Can You Trade After Hours With Fidelity

For investors seeking flexibility beyond the traditional 9:30 AM to 4:00 PM EST trading window, the question of after-hours trading capabilities becomes paramount. Fidelity Investments, a major player in the brokerage industry, offers extended hours trading, but with specific rules and limitations that potential users must understand.

This article examines the details of Fidelity's after-hours trading, outlining who can access it, what instruments can be traded, when and where it's available, and how it works. Understanding these nuances is crucial for investors looking to capitalize on market movements occurring outside of regular trading hours.

Fidelity's Extended Hours Trading: The Basics

Fidelity provides access to pre-market and after-hours trading sessions. This allows clients to react to news and events that occur outside of standard market hours.

These sessions are not identical to the regular trading day. They operate under different rules and come with inherent risks that investors should be aware of.

Who Can Trade After Hours With Fidelity?

Most Fidelity customers who have a brokerage account are eligible for extended hours trading. However, certain account types or specific restrictions may apply.

Investors are encouraged to contact Fidelity directly or consult their account documentation to confirm their eligibility.

What Can Be Traded?

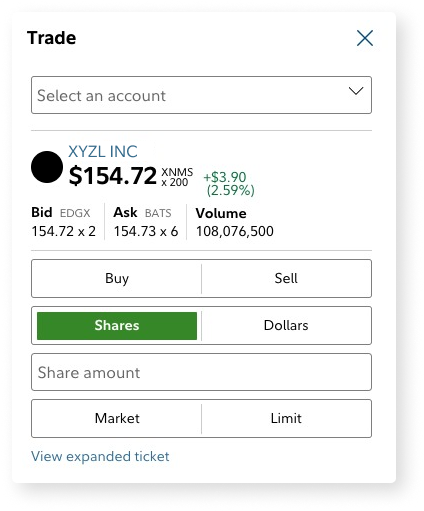

Not all securities are available for trading during extended hours. Typically, only exchange-listed stocks and exchange-traded funds (ETFs) that meet certain liquidity requirements are eligible.

Penny stocks and over-the-counter (OTC) securities are generally excluded.

When and Where Does Extended Hours Trading Take Place?

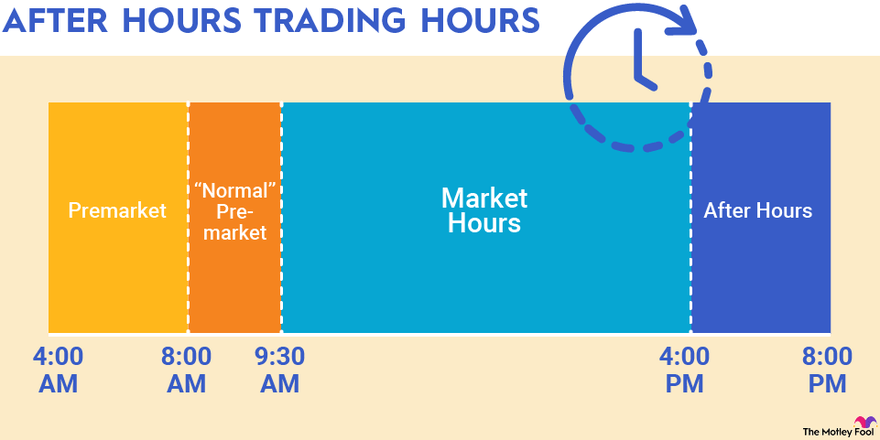

Fidelity offers two extended hours sessions. There is a pre-market session from 7:00 AM to 9:28 AM EST and an after-hours session from 4:00 PM to 8:00 PM EST.

