Canvas Credit Union Savings Interest Rate

In a move impacting savers across Colorado, Canvas Credit Union recently announced adjustments to its savings interest rates. The changes reflect broader economic trends and evolving strategies within the financial institution.

The rate adjustments, effective October 26, 2023, affect various savings products offered by Canvas. These changes underscore the delicate balance financial institutions must strike between attracting deposits and maintaining profitability in a fluctuating economic landscape.

Understanding the Rate Adjustments

The specific changes impact different tiers of savings accounts. Higher balances will now accrue interest at potentially different rates compared to previous offerings. Canvas Credit Union attributed the changes to market conditions and internal assessments of their competitive positioning.

A spokesperson for Canvas Credit Union explained that the adjustments are intended to ensure the long-term sustainability and competitiveness of their savings products. They emphasized their commitment to providing members with value while adapting to the prevailing economic climate.

Specific Rate Changes

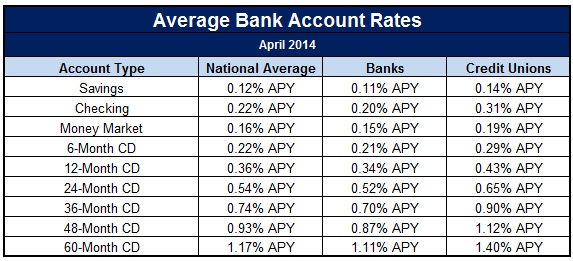

While specific rate details vary depending on the account type and balance, generally higher balance accounts may experience more significant changes.

Canvas Credit Union has published a detailed schedule of the new rates on its website and in branch locations. Members are encouraged to review these documents to understand how the changes will affect their individual accounts.

Why the Change?

