Does High 3 Include Locality Pay

For millions of federal employees, the complexities of compensation often extend far beyond the base salary. A recurring question that ignites debate and fuels confusion centers around the interplay between the "High-3" salary calculation – a critical factor in determining retirement benefits – and locality pay, an adjustment designed to address cost-of-living differences across various geographic areas. Does this crucial element of modern federal pay factor into the High-3 average, ultimately impacting the retirement income of those who've dedicated their careers to public service? The answer, while seemingly straightforward, is layered with nuances and regulations that demand careful scrutiny.

At the heart of the matter lies the fundamental question of whether locality pay, intended to offset the higher cost of living in certain areas, is included when calculating a federal employee's High-3 average salary, which serves as the foundation for their retirement annuity. This issue carries significant weight, as the High-3 average directly influences the amount of retirement income a federal worker can expect to receive after years of service. Understanding how locality pay interacts with this calculation is paramount for accurate retirement planning and financial security for federal employees nationwide.

The High-3 Average: A Cornerstone of Federal Retirement

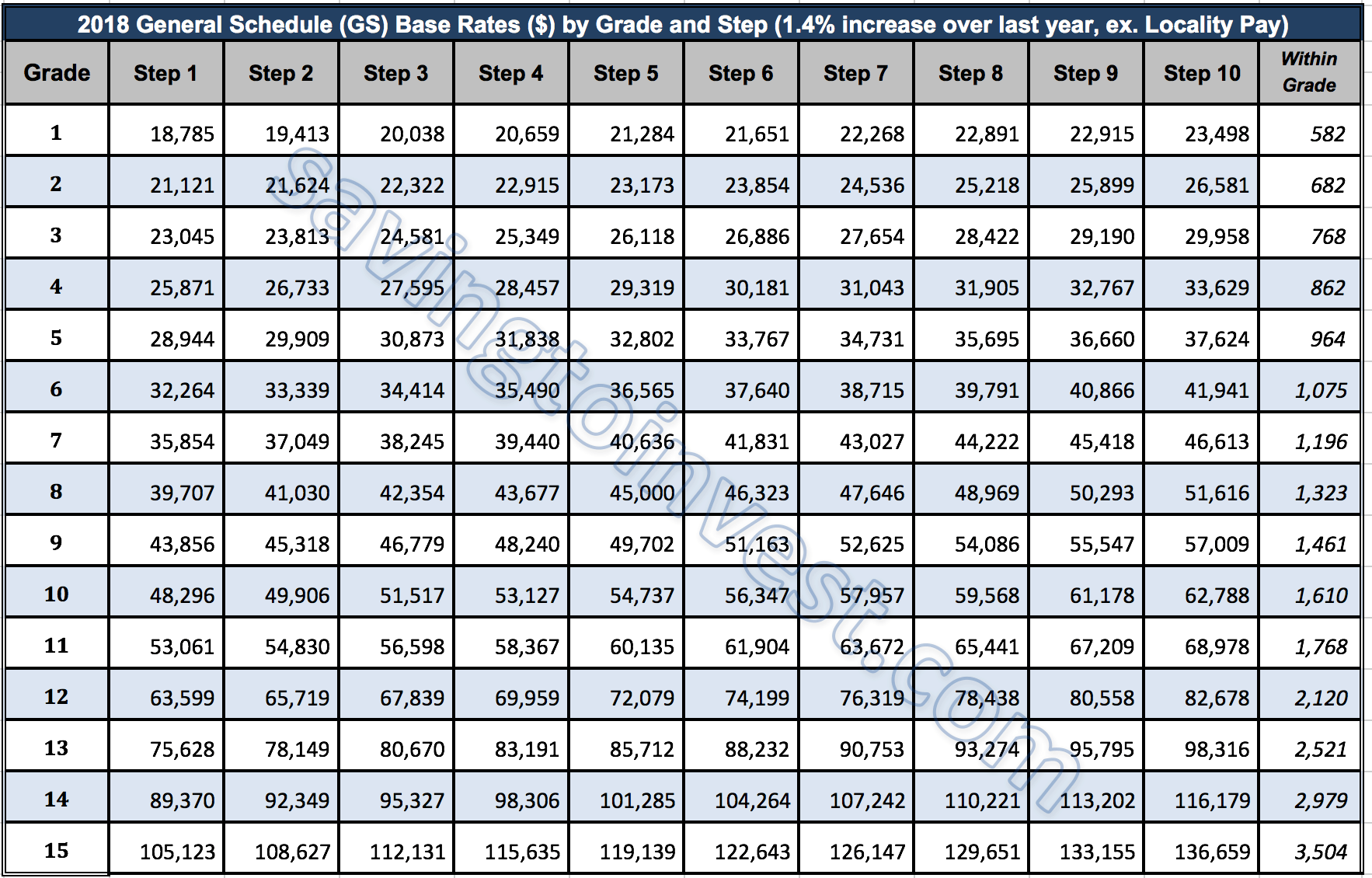

The High-3 average salary is a critical component of the federal government's retirement system, specifically under the Civil Service Retirement System (CSRS) and the Federal Employees Retirement System (FERS). It represents the average of an employee's highest three consecutive years of creditable civilian service. This average is then used in a formula to determine the employee's basic annuity, the regular payment received during retirement.

The importance of an accurate High-3 calculation cannot be overstated. A higher High-3 average translates directly into a larger retirement annuity, providing greater financial security during an employee's post-working years. Therefore, any factor that influences this average, such as locality pay, is of significant interest to federal employees approaching retirement.

