Does Capital One Creditwise Cost Money

.png)

In an era where financial awareness is paramount, tools that offer insights into credit health are more valuable than ever. But with an increasing number of credit monitoring services available, a crucial question arises: at what cost do these services come?

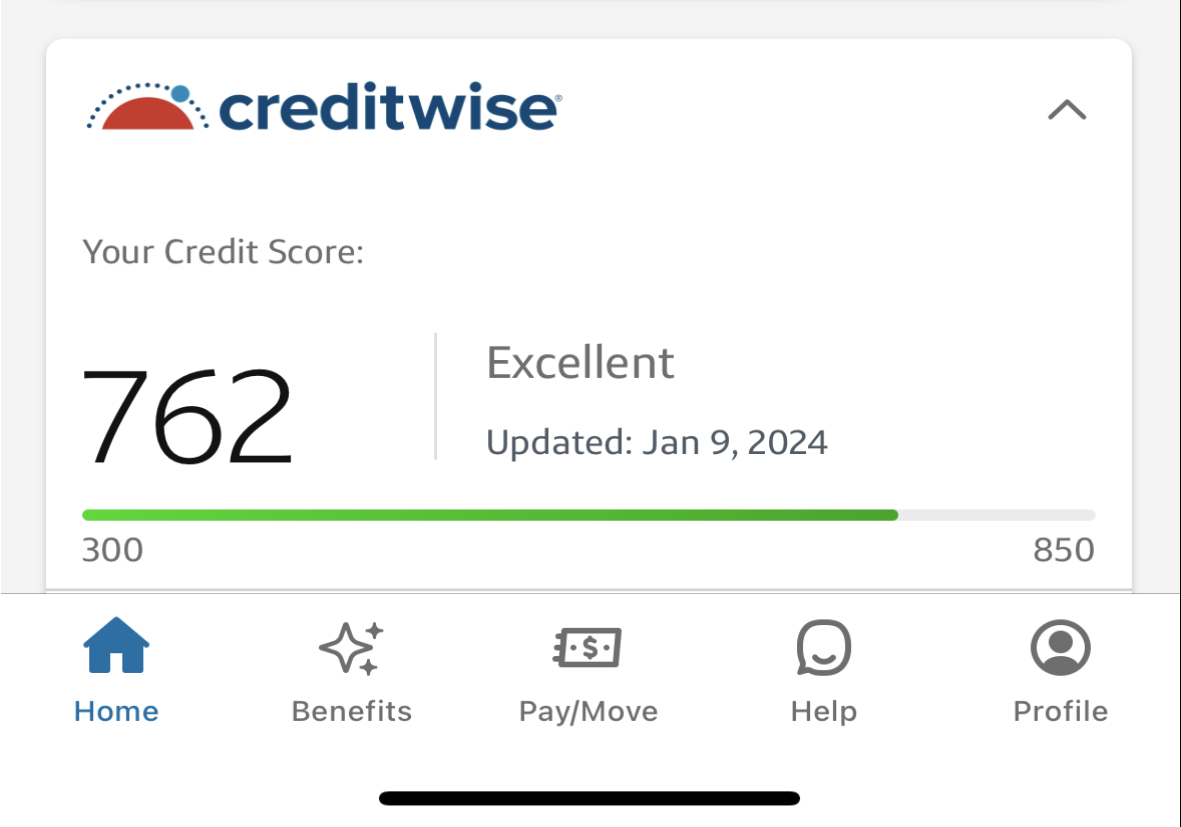

The focus today rests on Capital One CreditWise, a widely used platform that provides credit score and report access. Is it truly free, or are there hidden fees or conditions that users should be aware of? This article delves into the realities of Capital One CreditWise, examining its features, accessibility, and, most importantly, its cost structure to provide clarity for consumers navigating the complexities of credit monitoring.

The Core Proposition: Is CreditWise Really Free?

Capital One has consistently stated that CreditWise is a free service. This claim is supported by their official website and marketing materials.

The company does not charge users any fees for accessing their credit score, credit report, or other features offered within the platform.

This distinguishes it from some other credit monitoring services that may require a subscription or offer a free trial period followed by recurring charges.

Understanding the "Free" Model

The question then becomes: how can Capital One offer such a service without directly charging users? The answer lies in their business model.

Capital One, as a financial institution, benefits from having a large and engaged user base. CreditWise serves as a customer acquisition and engagement tool.

By providing a free service, they attract potential customers who may later become interested in Capital One's other financial products, such as credit cards and loans.