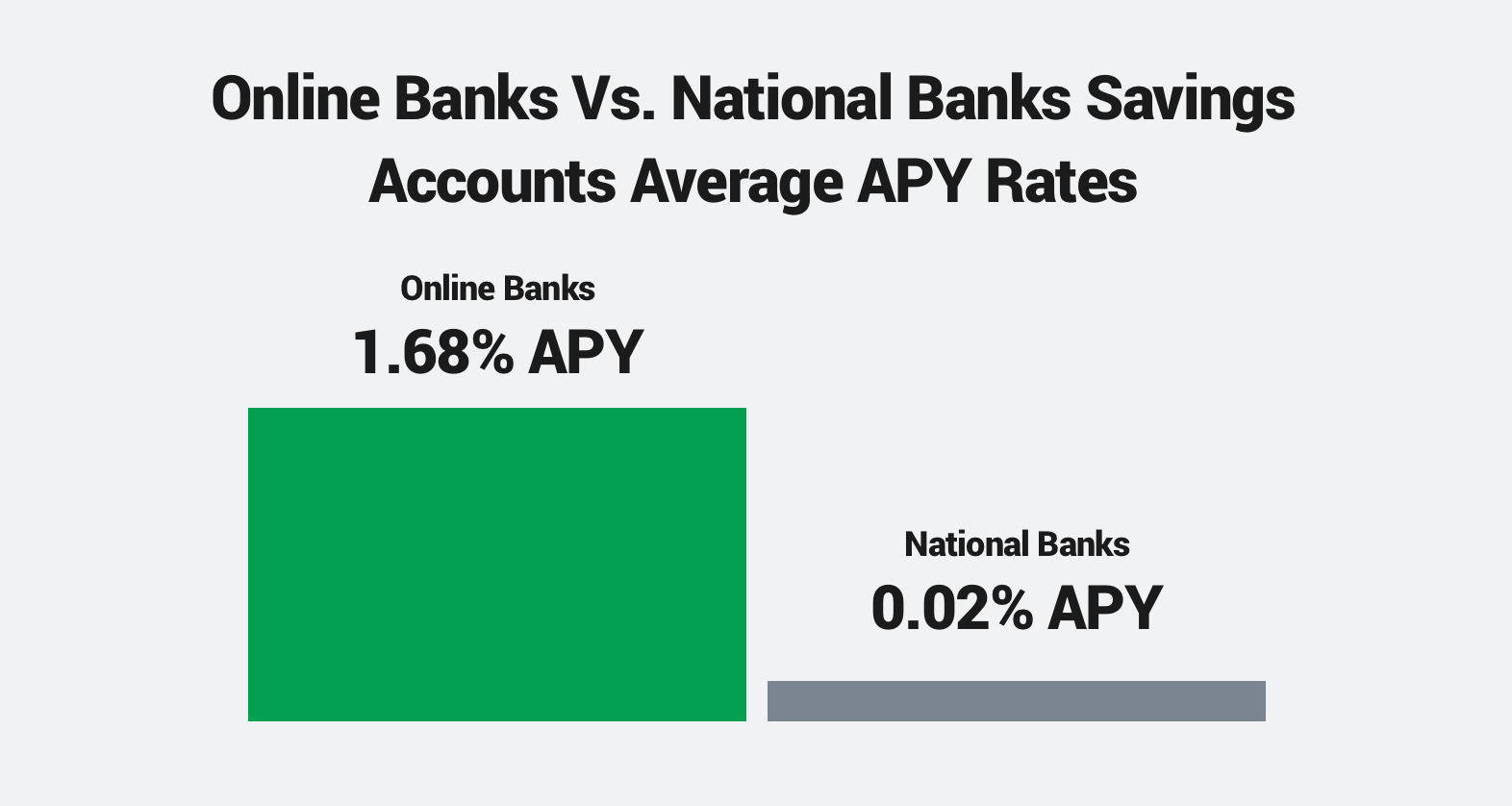

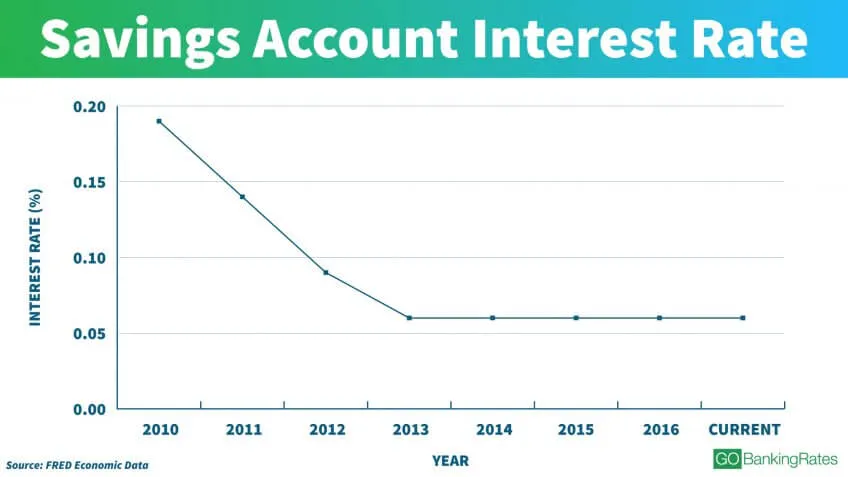

The decision to adjust savings interest rates is influenced by several factors. One key driver is the overall interest rate environment, largely dictated by the Federal Reserve's monetary policy.

When the Fed raises its benchmark interest rate, financial institutions typically respond by increasing rates on loans and, to a lesser extent, on savings products. Conversely, when the Fed lowers rates, savings interest rates often decline. Inflationary pressures also play a key role. Canvas Credit Union must consider the rate of inflation when setting savings rates to ensure that members' savings retain their purchasing power.

Impact on Members

The most direct impact will be on the interest earned on savings accounts. Depending on the specific rate change and the account balance, members may see either an increase or decrease in their monthly or annual interest payments.

Savers with larger balances stand to be more significantly affected by the change. It’s vital for members to review their account statements and familiarize themselves with the new rate structure.

