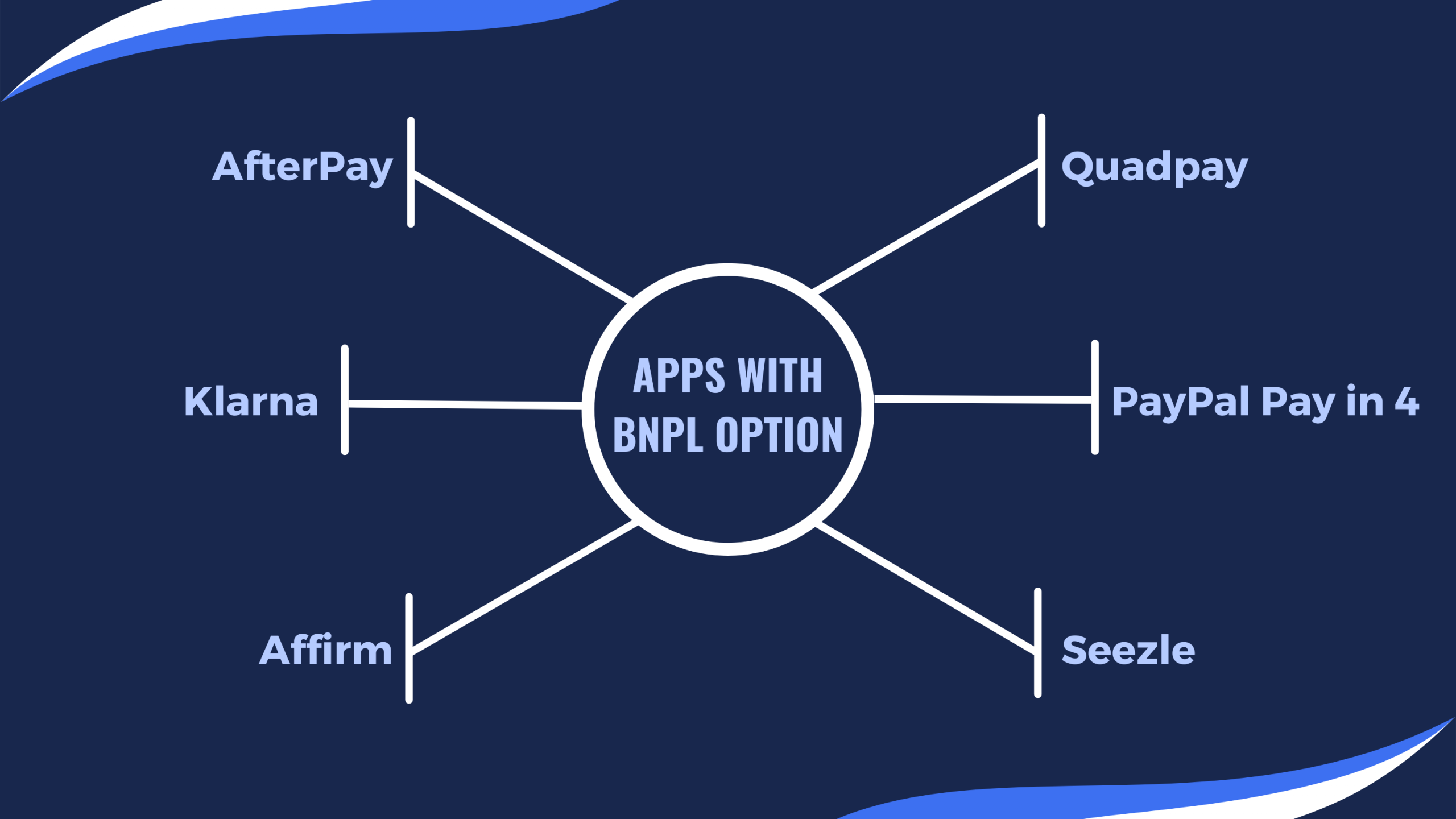

The Buy Now, Pay Later (BNPL) phenomenon has exploded in recent years, transforming how consumers approach purchases. Services like Sezzle, Affirm, and Klarna offer a tempting alternative to traditional credit cards.

