Corporations Benefit From Securities Markets Primarily By

Imagine a bustling marketplace, not filled with fruits and vegetables, but with ideas, investments, and dreams. Billions of dollars exchange hands daily, shaping the landscape of our economy. This isn't a scene from a futuristic movie, it's the reality of the securities market, a space where corporations and investors meet, and fortunes are both made and lost.

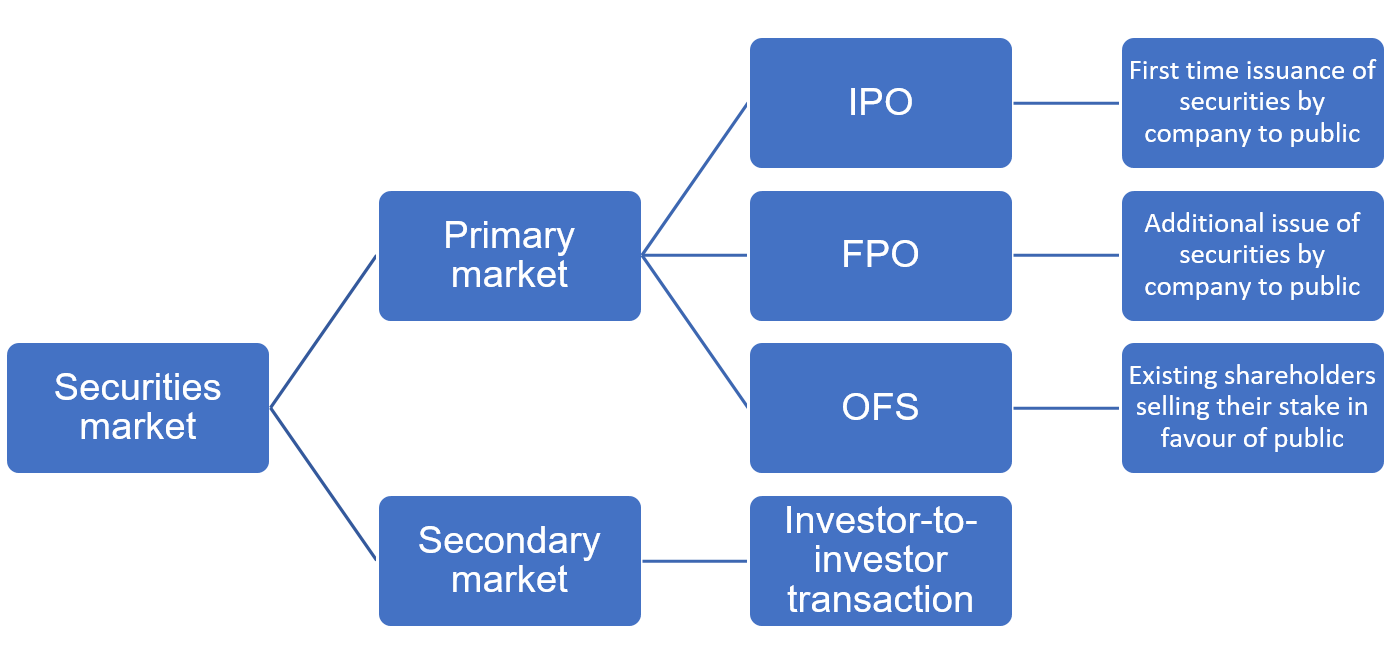

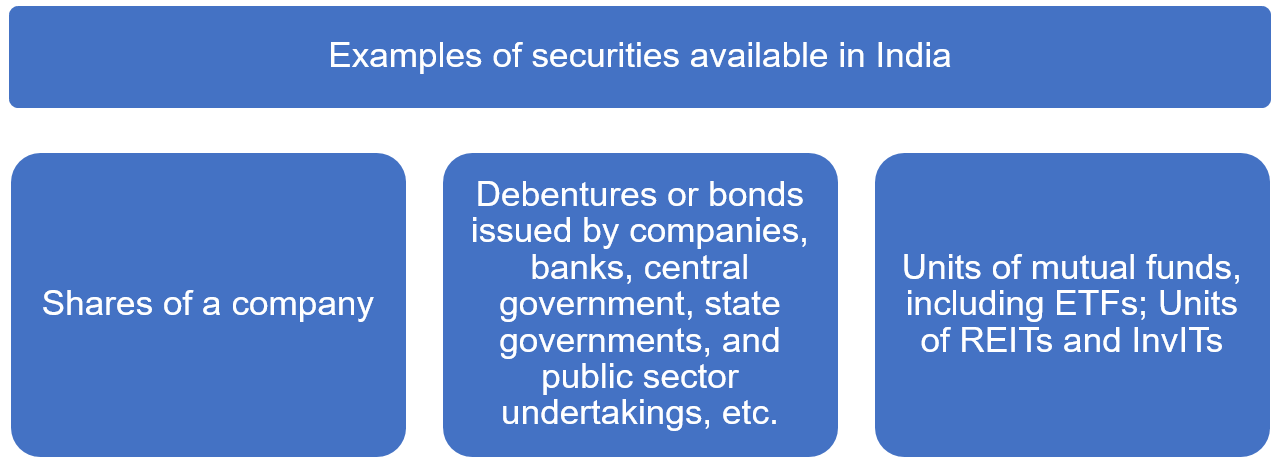

At the heart of this intricate system lies a fundamental question: how do corporations primarily benefit from these securities markets? The answer is multifaceted, but it boils down to access to capital. Through the issuance of stocks and bonds, companies can raise the funds necessary to fuel growth, innovation, and expansion, all while sharing ownership or promising future returns to investors.

