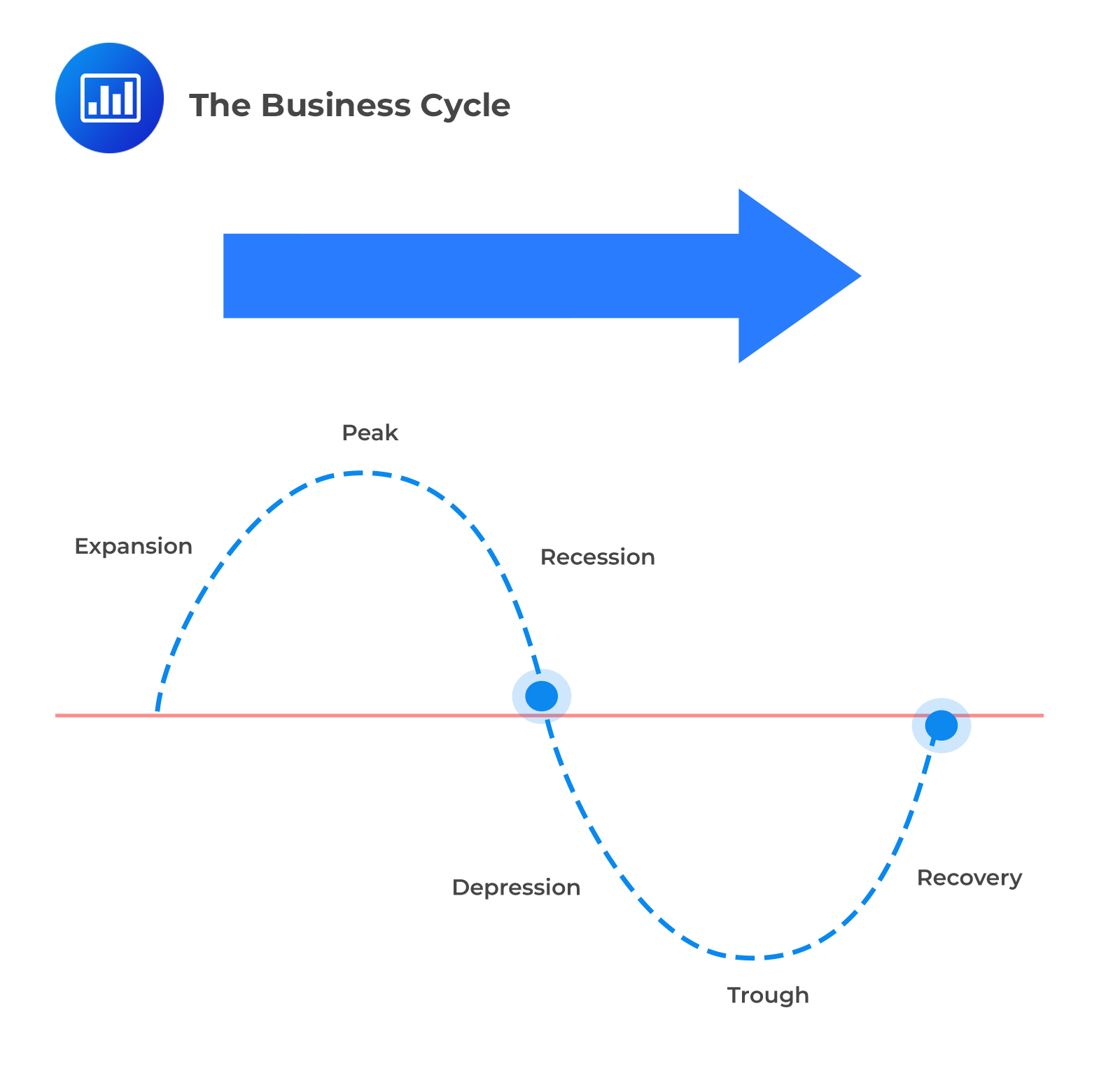

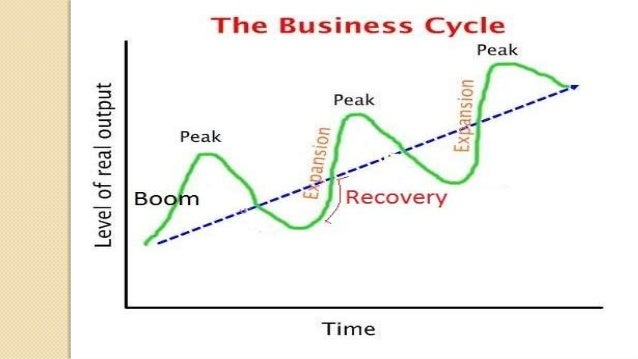

Current Phase Of The Business Cycle

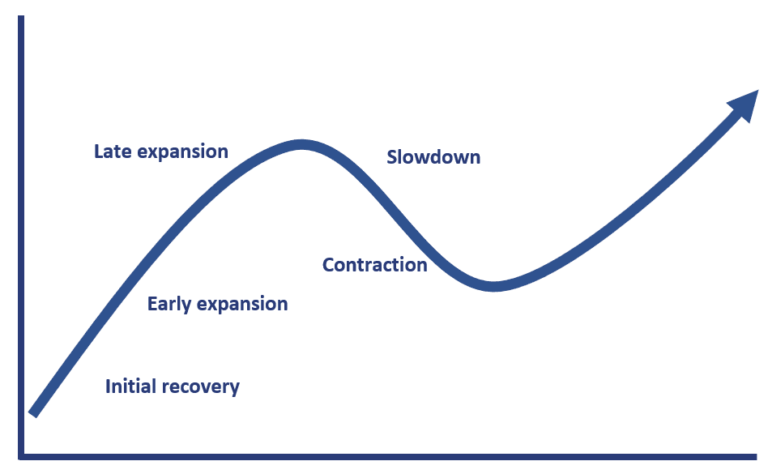

Whispers of recession are growing louder, but the economic landscape remains a complex tapestry of resilience and vulnerability. Economists are locked in a fierce debate: are we already in a recession, teetering on the brink, or experiencing a slowdown within an ongoing expansion?