They allow shoppers to split the cost of purchases into smaller, more manageable installments, often interest-free if payments are made on time.

This accessibility has made BNPL particularly appealing to younger demographics and those seeking greater financial flexibility.

What is Sezzle?

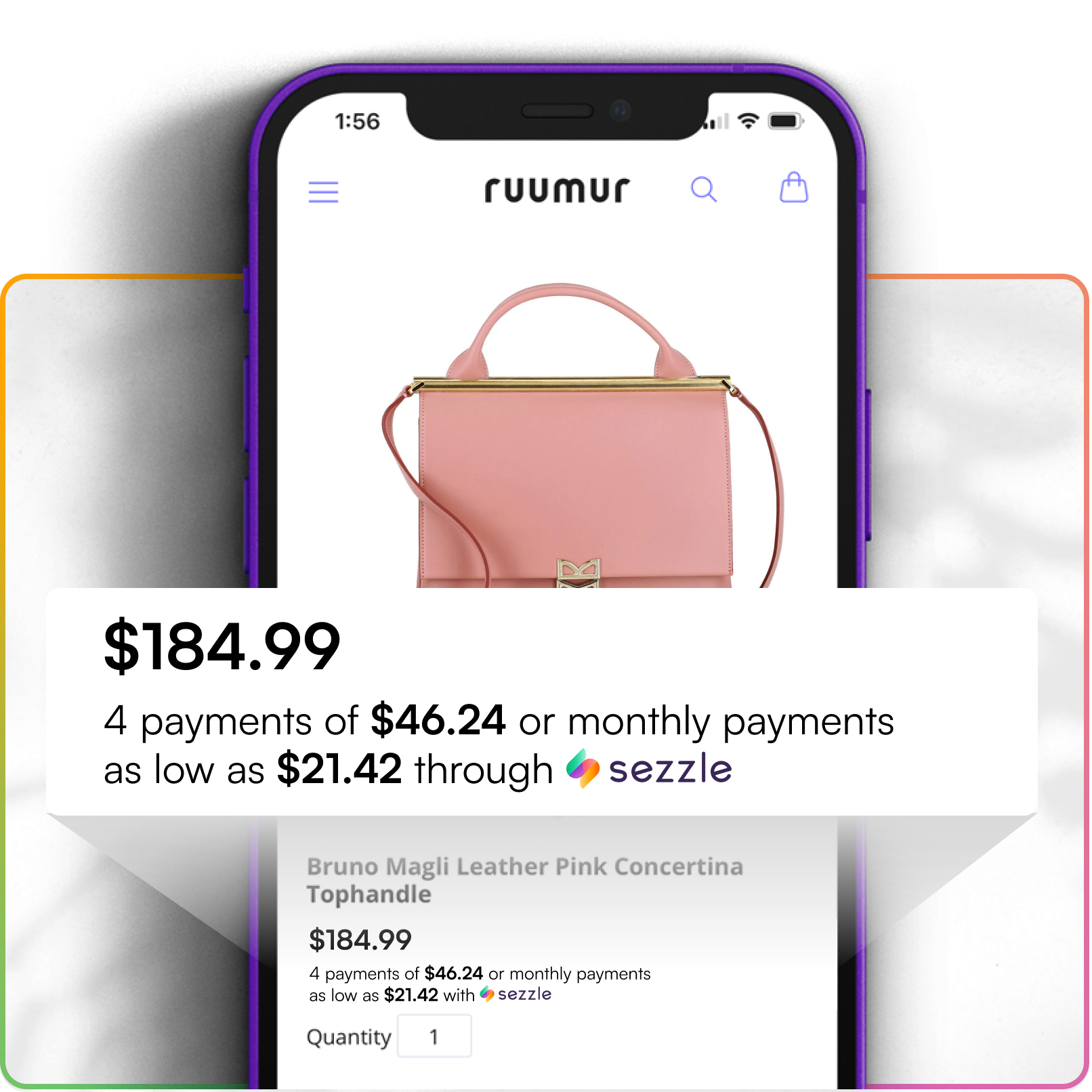

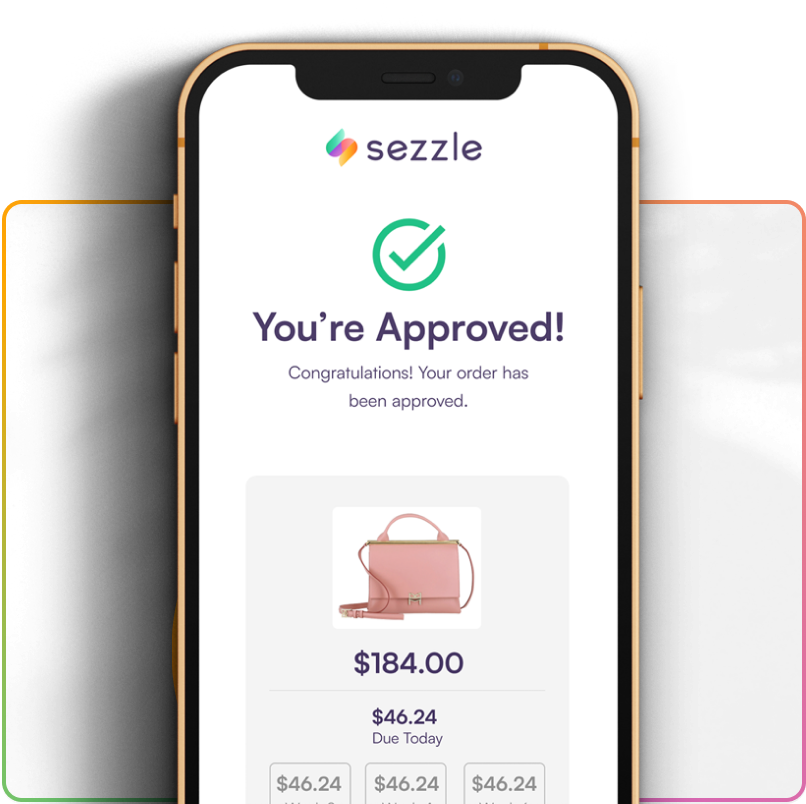

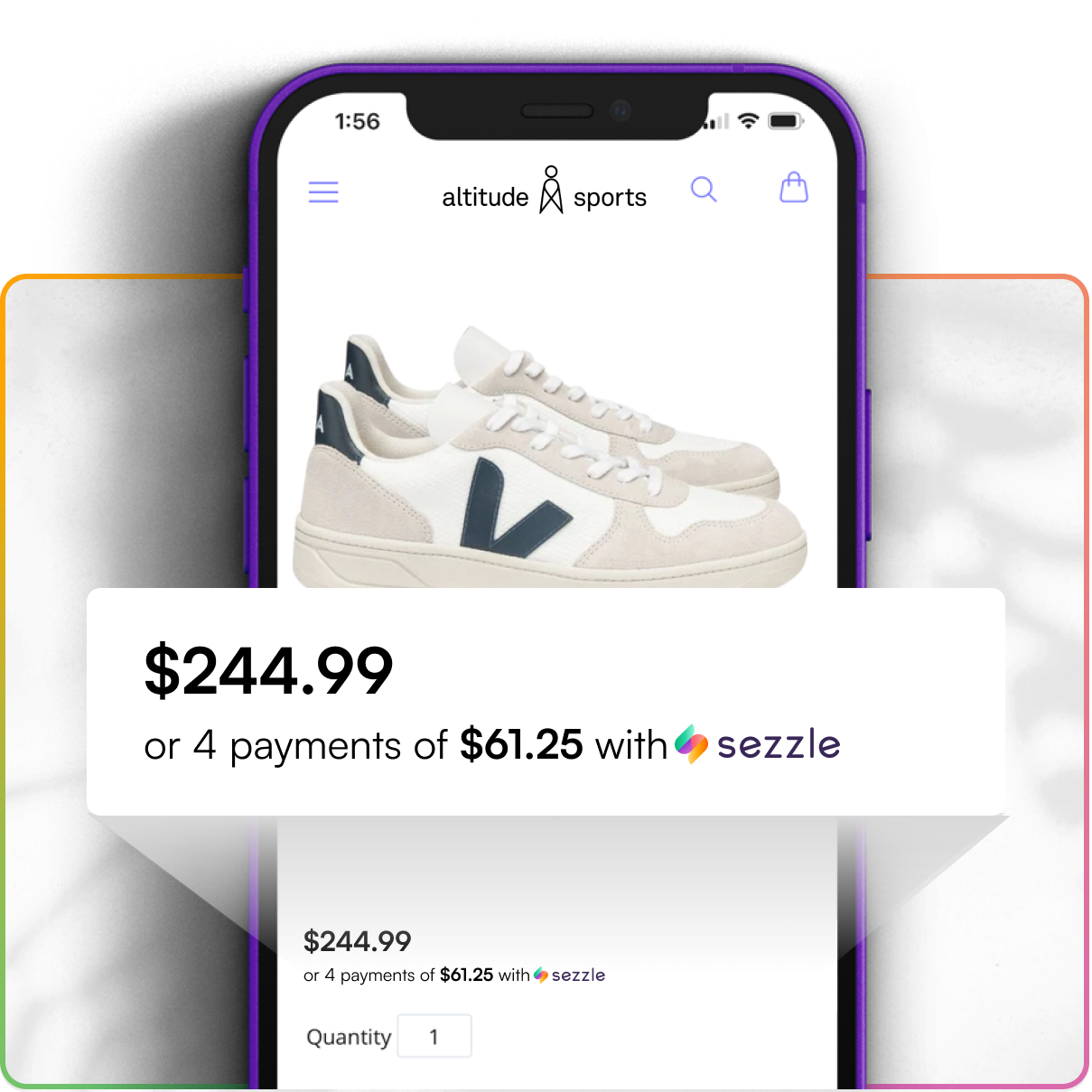

Sezzle distinguishes itself with its focus on younger consumers and its integration with a wide range of online retailers. The platform allows users to divide their payments into four installments, spread over six weeks.

This model has proven attractive to those seeking to budget more effectively or to make purchases without incurring immediate, large expenses.

Sezzle's user-friendly interface and seamless integration with various e-commerce platforms have contributed significantly to its popularity.

Sezzle and Groceries: A Patchwork Landscape

The burning question remains: can you actually use Sezzle to buy your groceries? The answer is not a straightforward yes or no.

The availability of Sezzle at grocery stores hinges on partnerships between Sezzle and specific retailers.

Currently, direct partnerships with major national grocery chains are limited.