The Lifeblood of Corporate Growth

The securities market serves as the lifeblood of corporate growth, offering avenues for funding that would otherwise be inaccessible. It allows companies to tap into a vast pool of capital from individual and institutional investors, both domestically and internationally.

Consider a young, ambitious tech startup with a groundbreaking idea. Traditional bank loans might be difficult to secure due to the inherent risks associated with new ventures. By issuing stock through an Initial Public Offering (IPO), the startup can raise substantial capital to develop its product, expand its team, and market its innovation to the world.

Funding Expansion and Innovation

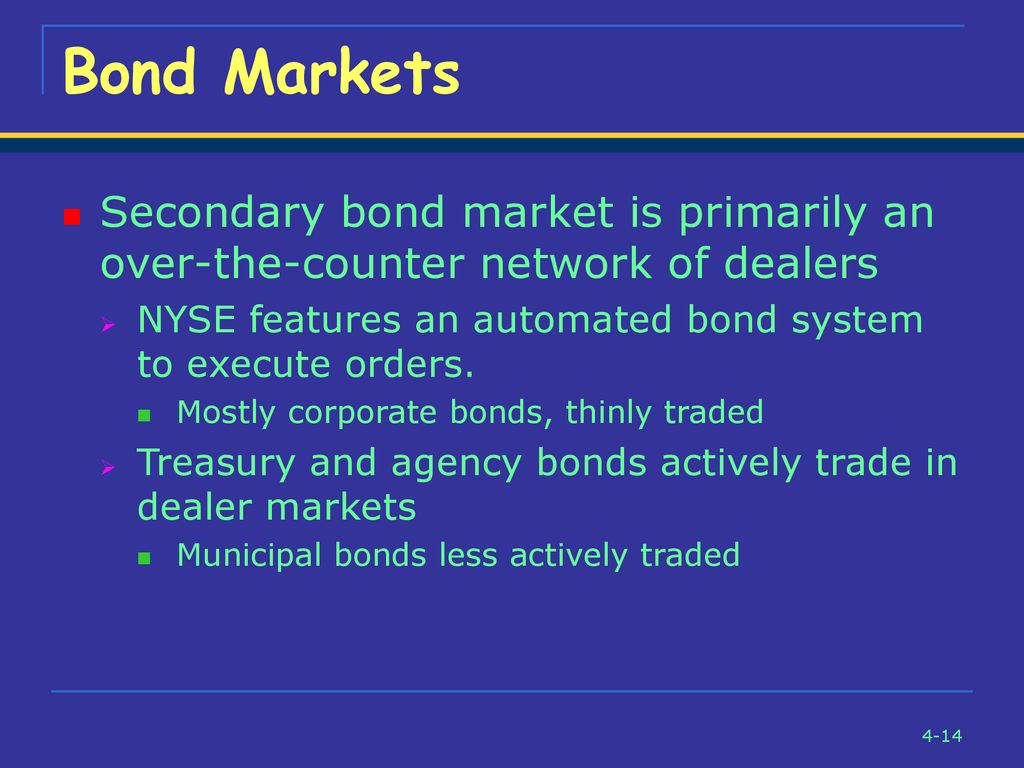

Established corporations also heavily rely on securities markets for funding major initiatives. When a company wants to build a new factory, acquire a competitor, or invest in research and development, issuing bonds becomes a viable option.

Bonds represent a debt instrument where investors lend money to the corporation in exchange for regular interest payments and the eventual return of the principal. This allows corporations to secure large sums of capital without diluting existing ownership, providing flexibility and control.

According to a 2023 report by the Securities Industry and Financial Markets Association (SIFMA), corporations issued over $10 trillion in bonds globally to fund various projects, highlighting the significance of this funding mechanism. These funds were crucial in maintaining operations and fostering advancements across several industries.