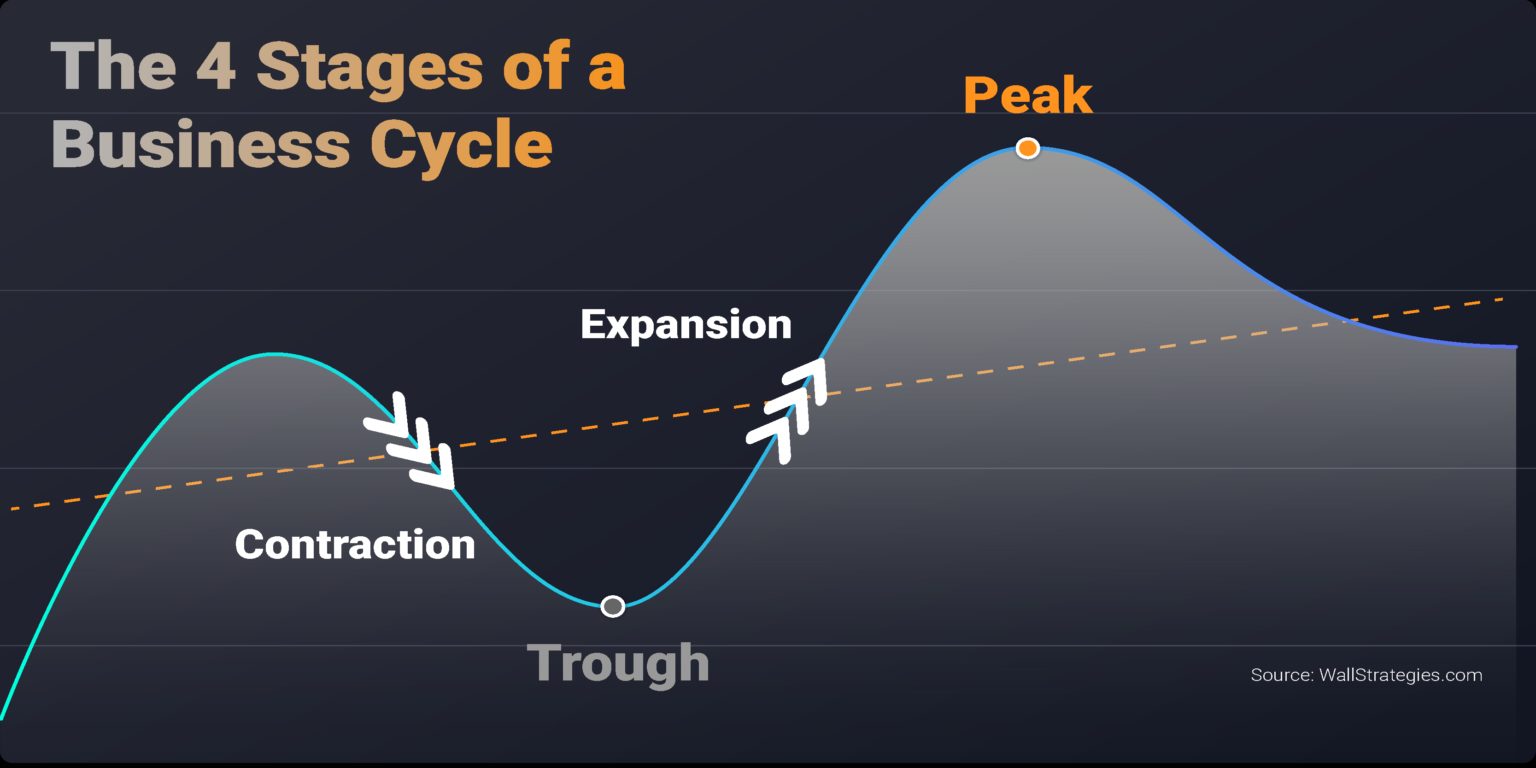

The current phase of the business cycle is characterized by slowing growth, persistent inflation, and rising interest rates, creating significant uncertainty for businesses and consumers alike. Understanding the nuances of this economic environment is crucial for informed decision-making.

The Great Debate: Recession or Slowdown?