Exploring the Possibilities

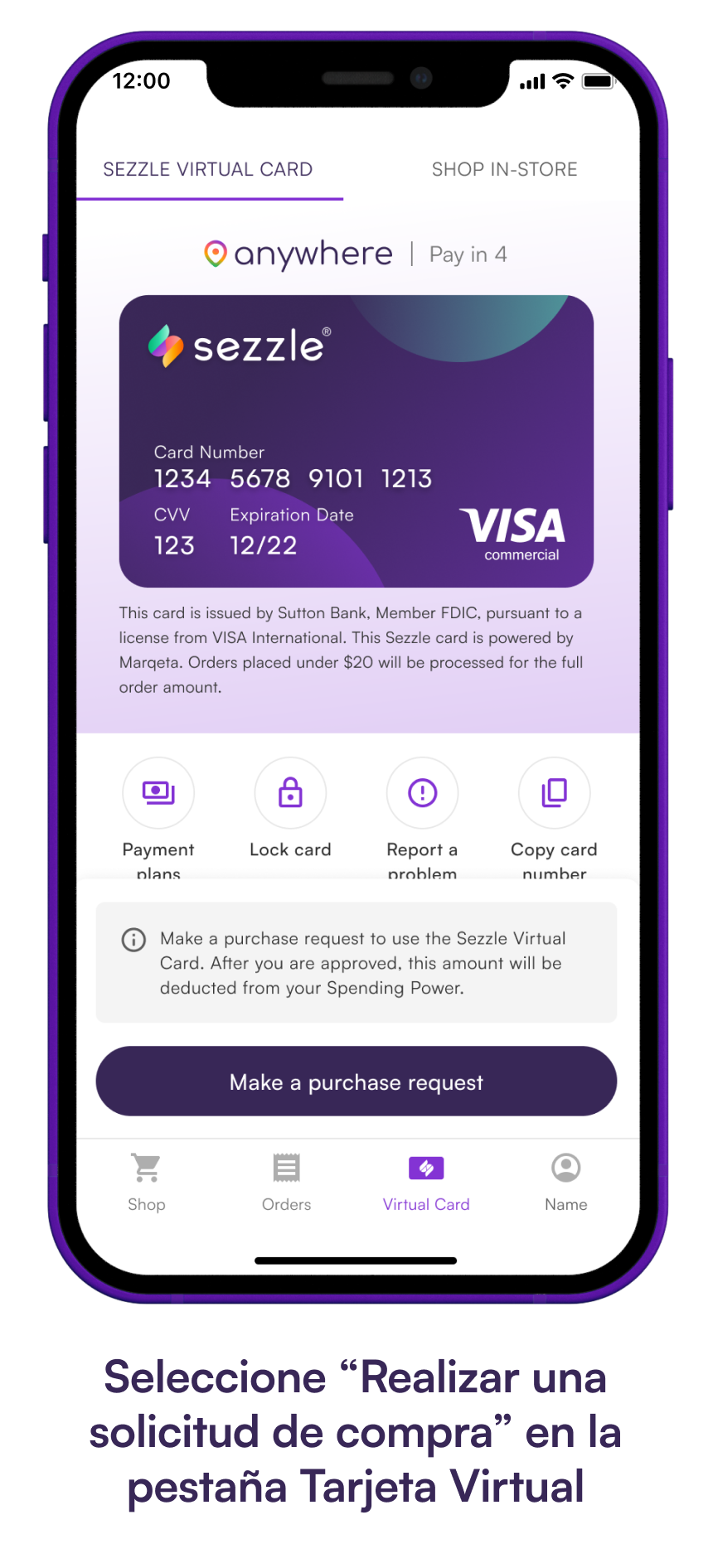

While you might not be able to walk into a Kroger or Safeway and directly use Sezzle at the checkout, there are indirect avenues to consider.

Many grocery delivery services, like Instacart or even some smaller local delivery platforms, may offer Sezzle as a payment option if they partner with Sezzle.

This means you could potentially purchase your groceries online through these services and then split the cost using Sezzle.

The Gift Card Route

Another workaround involves purchasing gift cards to grocery stores through the Sezzle platform itself. Many online retailers sell gift cards to various businesses, including grocery chains.

You could use Sezzle to buy a gift card for your preferred grocery store and then use that gift card to pay for your groceries in-store.

However, it's essential to check Sezzle's marketplace for availability and be aware of any potential fees or limitations associated with gift card purchases.

