Does H And R Block Do Small Business Taxes

Small business owners, listen up! Confused about tackling your business taxes? The crucial question: Can H&R Block handle it?

This article breaks down H&R Block's services for small business owners, clarifying what they offer and if they're the right fit for your tax needs. Don't risk costly errors; get the facts now.

H&R Block's Small Business Tax Services: What's Offered?

Yes, H&R Block provides tax services tailored for small businesses. Their offerings include tax preparation, bookkeeping, payroll services, and business formation assistance.

H&R Block caters to various business structures, from sole proprietorships to S corporations and partnerships. They aim to simplify the complexities of business taxes.

Tax Preparation Services

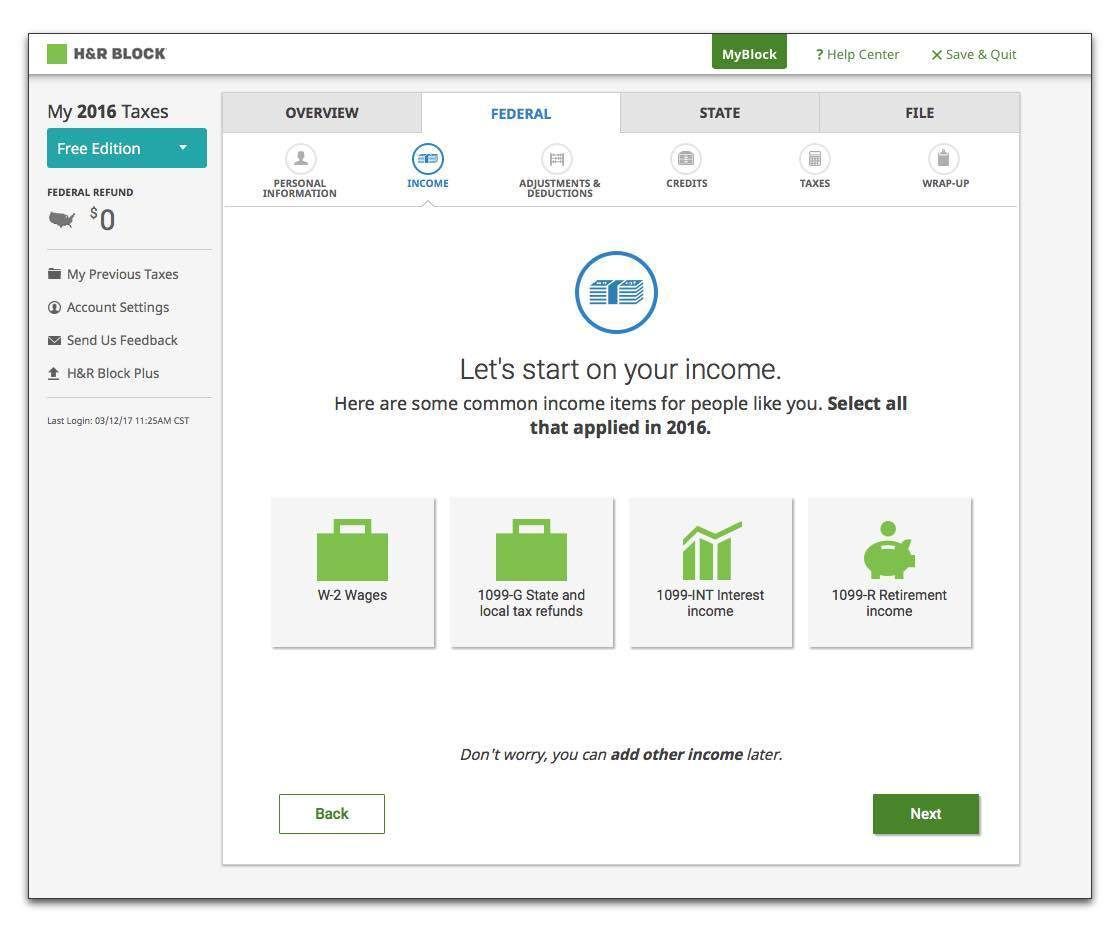

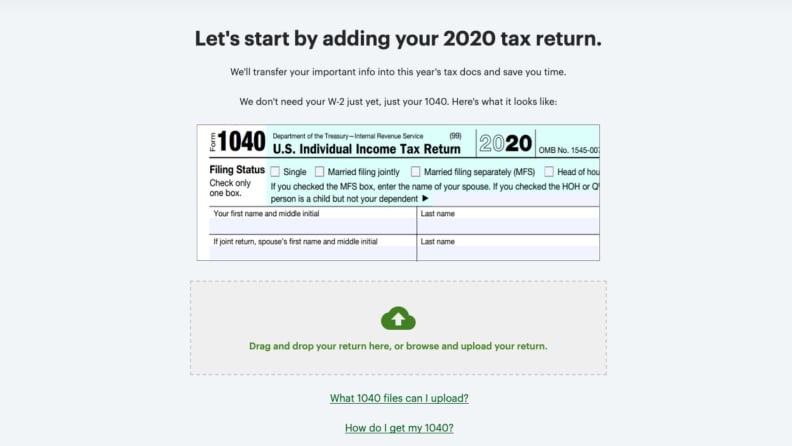

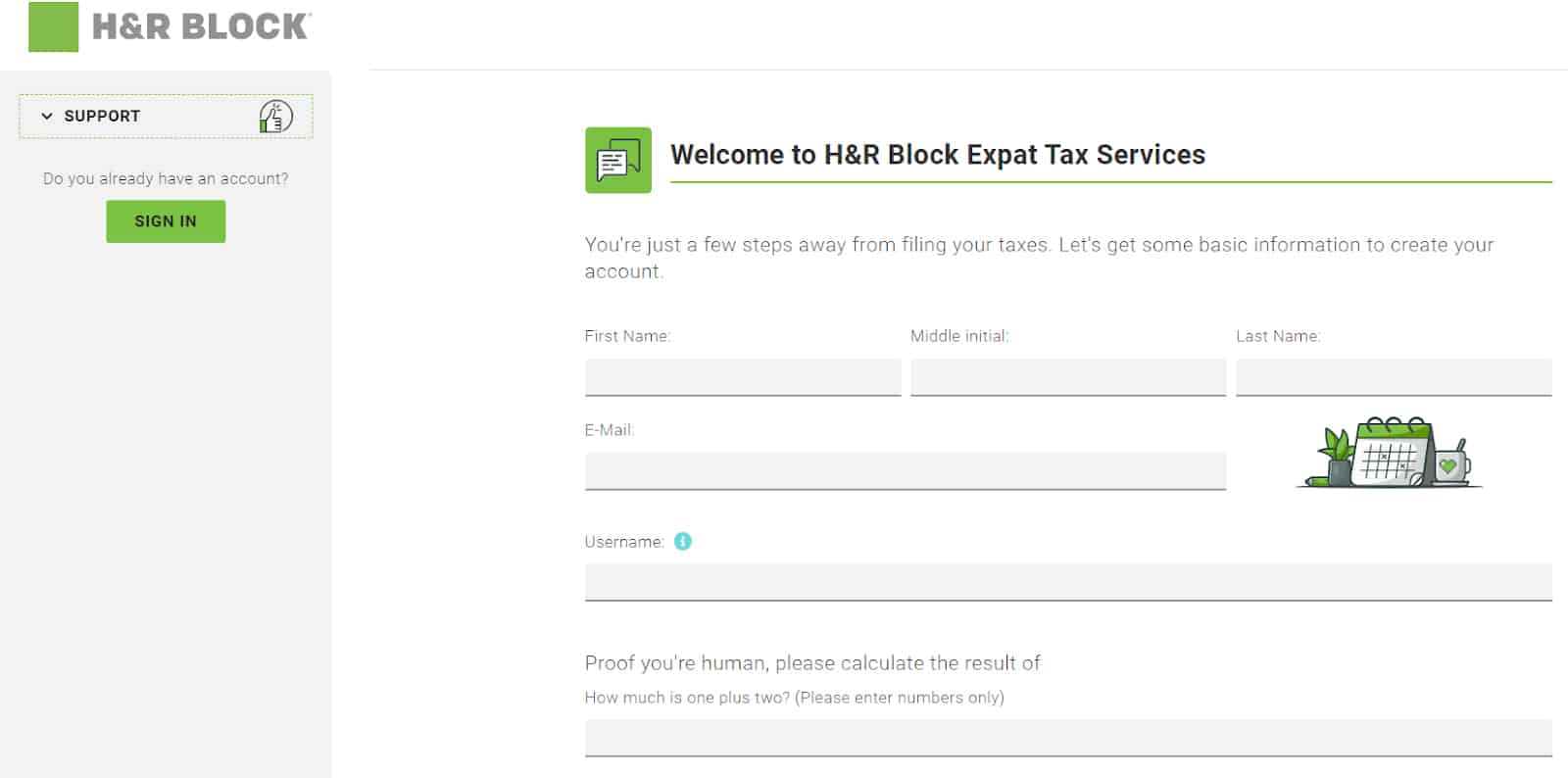

H&R Block provides both in-person and online tax preparation services for small businesses. You can work with a tax professional or use their online software.

Their services cover filing federal and state income taxes, as well as handling deductions and credits specific to your business. They offer assistance with 1099 forms and estimated tax payments.

Bookkeeping and Payroll Services

H&R Block offers bookkeeping services, including tracking income and expenses. They also provide payroll solutions for businesses with employees.

According to their website, these services are designed to help businesses stay organized and compliant with tax regulations. This may involve reconciling bank accounts and generating financial reports.

Business Formation Assistance

For entrepreneurs starting a business, H&R Block can assist with business formation. This includes choosing the right business structure and filing the necessary paperwork.

This support is designed to help new businesses navigate the initial setup process. They can guide you through the implications of different business entities on your tax obligations.

Who Should Consider H&R Block?

H&R Block may be a suitable option for small business owners seeking convenient and accessible tax services. Their wide network of locations and online platform provides flexibility.

Businesses with relatively straightforward tax situations may find their services sufficient. However, those with more complex needs might benefit from specialized accounting firms.

"H&R Block served approximately 15 million clients in the U.S. in FY23, utilizing tax professionals in retail offices and virtual methods," the company stated in its 2023 annual report.

Potential Drawbacks

While H&R Block offers a range of services, it's crucial to consider their limitations. Some businesses may find their expertise less specialized compared to dedicated accounting firms.

Their pricing structure should also be carefully evaluated to ensure it aligns with your budget. Complex tax situations might incur additional fees.

Next Steps: Research and Compare

Before making a decision, research and compare H&R Block's services with other tax professionals. Consider your business's specific needs and the level of support you require.

Contact H&R Block directly to discuss your situation and get a personalized quote. Don't wait until the last minute; start planning your tax strategy now.

.jpg)