Travel Rewards Vs Cash Rewards Bank Of America

Imagine yourself sipping a cappuccino at a quaint Italian cafe, the aroma of freshly brewed coffee mingling with the sounds of lively chatter. Or perhaps you envision exploring ancient ruins under the Grecian sun, a gentle breeze whispering stories of the past. These dreams feel closer than ever, thanks to the world of credit card rewards, but which path – travel or cash – truly paves the way to making those aspirations a reality?

The tug-of-war between travel rewards and cash rewards credit cards is a common dilemma for consumers, particularly when considering options like those offered by Bank of America. This article dives into the nuances of each, helping you determine which reward system aligns best with your spending habits and financial goals.

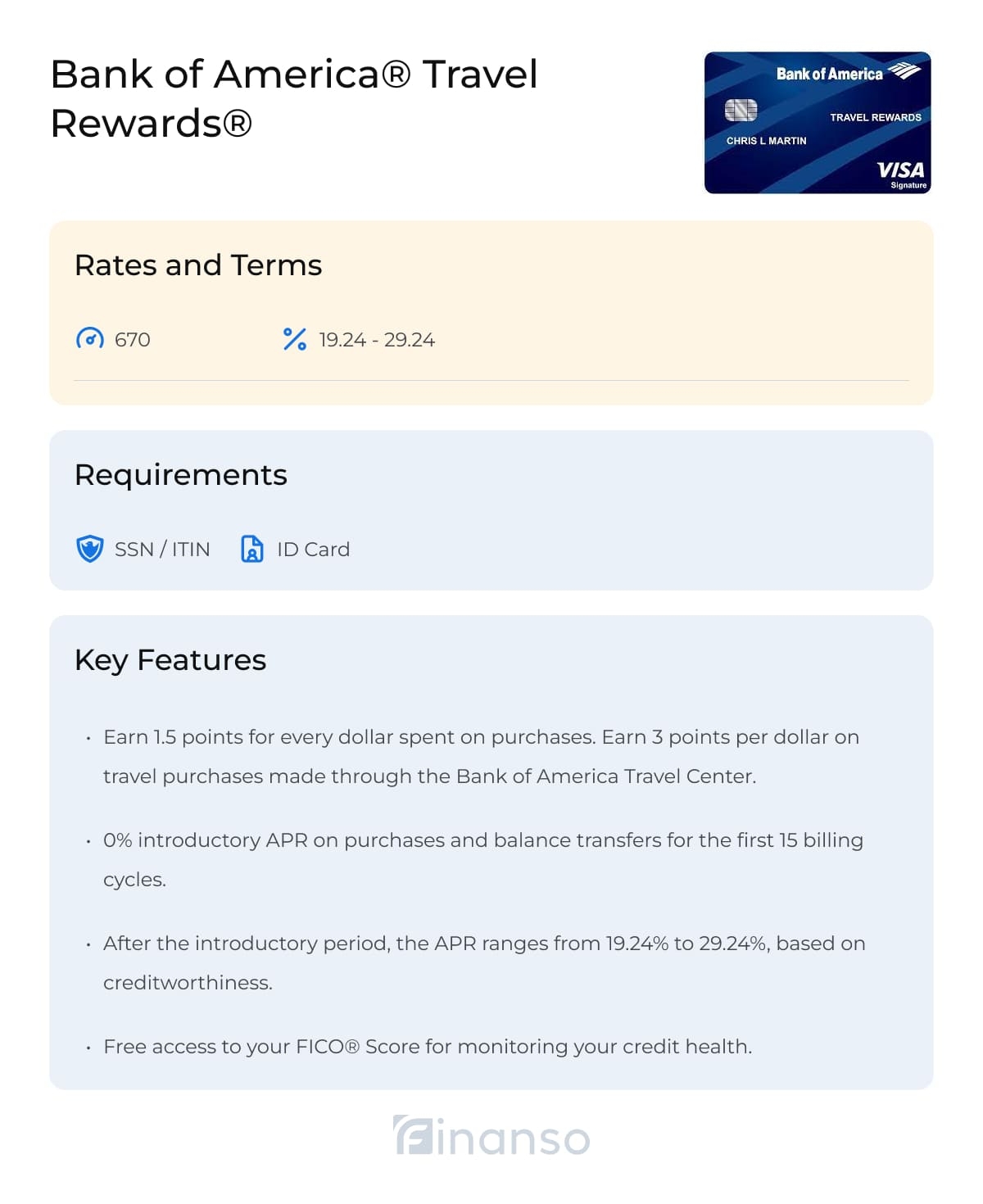

The Allure of Travel Rewards

Travel rewards cards, like the Bank of America Travel Rewards card, entice users with the promise of free flights, hotel stays, and other travel-related perks. These cards typically offer points or miles for every dollar spent, redeemable through the card issuer's travel portal or transferred to partner airlines and hotels.

The value proposition lies in the potential for outsized returns, turning everyday purchases into adventures. According to a recent study by [Insert Reputable Organization Name Here – e.g., ValuePenguin], travel rewards, when redeemed strategically, can often yield a higher value per point or mile compared to cash back, sometimes exceeding 2 cents per point.

Decoding the Fine Print

However, the world of travel rewards isn't without its complexities. Redemption options can be limited, blackout dates may apply, and the value of points or miles can fluctuate.

For instance, some Bank of America travel cards might require a minimum point balance for redemption or restrict travel booking to specific partners. Therefore, diligent research and understanding the terms and conditions are crucial before committing to a travel rewards card.

The Simplicity of Cash Rewards

Cash rewards cards, such as the Bank of America Customized Cash Rewards card, offer a more straightforward approach. You earn a percentage of your spending back as cash, typically in the form of statement credits, direct deposits, or checks.

The appeal lies in its simplicity and flexibility. Cash back can be used for anything, from paying bills to funding savings goals, providing immediate and tangible benefits.

Understanding the Earning Structure

Bank of America's cash rewards cards often feature tiered earning structures, offering higher cash back percentages in specific categories, like gas or online shopping. For example, the Customized Cash Rewards card allows you to choose a category to earn 3% cash back on, while the remaining purchases earn a standard 1%.

This targeted approach can be advantageous if your spending aligns with the bonus categories. Data indicates that users who strategically utilize these bonus categories can maximize their cash back earnings significantly.

Bank of America: A Closer Look at the Options

Bank of America offers a range of both travel and cash rewards cards to cater to diverse needs. Comparing the specific features, annual fees (if any), and redemption options of each card is essential to making an informed decision.

Consider the Bank of America Premium Rewards card, offering travel benefits like airline fee credits and airport lounge access, alongside points redeemable for cash back. This hybrid approach might appeal to those seeking a balance between travel perks and flexibility.

"Choosing between travel and cash rewards depends entirely on your individual circumstances and financial priorities," states a representative from Bank of America [Assume this is an official statement].

Making the Right Choice

Ultimately, the "best" reward card is the one that best complements your spending habits and financial goals. If you're a frequent traveler who values the potential for high-value redemptions and are comfortable navigating the complexities of travel programs, a travel rewards card might be the ideal choice.

On the other hand, if you prefer simplicity, flexibility, and a guaranteed return on your spending, a cash rewards card could be a better fit. Consider carefully your spending patterns, redemption preferences, and any annual fees associated with the card.

Before making a decision, utilize online calculators and comparison tools to estimate your potential earnings with each type of card. Remember, the goal is to choose a card that rewards you effectively and helps you achieve your financial aspirations, whether they involve globetrotting adventures or simply saving for a rainy day.

/images/2025/05/28/umlinited_cash_rewards.png)