Cost Changes In Proportion To Changes In Volume Of Activity

Businesses across various sectors are grappling with the intricate relationship between activity volume and cost fluctuations. The phenomenon, where costs shift in direct proportion to changes in production or service output, presents both opportunities and challenges for financial planning and operational efficiency.

Understanding this cost behavior is crucial for accurate budgeting, pricing strategies, and overall profitability. This article delves into the dynamics of costs changing in proportion to activity volume, examining its implications for businesses and consumers alike.

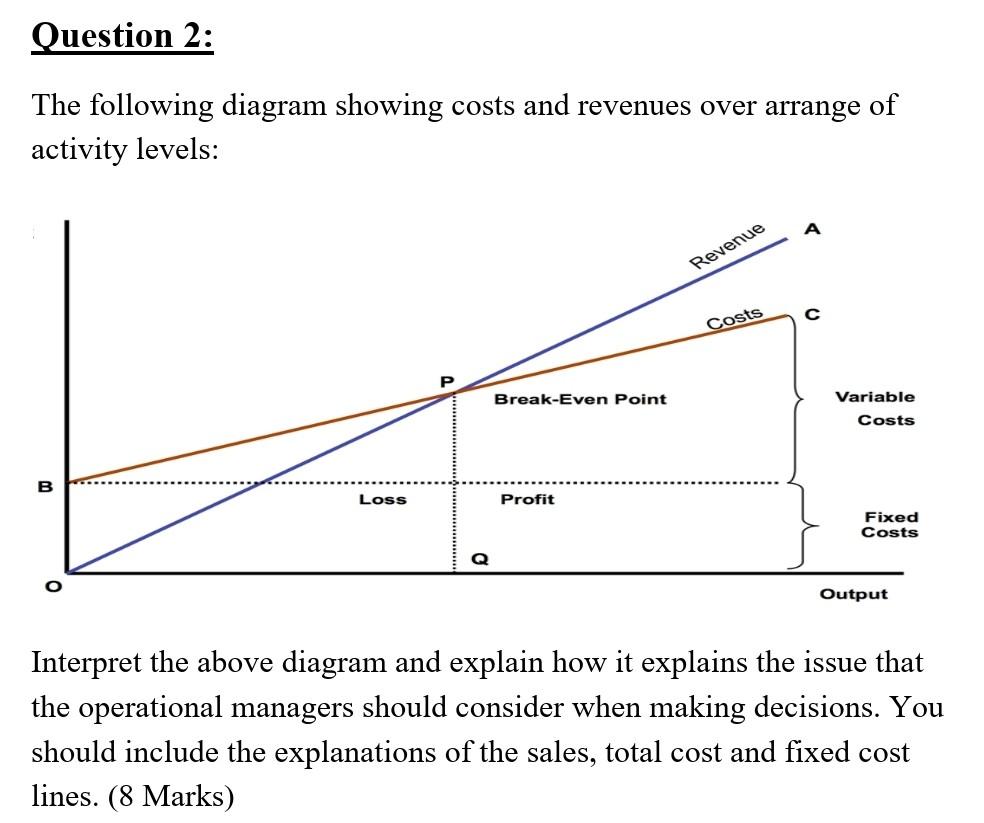

Understanding Proportional Cost Changes

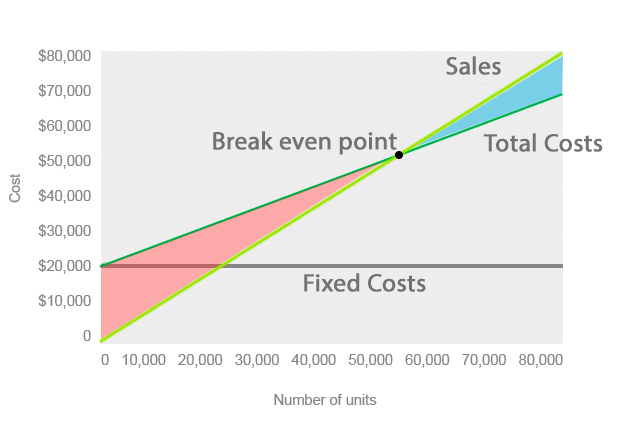

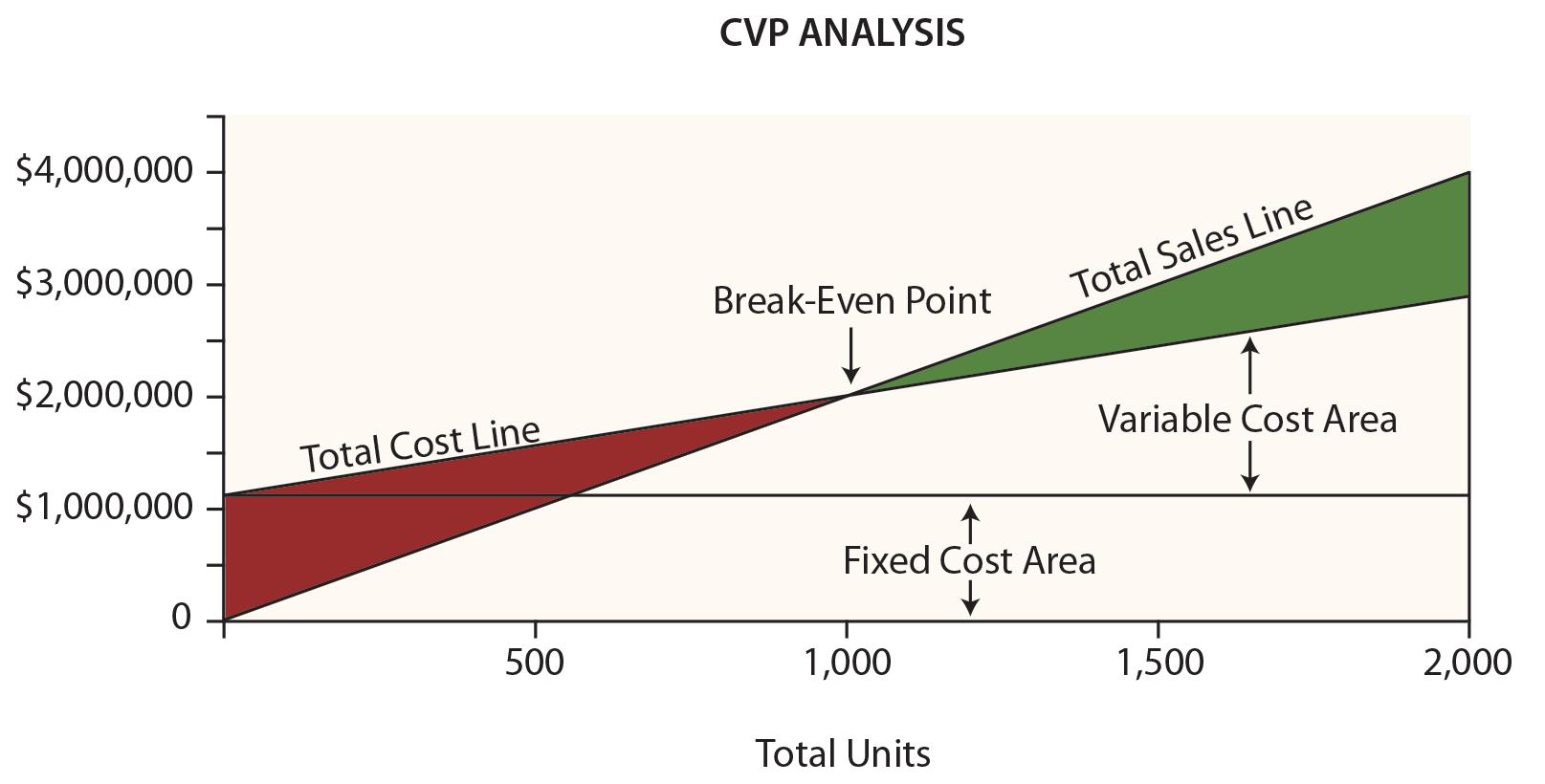

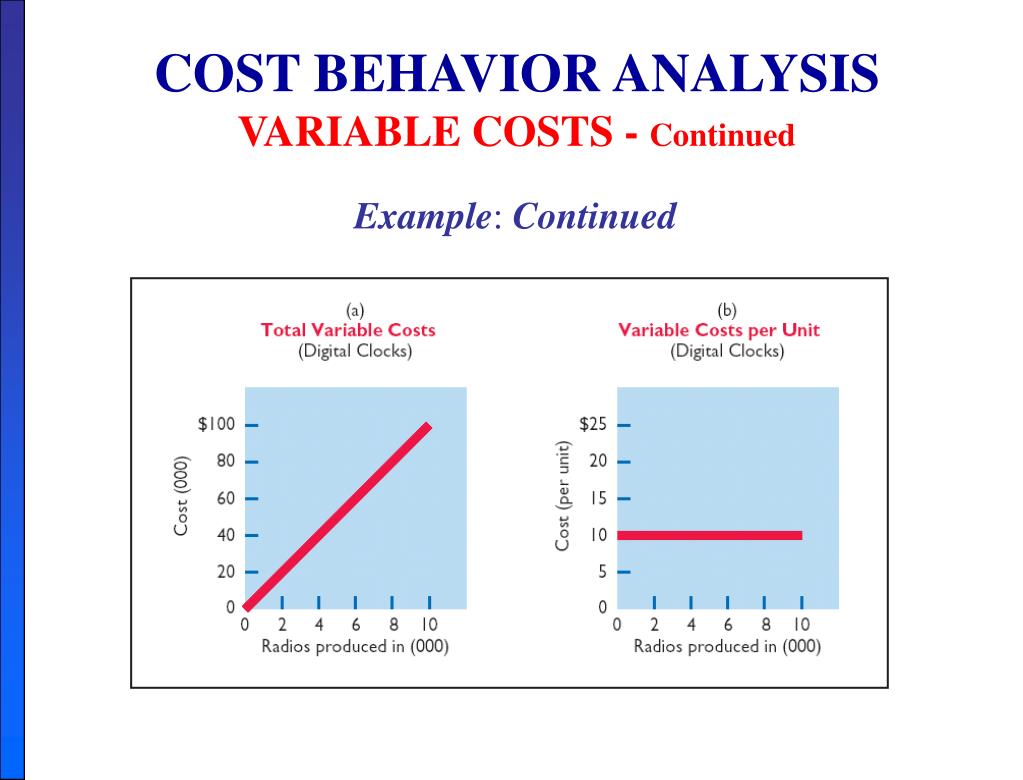

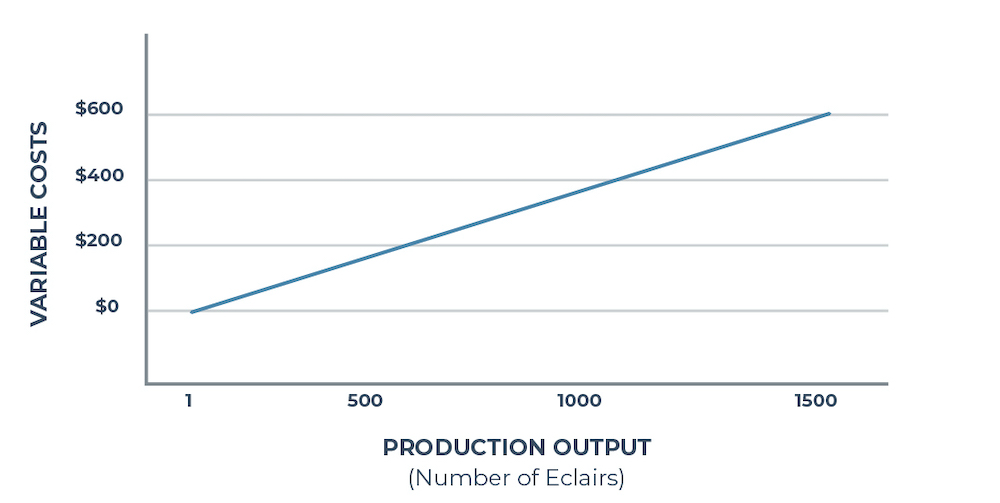

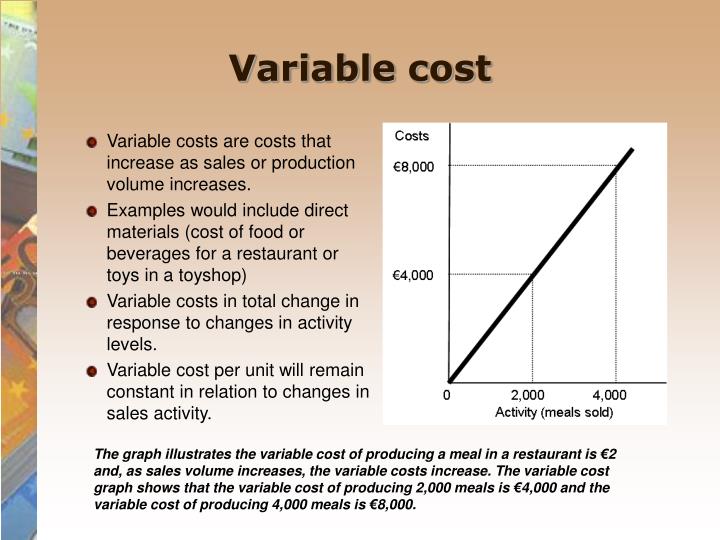

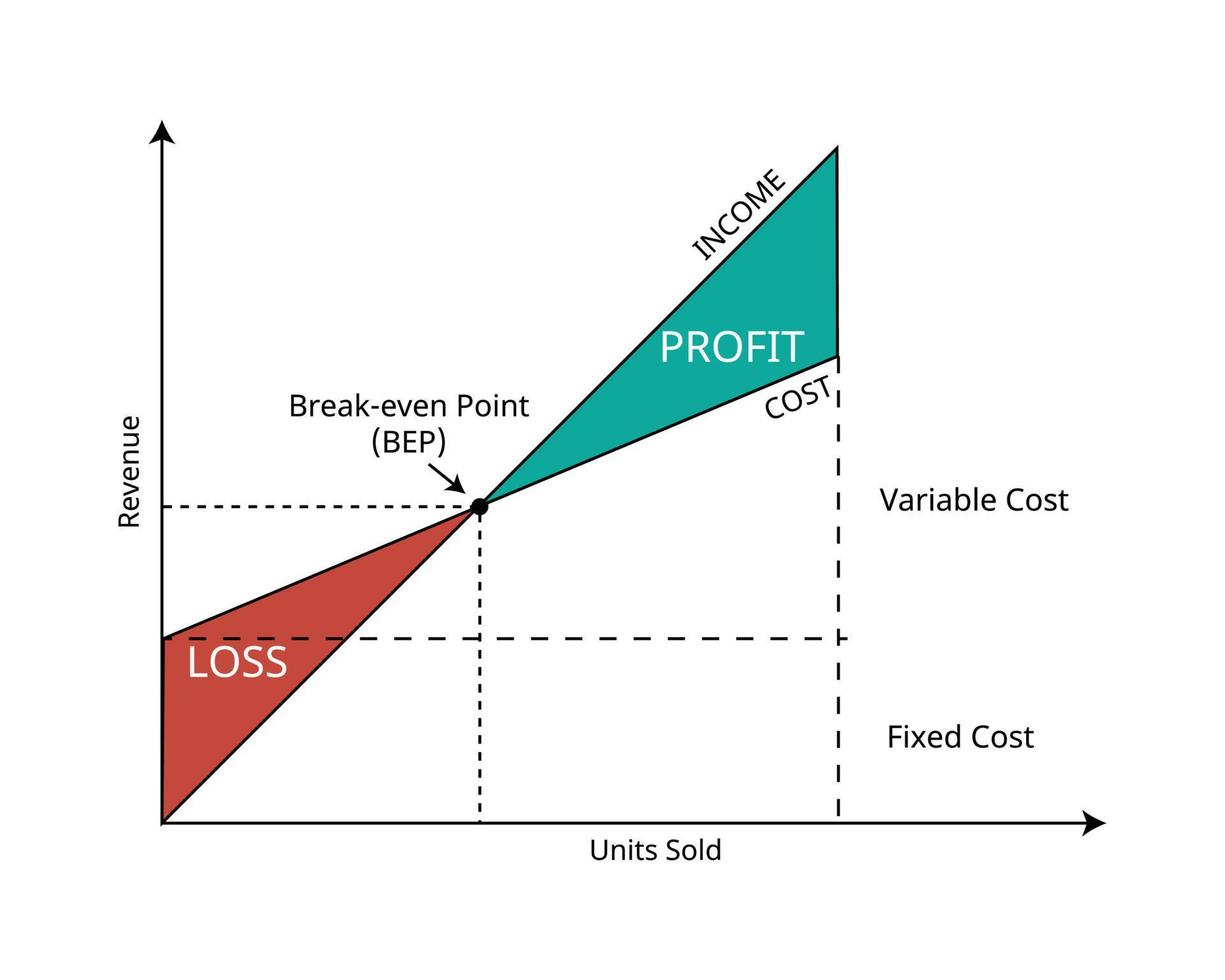

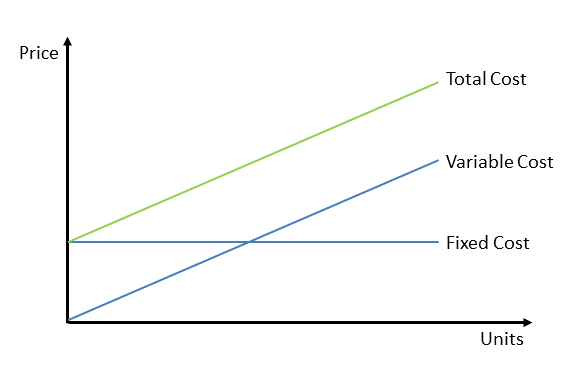

Costs that change in direct proportion to the volume of activity are often referred to as variable costs. These costs fluctuate with every unit of production or service provided. This concept stands in contrast to fixed costs, which remain relatively constant regardless of activity levels, at least within a relevant range.

Examples of variable costs include raw materials, direct labor (paid on an hourly or per-unit basis), and sales commissions. As production increases, so too does the expenditure on these items. Conversely, a decrease in activity leads to a corresponding reduction in these costs.

The Significance of Variable Costs

The ability to identify and manage variable costs effectively is essential for businesses of all sizes. This understanding enables informed decision-making regarding pricing, production levels, and resource allocation.

According to a report by the Institute of Management Accountants (IMA), "a clear grasp of cost behavior is fundamental to effective cost management and profitability analysis." Properly managing variable costs, as highlighted in their study, can directly impact the bottom line.

Businesses can leverage this knowledge to set competitive prices that cover variable costs and contribute towards covering fixed costs and generating profit. They can also optimize production levels to minimize waste and maximize efficiency.

Examples Across Industries

The principle of proportional cost changes manifests differently across various industries. In manufacturing, increased production directly translates to higher costs for raw materials like steel, plastic, or electronic components.

