Can You Overdraft Your Skylight Card

The Skylight ONE Visa Prepaid Card, popular for its accessibility and direct deposit features, has left some users questioning its overdraft policies. Can you actually overdraft your Skylight card? The answer is more nuanced than a simple yes or no.

This article delves into the specifics of Skylight's overdraft protection, examining official policies and user experiences to clarify the situation for current and potential cardholders. Understanding these policies is crucial for managing finances and avoiding unexpected fees.

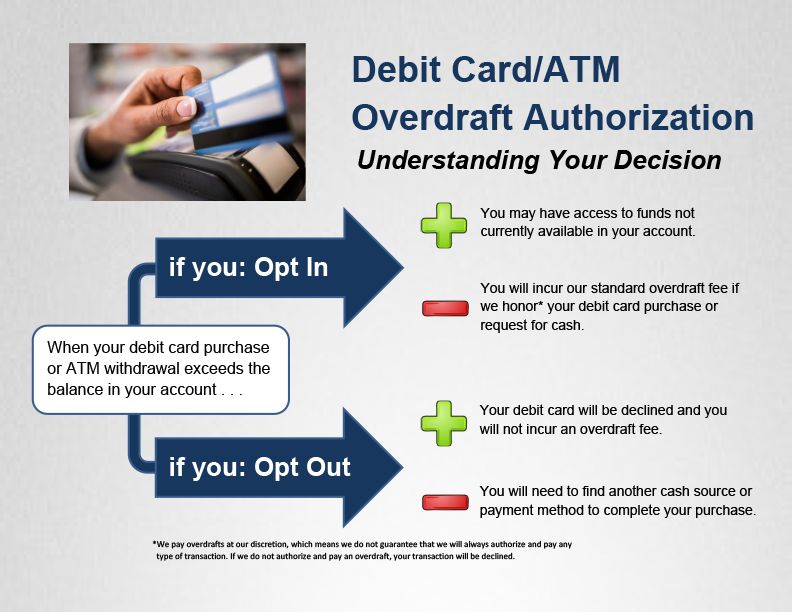

The key takeaway is that Skylight cards generally do not allow overdrafts in the traditional sense. Unlike traditional debit cards linked to checking accounts, prepaid cards like Skylight are designed to prevent spending beyond the available balance. This built-in feature is a major draw for consumers seeking to avoid overdraft fees, according to numerous financial literacy websites.

However, certain situations might appear to result in an overdraft-like scenario. These typically involve pending transactions or authorization holds.

Authorization Holds and Pending Transactions

Authorization holds are temporary holds placed on your card when you make a purchase, especially at gas stations or hotels. The merchant estimates the final cost, and that amount is held, reducing your available balance. The actual charge might be lower, but the initial hold can remain for several days, potentially creating a situation where your available balance is less than what you expect.

Pending transactions also play a role. A transaction remains pending until the merchant fully processes it. During this period, the funds are unavailable, and if other transactions occur before the pending one clears, it could lead to a temporary negative balance appearance, although technically not an overdraft.

The Role of Merchant Processing

Delays in merchant processing can contribute to confusion. If a merchant takes longer than expected to finalize a transaction, the held funds remain unavailable, potentially impacting your spending ability. Skylight's customer service representatives often advise users to contact the merchant directly in these situations to expedite the processing or release of the hold.

"We encourage our cardholders to monitor their transactions closely and be aware of pending authorizations," a Skylight representative stated in a recent online forum discussion.

This statement underscores the importance of proactive financial management when using a Skylight card.

Fees and Balance Management

While traditional overdraft fees are typically avoided with Skylight cards, other fees can apply. These include monthly maintenance fees, ATM withdrawal fees, and inactivity fees. Understanding the fee schedule, available on the Skylight website and cardholder agreement, is vital for cost-effective card usage.

To avoid any surprises related to authorization holds or pending transactions, Skylight recommends regularly checking your card balance online or through their mobile app. Setting up transaction alerts can also help you stay informed about your spending.

Many personal finance experts suggest keeping a small buffer on your Skylight card to account for unforeseen charges or holds. This proactive approach can minimize the risk of declined transactions or a temporarily reduced available balance.

In conclusion, while a traditional overdraft is generally not possible with a Skylight ONE Visa Prepaid Card, users should be mindful of authorization holds, pending transactions, and associated fees. Diligent monitoring of your account activity is the best way to avoid potential issues and maximize the benefits of the card.