Ethiopian Currency Vs Indian Currency

The stark disparities between the Ethiopian Birr (ETB) and the Indian Rupee (INR) highlight the complex economic landscapes of two nations with vastly different trajectories. While both countries grapple with their own unique set of economic challenges, the exchange rate between their currencies serves as a potent indicator of their relative economic strengths and vulnerabilities.

This article delves into a comparative analysis of the ETB and the INR, examining the factors influencing their respective values, the implications of the exchange rate for trade and investment, and the policy measures undertaken by both governments to manage their currencies. Understanding these dynamics is crucial for businesses, investors, and policymakers alike, as it sheds light on the potential opportunities and risks associated with engaging in economic activities between Ethiopia and India.

Economic Overviews

Ethiopia, a nation undergoing rapid development, has experienced significant economic growth in recent years. However, this growth has been accompanied by persistent inflation and a chronic shortage of foreign exchange.

India, on the other hand, boasts a more diversified and mature economy, consistently ranking among the fastest-growing major economies globally. Its strong manufacturing sector, burgeoning services industry, and large consumer market contribute to its economic resilience.

Currency Performance

The Ethiopian Birr (ETB) has faced consistent downward pressure against major currencies, including the INR. This depreciation is largely attributed to Ethiopia's high import dependence, limited export diversification, and a persistent trade deficit.

The Indian Rupee (INR), while not immune to fluctuations, has generally exhibited greater stability compared to the ETB. India's relatively stronger economic fundamentals, coupled with proactive interventions by the Reserve Bank of India (RBI), have helped to cushion the INR against significant depreciation.

Factors Influencing Exchange Rates

Several factors contribute to the fluctuating exchange rates between the ETB and the INR. These include macroeconomic indicators like inflation, interest rates, and economic growth rates in both countries.

Furthermore, government policies, global commodity prices, and investor sentiment all play a significant role in shaping currency values.

Inflation

Ethiopia has struggled with high inflation rates, eroding the purchasing power of the ETB. This inflationary pressure diminishes the value of the ETB relative to currencies like the INR, where inflation is comparatively better managed.

India's inflation targeting framework, implemented by the RBI, has been instrumental in maintaining price stability and bolstering investor confidence in the INR.

Interest Rates

Higher interest rates can attract foreign capital, boosting demand for a currency and leading to appreciation. However, raising interest rates can also stifle economic growth.

The differential in interest rates between Ethiopia and India impacts the flow of capital and, consequently, the exchange rate between the ETB and the INR.

Trade Balance

Ethiopia's persistent trade deficit, where imports far outweigh exports, exerts downward pressure on the ETB. The demand for foreign currencies to pay for imports exceeds the supply generated by exports, leading to Birr depreciation.

India's trade balance, while also often in deficit, is supported by a more diversified export base and a larger economy, mitigating the negative impact on the INR.

Implications for Trade and Investment

The exchange rate between the ETB and the INR has significant implications for trade and investment flows between the two countries. A weaker ETB makes Ethiopian exports cheaper and Indian exports more expensive.

However, it also increases the cost of Ethiopian imports, potentially fueling inflation. For Indian investors in Ethiopia, a depreciating ETB can erode the value of their investments when repatriated back to India.

"The exchange rate is a critical factor in determining the competitiveness of Ethiopian exports," stated Dr. Lemma Gudissa, an economist at the Ethiopian Development Research Institute.

Policy Responses

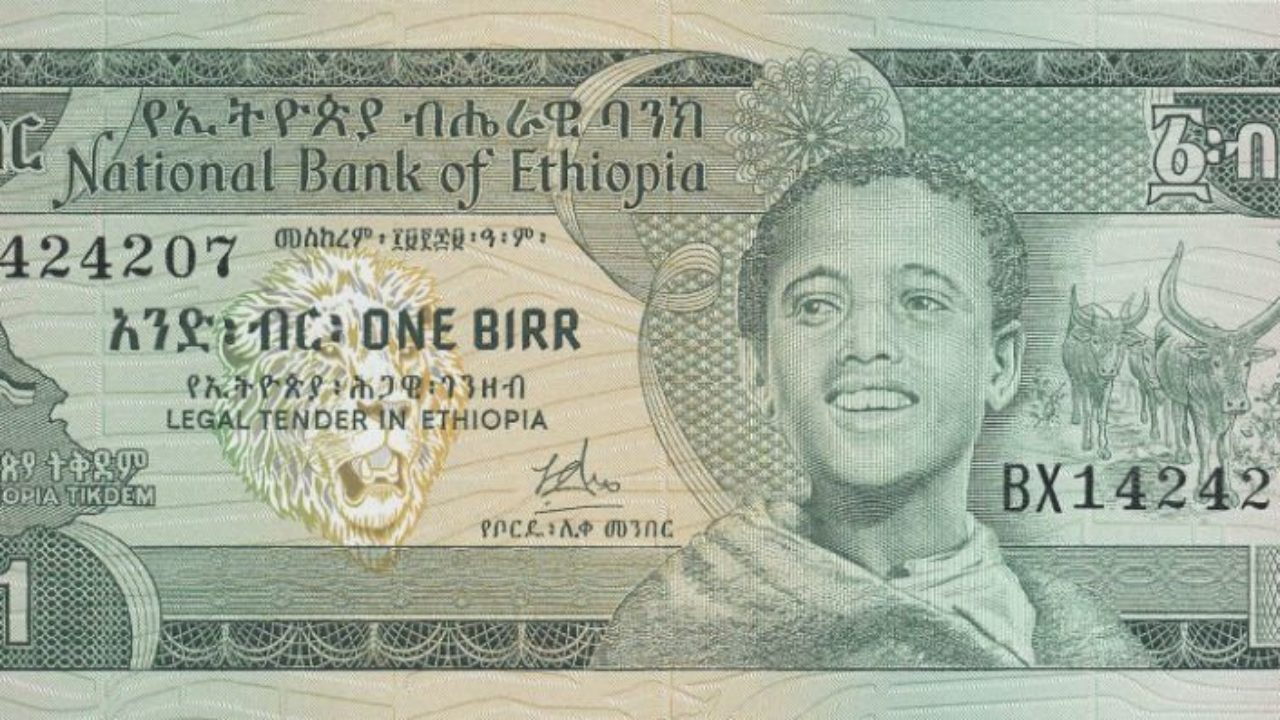

Both the Ethiopian and Indian governments have implemented various policy measures to manage their currencies and mitigate the adverse effects of exchange rate volatility. The National Bank of Ethiopia (NBE) has periodically devalued the ETB to boost export competitiveness.

The Reserve Bank of India (RBI) actively intervenes in the foreign exchange market to manage the INR's volatility, using its foreign exchange reserves to buy or sell Rupees.

Future Outlook

The future performance of the ETB and the INR will depend on a multitude of factors, including global economic conditions, domestic policy choices, and geopolitical developments. Ethiopia's continued efforts to diversify its economy and boost exports will be crucial in strengthening the ETB.

India's commitment to macroeconomic stability and structural reforms will continue to underpin the INR's resilience.

Sustained economic growth, prudent fiscal management, and targeted investments in key sectors are essential for both countries to bolster their currencies and ensure long-term economic prosperity. The relative performance of the ETB and INR will continue to reflect the divergent economic paths these nations are charting.