Locality Pay: Bridging the Cost-of-Living Gap

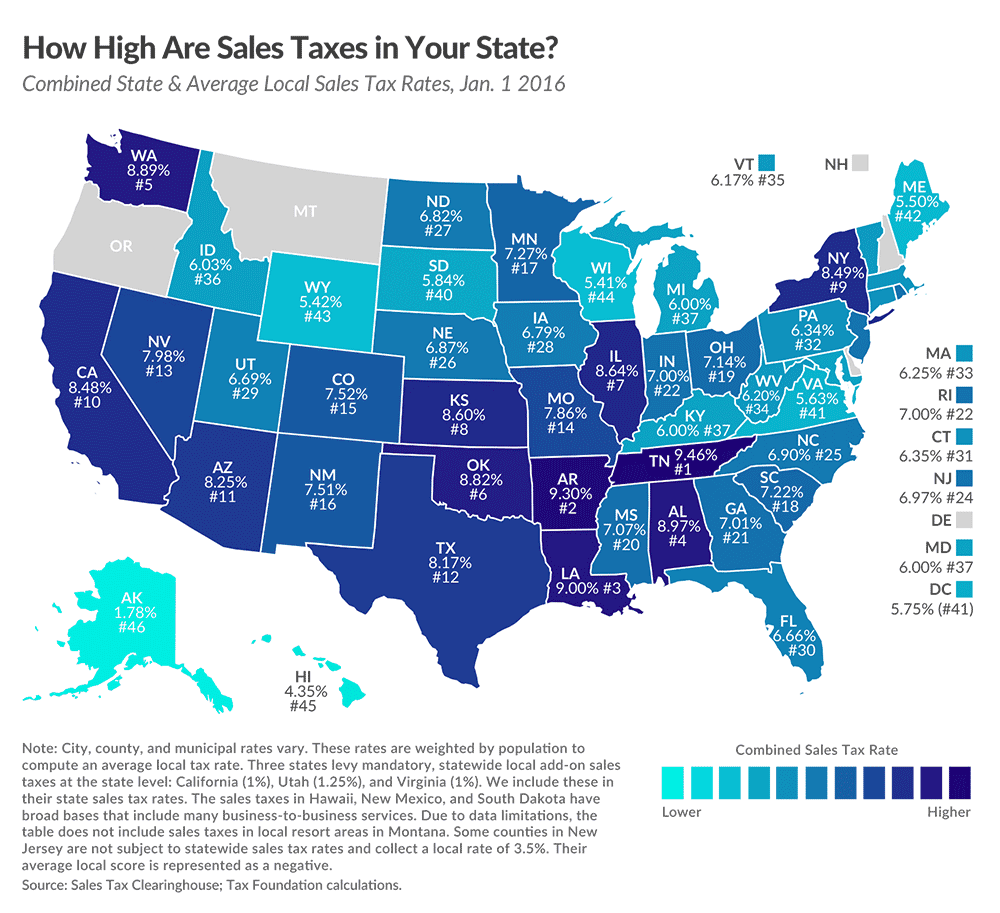

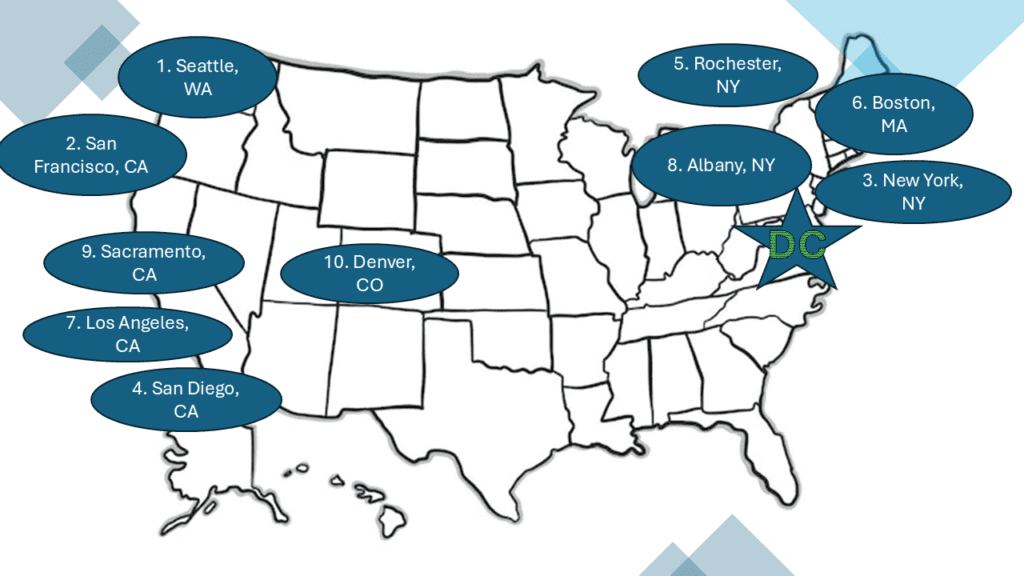

Locality pay is a supplemental pay adjustment designed to address the varying costs of living across different geographic areas in the United States. Federal employees working in areas with higher living expenses, such as major metropolitan cities, receive a locality pay supplement to help offset these costs and maintain a comparable standard of living to their counterparts in less expensive areas.

The concept of locality pay was formalized with the passage of the Federal Employees Pay Comparability Act (FEPCA) of 1990. This act aimed to close the gap between federal and non-federal pay in different localities, ensuring that the government could attract and retain qualified employees in competitive labor markets.

The Crucial Inclusion: Locality Pay and the High-3

The key point to clarify is that locality pay *is* included in the calculation of the High-3 average salary. Official sources, including the Office of Personnel Management (OPM), explicitly state that an employee's basic pay, which includes locality pay, is used to determine the High-3 average. This means that federal employees working in higher-cost areas will generally have a higher High-3 average, leading to a larger retirement annuity.

This inclusion is a significant benefit for federal employees working in areas with substantial locality pay adjustments. It recognizes that their overall compensation, including the cost-of-living supplement, contributes to their financial well-being and should be reflected in their retirement benefits.

Delving into the Details: What Constitutes Basic Pay?

While locality pay is included, it's essential to understand what *specifically* constitutes "basic pay" for High-3 calculation purposes. According to OPM guidelines, basic pay generally includes the employee's scheduled rate of pay, including locality pay, but excludes certain types of payments, such as overtime pay, bonuses, and awards.

