H And R Block Emerald Advance Requirements

For millions of Americans facing immediate financial needs during tax season, the promise of a quick loan can be alluring. H&R Block's Emerald Advance, a line of credit offered during the tax season, is often touted as a solution, but understanding its requirements is crucial for potential borrowers.

This article delves into the eligibility criteria for the H&R Block Emerald Advance, outlining the key qualifications and factors that determine approval.

Understanding the Emerald Advance

The Emerald Advance is a line of credit, not a refund advance, offered by H&R Block through its banking partner, Pathward, N.A. It's designed to provide access to funds before a tax refund arrives. The availability period typically runs from November to February.

Key Eligibility Requirements

Several factors determine eligibility for the Emerald Advance.

A primary requirement is applying in person at an H&R Block office. Borrowers must complete the application process with an H&R Block tax professional.

Creditworthiness is a critical factor. Pathward, N.A., conducts a credit check to assess the applicant's credit history and determine their ability to repay the loan.

A qualifying tax return is essential. Applicants must have a tax return prepared and filed by H&R Block. The size and complexity of the return can influence the loan amount offered.

Proof of income and identity are also necessary. Applicants will need to provide documentation to verify their income and identity.

Prior loan history with H&R Block, specifically relating to previous Emerald Advance lines of credit, can impact approval. Successful repayment of past advances may improve chances, while defaults could hinder approval.

Detailed Look at Specific Criteria

Credit score plays a significant role. While H&R Block doesn't explicitly state a minimum credit score requirement, a good to excellent credit score generally increases the likelihood of approval.

The income requirements are dependent on the amount the customer wants to borrow and their current financial situation.

Tax return requirements generally include filing a return with a certain level of complexity. Returns with significant deductions or credits might be favored. However, the specifics change every year.

The loan amount approved varies depending on the applicant's creditworthiness, income, and tax situation. Loan amounts typically range from $300 to $1,000. These amounts may be subject to change.

Pathward, N.A. determines the interest rates and fees associated with the Emerald Advance. These costs can significantly impact the overall cost of borrowing. Borrowers should review the terms and conditions carefully before accepting the loan.

According to H&R Block's website and related resources, the process also includes confirming the applicant's identity and ensuring they meet all regulatory requirements for lending.

The Application Process: A Step-by-Step Guide

The first step involves scheduling an appointment with an H&R Block tax professional. This can be done online or by phone.

During the appointment, the tax professional will prepare the applicant's tax return. The applicant will need to provide all necessary tax documents.

Once the tax return is prepared, the applicant can apply for the Emerald Advance. The tax professional will guide the applicant through the application process.

Pathward, N.A. will review the application and conduct a credit check. The approval process can take some time.

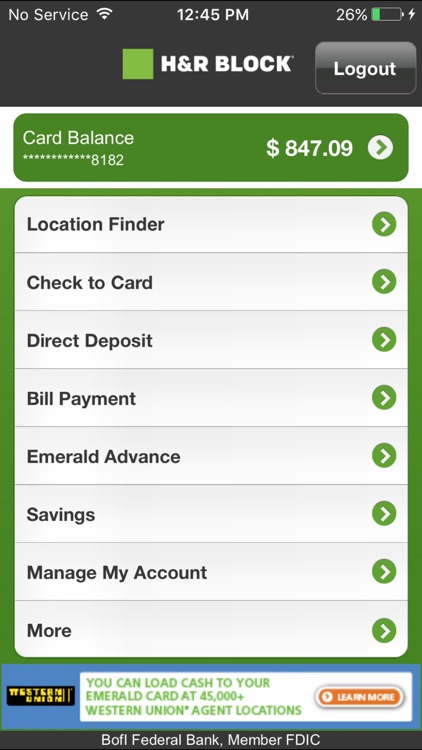

If approved, the funds are typically loaded onto an Emerald Card, a reloadable prepaid card issued by H&R Block.

Potential Impact and Considerations

The Emerald Advance can provide a quick source of funds for individuals facing immediate financial needs. However, it's crucial to weigh the benefits against the costs.

Interest rates and fees can be substantial, making the Emerald Advance a potentially expensive form of credit. Borrowers should explore alternative options, such as personal loans or credit cards, to compare costs.

The Emerald Advance can impact credit scores. Responsible borrowing and repayment can help build credit, while missed payments can damage credit.

For some, the convenience of accessing funds quickly outweighs the costs. For others, the high interest rates make it an unattractive option. The decision ultimately depends on individual circumstances and financial priorities.

Consumer advocacy groups often caution against relying on tax refund-related financial products. They emphasize the importance of financial literacy and responsible borrowing.

The requirements and terms of the Emerald Advance are subject to change. Potential borrowers should verify the latest information with H&R Block before applying. Tax laws and financial products are constantly changing, so it is crucial to stay updated.

Ultimately, understanding the Emerald Advance requirements empowers individuals to make informed financial decisions. Borrowers should carefully evaluate their needs and options before committing to the loan.