Can You Buy Vanguard Etfs Through Fidelity

Imagine strolling through a vibrant marketplace. Each stall overflows with unique offerings, promising a treasure trove of opportunities. In the realm of investing, Fidelity and Vanguard stand as two prominent vendors, each showcasing a diverse array of financial products. But can you mix and match, grabbing your favorite Vanguard ETFs from the Fidelity stand? Let's unravel this common question.

The core question at hand is simple: Can investors purchase Vanguard ETFs through Fidelity's brokerage platform? The short answer is a resounding yes. Fidelity, like most major brokerage firms, provides access to a wide range of exchange-traded funds (ETFs), including those managed by Vanguard.

The ability to buy Vanguard ETFs on Fidelity is significant because it allows investors to build diversified portfolios, leveraging the strengths of both platforms. It avoids the need to open multiple brokerage accounts to access specific funds or investment strategies.

Background and Significance

Vanguard and Fidelity are titans in the investment world, each known for its distinct approach and loyal following. Vanguard, often praised for its low-cost, investor-owned structure, pioneered index investing, making it accessible to the masses.

Fidelity, a privately held company, offers a broader range of services, including active management, wealth management, and brokerage services. Its extensive research tools and diverse investment options cater to a wide spectrum of investors.

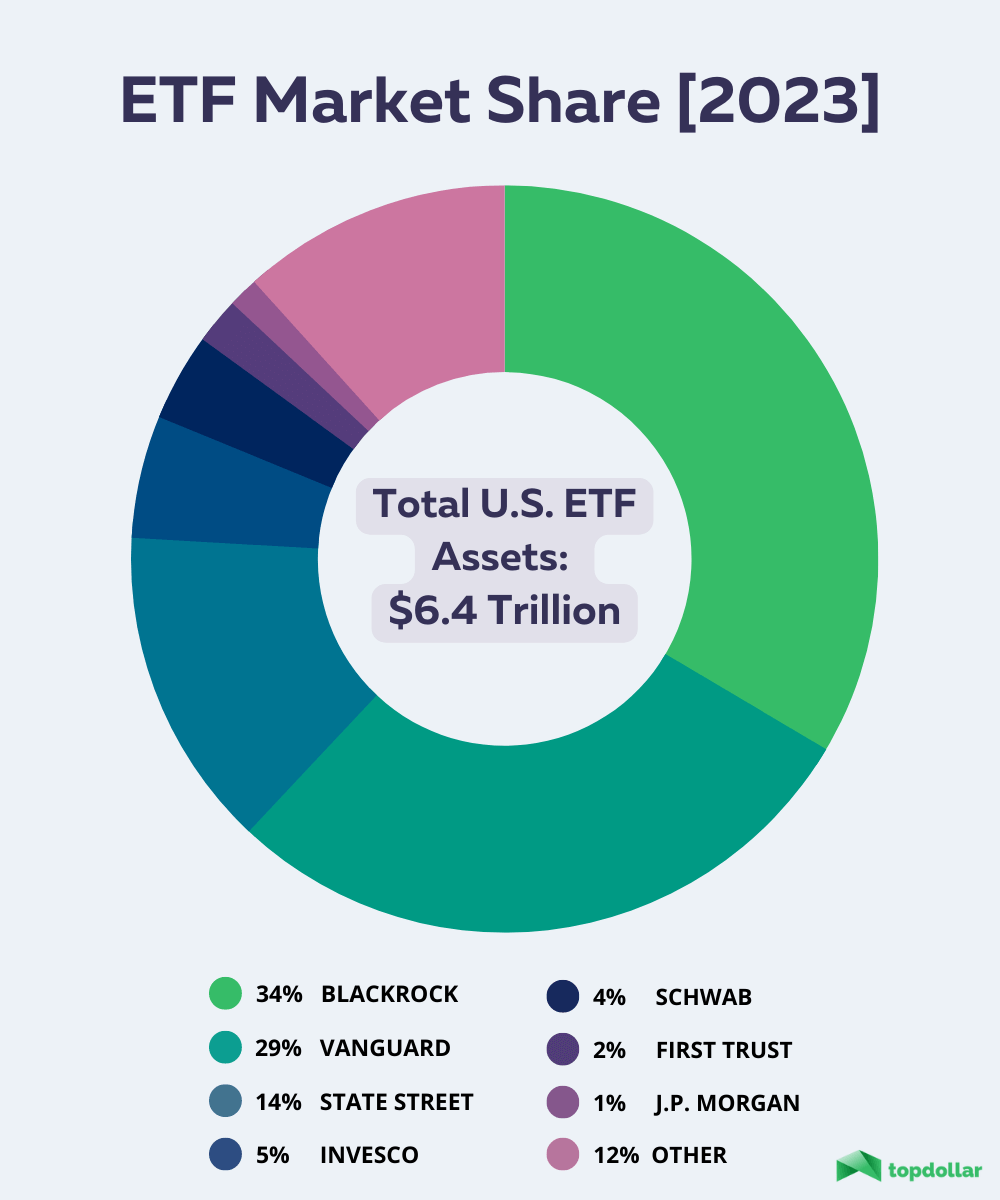

The rise of ETFs has democratized investing, providing easy access to diversified portfolios at a low cost. Both Vanguard and Fidelity have played crucial roles in this transformation, offering investors cost-effective tools to achieve their financial goals.