Building Credibility and Visibility

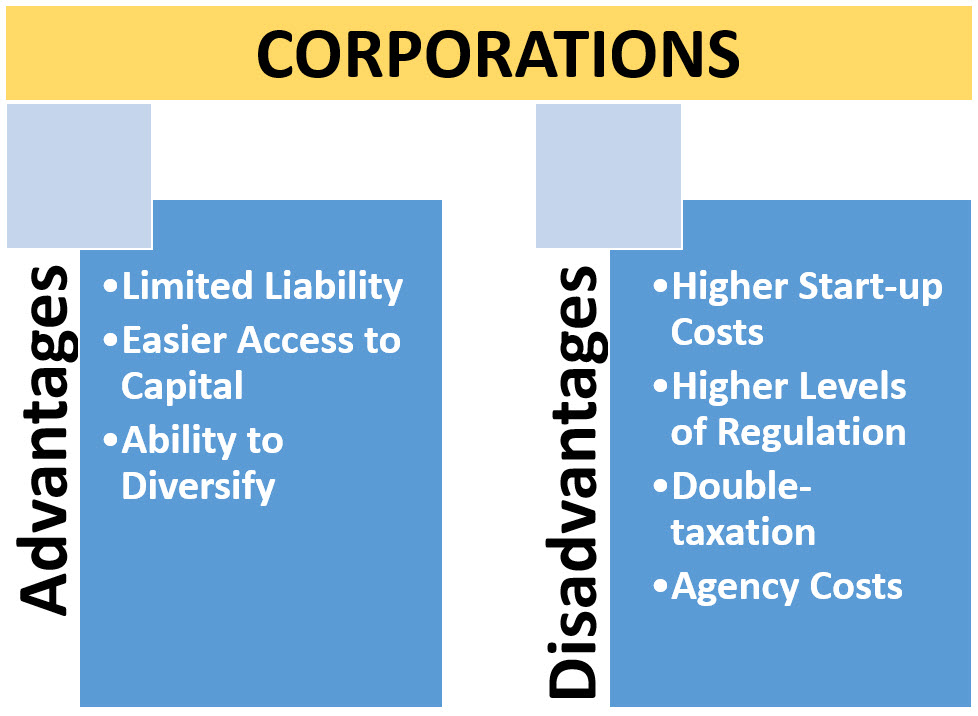

Beyond providing access to capital, participation in securities markets enhances a corporation's credibility and visibility. Becoming a publicly traded company subjects it to stricter regulatory oversight and reporting requirements.

This increased transparency can build trust with customers, suppliers, and potential business partners. Investors scrutinize financial statements, management practices, and future growth prospects, further incentivizing corporations to maintain high standards of corporate governance.

A well-managed, publicly traded company often gains a competitive edge over its privately held counterparts. This is because it is easier to attract and retain talent, negotiate favorable terms with suppliers, and secure strategic partnerships. These factors are important in sustaining long-term prosperity.

Enhanced Reputation and Brand Value

The process of going public and maintaining a strong presence in the securities market can significantly boost a company's reputation and brand value. Positive media coverage and investor confidence can elevate the company's profile, making it more appealing to consumers and employees alike.

A strong stock performance often correlates with enhanced brand perception. When a company's stock price rises, it signals to the market that investors believe in its future prospects. This positive sentiment can translate into increased sales and customer loyalty.

Conversely, negative news or poor financial performance can lead to a decline in stock price, potentially damaging the company's reputation and leading to a loss of investor confidence. This underscores the importance of consistent performance and transparent communication with stakeholders.

Navigating the Complexities and Risks

While the benefits of accessing securities markets are undeniable, corporations must also navigate the complexities and risks involved. The process of issuing stocks and bonds requires significant expertise and compliance with stringent regulatory requirements.

Fluctuations in market conditions, investor sentiment, and economic cycles can impact the value of a company's stock price, potentially creating volatility and uncertainty. Corporations must carefully manage their financial performance and communication strategies to mitigate these risks.

Moreover, the pressure to meet short-term earnings targets can sometimes incentivize corporations to prioritize profits over long-term sustainability and ethical considerations. It is essential for corporate leaders to maintain a balanced perspective and prioritize responsible corporate citizenship.

The Importance of Responsible Investing

The rise of socially responsible investing (SRI) has further emphasized the importance of environmental, social, and governance (ESG) factors. Investors are increasingly seeking companies that demonstrate a commitment to sustainability, ethical practices, and responsible corporate governance.

Corporations that prioritize ESG factors are more likely to attract long-term investors and build a stronger reputation with stakeholders. Failing to address these issues can lead to negative publicity, decreased investor confidence, and reputational damage.

According to a 2024 report by MSCI, companies with strong ESG ratings tend to outperform their peers over the long term, highlighting the financial benefits of responsible investing. This signals a fundamental shift in investor priorities, emphasizing the importance of aligning corporate values with societal needs.

A Symbiotic Relationship

Ultimately, the relationship between corporations and securities markets is symbiotic. Corporations rely on the markets for capital, visibility, and credibility, while investors seek opportunities to generate returns and support innovative businesses.

When this system functions effectively, it fuels economic growth, creates jobs, and fosters innovation. However, it is crucial to maintain a balance between fostering innovation and ensuring responsible corporate behavior.

The securities markets are not merely a tool for financial gain, they are a reflection of our collective aspirations and values. By investing in companies that prioritize sustainability, ethical practices, and long-term growth, we can build a more prosperous and equitable future for all.

![Corporations Benefit From Securities Markets Primarily By Economics 12 [Stock Market] Introduction. What is a stock? A stock](https://images.slideplayer.com/26/8807865/slides/slide_8.jpg)