The Benefits and Drawbacks of BNPL for Groceries

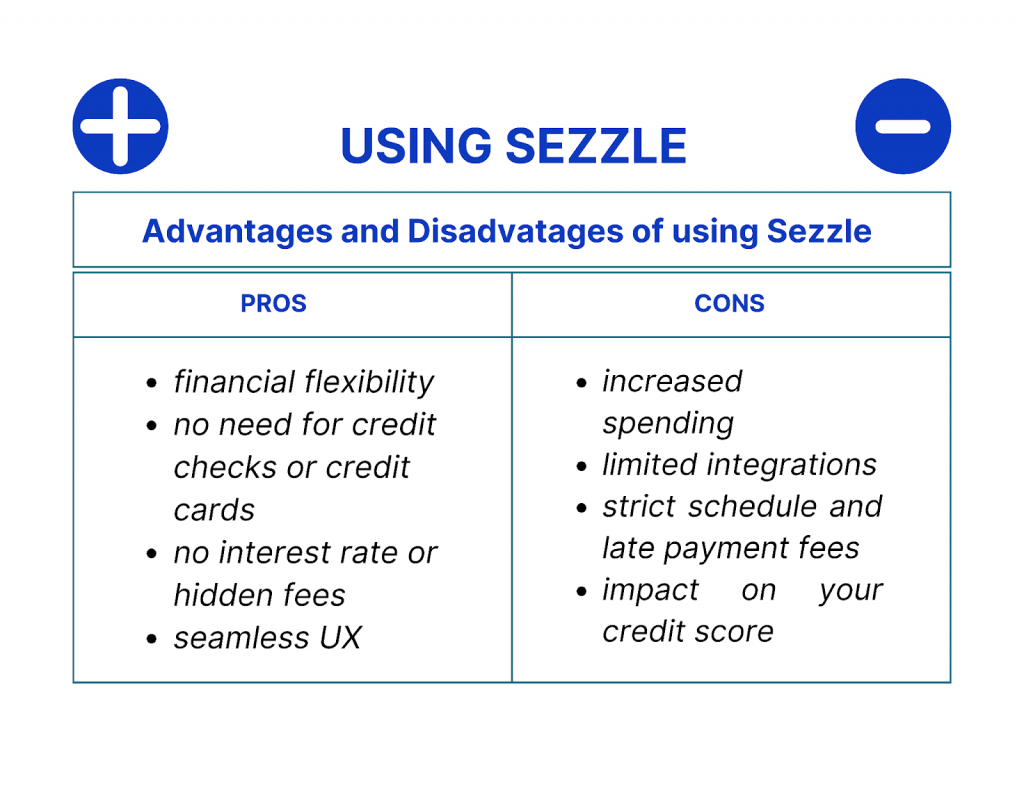

Using BNPL services like Sezzle for groceries presents both advantages and disadvantages.

On the one hand, it can provide a temporary buffer for families struggling with tight budgets or unexpected expenses.

Splitting grocery bills into smaller payments can make budgeting easier and prevent reliance on high-interest credit cards.

The Risks Involved

However, the ease of BNPL can also lead to overspending and debt accumulation if not managed responsibly.

Missed payments can result in late fees and potentially damage your credit score.

Furthermore, relying heavily on BNPL for essential purchases like groceries may indicate underlying financial instability that needs to be addressed.

"It's important to use BNPL responsibly and understand the terms and conditions before making a purchase," cautions Sarah Davies, a financial advisor at ClearPath Financial Planning. "While it can be a helpful tool, it's not a substitute for sound financial planning."

The Future of BNPL in the Grocery Sector

The future of BNPL in the grocery sector remains uncertain but promising. As BNPL becomes more mainstream, we may see more direct partnerships between Sezzle and major grocery chains.

This would make it easier for consumers to use Sezzle for in-store purchases.

The increasing adoption of digital payment methods and the growing demand for flexible payment options will likely fuel this trend.