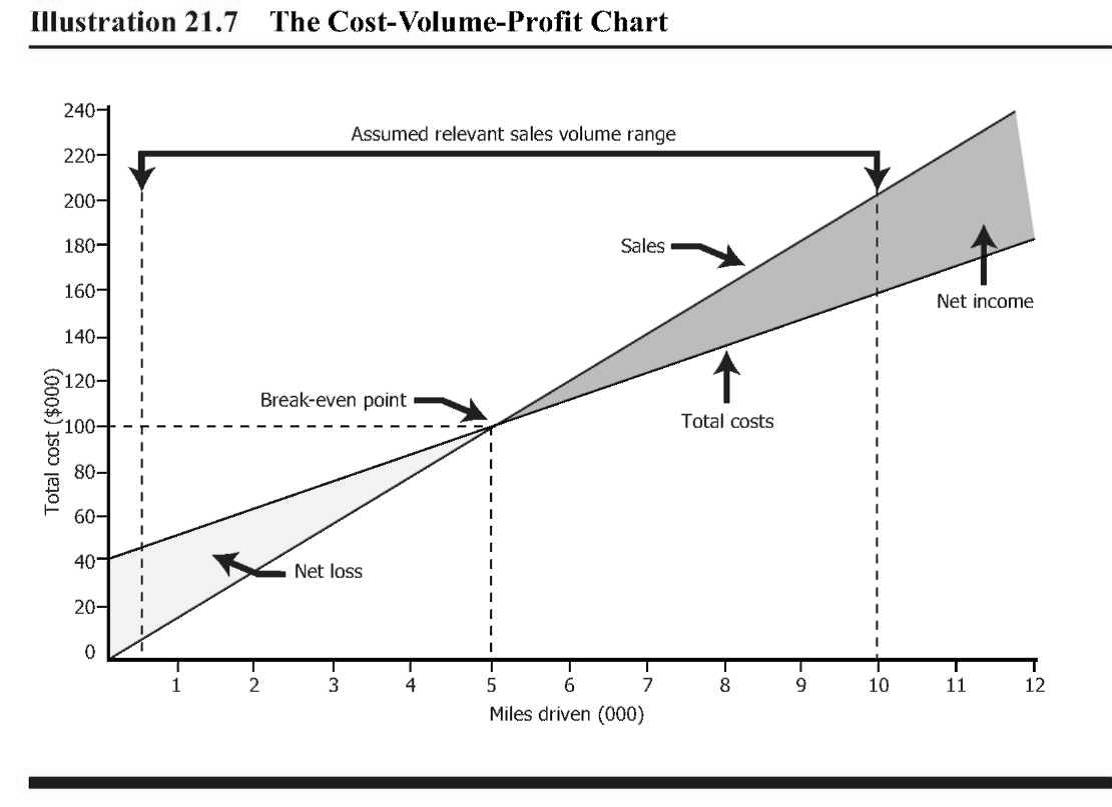

For a transportation company, fuel costs represent a significant variable expense. As the number of miles driven increases, so does the consumption of fuel and associated costs.

In the retail sector, sales commissions paid to employees are a prime example. Higher sales volumes result in greater commission payouts, directly proportional to the revenue generated.

The hospitality industry also experiences this. An increase in hotel occupancy rates leads to higher costs for cleaning supplies, laundry services, and guest amenities.

Impact and Considerations

The relationship between activity volume and cost has a significant impact on budgeting and forecasting. Accurate predictions of variable costs are critical for creating realistic financial projections.

However, certain complexities can arise. Economies of scale, for example, may lead to slight decreases in per-unit variable costs as production volumes increase, due to bulk purchasing discounts or more efficient resource utilization.

Conversely, constraints such as limited access to raw materials or increased demand for skilled labor can cause variable costs to rise disproportionately at higher activity levels. These factors must be considered when predicting cost behavior.

Furthermore, the nature of the product or service can influence the extent to which costs change proportionally. A product with complex assembly requirements might see a less-than-proportional increase in labor costs due to specialized skills and experience. Deloitte's recent analysis noted, "The interaction between different cost components is a critical area for further scrutiny during business modeling."

Challenges and Opportunities

One major challenge is accurately identifying and separating variable costs from fixed costs. In some cases, costs may exhibit a semi-variable behavior, with a fixed component and a variable component.

For instance, a sales representative's compensation might include a base salary (fixed) plus a commission on sales (variable). Accurately attributing these costs is crucial for effective management.

Opportunities lie in using this understanding to optimize resource allocation, negotiate better supplier contracts, and improve production efficiency. By focusing on minimizing variable costs, businesses can improve their competitive advantage.

Technological advancements, such as automation and process optimization, can also help to reduce variable costs over time. However, these investments often require significant upfront capital expenditures.

Conclusion

The principle of costs changing in proportion to activity volume is a fundamental concept in business management. A clear understanding of this relationship allows for more effective financial planning, resource allocation, and pricing strategies.

While complexities and nuances exist, effectively managing variable costs is essential for long-term profitability and competitiveness in a dynamic marketplace. Continuous monitoring and analysis of cost behavior is paramount for making informed decisions and adapting to changing market conditions, as outlined by PwC in their annual CFO survey.