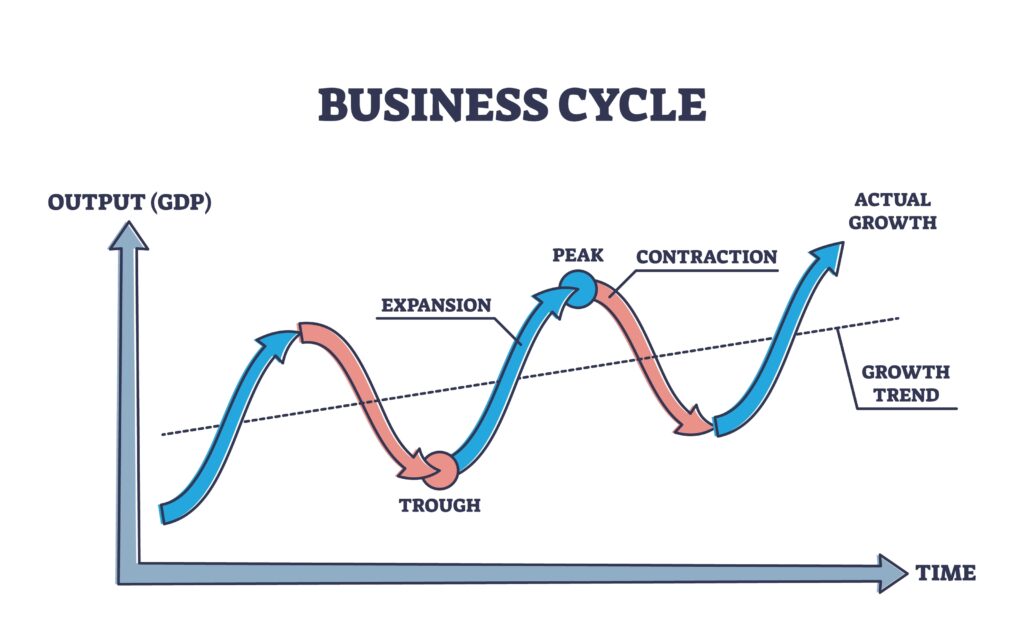

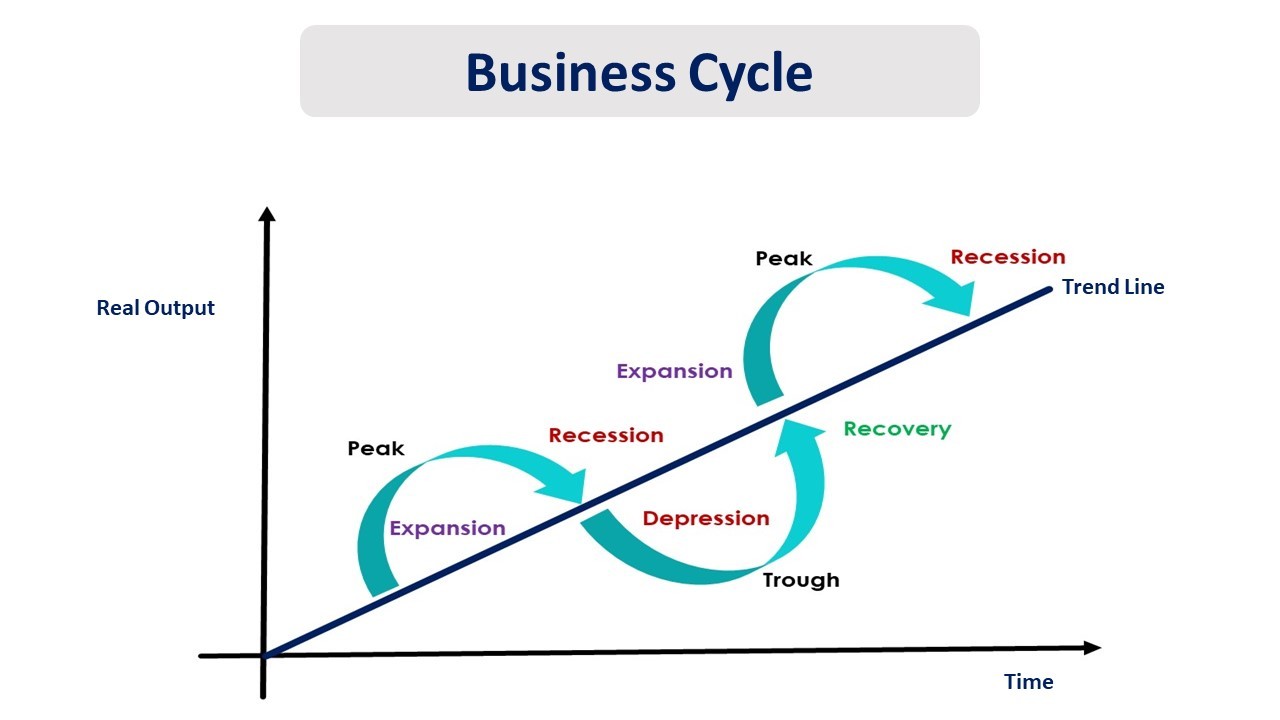

The traditional definition of a recession – two consecutive quarters of negative GDP growth – was technically met earlier this year. However, many economists argue that this definition is too simplistic in the current context.

The labor market, a key indicator of economic health, remains surprisingly strong. The Bureau of Labor Statistics reports unemployment rates near historic lows, suggesting continued demand for workers.

Federal Reserve Chairman Jerome Powell has repeatedly emphasized the strength of the labor market as a counterargument to the recession narrative. This complicates the picture considerably.

Arguments for a Recession

Despite the robust labor market, several factors point toward a potential recession. Inflation, while showing signs of easing, remains significantly above the Federal Reserve's target of 2%.

The Federal Reserve's aggressive interest rate hikes, intended to curb inflation, are also dampening economic activity. Rising interest rates make borrowing more expensive for businesses and consumers, leading to decreased investment and spending.

The housing market, a key sector of the economy, has also cooled significantly in response to rising mortgage rates. This slowdown has ripple effects throughout the economy, affecting construction, real estate, and related industries.

"We are seeing signs of a slowdown, but it's unclear whether this will translate into a full-blown recession," said Dr. Anya Sharma, an economist at the Peterson Institute for International Economics.

Arguments Against a Recession

Those who argue against a recession point to the strength of consumer spending, fueled by pent-up demand and savings accumulated during the pandemic. While inflation has eroded purchasing power, consumers are still spending, albeit more cautiously.

Business investment, while slowing, remains relatively healthy. Companies are still investing in technology and equipment, suggesting confidence in the long-term outlook.