How it Works

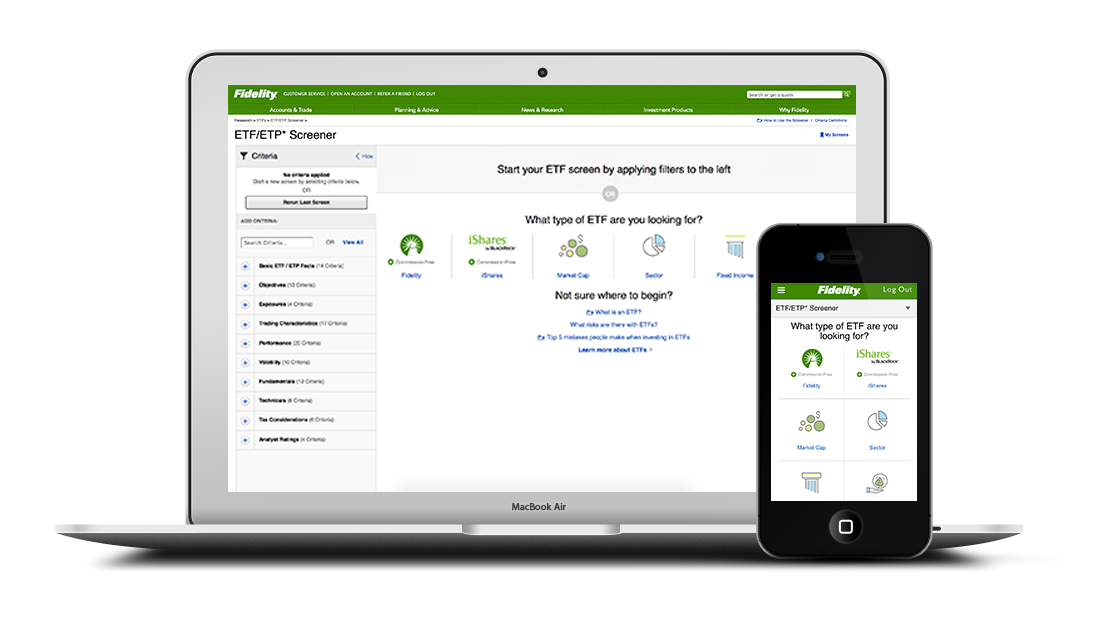

Buying Vanguard ETFs through Fidelity is a straightforward process, mirroring the purchase of any other ETF or stock. Investors simply log into their Fidelity account, search for the desired Vanguard ETF by its ticker symbol (e.g., VOO for Vanguard's S&P 500 ETF), and place an order to buy the desired number of shares.

Fidelity acts as an intermediary, executing the trade on the stock exchange and settling the transaction within the investor's account. Standard brokerage commissions may apply, although Fidelity, like many brokers, offers commission-free trading on many ETFs and stocks.

Potential Benefits and Considerations

The primary benefit is convenience. Investors can consolidate their investment activities within a single Fidelity account, streamlining portfolio management and simplifying tax reporting.

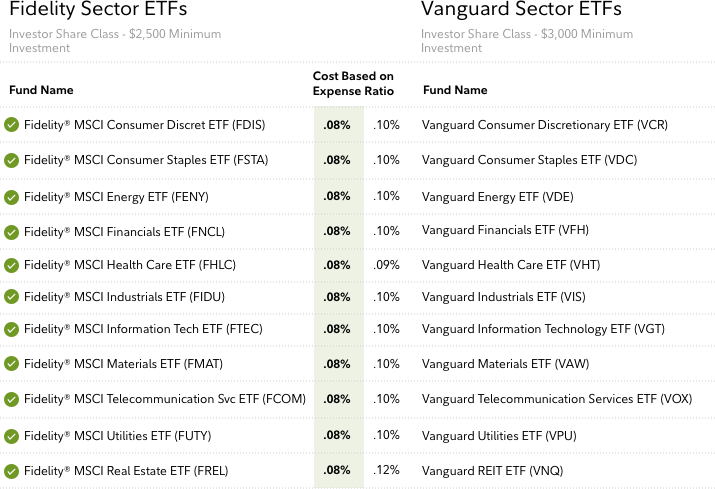

Access to Vanguard's low-cost ETFs within Fidelity allows investors to build well-diversified portfolios without incurring excessive fees. It also opens up the opportunity to combine Vanguard's passive investment strategies with Fidelity's active management options or research tools.

Before investing, it's crucial to understand the expense ratios of the ETFs and any potential trading fees associated with the brokerage account. Also, research the specific Vanguard ETFs to ensure they align with your investment objectives and risk tolerance.

Always remember to conduct thorough research and consider seeking advice from a financial advisor before making any investment decisions.

Conclusion

In conclusion, the ability to purchase Vanguard ETFs through Fidelity is a testament to the interconnectedness of the modern investment landscape. This flexibility empowers investors with more choices and greater control over their financial futures.

By leveraging the strengths of both platforms, investors can build diversified, low-cost portfolios that align with their individual goals. It is a win-win situation, paving the way for a more accessible and investor-friendly investment environment.

.png)

/ScreenShot2020-03-11at1.15.30PM-6b52b18a5b174c02a257106e75f784fa.png)