Technological Advancements

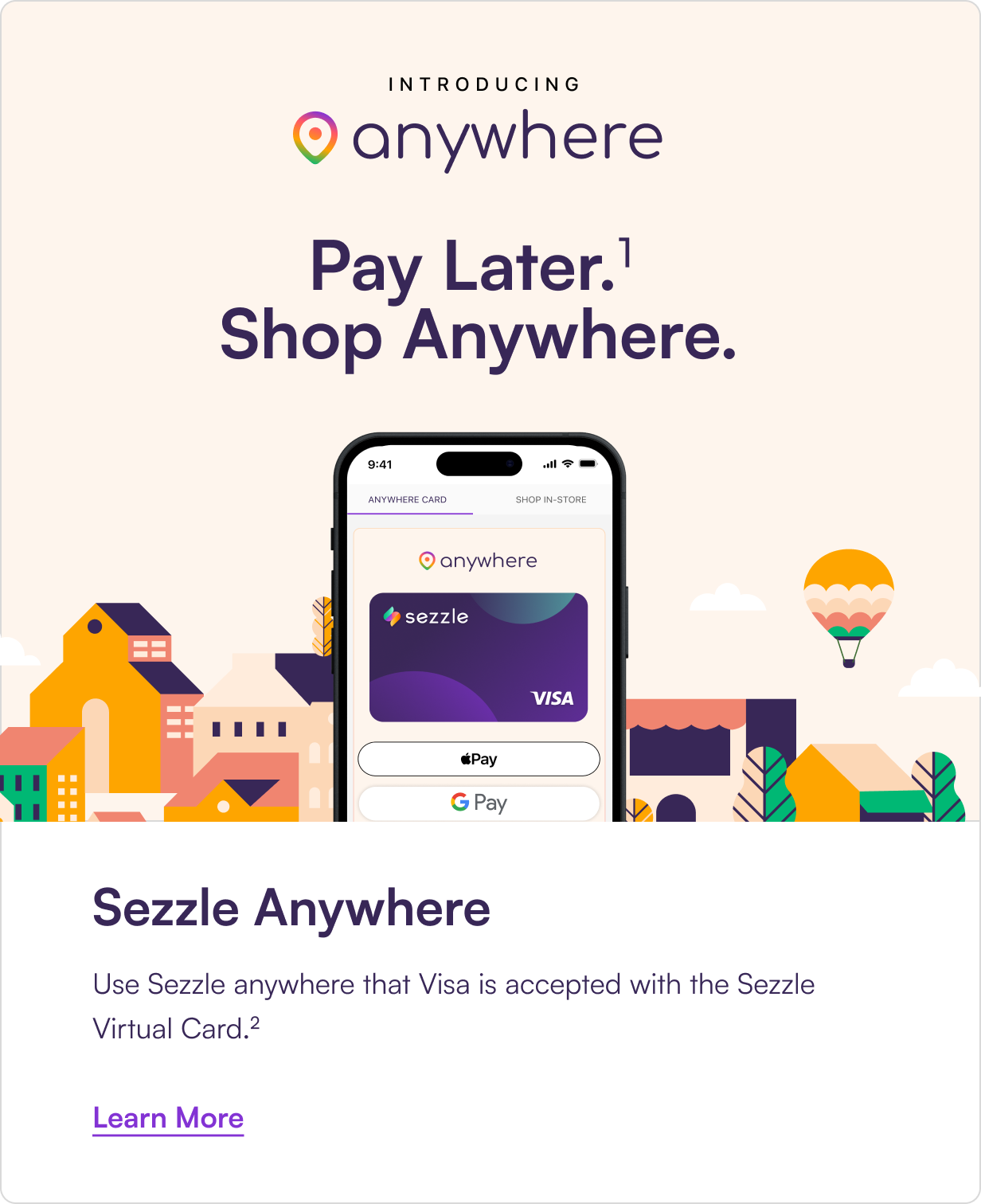

Technological advancements, such as seamless integration with mobile wallets and loyalty programs, could also pave the way for wider BNPL adoption in the grocery industry.

Imagine scanning a barcode at the checkout and instantly selecting Sezzle as your payment method, all through your smartphone.

This level of convenience could significantly increase the appeal of using BNPL for everyday purchases like groceries.

A Word of Caution

While the convenience of using Sezzle for groceries can be tempting, it's crucial to approach it with caution and awareness. Evaluate your financial situation honestly and consider whether BNPL aligns with your long-term financial goals.

Avoid using Sezzle as a crutch for overspending or as a substitute for budgeting and saving.

Remember that responsible financial management is the key to long-term financial well-being.

Sezzle could offer a lifeline in times of need, but a reliance on it for groceries might signify deeper financial issues.

Conclusion

So, can you buy groceries with Sezzle? The answer is a conditional "maybe." While direct partnerships with major grocery chains are still limited, alternative routes like online delivery services and gift card purchases offer potential avenues.

The future holds promise for wider adoption, but it's essential to approach BNPL with responsibility and awareness.

Ultimately, using Sezzle for groceries is a personal decision that should be based on your individual financial circumstances and a commitment to responsible spending habits. As you navigate the aisles, remember that a well-planned budget is often the most reliable tool in your shopping cart.