Combined Federal State Filing Cf Sf Program

Immediate action is required: The Combined Federal/State Filing (CF/SF) Program is undergoing crucial changes impacting tax-exempt organizations nationwide. Failing to comply with these updates could result in penalties and loss of tax-exempt status.

This article provides a concise overview of the CF/SF Program, recent modifications, and essential steps organizations must take to ensure continued compliance, aiming to minimize disruption and potential repercussions.

What is the Combined Federal/State Filing (CF/SF) Program?

The CF/SF Program, administered by the IRS, allows eligible tax-exempt organizations to satisfy their annual reporting requirements to both the federal government and participating states by filing a single electronic Form 990.

This streamlines the filing process and reduces administrative burden for nonprofits. The program aims to improve data quality and consistency across federal and state levels.

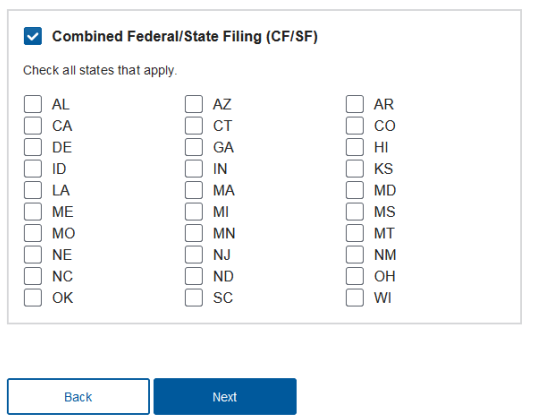

Which States Participate?

Currently, a limited number of states participate in the CF/SF Program.

These states include:

Alabama, California, Connecticut, Maine, Michigan, Minnesota, New Jersey, New Mexico, New York, North Carolina, Oregon, and Utah.

Organizations must verify participation status of each state annually as participation can change.

Recent Changes and Updates

The IRS has implemented several updates to the CF/SF Program in recent years, primarily focusing on data submission formats and required information.

A critical change involves the adoption of the XML (Extensible Markup Language) format for data transmission.

This necessitates that organizations utilize software compatible with this format or engage a service provider that does.

Mandatory Electronic Filing

Electronic filing is now mandatory for most tax-exempt organizations.

Paper submissions are generally no longer accepted. Exceptions may apply to very small organizations in specific circumstances, but these are increasingly rare.

Schedule H Requirements

Organizations operating hospitals must pay close attention to Schedule H (Form 990), Hospitals.

This schedule has specific requirements related to community benefit reporting, charity care, and billing practices. Data submitted through CF/SF must accurately reflect this information.

Increased Scrutiny on Executive Compensation

The IRS is placing greater emphasis on transparency and justification of executive compensation.

Organizations must ensure that compensation arrangements are reasonable and documented according to applicable regulations, with proper disclosures included in Form 990 filings.

Who is Affected?

The CF/SF Program affects all tax-exempt organizations recognized under IRC Section 501(c) that are required to file Form 990 annually and operate in participating states.

This includes public charities, private foundations, and other nonprofit entities.

Organizations with revenue above a certain threshold (generally $50,000) are required to file Form 990. Smaller organizations may be required to file Form 990-N (e-Postcard).

When are Filings Due?

The filing deadline for Form 990 is the 15th day of the fifth month following the end of the organization's accounting period.

For organizations with a calendar year-end, the deadline is May 15th.

Failure to file on time can result in significant penalties.

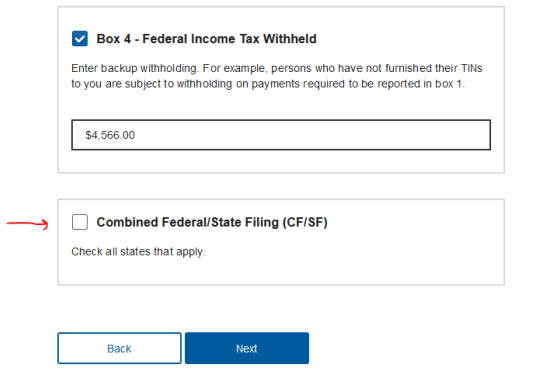

How to Comply with CF/SF Requirements

Organizations must take several steps to ensure compliance with the CF/SF Program.

First, verify that the organization operates in a participating state.

Second, ensure you are using software or a service provider that supports XML format.

Third, carefully review all data before submission to ensure accuracy and completeness.

Seek Professional Guidance

Given the complexity of tax regulations, it's strongly recommended that organizations seek guidance from qualified tax professionals.

Enrolled Agents, CPAs, and attorneys specializing in nonprofit law can provide valuable assistance in navigating the CF/SF Program requirements and ensuring compliance.

Consequences of Non-Compliance

Failure to comply with the CF/SF Program can have serious consequences.

Penalties for late filing or inaccurate reporting can be substantial. Repeated non-compliance may result in the revocation of the organization's tax-exempt status.

Loss of tax-exempt status can severely impact an organization's ability to raise funds and operate effectively.

Next Steps and Ongoing Developments

Organizations should immediately review their current filing procedures and ensure they are aligned with the latest CF/SF requirements. Monitor the IRS website for updates and changes to the program.

The IRS frequently publishes guidance and FAQs related to Form 990 filing requirements.

Proactive measures are essential to avoid penalties and maintain compliance.