Expert Perspectives

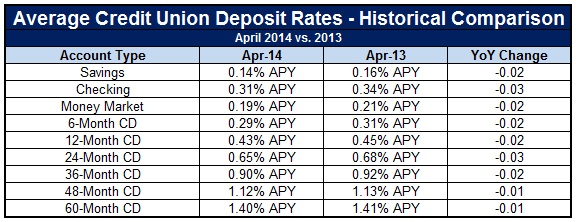

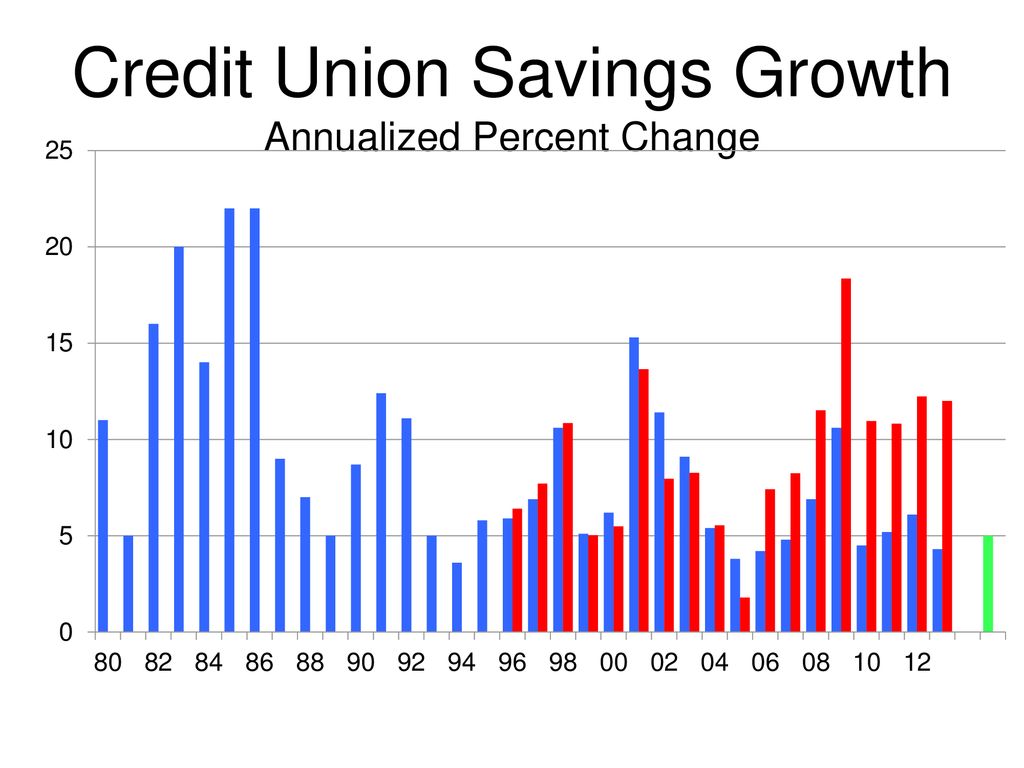

Financial analysts suggest that the recent rate adjustments by Canvas Credit Union are indicative of a broader trend within the financial services industry. Many institutions are re-evaluating their savings rates in response to the current economic uncertainty.

According to a report by The Credit Union National Association (CUNA), credit unions nationwide are facing increasing pressure to balance member needs with the need to maintain healthy profit margins. This pressure is driving many to make strategic adjustments to their deposit rates.

"Credit unions are constantly evaluating their offerings to remain competitive and sustainable. Adjustments to savings rates are a necessary part of this process," said CUNA economist, Mike Schenk.

Canvas Credit Union's Response

Canvas Credit Union maintains that it remains committed to offering competitive savings options. They emphasized that the rate adjustments are part of a comprehensive strategy to ensure long-term financial stability.