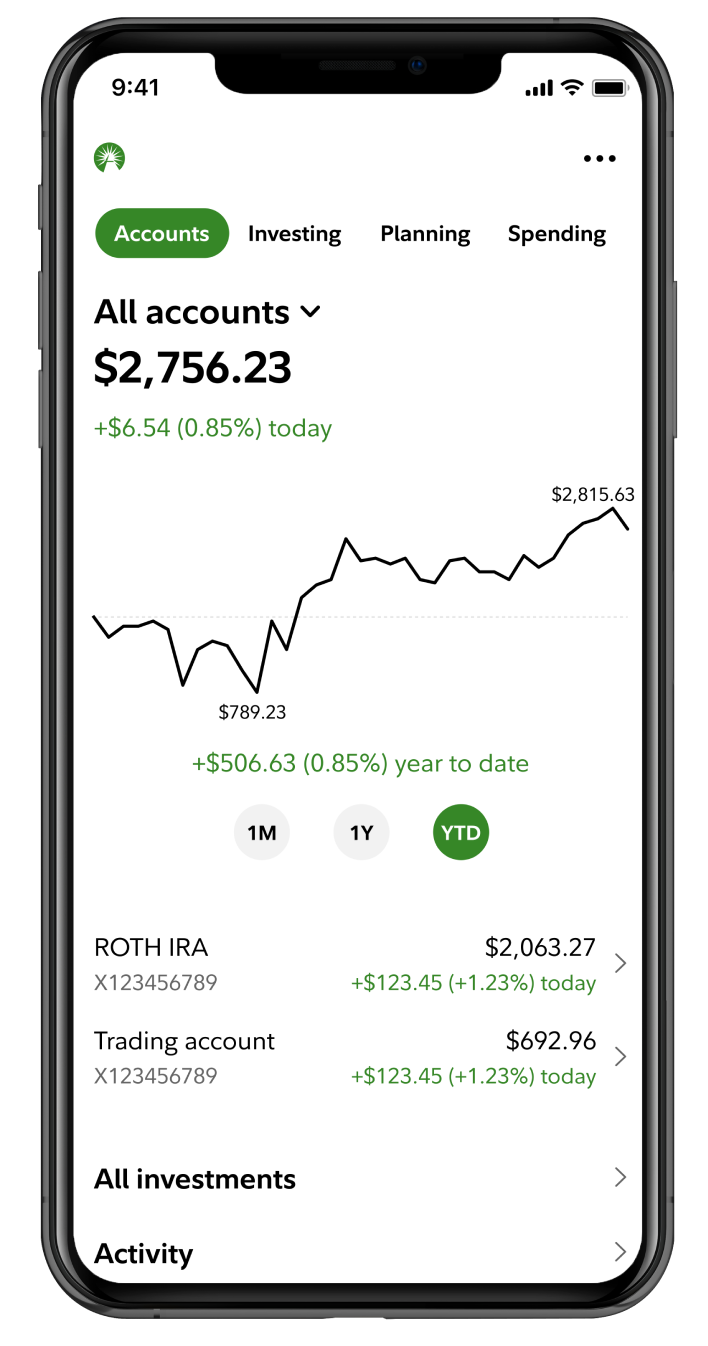

These sessions are conducted electronically through Fidelity's trading platforms.

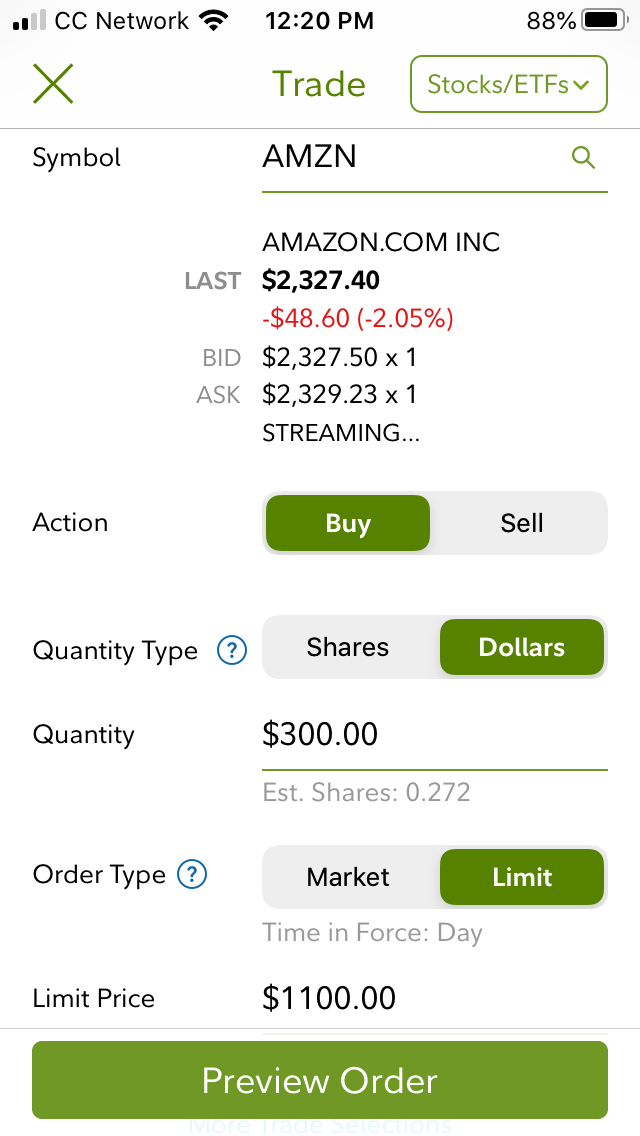

How Does It Work?

Orders placed during extended hours are typically limit orders. Market orders are generally not accepted during these sessions.

This means investors must specify the price at which they are willing to buy or sell a security. This helps mitigate some of the risks associated with the lower liquidity often present during extended hours trading.

Risks of After-Hours Trading

After-hours trading comes with increased risks. These risks include lower liquidity, greater price volatility, and wider spreads between bid and ask prices.

These factors can make it more difficult to execute trades at desired prices and increase the potential for losses.

Furthermore, news announcements and market-moving events occurring after the close of regular trading can significantly impact prices in the extended hours session. Investors should exercise caution and carefully consider their risk tolerance before engaging in after-hours trading.

"Investors should understand that extended hours trading is not for everyone," warns a statement on Fidelity's website. "It's essential to have a solid understanding of the risks involved and to manage your positions carefully."

The Impact on Investors

The availability of after-hours trading through Fidelity and other brokers provides investors with increased flexibility and the ability to react quickly to market-moving events.

This can be particularly beneficial for those who are unable to monitor the market during regular trading hours.

However, it's crucial to remember that increased flexibility comes with increased risk. Investors should carefully weigh the potential benefits against the inherent risks before engaging in extended hours trading.

Conclusion

Fidelity does offer after-hours trading to its eligible customers, providing an opportunity to trade outside of regular market hours. Investors must use limit orders and understand the specific risks associated with these sessions.

By understanding the rules, limitations, and risks involved, investors can make informed decisions about whether extended hours trading is appropriate for their investment strategies. Always conduct thorough research and consider seeking professional financial advice before engaging in any trading activity, especially during extended hours.