Does Breaking A Lease Affect Your Credit Score

Breaking a lease agreement is a situation many renters face, but the repercussions can extend beyond just losing a security deposit. One of the most pressing concerns for tenants considering this move is whether breaking a lease impacts their credit score. The answer, unfortunately, isn't a simple yes or no, but hinges on a complex interplay of factors.

Understanding this interaction is crucial for renters to make informed decisions and mitigate potential financial damage. This article explores the circumstances under which breaking a lease might affect your credit score, providing clarity on a frequently misunderstood aspect of renting.

The Nuances of Lease Agreements and Credit Reports

A lease is a legally binding contract between a landlord and a tenant. It outlines the responsibilities of both parties, including the duration of the tenancy and the amount of rent due each month.

Credit scores, on the other hand, are numerical representations of an individual's creditworthiness. They are primarily based on information reported to the three major credit bureaus: Equifax, Experian, and TransUnion.

Rent payments typically are not reported to credit bureaus, meaning that simply paying rent on time won't necessarily improve your credit score. Similarly, breaking a lease doesn't automatically trigger a negative credit score impact.

When Breaking a Lease Impacts Your Credit Score

The key to understanding the potential credit score impact lies in whether the broken lease results in debt that is reported to a credit bureau or sent to a collection agency.

Unpaid Rent and Collection Agencies

If you break a lease and fail to pay the rent owed, the landlord may attempt to recover the money. This can be done through legal action or by selling the debt to a collection agency.

If the debt is sold to a collection agency, the agency will likely report the debt to the credit bureaus. This is where your credit score can be significantly affected.

A collection account on your credit report can substantially lower your score, especially if it's a recent event.

Judgments and Court Orders

If the landlord sues you for the unpaid rent and wins a judgment in court, this judgment can also appear on your credit report. Judgments are public records and can be reported by credit bureaus.

Like collection accounts, a judgment can negatively impact your credit score.

The severity of the impact will depend on the scoring model used and the other information in your credit report.

Late Fees and Other Charges

Late fees associated with unpaid rent or damages to the property can also contribute to the debt owed to the landlord. If these fees are significant and remain unpaid, they can be included in the debt sent to a collection agency.

Ensure that you understand all potential charges outlined in your lease agreement to avoid unexpected debts.

Mitigating the Impact of Breaking a Lease

If you are considering breaking a lease, there are steps you can take to minimize the potential impact on your credit score.

Communicate with Your Landlord

Open communication with your landlord is crucial. Explain your situation and try to negotiate a mutually agreeable solution.

Perhaps you can find a suitable replacement tenant, which could relieve you of your financial obligations.

Subletting

Many leases allow for subletting, which means you can rent the property to another tenant while remaining legally responsible for the lease. However, you're responsible for the subtenant honoring the original lease terms.

This can be a viable option to avoid breaking the lease entirely and incurring significant financial penalties.