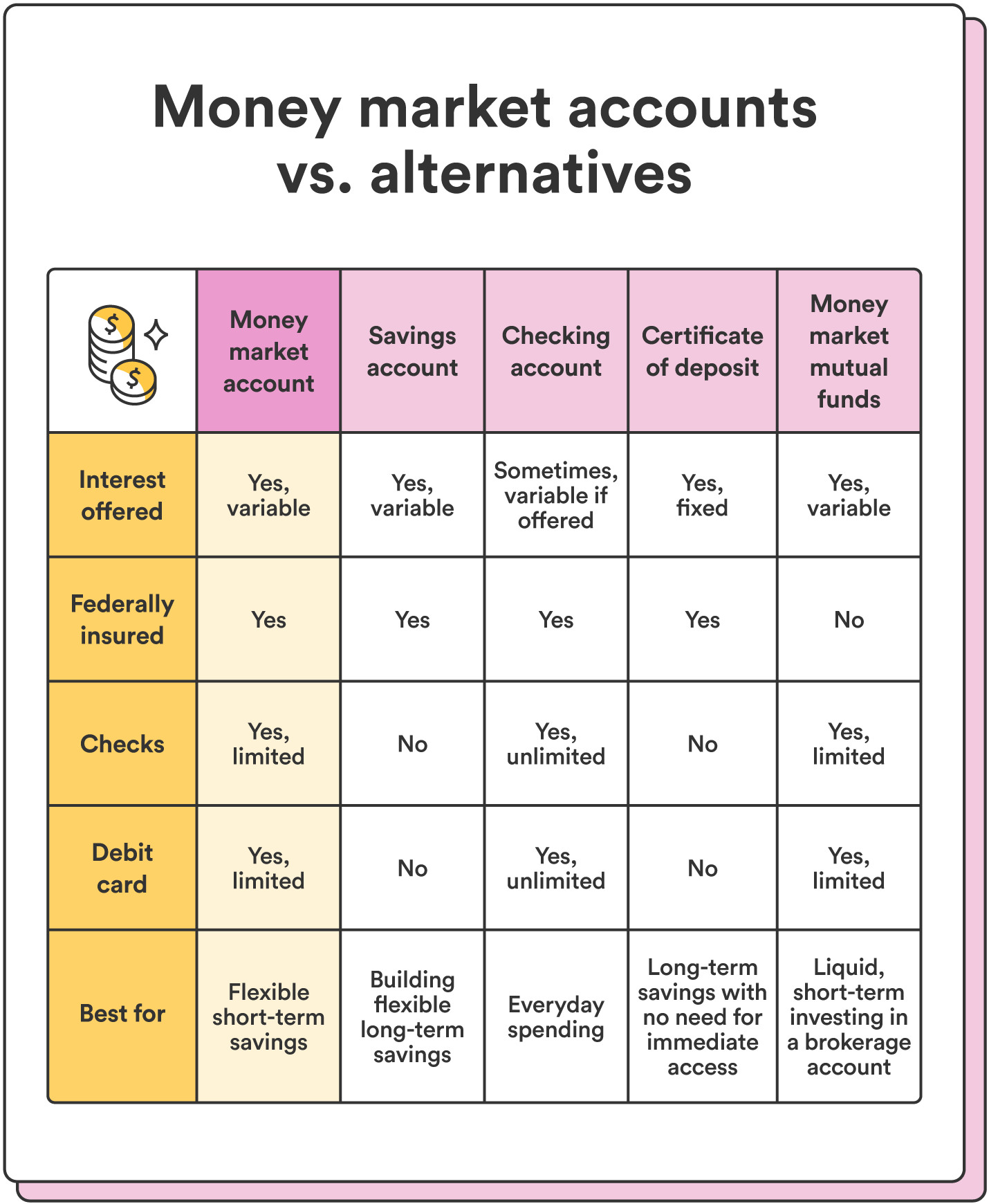

In addition to savings accounts, Canvas Credit Union offers a variety of other financial products and services, including checking accounts, loans, and investment options. They encourage members to explore these options to diversify their financial portfolio.

Looking Ahead

It is likely that savings interest rates will continue to fluctuate in response to changing economic conditions. Savers should regularly review their account statements and consider consulting with a financial advisor to ensure their savings strategy aligns with their individual goals.

Staying informed about the latest rate changes and understanding the factors driving these changes is crucial for making informed financial decisions. Members of Canvas Credit Union are encouraged to reach out to the credit union directly with any questions or concerns regarding the rate adjustments.

As the economic landscape evolves, both financial institutions and savers must adapt to ensure a secure financial future. The changes at Canvas Credit Union are a microcosm of the dynamic forces shaping the financial world.