Understanding these nuances is critical for accurate retirement planning. Employees should review their pay stubs and consult with human resources professionals to ensure they have a clear understanding of what components of their compensation are included in their basic pay and, consequently, their High-3 average.

Potential Challenges and Considerations

Despite the general rule of inclusion, certain situations can complicate the High-3 calculation and the impact of locality pay. For example, an employee who transfers from a high-locality pay area to a low-locality pay area shortly before retirement may see a slight reduction in their High-3 average compared to if they had remained in the higher-cost area.

Another consideration is the impact of pay freezes or reductions. If an employee experiences a pay freeze during their highest three years of service, or if their pay is reduced due to a disciplinary action, this could also affect their High-3 average, even with the inclusion of locality pay. Therefore, proactive financial planning and understanding potential career transitions are essential for managing retirement expectations.

Looking Ahead: Ensuring Transparency and Accuracy

As the federal workforce continues to evolve, ensuring transparency and accuracy in High-3 calculations remains paramount. The OPM plays a crucial role in providing clear guidance and resources to federal employees, helping them understand the intricacies of their retirement benefits, including the role of locality pay.

Federal employees also have a responsibility to actively engage in their retirement planning process. Regularly reviewing pay statements, seeking clarification from HR professionals, and utilizing online resources can help ensure that their High-3 average is calculated accurately and that they are well-prepared for their retirement years. Continued vigilance and clear communication between federal agencies and their employees are essential to safeguarding the integrity of the federal retirement system.

Ultimately, understanding the inclusion of locality pay in the High-3 average is a vital piece of the retirement puzzle for federal employees. By being informed and proactive, they can navigate the complexities of the system and secure a financially stable future.