Emerald Advance Year Round Line Of Credit

Emerald Advance, the line of credit product previously offered by H&R Block, is no longer available year-round. The financial service, which provided a revolving line of credit tied to tax refund anticipation, has undergone significant changes affecting its accessibility and usage.

The discontinuation of the year-round access marks a shift in H&R Block's financial product offerings. The change impacts consumers who relied on the Emerald Advance for ongoing access to funds beyond the tax season.

What Happened to Emerald Advance?

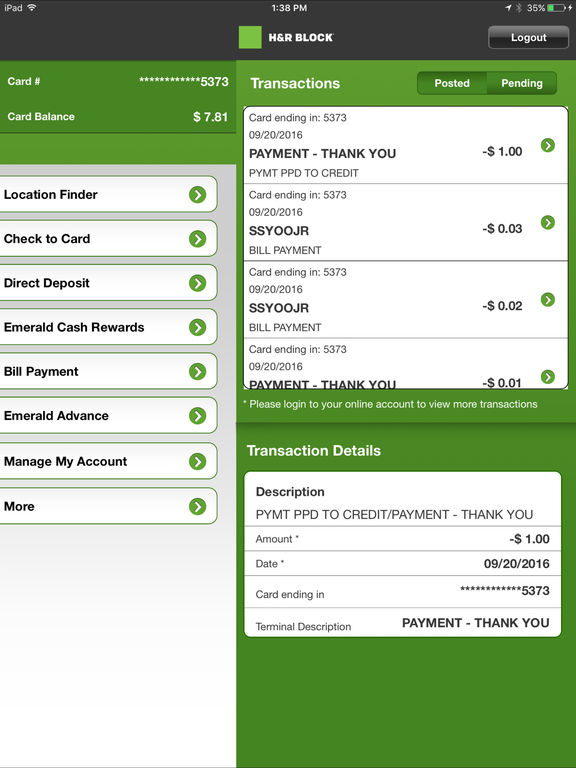

The Emerald Advance was originally designed to provide clients with a line of credit that could be accessed even outside of tax season. Consumers could apply for the credit line during the tax season and, if approved, use it for various financial needs throughout the year.

However, H&R Block has adjusted the program. This adjustment severely limits the ability to use the credit line after the tax season.

Specifically, while existing Emerald Advance lines of credit remain open for eligible clients, the ability to draw on those lines of credit is primarily restricted to the tax filing period. New applications are no longer accepted outside of this period.

Key Details of the Change

The core change involves restricting access to the line of credit. Previously, borrowers could draw from their Emerald Advance accounts throughout the year, subject to their available credit.

Now, drawing on the line of credit is largely confined to the tax season, generally from January to late spring. H&R Block has not issued a detailed public statement outlining the specific reasons for the change.

The alteration likely stems from a combination of factors. These factors include evolving market conditions, regulatory considerations, and internal strategic decisions regarding their financial product portfolio.

Impact on Consumers

The primary impact is on consumers who used the Emerald Advance as a continuous source of credit. The line of credit was particularly utilized for bridging financial gaps and managing unexpected expenses.

These consumers will need to seek alternative options for their credit needs outside of the tax season. This change potentially requires some users to re-evaluate their budgeting and financial planning strategies.

For those still holding an active Emerald Advance line of credit, it's crucial to understand the updated terms and conditions. Contacting H&R Block directly for clarification on their specific account is advisable.

Alternative Options for Consumers

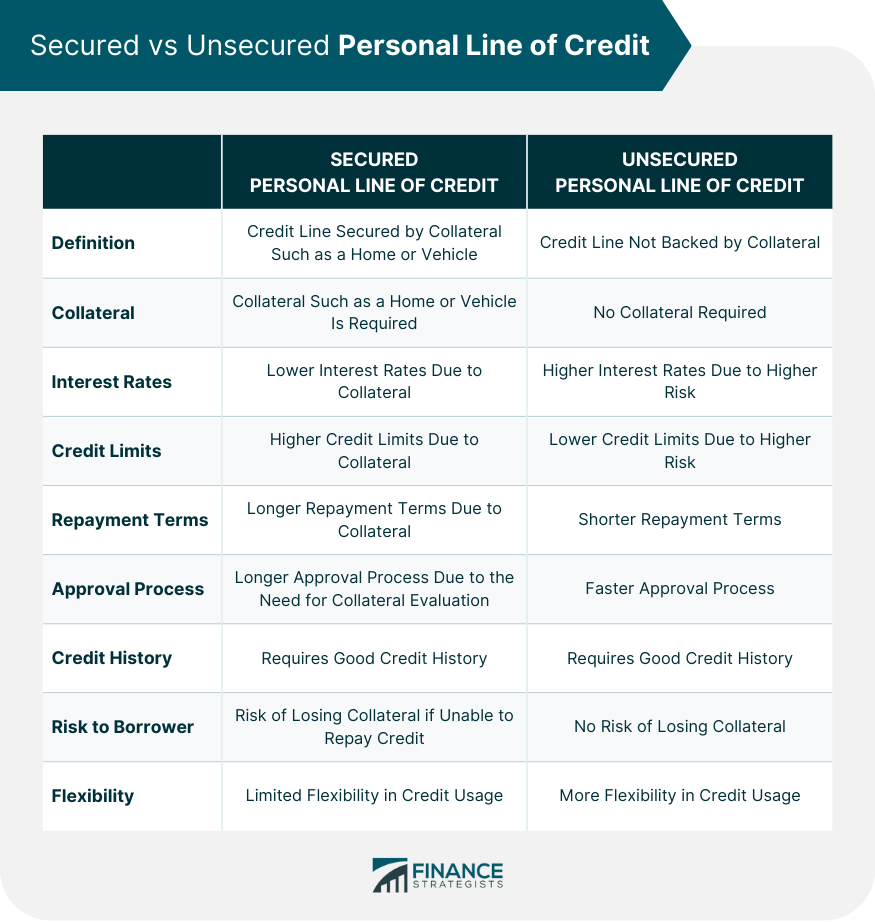

With the restriction on year-round access to Emerald Advance, consumers may consider several alternative financial products. These include traditional credit cards, personal loans, and other lines of credit offered by various financial institutions.

Credit unions often provide more favorable terms on loans and lines of credit. Comparison shopping is essential to securing the most suitable option for individual financial circumstances.

Responsible credit management and budgeting are essential regardless of the chosen financial product. Consider creating a budget, tracking expenses, and avoiding overspending.

Future of H&R Block's Financial Products

The future of H&R Block's other financial product offerings remains to be seen. The company is likely to continue adapting its services to align with market demands and regulatory requirements.

Consumers should monitor H&R Block's announcements for any further changes or additions to their financial services portfolio. Seeking independent financial advice can help individuals make informed decisions.

The change to the Emerald Advance highlights the dynamic nature of the financial services landscape. Staying informed about available options and managing finances responsibly is crucial for consumers.

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)