Potential Cross-Selling and Marketing

While CreditWise itself remains free, users may encounter targeted advertisements for Capital One products within the platform.

These advertisements are based on the user's credit profile and financial habits, making them relevant and potentially appealing. However, engagement with these ads is entirely optional.

Users are not obligated to apply for any Capital One products, and declining these offers does not affect their access to CreditWise's core features.

Features Offered by CreditWise

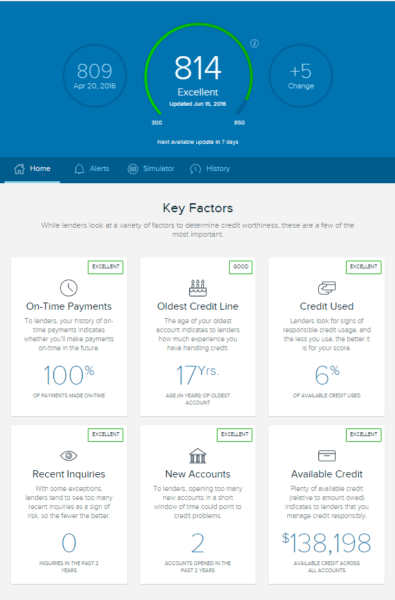

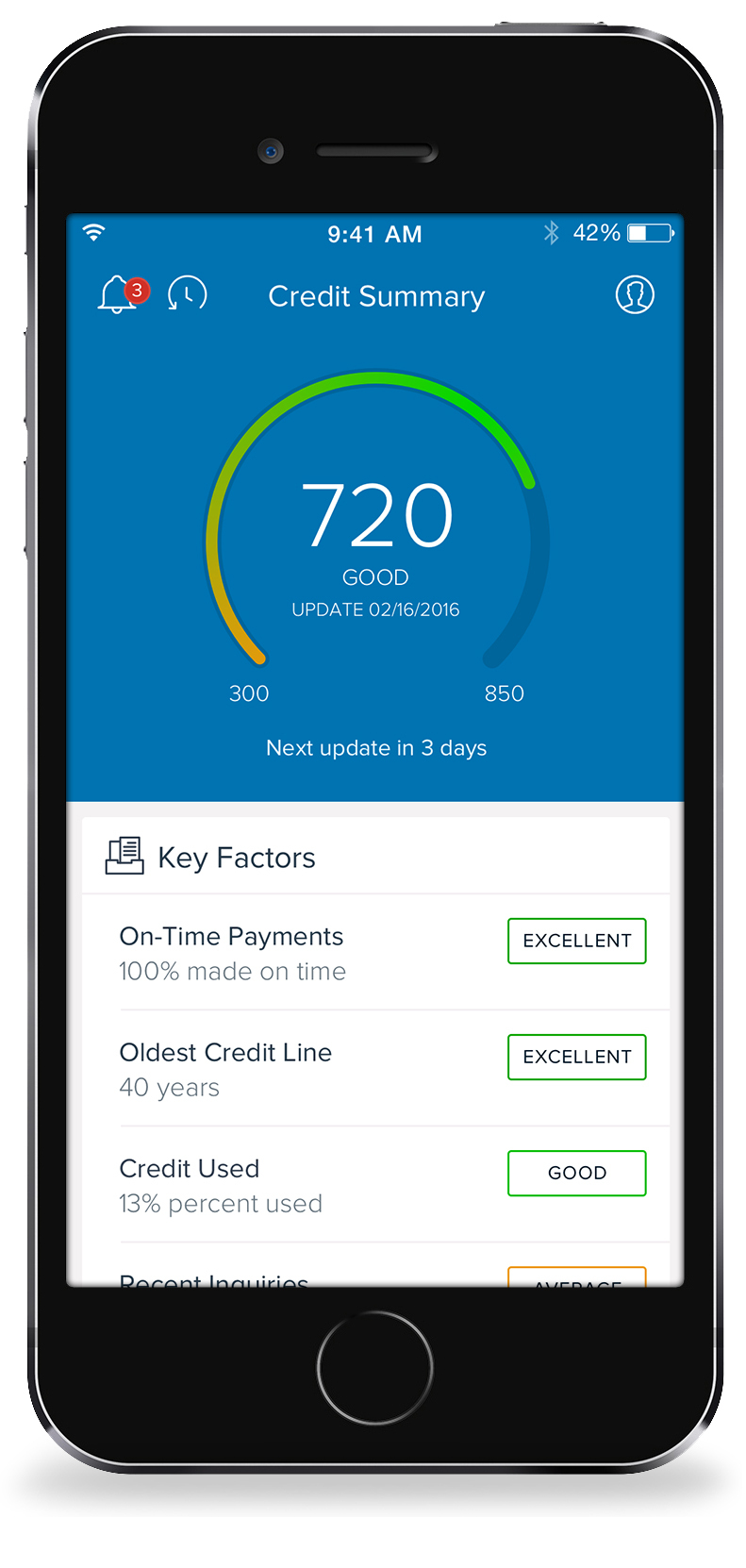

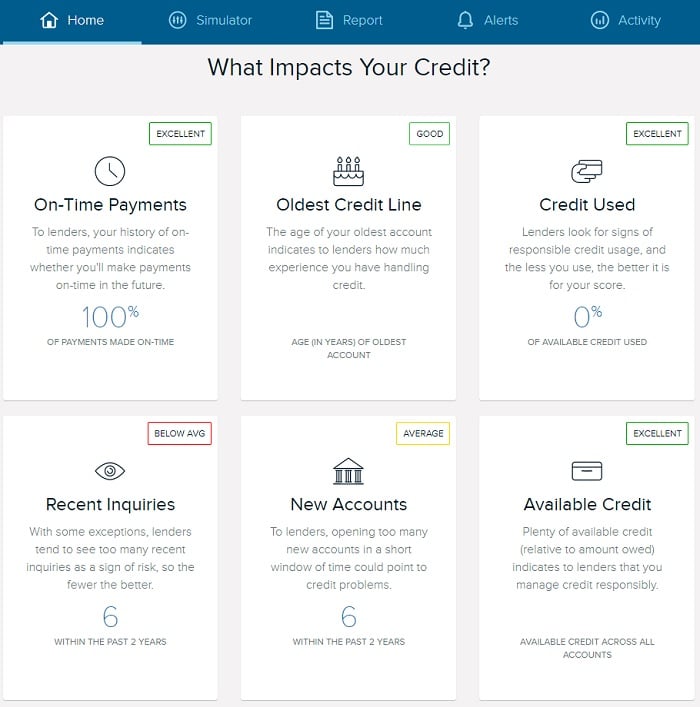

CreditWise provides a range of features designed to help users understand and manage their credit health. These features include, among others, access to your TransUnion credit report.

It also offers credit score monitoring with weekly updates, a credit simulator to explore the impact of financial decisions, and alerts for potential credit report changes.

The service also provides tools to help identify and address potential errors or fraudulent activity on your credit report.

Data Security and Privacy

Given the sensitive nature of credit information, data security is a critical concern. Capital One employs industry-standard security measures to protect user data within CreditWise.

These measures include encryption, firewalls, and regular security audits. However, users should still practice good security habits, such as using strong passwords and being cautious of phishing scams.

It’s also important for users to review Capital One's privacy policy to understand how their data is collected, used, and protected.

Comparing CreditWise to Other Services

While CreditWise is free, other credit monitoring services offer different features and benefits, often at a cost. Services like Experian CreditWorks or MyFICO may provide more detailed credit reports from all three major credit bureaus or offer identity theft protection features.

The best option for a user depends on their individual needs and priorities. Someone primarily interested in monitoring their credit score and receiving alerts may find CreditWise sufficient.

However, those seeking more comprehensive credit monitoring or identity theft protection may prefer a paid service.

Accessibility and Eligibility

One important point to note is that CreditWise is available to everyone, not just Capital One customers. You don't need to hold a Capital One credit card or banking account to use the platform.

This accessibility makes it a valuable tool for a wide range of consumers seeking to understand their credit health.

Users can sign up for CreditWise on Capital One's website or through their mobile app.

Looking Ahead: The Future of Free Credit Monitoring

The demand for free and accessible credit monitoring services is likely to continue to grow. As financial technology evolves, we can expect to see further innovation in this space.

This could include the integration of new data sources, the development of more sophisticated credit scoring models, and the expansion of free features.

For now, Capital One CreditWise remains a valuable and free tool for consumers seeking to take control of their credit health, but staying informed about its features and potential limitations is key to using it effectively.

In conclusion, while Capital One CreditWise is indeed a free service, understanding how Capital One benefits from offering it, the features it provides, and its limitations compared to paid alternatives is crucial for making informed financial decisions. Users should always be aware of potential marketing efforts within the platform and prioritize data security to protect their credit information.