Furthermore, the manufacturing sector, although facing challenges, has shown some resilience. Government spending on infrastructure projects is also providing a boost to economic activity.

Key Economic Indicators to Watch

Several economic indicators will be crucial in determining the trajectory of the economy in the coming months. These include inflation data, employment reports, and consumer spending figures.

The Consumer Price Index (CPI), a measure of inflation, will be closely watched for further signs of easing price pressures. Employment reports will provide insights into the health of the labor market.

Retail sales data will indicate the strength of consumer spending. These data points will collectively paint a clearer picture of the economic outlook.

The Role of the Federal Reserve

The Federal Reserve's monetary policy decisions will play a crucial role in shaping the economic landscape. The central bank faces a delicate balancing act: curbing inflation without triggering a recession.

Further interest rate hikes are likely, but the pace and magnitude of these hikes will depend on incoming economic data. The Federal Reserve is closely monitoring inflation, employment, and financial market conditions.

Looking Ahead: Uncertainty Prevails

The economic outlook remains highly uncertain. The interplay of inflation, interest rates, and consumer behavior will determine the future direction of the economy.

Businesses and consumers should prepare for continued volatility. Adapting to changing economic conditions and making informed financial decisions will be essential for navigating the challenges ahead.

The current phase of the business cycle presents both risks and opportunities. Prudent planning and careful monitoring of economic indicators will be crucial for success in this complex environment. The debate continues, and the future remains to be written.

:max_bytes(150000):strip_icc()/phasesofthebusinesscycle-c7cb7a3ce6894e86a3e44d5b0fe4d5e2.jpg)

/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)

:max_bytes(150000):strip_icc()/businesscycle-013-ba572c5d577c4bd6a367177a02c26423.png)