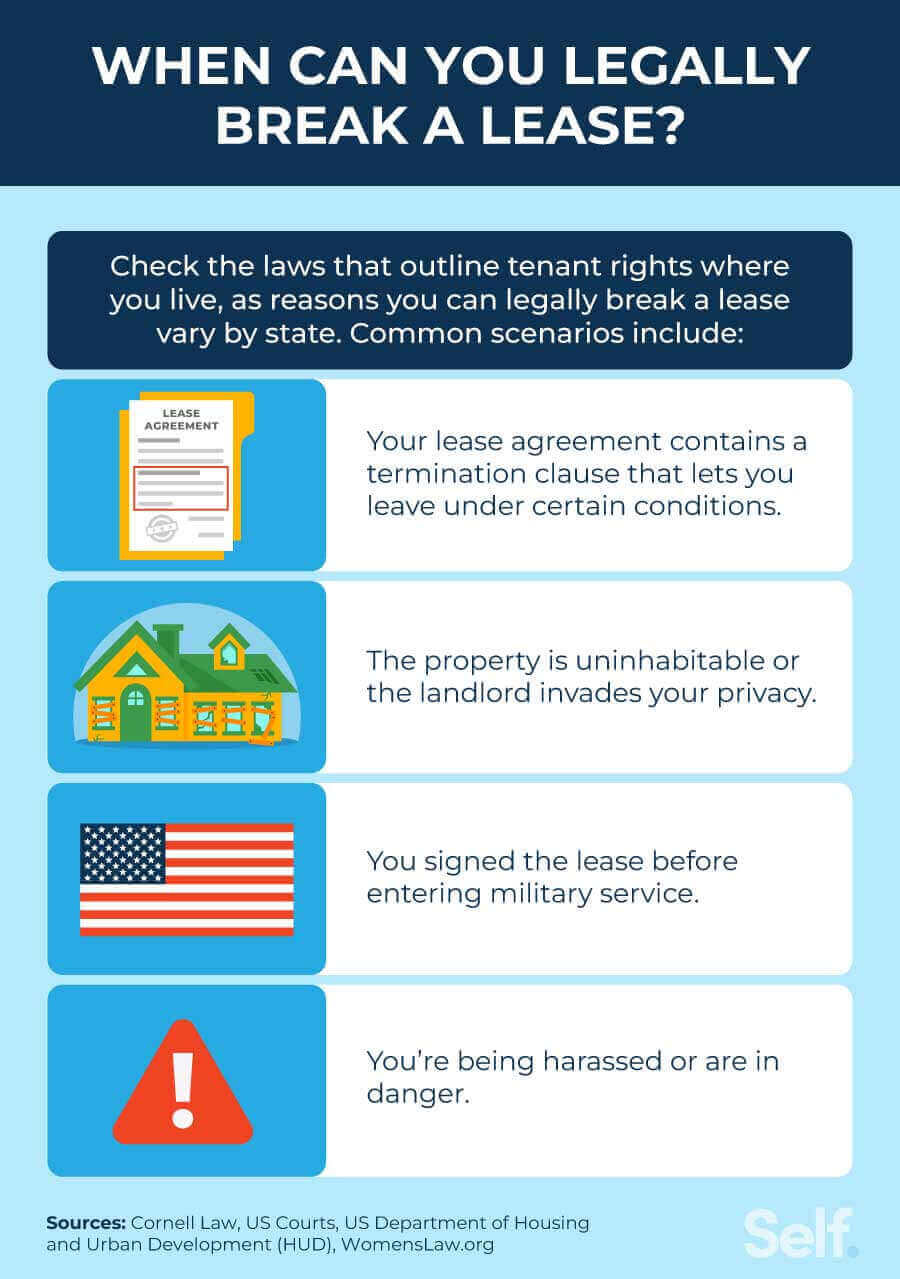

Review Your Lease Agreement

Familiarize yourself with the terms of your lease agreement regarding early termination. Some leases include clauses that allow you to break the lease under specific circumstances, such as a job relocation, for a set fee.

Settling the Debt

If you are unable to avoid owing money to your landlord, try to negotiate a payment plan. Paying off the debt, even in installments, can prevent it from being sent to a collection agency or resulting in a judgment.

Check Your Credit Report

Regularly monitor your credit report for any inaccuracies or negative entries. You are entitled to a free credit report from each of the three major credit bureaus annually through AnnualCreditReport.com.

Dispute any errors you find with the credit bureau and the reporting party.

Conclusion

Breaking a lease doesn't directly impact your credit score, but the resulting unpaid debt can lead to negative consequences, such as collection accounts or judgments. These, in turn, can significantly lower your credit score.

By understanding the potential risks and taking proactive steps to mitigate them, renters can minimize the financial impact of breaking a lease. Communication, negotiation, and careful review of lease terms are key to navigating this challenging situation.

Ultimately, responsible financial behavior is the best defense against a damaged credit score. Addressing any outstanding debts promptly and maintaining a positive credit history will help you weather the storm of breaking a lease.